Global Lithography Metrology Equipment Market

Market Size in USD Million

CAGR :

%

USD

701.14 Million

USD

1,259.82 Million

2023

2031

USD

701.14 Million

USD

1,259.82 Million

2023

2031

| 2024 –2031 | |

| USD 701.14 Million | |

| USD 1,259.82 Million | |

|

|

|

|

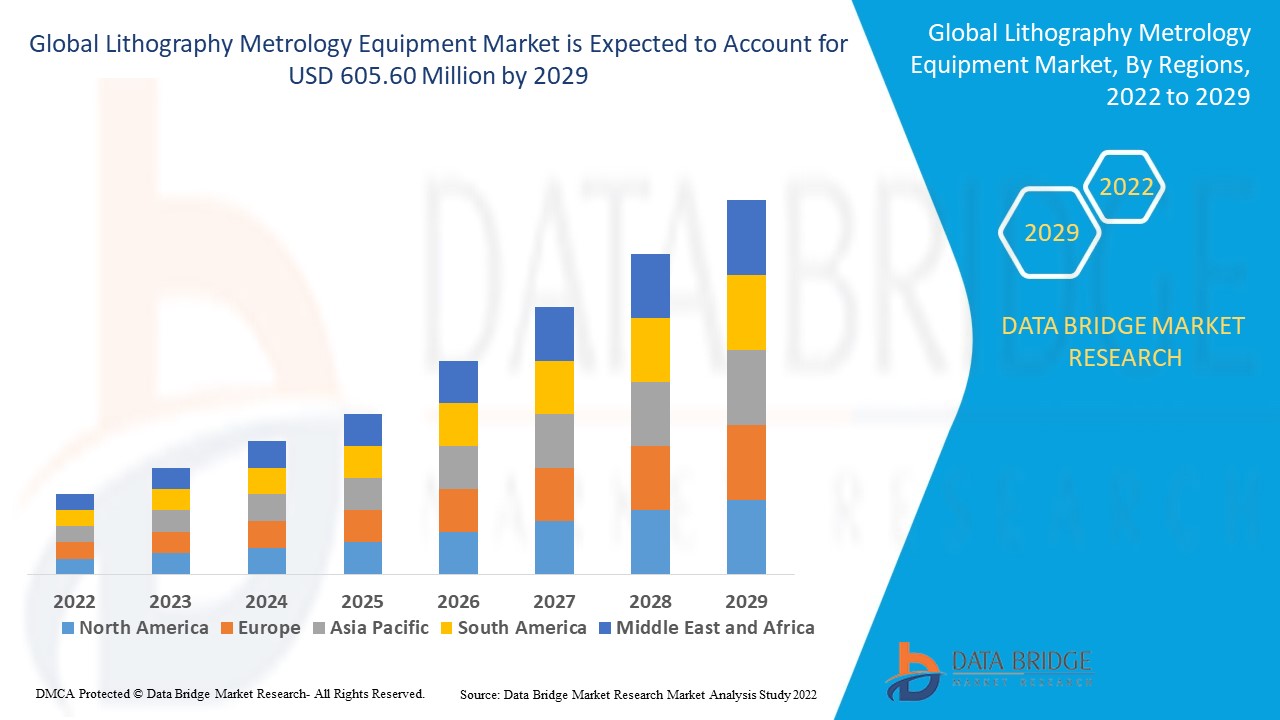

Global Lithography Metrology Equipment Market - Industry Overview

The Global Lithography Metrology Equipment Market is a vital component of the semiconductor industry, focusing on tools that ensure the precision of patterns etched during the lithography process. Global Lithography Metrology Equipment Market is experiencing steady growth, driven by the rising demand for advanced semiconductors across sectors like consumer electronics, automotive, and telecommunications. The push for smaller, more powerful devices is fueling the need for increasingly precise metrology tools, especially with the adoption of cutting-edge technologies like extreme ultraviolet (EUV) lithography.

Data Bridge Market Research Market Report provides details of new recent developments, market share, market trends on the basis of its segmentations and regional analysis, the impact of market players, analyses of opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market, contact Data Bridge Market Research’s team of expert analysts. Our team will help you make informed market decisions to achieve business growth.

