Global Low Earth Orbit (LEO) Satellite Payload Market, By Type (Small Satellite, Medium Satellite, Large Satellite, Cube Satellite), Frequency (L- Band, S-Band, X-Band, C-Band, Ka-Band, Ku-Band, and Others), Application (Communication and Navigation, Earth Observation and Remote Sensing, Surveillance, Scientific, and Others), Sub-System (Payload, Telecommunication, Power System, Propulsion System, Satellite Bus, and Others), End-Use (Commercial, Government and Military, Civil, and Others) – Industry Trends and Forecast to 2031.

Low Earth Orbit (LEO) Satellite Payload Market Analysis and Size

The low earth orbit (LEO) satellite payload market is experiencing significant growth, driven by advancements in miniaturization, AI integration, and improved propulsion technologies. Innovations such as reusable rockets, enhanced satellite communication systems, and cost-effective manufacturing processes are propelling market expansion. Increased demand for high-speed internet, earth observation, and IoT connectivity further fuels this dynamic sector's evolution and potential.

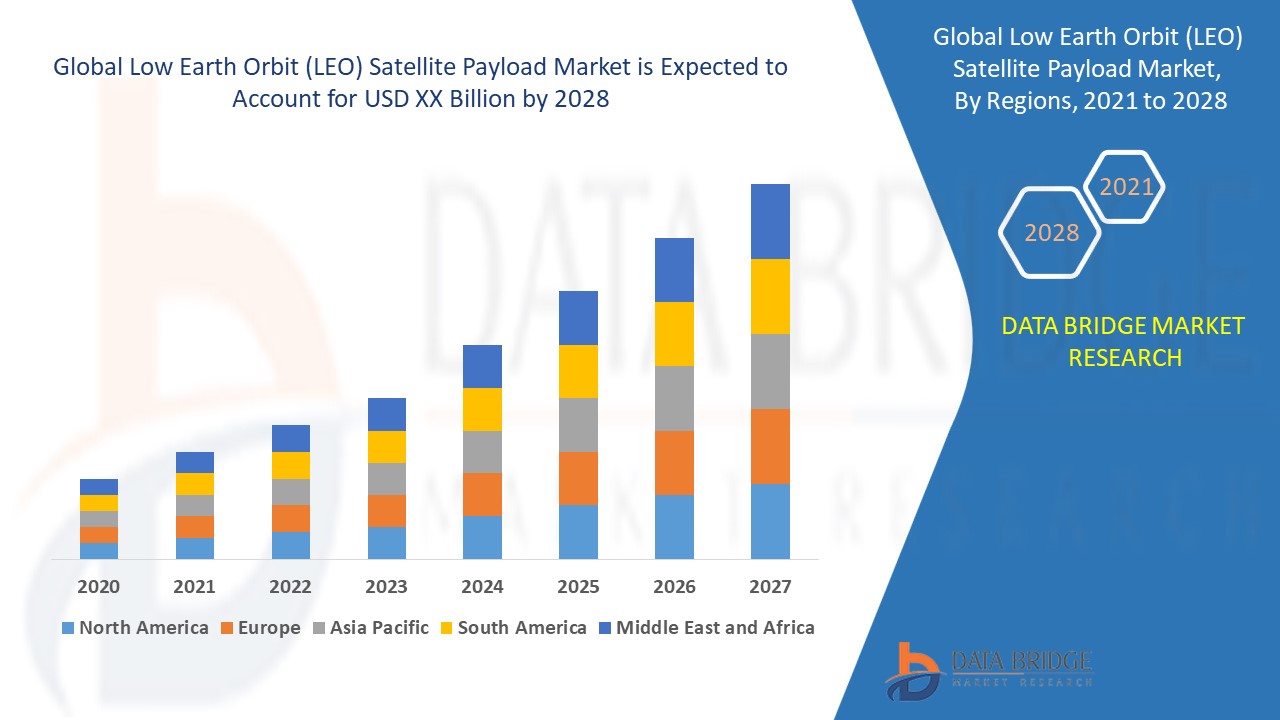

The global low earth orbit (LEO) satellite payload market size was valued at USD 16.54 billion in 2023 and is projected to reach USD 25.96 billion by 2031, with a CAGR of 5.80% during the forecast period 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Small Satellite, Medium Satellite, Large Satellite, Cube Satellite), Frequency (L- Band, S-Band, X-Band, C-Band, Ka-Band, Ku-Band, and Others), Application (Communication and Navigation, Earth Observation and Remote Sensing, Surveillance, Scientific, and Others), Sub-System (Payload, Telecommunication, Power System, Propulsion System, Satellite Bus, and Others), End-Use (Commercial, Government and Military, Civil, and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

AIRBUS (France), RTX (U.S.), Thales (France), Lockheed Martin Corporation (U.S.), Honeywell International Inc. (U.S.), L3Harris Technologies, Inc. (U.S.), Boeing (U.S.), Viasat, Inc. (U.S.), SpaceX (U.S.), MDA (Canada), LUCIX CORPORATION (U.S.), Mitsubishi Electric Corporation (Japan), ISRO (India), General Dynamics Mission Systems, Inc. (U.S.), and Northrop Grumman Corporation (U.S.)

|

|

Market Opportunities

|

|

Market Definition

A low earth orbit (LEO) satellite payload refers to the instruments, sensors, and equipment carried by a satellite designed to operate in orbits typically between 180 to 2,000 kilometers above earth. These payloads can include communication devices, cameras, scientific instruments, and other tools for data collection, imaging, and monitoring, supporting various applications such as weather forecasting, Earth observation, and telecommunications.

