Global De Oiled Lecithin Market

Market Size in USD Million

CAGR :

%

USD

238.72 Million

USD

458.82 Million

2024

2032

USD

238.72 Million

USD

458.82 Million

2024

2032

| 2025 –2032 | |

| USD 238.72 Million | |

| USD 458.82 Million | |

|

|

|

|

De-oiled Lecithin Market Size

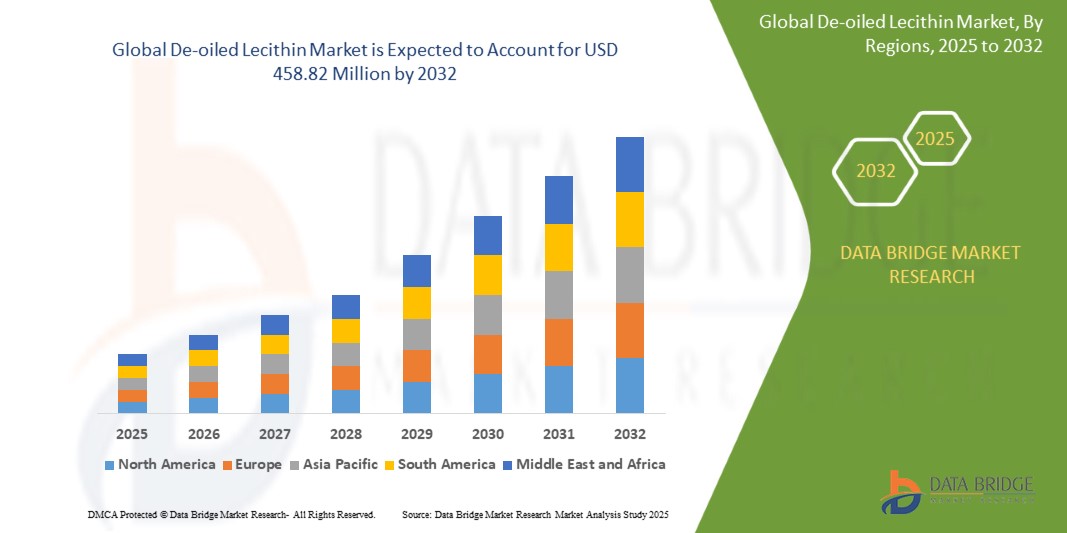

- The global De-oiled Lecithin market size was valued at USD 238.72 million in 2024 and is expected to reach USD 458.82 million by 2032, at a CAGR of 8.51% during the forecast period

- This growth is driven by factors such as the increasing consumer demand for natural and clean-label ingredients, the expanding applications of de-oiled lecithin across various industries, and the rising awareness of its health benefits

De-oiled Lecithin Market Analysis

- De-oiled lecithin is enriched with phospholipid compounds and is oil-free. It is basically oil-free or contains negligible amounts of oil and has a high concentration of polyunsaturated fatty acids. Lecithin descaling is available in powder or granule form

- The product comes in powder or granule form that is easy to handle and compactly packaged to facilitate transportation and storage. Highly dispersible powder or granular lecithin offers a competitive advantage over other forms of lecithin available in liquid form

- Asia-Pacific is expected to dominate the De-oiled Lecithins market due the major producers of the raw materials for the lecithin production

- Europe is expected to be the fastest growing region in the De-oiled Lecithin market during the forecast period due to Increasing consumer awareness about healthy and natural ingredient

- The soy segment is expected to dominate the De-oiled Lecithin market with the largest share of 59.5% in 2025 due to high soybeans are widely cultivated globally, ensuring a steady and cost-effective supply of lecithin. Soy lecithin is versatile, serving as an emulsifier, stabilizer, and antioxidant in various applications

Report Scope and De-oiled Lecithin Market Segmentation

|

Attributes |

De-oiled Lecithin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

De-oiled Lecithin Market Trends

“Shift Towards Non-GMO and Clean-Label Ingredients”

- There is a growing consumer preference for natural, non-GMO, and allergen-free ingredients, particularly in the food and beverage industry. This trend is driving manufacturers to adopt non-GMO and clean-label formulations, including de-oiled lecithin derived from sources such as sunflower and rapeseed

- Consumers are increasingly aware of the health implications of genetically modified organisms (GMOs), leading to a shift towards products that are perceived as healthier and more natural

- Regulatory bodies are also promoting the use of non-GMO ingredients, aligning with consumer preferences and encouraging manufacturers to reformulate products to meet these demands

- This trend is not only prevalent in developed markets but is also gaining momentum in emerging economies, where consumers are becoming more health-conscious and demanding cleaner labels

De-oiled Lecithin Market Dynamics

Driver

“Increasing Demand for Natural Food Additives”

- De-oiled lecithin offers functional benefits such as emulsification, stabilization, and improved texture, making it a valuable ingredient in various food products

- It is associated with health benefits such as lowering cholesterol levels and supporting brain health, which appeals to health-conscious consumers

- The clean-label movement, where consumers seek transparency and natural ingredients, is propelling the demand for de-oiled lecithin as a natural emulsifier

