Global Leather Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

8.33 Billion

USD

13.48 Billion

2022

2030

USD

8.33 Billion

USD

13.48 Billion

2022

2030

| 2023 –2030 | |

| USD 8.33 Billion | |

| USD 13.48 Billion | |

|

|

|

|

Leather Chemicals Market Analysis and Size

Factors such as the growing operational expenditures, and strict environmental governing strategies are anticipated to further impede the growth of the leather chemicals market during the forecast period. Also, tanned leather generates wastewater that contains sulfides and chromium, which are exposing negative influence on the environment and workers, which in turn this is a main factor that is anticipated to hamper the global leather chemicals market during the forecast period 2023-2030.

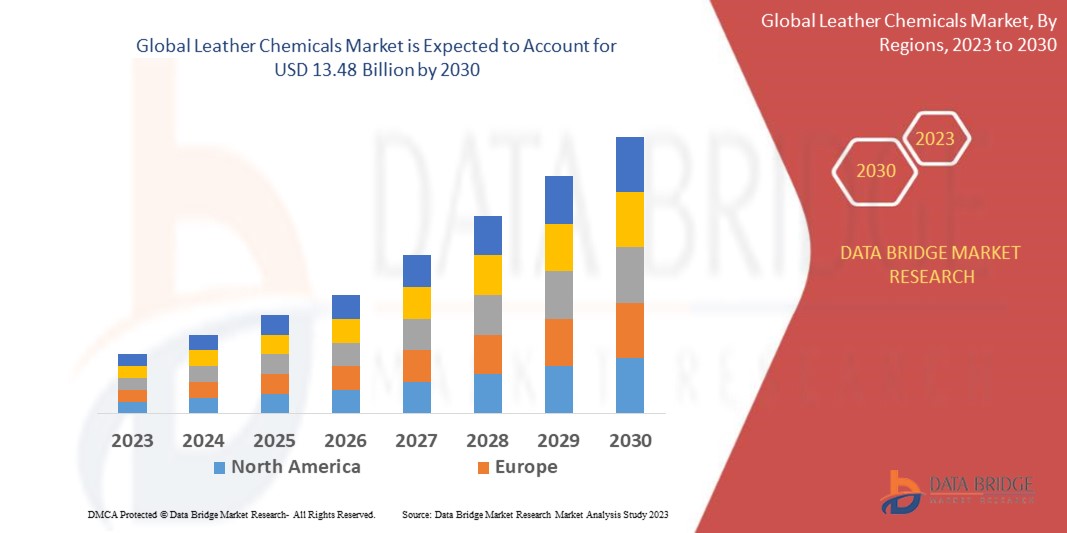

Data Bridge Market Research analyses that the leather chemicals market which was USD 8.33 billion in 2022, is expected to reach USD 13.48 billion by 2030, and is expected to undergo a CAGR of 6.2% during the forecast period of 2023 to 2030.

“Tanning and Dyeing Chemicals” dominates the chemicals type segment of the leather chemicals market as they are used to transform raw hides or skins into a stable, durable, and flexible material suitable for various applications. Dyeing chemicals, on the other hand, impart color and enhance the aesthetic appeal of leather products. Both tanning and dyeing chemicals are essential for achieving desired quality, appearance, and performance characteristics in leather production. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Leather Chemicals Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

Chemicals Type (Tanning and Dyeing Chemicals, Beam House Chemicals, and Finishing Chemicals), End User (Footwear, Furniture, Automotive, Textile and Fashion, and Others) |

|

Countries Covered |

North America (U.S., Canada, and Mexico), South America (Brazil, Argentina, and Rest of South America), Europe (Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, and the rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific), Middle East and Africa (U.A.E, Saudi Arabia, Egypt, South Africa, Israel, and the rest of Middle East and Africa) |

|

Market Players Covered |

BASF SE (Germany), TFL Ledertechnik GmbH & Co.KG (Germany), Stahl Holdings B.V. (Netherlands), LANXESS (Germany), Bayer AG (Germany), Clariant International Ltd (Switzerland), Heim Leather Chem GmbH (Germany), DyStar Singapore Pte Ltd. (Singapore), Knox Lawrence International LLC (U.S.), Pidilite Industries Ltd. (India), Elementis (United Kingdom), SCHILL+SEILACHER GMBH (Germany), DuPont (U.S.), Eastman Chemical Company (U.S.), Solvay S.A. (Belgium), Asahi Kasei (Japan), Evonik Industries (Germany), SABIC (Saudi Arabia), Arkema (France), ANGUS Chemical Company (U.S.), and Corbion (Netherlands) |

|

Market Opportunities |

|

Market Definition

Leather chemicals are generally grouped into bronzing and dyeing chemicals, beam house chemicals, and finishing chemicals. Tanning chemicals contains of chemicals that are utilized to transform raw hide into leather. Commonly utilized tanning chemicals are vegetable tannin, mineral salts, and animal oil. Varying upon type of processing chemicals developed for tanning, leather products are grouped into vegetable tanned leather, synthetic tanned leather, alum tanned leather, aldehyde tanned leather, and chromium tanned leather.

Leather Chemicals Market Dynamics

Drivers

- Growing Demand for Leather Products

The global demand for leather products such as footwear, apparel, and accessories continues to rise. As a result, there is an increased need for leather chemicals to enhance the quality, durability, and aesthetics of leather. The growing consumer preference for leather goods is a significant driver of the market's growth.

- Expansion of the Automotive Industry

The automotive industry is a major consumer of leather, particularly in luxury car segments. The increasing production of automobiles, coupled with the rising preference for leather upholstery, drives the demand for leather chemicals. These chemicals help in improving the quality, texture, and appearance of automotive leather, thereby supporting market growth.