Low Earth Orbit (LEO) Satellite Payload Market Dynamics

Drivers

- Increased Demand for Broadband Connectivity

The increased demand for broadband connectivity, especially in remote and underserved regions, is significantly driving the LEO satellite payload market. Satellite constellations such as Starlink and OneWeb exemplify this trend by expanding global broadband networks. For instance, Starlink's deployment aims to provide high-speed internet access to rural areas worldwide, addressing the digital divide and boosting market growth by meeting the rising connectivity needs of these populations.

- Advancements in Satellite Technology

Advancements in satellite technology, such as the miniaturization of components, make payloads more cost-effective. This enables smaller, cheaper satellites to deliver enhanced capabilities, including higher data throughput and improved reliability. For instance, CubeSats, which are compact and efficient, have revolutionized Earth observation and communication services by providing high-quality data at a fraction of the cost, driving the low earth orbit satellite payload market's growth.

Opportunities

- Rising Number of Satellite Launches

The rising number of satellite launches, driven by significant reductions in launch costs due to reusable rocket technology pioneered by companies such as SpaceX, has notably boosted the LEO satellite payload market. For instance, SpaceX's Falcon 9 reusable rockets have drastically lowered the price of launching satellites, leading to increased frequency of launches. This surge in launch opportunities facilitates more frequent payload deployments, thereby driving market growth and expanding satellite-based services.

- Growing Commercial Applications and Services

The expanding commercial applications of LEO satellite payloads are driving market growth. Services such as Earth observation, weather forecasting, and asset tracking are flourishing due to the capabilities of LEO satellites. Additionally, the global coverage provided by LEO satellites is crucial for the proliferation of Internet of Things (IoT) networks. For instance, companies such as Planet Labs leverage LEO satellites for high-resolution Earth imaging, while IoT startups such as Swarm Technologies use LEO satellites for global connectivity in remote areas.

Restraints/Challenges

- High Initial Investment

The substantial capital investment required for developing, launching, and maintaining LEO satellite payloads acts as a deterrent for potential market entrants, constraining market expansion. This financial barrier inhibits the growth and accessibility of the LEO satellite payload market, limiting opportunities for new players and hindering overall industry development.

- Data Security Concerns

Data security concerns surrounding the transmission and storage of sensitive data via LEO satellite payloads present a significant hindrance to market growth. The necessity for robust encryption and cybersecurity measures to mitigate potential threats adds complexity and cost, deterring potential users and investors from engaging in LEO satellite services.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief; our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2021, Planet Labs announced its acquisition of VanderSat, a Dutch firm specializing in Earth surface data, for approximately USD 28 million. VanderSat's expertise lies in combining public satellite data with proprietary algorithms to analyze soil moisture and land surface temperature, enhancing insights into environmental conditions

- In 2021, Five Astrocast satellites were deployed to gather and transmit data from various remote stations, including weather buoys, wellhead sensors, and pollution monitors. These satellites bolster Earth observation capabilities, facilitating improved monitoring of environmental parameters and enhancing our understanding of climate patterns

- In 2022, The Space Development Agency (SDA) awarded Lockheed Martin a prototype contract worth nearly USD 700 million for the development and manufacturing of 42 small satellites. These satellites, part of Tranche 1 of the agency's Transport Layer, are crucial for advancing joint all-domain operations, enabling seamless connectivity between Earth and space domains for enhanced military capabilities

- In 2021, SpaceX received authorization from the FCC to launch 2,824 satellites into low Earth orbit, aiming to extend high-speed broadband internet access to underserved populations. This initiative by the U.S.-based satellite communications company aligns with efforts to bridge the digital divide, providing connectivity to individuals lacking access to reliable internet services

Low Earth Orbit (LEO) Satellite Payload Market Scope

The market is segmented on the basis of type, frequency, application, sub-system, and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Small Satellite

- Medium Satellite

- Large Satellite

- Cube Satellite

Frequency

- L- Band

- S-Band

- X-Band

- C-Band

- Ka-Band

- Ku-Band

- Others

Application

- Communication and Navigation

- Earth Observation and Remote Sensing

- Surveillance

- Scientific

- Others

Sub-System

- Payload

- Earth Observation

- Communication

- Navigation

- Others

- Telecommunication

- Antenna

- Transponder

- Others

- Power System

- Solar Cell

- Batteries

- Others

- Propulsion System

- Thrusters

- Propellant Tank

- Valves and Regulators

- Others

- Satellite Bus

- Others

End-Use

- Commercial

- Government and Military

- Civil

- Others

Low Earth Orbit (LEO) Satellite Payload Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, type, frequency, application, sub-system, and end-use as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe region is expected to exhibit the highest growth in the low earth orbit (LEO) satellite payload market. This surge is attributed to increased commercialization of space and the burgeoning regional space industry. The demand for LEO satellite payloads is poised to soar, driving innovation and opportunities in Europe's space sector.

North America is expected to dominate the low earth orbit (LEO) satellite payload market, propelled by substantial government investments in space technologies. With a focus on military communication satellite development, the U.S. leads, driving innovation and growth in the region's LEO satellite payload sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Low Earth Orbit (LEO) Satellite Payload Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- AIRBUS (France)

- RTX (U.S.)

- Thales (France)

- Lockheed Martin Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Boeing (U.S.)

- Viasat, Inc. (U.S.)

- SpaceX (U.S.)

- MDA (Canada)

- LUCIX CORPORATION (U.S.)

- Mitsubishi Electric Corporation (Japan)

- ISRO (India)

- General Dynamics Mission Systems, Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

SKU-