Global Liquid Lecithin Market

Market Size in USD Million

CAGR :

%

USD

479.56 Million

USD

817.84 Million

2024

2032

USD

479.56 Million

USD

817.84 Million

2024

2032

| 2025 –2032 | |

| USD 479.56 Million | |

| USD 817.84 Million | |

|

|

|

|

Liquid Lecithin Market Size

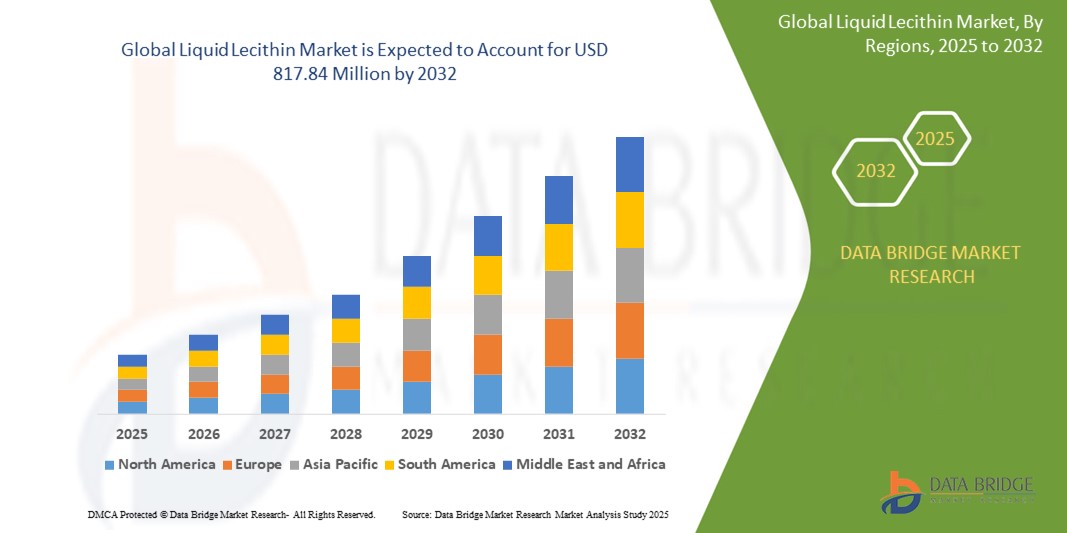

- The global liquid lecithin market size was valued at USD 479.56 million in 2024 and is expected to reach USD 817.84 million by 2032, at a CAGR of 6.90% during the forecast period

- The market growth is largely fueled by increasing demand for natural emulsifiers and rising awareness of health benefits associated with lecithin use

- Growing application of liquid lecithin in the food and beverage industry as a stabilizer and emulsifier is driving market expansion

- Rising utilization in pharmaceutical and cosmetic products due to its antioxidant and skin-conditioning properties supports market growth

Liquid Lecithin Market Analysis

- The liquid lecithin market is growing steadily due to its versatile applications across food, cosmetics, and pharmaceutical industries where it acts as a natural emulsifier and stabilizer

- Increasing consumer preference for natural and clean-label ingredients is pushing manufacturers to adopt liquid lecithin, especially types derived from sunflower and soy, which are favored for their non-allergenic and non-GMO properties

- North America dominated the liquid lecithin market with the largest revenue share of 40.01% in 2024, driven by a well-established food processing industry and rising consumer preference for clean-label and natural ingredients

- Asia-Pacific is expected to be the fastest growing region in the liquid lecithin market during the forecast period due to expanding food processing industries, rising disposable incomes, and growing awareness about health benefits

- The soy segment dominated the market with the largest revenue share of 55% in 2024, driven by the wide availability of soybeans and its cost-effectiveness as a lecithin source. Soy-based liquid lecithin is favored for its functional properties and versatility across multiple industries, including food and cosmetics

Report Scope and Liquid Lecithin Market Segmentation

|

Attributes |

Liquid Lecithin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Lecithin Market Trends

“Rising Demand for Clean-Label and Plant-Based Lecithin”

- Consumers are increasingly preferring natural and simple ingredients, boosting demand for liquid lecithin as a clean-label emulsifier

- Plant-based lecithin from sources like soy and sunflower is becoming more popular due to the rise in vegan and allergen-friendly products

- Manufacturers are expanding offerings to include organic and non-genetically modified lecithin variants to meet health-conscious consumer needs

- Liquid lecithin is widely used in foods such as chocolates, baked goods, and dairy products to improve texture and shelf life naturally

- The cosmetics industry is also driving demand, valuing liquid lecithin for its natural moisturizing and emulsifying properties

- For instance, companies have recently increased production capacity for soy-based liquid lecithin to keep up with the growing market demand

- In conclusion, the focus on clean-label and plant-based ingredients is a key factor shaping the liquid lecithin market, with broad adoption across food, beverage, and personal care sectors

