Global Lithium Ion Battery Recycling Market

Market Size in USD Million

CAGR :

%

USD

6.93 Million

USD

30.73 Million

2024

2032

USD

6.93 Million

USD

30.73 Million

2024

2032

| 2025 –2032 | |

| USD 6.93 Million | |

| USD 30.73 Million | |

|

|

|

Lithium-Ion Battery Recycling Market Analysis

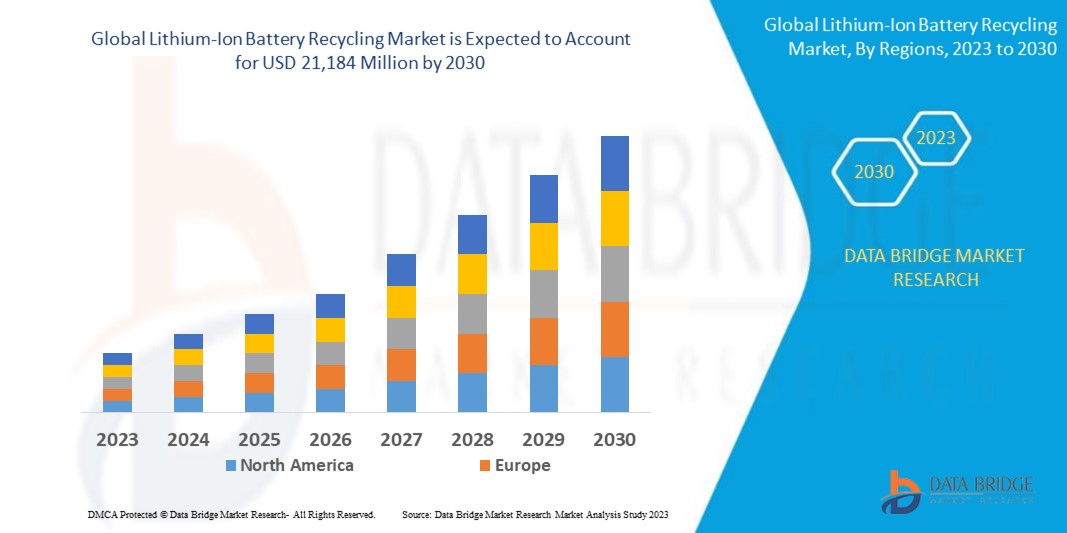

The lithium-ion battery recycling market is experiencing significant growth due to the increasing demand for electric vehicles (EVs), renewable energy storage systems, and the growing emphasis on sustainability. As global adoption of EVs rises, so does the need for efficient recycling of used batteries to recover valuable materials such as lithium, cobalt, nickel, and manganese. These metals are critical for the production of new batteries, and recycling helps reduce environmental impacts and dependence on raw material mining. The market is expected to expand rapidly, driven by advancements in recycling technologies such as hydrometallurgical, pyrometallurgical, and physical/mechanical processes, which offer improved efficiency in material recovery and reduced emissions. Leading players such as Li-Cycle, Umicore, and Cirba Solutions are innovating with cutting-edge technologies to enhance the recycling process, enabling higher recovery rates and lower operational costs. Governments worldwide are also introducing regulations to support the recycling ecosystem, further promoting sustainable practices. The Asia-Pacific region is anticipated to dominate the market due to its established battery manufacturing hubs, while Europe and North America are rapidly growing as key players, driven by their transition to green energy solutions.

Lithium-Ion Battery Recycling Market Size

The global lithium-ion battery recycling market size was valued at USD 6.93 billion in 2024 and is projected to reach USD 30.73 billion by 2032, with a CAGR of 20.45% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Lithium-Ion Battery Recycling Market Trends

“Increasing Focus on Closed-Loop Recycling”

One key trend in the lithium-ion battery recycling market is the increasing focus on closed-loop recycling, which aims to recycle used batteries back into new ones, minimizing the need for raw material extraction. Companies such as Li-Cycle and Umicore are leading this trend by implementing advanced hydrometallurgical and pyrometallurgical processes to efficiently recover critical materials such as lithium, cobalt, and nickel from spent batteries. For instance, Li-Cycle's Spoke and Hub model allows for the collection and processing of end-of-life batteries to recover up to 95% of materials, which are then reintroduced into the supply chain to produce new batteries. This closed-loop approach reduces environmental impact and dependency on mining, aligning with growing sustainability efforts in the electric vehicle (EV) and renewable energy sectors. As demand for electric vehicles and battery storage increases, the adoption of closed-loop recycling is expected to expand, driving both environmental and economic benefits.