- Technological Advancements in Leather Processing

The development of innovative leather processing techniques and technologies has significantly impacted the leather chemicals market. Advancements in tanning methods, dyeing processes, and finishing technologies have created a demand for specialized chemicals that can cater to these advanced processes. Manufacturers are investing in research and development to introduce high-performance chemicals that meet the evolving industry requirements.

Opportunities

- Rising Demand for Sustainable Leather Chemicals

With growing environmental concerns and regulations, there is a significant opportunity for the development and adoption of sustainable leather chemicals. Manufacturers can capitalize on this trend by introducing eco-friendly and bio-based chemicals that offer improved performance while minimizing environmental impact. The increasing consumer preference for sustainable products creates a favorable market environment for these offerings.

- Increasing Investments in the Leather Industry

Governments and industry players are recognizing the potential of the leather industry and are investing in its development. Supportive government policies, initiatives to promote the leather sector, and investments in manufacturing infrastructure are creating growth opportunities for the leather chemicals market. These investments aim to enhance production capabilities, improve quality standards, and increase export potential.

Restraints/Challenges

- Substitution by Alternative Materials

Leather faces competition from alternative materials such as synthetic fabrics, faux leather, and vegan options. Changing consumer preferences, increasing availability of alternative materials, and their lower cost can lead to a decline in demand for genuine leather products. This substitution effect poses a challenge to the growth of the leather industry and subsequently affects the demand for leather chemicals.

- Labor-Intensive Production Processes

Leather production involves several labor-intensive processes, including tanning, dyeing, and finishing. The availability of skilled labor and the rising labor costs can impact the overall production efficiency and cost-effectiveness of leather chemical manufacturers. Automating certain processes and investing in advanced technologies can help mitigate this restraint, but it requires significant investments and adaptation by the industry.

- Environmental Concerns and Regulatory Pressures

The leather industry has been subject to increasing scrutiny due to its environmental impact. Stringent regulations on chemical usage, waste management, and emissions control pose challenges for leather chemical manufacturers. Compliance with these regulations requires investments in research, development, and adoption of cleaner and more sustainable technologies, which can increase costs and affect profit margins.

- Fluctuating Raw Material Prices

Leather chemicals are derived from various raw materials, including petrochemicals, natural extracts, and minerals. Fluctuations in the prices of these raw materials can impact the overall cost structure of leather chemicals. Volatile prices can lead to increased production costs and affect profitability for manufacturers. Managing raw material price fluctuations and ensuring a stable supply chain can be a significant challenge for companies operating in the global market.

This leather chemicals market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Leather chemicals market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Development

- In August 2020, Lanxess AG partnered with Hüni AG from Switzerland to collaborate on the commercialization of Lanxess' modular plant concept called ReeL (resource-efficient manufacture of leather chemicals). This innovative technology, developed by Lanxess Leather business unit in collaboration with German Companies Invite and Heller-Leder, focuses on recycling shavings from leather production directly at the tannery site to produce X-Biomer retanning agents automatically

Global Leather Chemicals Market Scope

The global leather chemicals market is segmented on the basis of chemicals type, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Chemicals Type

- Tanning and Dyeing Chemicals

- Beam House Chemicals

- Finishing Chemicals

End User

- Footwear

- Furniture

- Automotive

- Textile and Fashion

- Others

Global Leather Chemicals Market Regional Analysis/Insights

The global leather chemicals market is analysed and market size insights and trends are provided by source, grade, and application and are referenced above. The countries covered in the leather chemicals market report are U.S., Canada, and Mexico in North America, Brazil, Argentina, and the rest of South America in South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, and the rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific in Asia-Pacific, and U.A.E, Saudi Arabia, Egypt, South Africa, Israel, and the rest of the Middle East and Africa in Middle East and Africa.

Asia-Pacific dominates the leather chemicals market because of the continuous supply of raw materials and low price labour. Furthermore, the growing of disposable income of customers in emerging nations coupled with supplement need for premium products. Additionally, well known manufacturers have a well-formed track, and therefore are competent to effectively settle any demand and supply gap concerns which in turn will boost the growth of the leather chemicals market.

Europe is expected to be the fastest growing market during the forecast period of 2023 to 2030 owing to its domination over the footwear, automobile, and consumer appliances industries. Furthermore, the governments are focusing on bio-based and low-cost products with high durability, which in turn is anticipated to further supplement the growth of the leather chemicals market in the region during the forecast market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Leather Chemicals Market Share Analysis

The global leather chemicals market competitive landscape provides details by competitors. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the global leather chemicals market.

Some of the major players operating in the global leather chemicals market are:

- BASF SE (Germany)

- TFL Ledertechnik GmbH & Co.KG (Germany)

- Stahl Holdings B.V. (Netherlands)

- LANXESS (Germany)

- Bayer AG (Germany)

- Clariant International Ltd (Switzerland)

- Heim Leather Chem GmbH (Germany)

- DyStar Singapore Pte Ltd. (Singapore)

- Knox Lawrence International LLC (U.S.)

- Pidilite Industries Ltd. (India)

- Elementis (United Kingdom)

- SCHILL+SEILACHER GMBH (Germany)

- DuPont (U.S.)

- Eastman Chemical Company (U.S.)

- Solvay S.A. (Belgium)

- Asahi Kasei (Japan)

- Evonik Industries (Germany)

- SABIC (Saudi Arabia)

- Arkema (France)

- ANGUS Chemical Company (U.S.)

- Corbion (Netherlands)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Leather Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Leather Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Leather Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.