Liquid Lecithin Market Dynamics

Driver

“Growing Demand for Natural Emulsifiers in Food Industry”

- Consumer demand for natural and clean-label ingredients is rising globally, driving food manufacturers to use liquid lecithin as a recognizable and minimally processed emulsifier

- Liquid lecithin, mainly from soybeans and sunflower seeds, is widely used in chocolates, baked goods, margarine, and dairy alternatives to improve texture and shelf life

- The plant-based food sector is rapidly growing, with liquid lecithin playing a key role in stabilizing emulsions in vegan and clean-label products, aligning with shifting dietary preferences

- For instance, major food companies like Nestlé and Danone have reformulated products using natural emulsifiers like liquid lecithin to meet clean-label and organic certification standards

- Rising health awareness supports liquid lecithin use due to its benefits such as aiding digestion and lowering cholesterol, encouraging food and beverage brands to adopt it broadly

- In conclusion, the increasing focus on natural and clean-label ingredients is a significant driver, fueling the expansion of the liquid lecithin market worldwide

Restraint/Challenge

“Supply Chain Vulnerabilities and Price Volatility”

- The liquid lecithin market faces challenges due to supply chain vulnerabilities as raw materials like soybeans and sunflower seeds depend heavily on weather, crop health, and geopolitical stability

- For instance, poor soybean harvests in key producing countries cause shortages, driving up prices and making it difficult for producers to maintain steady supply at competitive costs

- Processing and refining costs, combined with global trade tariffs and transportation expenses, contribute to price volatility, complicating budgeting for manufacturers and buyers

- Small and medium producers struggle to absorb fluctuating costs, limiting their ability to compete and slowing market growth

- Global disruptions such as pandemics and trade conflicts expose the fragility of natural raw material sourcing, sometimes forcing manufacturers to consider synthetic emulsifiers despite consumer demand for natural options

- In conclusion, supply chain uncertainties and price fluctuations remain significant restraints, limiting the liquid lecithin market’s consistent growth despite rising demand

Liquid Lecithin Market Scop

The market is segmented on the basis of source, application, and modification.

• By Source

On the basis of source, the liquid lecithin market is segmented into sunflower, egg, soy, rapeseed, and others. The soy segment dominated the market with the largest revenue share of 55% in 2024, driven by the wide availability of soybeans and its cost-effectiveness as a lecithin source. Soy-based liquid lecithin is favored for its functional properties and versatility across multiple industries, including food and cosmetics. The increasing demand for plant-based ingredients further strengthens soy lecithin’s market dominance.

The sunflower segment is expected to witness the fastest growth rate of around 8% CAGR from 2025 to 2032, fueled by consumer preference for allergen-free and non-GMO products. Sunflower lecithin is gaining traction due to its natural, non-soy origin, making it ideal for clean-label and allergen-sensitive applications.

• By Application

On the basis of application, the liquid lecithin market is segmented into feed, industrial, convenience food, bakery, confectionary, pharmaceutical, personal care and cosmetics, and others. The convenience food segment held the largest market share of about 30% in 2024, driven by the growing consumption of ready-to-eat and processed foods that rely on liquid lecithin for improved texture and shelf life.

The pharmaceutical segment is anticipated to witness the fastest CAGR of approximately 9% between 2025 and 2032, propelled by increasing use of liquid lecithin as an excipient and emulsifier in drug formulations and supplements. The rising focus on improving bioavailability and patient compliance supports this growth.

• By Modification

On the basis of modification, the market is segmented into genetically modified and non-genetically modified liquid lecithin. The genetically modified segment accounted for the larger share in 2024, primarily due to the widespread use of genetically modified soybeans as raw material.

The non-genetically modified segment is expected to grow faster, driven by consumer demand for organic and natural products, especially in food and personal care sectors, where clean-label requirements are stringent.

Liquid Lecithin Market Regional Analysis

- North America dominated the liquid lecithin market with the largest revenue share of 40.01% in 2024, driven by a well-established food processing industry and rising consumer preference for clean-label and natural ingredients

- The region benefits from strong demand in convenience foods, baked goods, and personal care products, where liquid lecithin is widely used as an emulsifier and texture enhancer

- Increasing investments in research and development for plant-based and allergen-free lecithin products further fuel market growth in North America

U.S. Liquid Lecithin Market Insight

The U.S. liquid lecithin market holds a significant share globally, driven by the growing demand for clean-label and natural ingredients in food and beverage production. Increasing awareness among consumers about health benefits linked to lecithin, such as cholesterol reduction and improved brain function, supports market growth. Additionally, food manufacturers are focusing on incorporating liquid lecithin to enhance texture, emulsification, and shelf life in various products.