Report Scope and Lithium-Ion Battery Recycling Market Segmentation

|

Attributes |

Lithium-Ion Battery Recycling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Umicore N.V. (Belgium), Cirba Solutions (U.S.), Li-Cycle Corp. (Canada), RecycLiCo Battery Materials Inc. (Canada), GEM Co., Ltd. (China), Recupyl S.A.S. (France), Environmental 360 Solutions Ltd. (Canada), Neometals Ltd (Australia), ACCUREC-Recycling GmbH (Germany), Glencore (Switzerland), GP Batteries International Limited (Hong Kong), Battery Recycling Made Easy (U.S.), Guangdong Brunp Recycling Technology Co., Ltd. (China), Lithion Technologies (Canada), and Eco-Bat Technologies Ltd. (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Lithium-Ion Battery Recycling Market Definition

Lithium-ion battery recycling refers to the process of collecting and processing used or end-of-life lithium-ion batteries to recover valuable materials, such as lithium, cobalt, nickel, and graphite, for reuse in the production of new batteries. The recycling process helps reduce the environmental impact of mining for these materials, minimizes waste, and supports the sustainable growth of industries such as electric vehicles (EVs) and renewable energy storage.

Lithium-Ion Battery Recycling Market Dynamics

Drivers

- Increasing Adoption of Electric Vehicles (EVs)

The increasing adoption of electric vehicles (EVs) is a significant market driver for the lithium-ion battery industry, as EVs rely heavily on these batteries for energy storage. For instance, electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. This surge in EV adoption directly correlates with the rising demand for lithium-ion batteries, further driving the need for efficient battery recycling solutions. As more EVs enter the market, the supply of end-of-life batteries will increase, prompting the development of robust recycling systems to recover valuable materials such as lithium, cobalt, and nickel. These materials are essential for new battery production, ensuring a sustainable supply chain. Consequently, the growing EV market is a key factor in boosting the lithium-ion battery recycling sector.

- Rising Resource Conservation and Material Recovery

Rising resource conservation and material recovery are becoming crucial drivers of the lithium-ion battery market, as both environmental concerns and resource scarcity prompt industries to focus on recycling and reusing critical materials. According to a report by the International Energy Agency (IEA), the demand for key battery materials such as lithium, cobalt, and nickel is expected to increase significantly, potentially quadrupling by 2040. This growing demand, coupled with the finite availability of these resources, has led to an intensified focus on recycling and sustainable sourcing practices. For instance, battery recycling initiatives are gaining momentum, with companies such as Tesla and Li-Cycle investing in advanced recycling technologies to recover valuable materials from used batteries. Li-Cycle, for instance, boasts a process that can recover up to 95% of the materials in lithium-ion batteries, significantly reducing the need for new raw materials. As governments and industries strive to meet stricter environmental regulations and reduce their carbon footprint, material recovery and resource conservation become key drivers of market growth, opening opportunities for recycling innovations, closed-loop supply chains, and a more sustainable battery production ecosystem.

Opportunities

- Growing Technological Advancements in Recycling

New recycling technologies are playing a crucial role in enhancing the efficiency of lithium-ion battery recycling. Among these, hydrometallurgical and pyrometallurgical processes are particularly effective in recovering valuable materials such as lithium, cobalt, and nickel from used batteries. Hydrometallurgy uses chemical solutions to extract metals, while pyrometallurgy involves high-temperature processes to melt and recover metals. Companies such as Li-Cycle and Umicore are leading the way in these advancements. Li-Cycle's Spoke and Hub model, for instance, uses innovative processes to recover up to 95% of battery materials, significantly improving recovery rates. Additionally, these advancements help reduce the costs associated with recycling and minimize the environmental impacts of traditional mining, making battery recycling more viable and sustainable. As the demand for electric vehicles (EVs) and renewable energy systems grows, the development of these technologies will continue to drive the expansion of the lithium-ion battery recycling market.

- Increasing Regulatory Pressures

Regulatory pressures are playing a significant role in driving the growth of the lithium-ion battery recycling market, with many countries, especially in Europe and Asia, implementing stricter regulations to ensure the collection and recycling of used batteries. For instance, the European Union’s Battery Directive, which was updated in 2021, mandates that 65% of portable batteries must be collected and recycled by 2025, with specific targets for different materials such as lead, nickel, and lithium. This directive also includes provisions for establishing extended producer responsibility (EPR) programs, requiring manufacturers to take responsibility for the lifecycle of their batteries, including recycling. In addition to regulatory targets, governments are offering financial incentives, such as subsidies for the development of recycling infrastructure, to make battery recycling more economically viable. In Asia, countries such as Japan and South Korea are also pushing for more sustainable battery management systems. These regulations are creating a compliant framework and opening up a market opportunity for recycling businesses to expand. Companies involved in battery collection, sorting, and recycling, such as Li-Cycle and Redwood Materials, are capitalizing on these regulatory incentives to scale their operations. As these regulations are enforced more rigorously across the globe, the demand for efficient and innovative battery recycling solutions will continue to grow, presenting substantial market opportunities for those positioned in the recycling and sustainable materials sectors.

Restraints/Challenges

- High Recycling Costs

High recycling costs remain a significant challenge in the lithium-ion battery recycling market, despite advancements in technology. The complex composition of lithium-ion batteries, which contain various metals such as lithium, cobalt, and nickel, requires specialized equipment and processes such as hydrometallurgy and pyrometallurgy for efficient separation and recovery. These processes are costly due to the need for high energy consumption and the advanced infrastructure required to handle hazardous materials. For instance, Li-Cycle, a leader in battery recycling, has invested heavily in its Spoke and Hub model, which offers high recovery rates but also comes with significant operational costs. Smaller-scale recycling operations face particular difficulties in achieving cost efficiency, as they lack the scale and resources to make recycling economically viable. This high cost structure limits the growth of recycling capabilities, slowing down the global transition toward a more sustainable circular economy in battery production.