- Regulatory trends favoring natural and non-GMO ingredients are further driving the adoption of de-oiled lecithin in food formulations

Opportunity

“Expansion in Emerging Markets”

- The Asia-Pacific region, particularly countries such as China and India, is witnessing significant growth in the de-oiled lecithin market due to increased soybean cultivation and rising health awareness among consumers

- Rapid urbanization and changing lifestyles are leading to higher consumption of processed and convenience foods, which often contain de-oiled lecithin as an emulsifier

- Governments in emerging markets are implementing regulations that support the use of natural and non-GMO ingredients, creating a favorable environment for the growth of the de-oiled lecithin market

- There is significant potential for market penetration in these regions as consumer awareness about the benefits of de-oiled lecithin increases

Restraint/Challenge

“Volatile Raw Material Prices”

- The prices of raw materials, particularly soybeans, are subject to fluctuations due to factors such as weather conditions, geopolitical tensions, and supply chain disruptions

- Fluctuating raw material prices can lead to increased production costs for de-oiled lecithin, affecting the profitability of manufacturers

- Such volatility can create instability in the market, making it challenging for companies to maintain consistent pricing and supply levels

- Increased production costs may result in higher prices for end consumers, potentially reducing demand for products containing de-oiled lecithin

- External factors such as trade restrictions or pandemics can exacerbate raw material shortages, further impacting production and pricing stability

De-oiled Lecithin Market Scope

The market is segmented on the basis type, method extraction, source, form, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Method of Extraction |

|

|

By Source |

|

|

By Form |

|

|

By Application |

|

In 2025, the soy is projected to dominate the market with a largest share in source segment

The soy segment is expected to dominate the De-oiled Lecithin market with the largest share of 59.5% in 2025 due to high soybeans are widely cultivated globally, ensuring a steady and cost-effective supply of lecithin. Soy lecithin is versatile, serving as an emulsifier, stabilizer, and antioxidant in various applications.

The food and beverages is expected to account for the largest share during the forecast period in application segment

In 2025, the food segment is expected to dominate the market with the largest market share of 60.5% due to its high demand in the food industry for its emulsifying properties, enhancing texture and shelf life in products such as chocolates, baked goods, and dairy alternatives. The increasing consumer demand for clean-label and natural ingredients further drives its adoption in this sector.

De-oiled Lecithin Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the De-oiled Lecithin Market”

- Agricultural Production in countries such as China and India are major producers of soybeans and sunflowers, key raw materials for lecithin production

- The extensive livestock sector in the region supports the demand for lecithin in animal feed applications

- South Korea's well-established personal care industry drives the demand for lecithin-based emulsifiers

- India and China's expanding pharmaceutical sectors contribute to the increased use of lecithin in drug formulations

“Europe is Projected to Register the Highest CAGR in the De-oiled Lecithin Market”

- Increasing consumer awareness about healthy and natural ingredients is driving demand for clean-label products

- Stringent regulatory standards in Europe promote the use of non-GMO and allergen-free food products, boosting lecithin demand

- The robust growth of the food & beverage sector, particularly in bakery, confectionery, and processed foods, fuels the demand for high-quality emulsifiers such as de-oiled lecithin

- Europe's strong emphasis on sustainable and ethical sourcing practices aligns with the adoption of de-oiled lecithin, further accelerating market expansion

De-oiled Lecithin Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ADM (U.S.)

- Clarkson Grain Company (U.S.)

- Cargill, Incorporated (U.S.)

- LECICO GmbH (Germany)

- Lecital (Spain)

- Austrade Inc. (U.S.)

- Stern-Wywiol Gruppe GmbH & Co. KG (Germany)

- DuPont (U.S.)

- GIIAVA (U.S.)

- Bunge Limited (U.S.)

- LASENOR EMUL, S.L. (Spain)

- Amitex Agro Product Pvt. Ltd. (India)

- American Lecithin Company (U.S.)

- Novastell (U.S.)

Latest Developments in Global De-oiled Lecithin Market

- In August 2022, Louis Dreyfus Company Agricultural Industries LLC (LDC) announced the opening of its new soy liquid lecithin plant in Claypool, Indiana, US. This plant integrates the production of glycerin biodiesel, and lecithin refining, and soybean processing into one of the largest facilities in the country. It also features a canola oil distribution terminal and a food-grade packaging line

- In June 2021, Bunge Limited and IMCD Group BV signed an agreement allowing IMCD to distribute BungeMaxx lecithin products across multiple European countries. The partnership aims to cater to the growing demand for natural emulsifiers in the European food industry. The agreement facilitates Bunge's expansion into key market segments, enhancing its product reach

- In March 2021, Stern-Wywiol Gruppe launched SternPur SDH-50, a non-GMO and allergen-free emulsifier alternative. The product is designed to meet the demand for clean-label ingredients in plant-based and nutritional supplement products. ternPur SDH-50 enhances the bioavailability of fat-soluble nutrients, offering functional benefits

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global De Oiled Lecithin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global De Oiled Lecithin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global De Oiled Lecithin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.