Europe Liquid Lecithin Market Insight

Europe’s liquid lecithin market is expanding steadily due to rising demand in pharmaceutical and cosmetic industries, where lecithin is valued for its moisturizing and stabilizing properties. The region also witnesses increased use in bakery and confectionery sectors, encouraged by consumer preferences for natural additives. Strong regulatory frameworks supporting natural and safe food ingredients further bolster market growth.

U.K. Liquid Lecithin Market Insight

In the U.K., the liquid lecithin market is growing with rising health-conscious consumer behavior and demand for plant-based ingredients. The food sector is adopting liquid lecithin to improve product quality and meet clean-label standards. Increasing innovation in functional foods and supplements is also creating new application avenues for liquid lecithin.

Germany Liquid Lecithin Market Insight

Germany’s market growth is fueled by advanced pharmaceutical research and a strong emphasis on sustainable and natural product development. The country’s food processing industry is integrating liquid lecithin to improve emulsification and extend product freshness. Consumer interest in natural cosmetics and personal care products also drives demand.

Asia-Pacific Liquid Lecithin Market Insight

Asia-Pacific is expected to register the fastest growth due to expanding food processing industries, rising disposable incomes, and growing awareness about health benefits. Countries such as China, India, and Japan are witnessing rapid adoption of liquid lecithin in bakery, confectionery, and pharmaceutical applications. Government initiatives promoting health and nutrition further support market expansion.

Japan Liquid Lecithin Market Insight

Japan’s liquid lecithin market is influenced by the nation’s focus on health and longevity, with increasing use in dietary supplements and functional foods. The cosmetic industry also drives demand due to lecithin’s skin-nourishing properties. Technological advancements in extraction and formulation techniques are enabling high-quality liquid lecithin products.

China Liquid Lecithin Market Insight

China leads the Asia-Pacific region with the largest market revenue share, driven by rapid urbanization, expanding middle-class population, and a booming food and pharmaceutical industry. The rise in demand for natural food additives and increased investments in production infrastructure support market growth. The government’s emphasis on food safety and nutrition is further encouraging the use of liquid lecithin in multiple sectors.

Liquid Lecithin Market Share

The liquid lecithin industry is primarily led by well-established companies, including:

- VAV Life Sciences Pvt. Ltd. (India)

- American Lecithin Company (U.S.)

- ADM (U.S.)

- AVRIL SCA (France)

- LASENOR EMUL, S.L. (Spain)

- Sonic Biochem (India)

- Bunge Limited (U.S.)

- Avanti Polar Lipids (U.S.)

- Cargill, Incorporated (U.S.)

- SODRUGESTVO GROUP (Luxembourg)

- Lecital (Serbia)

- Stern-Wywiol Gruppe GmbH & Co. KG (Germany)

- Lipoid GmbH (Germany)

- DuPont (U.S.)

- Wilmar International Ltd (Singapore)

- Victoria Group (Serbia)

- Sternchemie GmbH & Co. KG (Germany)

- THEW ARNOTT & CO LTD (U.K.)

- NOW Foods (U.S.)

- Soya International (U.K.)

Latest Developments in Global Liquid Lecithin Market

- In September 2021, AAK, a global leader in vegetable oils and fats, acquired BIC Ingredients, the lecithin product division of PIC International Holdings. This acquisition allows AAK to expand its portfolio with non-GMO specialty lecithins and lecithin compounds, enhancing its offerings in the natural and functional ingredient markets

- In 2021, Corbion unveiled the Pristine 3000, the company's 'most robust dough conditioning innovation yet,' adding to its Pristine range of clean label solutions. The solution enables bakers to overcome common challenges, such as wheat protein inconsistencies and high-speed processing, without relying on gluten supplementation and conventional solutions, like diacetyl tartaric acid ester of monoglycerides (DATEM).

- In 2020, The Brazilian unit of US commodities trader Cargill build a new facility to produce pectin (which can be used as an emulsifier), a fruit by-product used in jams, beverages, dairy products and confectionery.

- In March 2020, Kerry Group set up a new regional development and food manufacturing facility in Georgia, Rome. This new establishment would help the company to serve its customer base in Europe, increase its production capacity, and expand its geographic reach.

- In August 2022, Louis Dreyfus Company Agricultural Industries LLC (LDC) expanded its global lecithin manufacturing capabilities by opening a new soy liquid lecithin production facility in Claypool, Indiana, US. This strategic move strengthens LDC's position in the lecithin market, enhancing its ability to meet growing demand for high-quality soy-based ingredients

- In January 2022, SepPure Technologies, based in Singapore, entered a strategic partnership with GIIAVA, a leading soy lecithin producer, to develop and implement innovative process solutions at a soy lecithin production facility in Singapore. This collaboration aims to enhance production efficiency and product quality, leveraging SepPure’s advanced technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquid Lecithin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquid Lecithin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquid Lecithin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.