- Lack of Adequate Recycling Infrastructure

Lack of Adequate Recycling Infrastructure remains a significant challenge in the lithium-ion battery recycling market, particularly in regions where proper collection, sorting, and processing facilities are underdeveloped. In many parts of the world, including parts of the U.S. and Europe, the infrastructure needed to handle the growing volume of used batteries from electric vehicles (EVs) and consumer electronics is insufficient. For instance, in the U.S., although battery recycling programs are available, only about 5% of used lithium-ion batteries are currently being recycled. As the demand for lithium-ion batteries continues to rise with the growth of the EV market, the absence of an efficient, global recycling infrastructure will slow the transition to a circular economy and prolong reliance on raw material mining.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Lithium-Ion Battery Recycling Market Scope

The market is segmented on the basis of component, chemistry, and recycling process. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Components

- Active Material

- Non-Active Material

Chemistry

- Lithium-Nickel Manganese Cobalt (Li-NMC)

- Lithium Cobalt Oxide (LCO)

- Lithium-Manganese Oxide (LMO)

- Lithium-Iron Phosphate (LFP)

- Lithium-Nickel Cobalt Aluminium Oxide (NCA)

- Lithium-Titanate Oxide (LTO)

Recycling Processes

- Hydrometallurgical Process

- Pyrometallurgy Process

- Physical/Mechanical Process

Lithium-Ion Battery Recycling Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, component, chemistry, and recycling process as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is dominating the lithium-ion battery recycling market due to its prominent role in manufacturing these batteries. China, Japan, and South Korea are key players in the production of lithium-ion batteries, contributing to a substantial volume of battery waste. As the demand for electric vehicles and renewable energy solutions grows, the region faces an increasing need to manage and recycle these batteries effectively. This, in turn, presents significant opportunities for battery recycling and sustainable material recovery within the region.

Europe is the fastest-growing region in the lithium-ion battery recycling market, driven by the rapid expansion of the automotive industry, which is fueling a higher demand for lithium-ion batteries. The rising adoption of Electric Vehicles (EVs), which rely on these batteries, along with growing environmental awareness in the region, is further accelerating the focus on recycling. These factors are collectively contributing to the robust growth of the lithium-ion battery recycling market in Europe.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Lithium-Ion Battery Recycling Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Lithium-Ion Battery Recycling Market Leaders Operating in the Market Are:

- Umicore N.V. (Belgium)

- Cirba Solutions (U.S.)

- Li-Cycle Corp. (Canada)

- RecycLiCo Battery Materials Inc. (Canada)

- GEM Co., Ltd. (China)

- Recupyl S.A.S. (France)

- Environmental 360 Solutions Ltd. (Canada)

- Neometals Ltd (Australia)

- ACCUREC-Recycling GmbH (Germany)

- Glencore (Switzerland)

- GP Batteries International Limited (Hong Kong)

- Battery Recycling Made Easy (U.S.)

- Guangdong Brunp Recycling Technology Co., Ltd. (China)

- Lithion Technologies (Canada)

- Eco-Bat Technologies Ltd. (U.K.)

Latest Developments in Lithium-Ion Battery Recycling Market

- In February 2024, Cirba Solutions and EcoPro signed a Memorandum of Understanding (MoU) to enhance lithium-ion battery recycling efforts, with this collaboration being pivotal due to the growing demand for battery materials and the emphasis on clean energy production in the U.S

- In March 2023, Li-Cycle was awarded a USD 375 million loan from the U.S. Department of Energy to develop a lithium-ion battery recycling facility near Rochester, New York, with the facility aiming to focus on recycling key battery materials, addressing the high cost of lithium mining in the U.S. and local opposition to extraction projects

- In February 2023, Fortum Battery Recycling commenced its electric vehicle (EV) battery recycling operations in Kirchardt, Germany, with this hub processing over 3,000 tons of end-of-life batteries and production scrap annually, and being connected to the Harjavalta site, where the hydrometallurgical process occurs

- In August 2022, Mercedes-Benz Group AG announced a partnership with Contemporary Amperex Technology Co. Ltd. to establish a battery manufacturing plant in Hungary, with a USD 7.6 billion investment, and the factory set to produce 100 gigawatt-hours of batteries, enough to power more than 1 million vehicles, while operating on renewable energy

- In April 2022, Umicore entered into a long-term strategic supply agreement with Automotive Cells Company (ACC) for battery recycling services, with the recovered metals from Umicore’s recycling process being delivered to ACC's pilot plant in Nersac, France, in battery-grade quality for reuse in new lithium-ion battery production

- In August 2021, Glencore formed a long-term strategic partnership with Britishvolt, a leader in electric vehicle battery production in the UK, with Glencore supplying Britishvolt with cobalt, further strengthening its position in the lithium-ion battery recycling market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lithium Ion Battery Recycling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lithium Ion Battery Recycling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lithium Ion Battery Recycling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.