Global Lithography Metrology Equipment Market Size and Market Analysis

|

Global Lithography Metrology Equipment Market Report Metrics Details |

|

||

|

Report Metric |

Details |

||

|

Forecast Period |

2024-2031 |

||

|

Base Year |

2023 |

||

|

Historic Year |

2022 (Customizable 2016-2021) |

||

|

Measuring Unit |

USD Million |

||

|

Data Pointers |

Market value, growth rate, market segments, geographical coverage, market players, and market scenario, in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

||

The global lithography metrology equipment market encompasses various tools and technologies designed to measure and analyze the patterns created during the lithography process, ensuring precision and accuracy at nanometer scales consequently covering a broad spectrum of market. As a result Databridge Market Research dived into comprehensively analyzing the market and unveiled that the Global Lithography Metrology Equipment Market is increasing at a CAGR of 7.60%. Our detailed analysis forecasts that the market is valued at USD 701.14 million in 2023 and is expected to grow up to USD 1259.82 million by 2031. Our meticulously created report, developed through comprehensive research and analytics, is a distinguished paper that unveils eye-opening data about the market.

Global Lithography Metrology Equipment Market Dynamics

Global Lithography Metrology Equipment Market Growth Drivers

Advancements in Semiconductor Manufacturing Technologies

Extreme Ultraviolet (EUV) lithography, which is essential for producing advanced semiconductor devices, demands new metrology tools capable of measuring and inspecting features at the nanometer scale. The increasing adoption of EUV technology is a significant driver for the growth of the lithography metrology equipment market.

Penetration of Internet of Things

The expansion of the Internet of Things (IoT) and the growing number of connected devices are driving a significant demand for semiconductor components. These devices, from smart appliances to industrial sensors, require specialized, highly efficient chips. To meet this demand, manufacturers are producing more complex and miniaturized semiconductor chips, increasing the need for advanced lithography metrology equipment. Consequently, driving Global Lithography metrology equipment market.

Global Lithography Metrology Equipment Market Growth Opportunities

Expansion of EUV Technology

Semiconductor manufacturers increasingly adopt Extreme Ultraviolet (EUV) lithography for advanced nodes. For instance, 7nm, 5nm, and below. There is a growing demand for metrology equipment that can handle the unique challenges of this technology. Developing and supplying metrology tools optimized for EUV processes represents a significant growth opportunity for equipment manufacturers.

Non-Semiconductor Applications

The primary market for lithography metrology equipment is semiconductor manufacturing, but there is significant potential for growth by expanding into other high-precision industries. Sectors such as photonics, MEMS (Micro-Electro-Mechanical Systems), and advanced displays require similar levels of precision and accuracy in their manufacturing processes. Tapping into diverse emerging markets can drive further expansion and diversification in the global lithography metrology equipment market, opening up additional revenue streams and reducing dependency on the semiconductor sector alone.

Global Lithography Metrology Equipment Market Growth Challenges

Capital-Intensive Nature

The high sophistication and expense associated with lithography metrology equipment present a significant growth challenge for the Global Lithography Metrology Equipment Market. The substantial capital investment required for developing and manufacturing lithographic metrology advanced tools can serve as a barrier, particularly for smaller companies looking to enter or expand within the market. The high costs of production and R&D limit market participation to well-established players with the financial resources to invest in cutting-edge technology, thereby constraining overall market growth and competition.

Need for Specialized Talent

The development and operation of advanced lithography metrology equipment require highly skilled personnel with expertise in optics, nanotechnology, and semiconductor processes. The growing shortage of such specialized talent poses a significant challenge for the Global Lithography Metrology Equipment Market. According to the Semiconductor Industry Association, the U.S. economy is expected to create an estimated 3.85 million additional jobs in the semiconductor industry by 2030, with 1.4 million of these jobs projected to remain unfilled due to a lack of technical skills. This shortage of qualified professionals can hinder the development, deployment, and maintenance of complex metrology tools, impacting the market's ability to grow and innovate effectively.

Global Lithography Metrology Equipment Market Restraints

Supply Chain and Geopolitical Risks

Geopolitical tensions and trade disputes serve as a significant restraint for the Global Lithography Metrology Equipment Market. For instance, the ongoing U.S.-China trade war has led to increased tariffs on semiconductor manufacturing equipment and components, raising production costs for manufacturers. In 2018, the U.S. imposed tariffs on Chinese goods, including semiconductor equipment, which directly impacted the cost structures and supply chain dynamics for key players such as ASML and KLA Corporation. Geopolitical trade conflict underscores the broader market uncertainty and operational challenges that arise from geopolitical and trade-related issues, posing a significant restraint on market growth.

Regulatory and Environmental Compliance

Compliance with stringent regulatory and environmental standards represents a significant restraint for the Global Lithography Metrology Equipment Market. For instance, the EU’s RoHS directive necessitates reducing hazardous substances in electronic products, which leads to increased development costs for redesign and testing. Similarly, adherence to the Global Harmonized System (GHS) for chemical labeling requires additional investment in safety and labeling processes. These regulatory requirements add complexity and financial burden to the development and manufacturing of metrology equipment, impacting overall Global Lithography Metrology Equipment Market growth.

Global Lithography Metrology Equipment Market Scope and Trends

|

Global Lithography Metrology Equipment Market Segmentations Overview |

|

|

Market |

Sub-Segments |

|

Technology |

Critical-Dimension Scanning Electron Microscope (CD-SEM), Optical Critical Dimension Metrology (OCD), Overlay Control, Others |

|

Product |

Chemical Control Equipment, Gas Control Equipment, Others |

|

Application |

Quality Control and Inspection, Reverse Engineering, Virtual Simulation, Others |

- Cutting-edge deposition methods like as chemical vapor deposition (CVD) and atomic layer deposition (ALD) are making it easier to deposit thin films with remarkable conformity and uniformity, which is essential for producing cutting-edge devices.

- Hitachi High-Tech Corporation introduced the Hitachi Dark Field Wafer Defect Inspection System DI4600, a new tool designed for inspecting particles and defects on patterned wafers in semiconductor production lines. The DI4600 enhances detection capabilities through the incorporation of a dedicated server, which provides significantly increased data processing power essential for identifying particles and defects more effectively.

- Samsung Electronics has developed a high-throughput metrology technique for semiconductor manufacturing that measures the in-cell uniformity (ICU) and in-wafer uniformity (IWU) of semiconductor devices used in high-volume manufacturing. The methodology combines spectroscopy and imaging.

Global Lithography Metrology Equipment Market Regional Analysis – Market Trends

|

Global Lithography Metrology Equipment Market Regional Overview |

|

|

|

Region |

Countries |

|

|

Europe |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe |

|

|

APAC |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific |

|

|

North America |

U.S., Canada, and Mexico |

|

|

MEA |

Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East, and Africa |

|

|

South America |

Brazil, Argentina, and Rest of South America |

|

Key Insights

- North America, particularly the United States, is a significant market for advanced lithography metrology equipment due to its strong presence in semiconductor R&D and technology innovation. Key players such as ASML, KLA Corporation, and others are based in the U.S.

- Europe has a notable presence in the lithography metrology equipment market, with companies like ASML and various research institutions contributing to the sector. The region focuses on high-precision equipment and advanced technologies.

- APAC is the largest and fastest-growing market for lithography metrology equipment, primarily due to its substantial semiconductor manufacturing base. Countries like China, Taiwan, South Korea, and Japan are major players in the semiconductor industry.

- Latin America is a developing market for lithography metrology equipment, with growing interest in expanding semiconductor manufacturing capabilities. Brazil and Mexico are making strides in technology and manufacturing, which could increase the demand for advanced metrology equipment in the region.

Global Lithography Metrology Equipment Market Leading Players

- ADVANTEST CORPORATION (Japan)

- Applied Materials, Inc. (US)

- ASML (Netherlands)

- Canon Inc. (Japan)

- Hitachi High-Tech Corporation (Japan)

- KLA Corporation (US)

- Onto Innovation (US)

- Nanometrics Inc. (US)

- Nikon Metrology Inc. (US)

- Nova Measuring Instruments Ltd. (Israel)

- Tokyo Electron Limited (Japan)

Global Lithography Metrology Equipment Market Recent Developments

- In July, 2024 ASML unveiled its latest Extreme Ultraviolet (EUV) metrology system, designed to enhance precision and speed in semiconductor manufacturing. This new equipment aims to support advanced node production by improving patterning accuracy and reducing defect rates.

- In February, 2023, Applied Materials introduced a new optical critical dimension (OCD) metrology tool that offers improved resolution and faster measurement speeds. This tool is designed to meet the demands of the latest semiconductor manufacturing technologies.

- In December, 2023 Hitachi High-Tech expanded its semiconductor metrology offerings with the introduction of a new critical-dimension scanning electron microscope (CD-SEM) system. This system aims to support the growing needs for high-resolution metrology in cutting-edge semiconductor manufacturing.

- In March, 2023 EUV Tech, a prominent producer of metrology equipment for advanced semiconductor manufacturing utilizing extreme ultraviolet lithography (EUVL), has secured Series A funding led by Intel Capital. This investment will enable EUV Tech to support its global installed base of equipment, improve its current product offerings, and launch several new innovative products currently in development.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lithography Metrology Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lithography Metrology Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lithography Metrology Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.