Global Ion Implanter Market, By Technology (Low-energy Implanter, Medium-energy Implanter, High-energy Implanter), Application (Semiconductor Fabrication, Metal Finishing, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Over the recent years, the demand for electronic devices such as smartphones, laptops, and other electronic devices has largely increased. The ion implanter market has been growing rapidly. According to the Consumer Electronics Association (CEA), the consumer electronic devices market will be worth $415,897 million in 2021, up 13.9 percent from the previous year. Furthermore, new technologies such as artificial intelligence and voice recognition are encouraging end-users to purchase advanced electronic devices. As a result, the ion implanters market is expected to grow significantly during the forecast period.

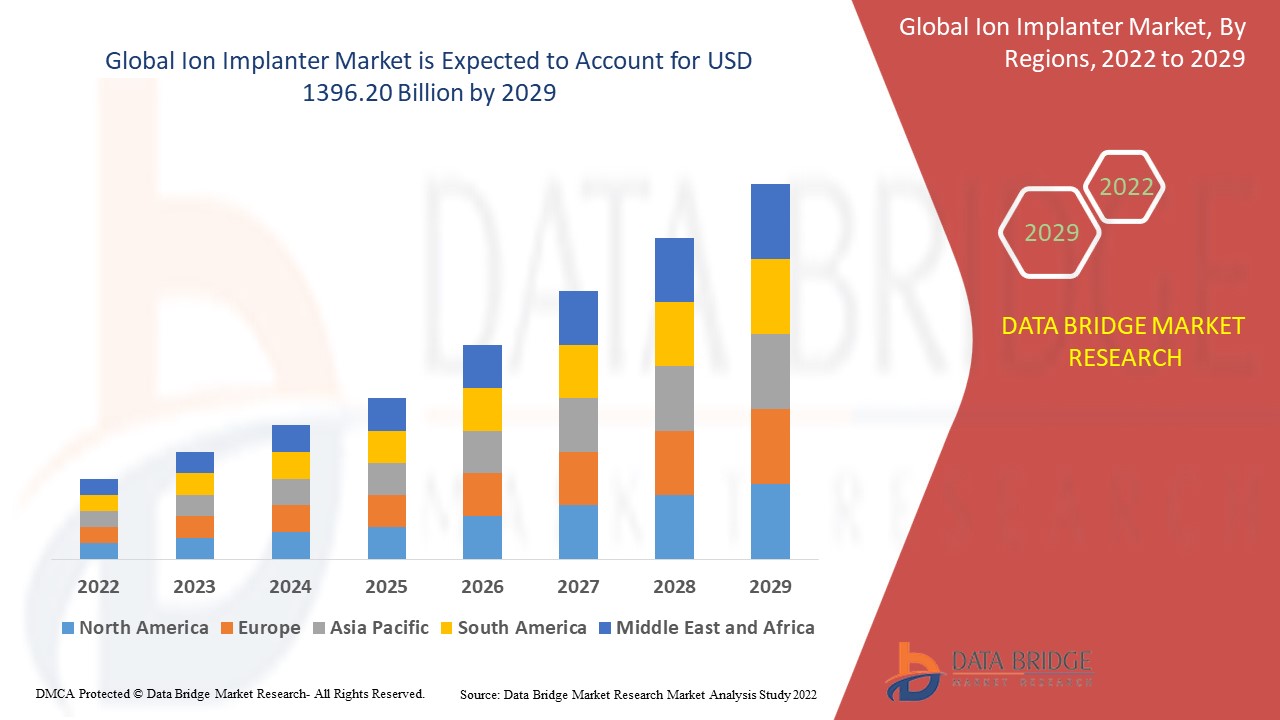

Global Ion Implanter Market was valued at USD 945.00 million in 2021 and is expected to reach USD 1396.20 million by 2029, registering a CAGR of 5.00% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

By Technology (Low-energy Implanter, Medium-energy Implanter, High-energy Implanter), Application (Semiconductor Fabrication, Metal Finishing, Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa

|

|

Market Players Covered

|

Applied Materials, Inc., (U.S.), Axcelis Technologies (U.S.), Varian Inc. (U.S.), Nissin Ion Equipment Co. Ltd. (U.S.), Sumitomo Heavy Industries Ltd., (Japan), Amtech Systems Inc. (U.S.), Intevac Inc. (U.S.), ULVAC Inc., (Japan), Ion beam services SA (France), Nissin Electric Co. Ltd. (Japan), High Voltage Engineering Europa B.V. (Netherlands), II-VI Incorporated (U.S.), CuttingEdge Ions (U.S.), Phoenix (U.S.), MKS Instruments (U.S.) and Kingstone Semiconductor Joint Stock Company Ltd (China)

|

|

Market Opportunities

|

|

Market Definition

Ion implantation is a low-temperature process that causes ions of one element to penetrate into a solid target, changing the target's physical, chemical, or electrical properties. Ion implantation is commonly used in semiconductor doping with boron, phosphorus, or arsenic. Each dopant atom implanted in a semiconductor can generate a charge carrier in the semiconductor. Ion implantation is a fundamental process in the fabrication of silicon microchips. It's also used to toughen steel by injecting nitrogen molecules into it and reinforcing materials used to make prosthetic devices to keep them from eroding.

Ion Implanter Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High Demand for Semiconductors Fabrication

Ion implanters are currently widely used in the fabrication of semiconductors. Owing to high demand for smartphones, laptops, and other electronic devices, the electronic device market has grown rapidly. Moreover, the silicon wafer sizes are shifting from 100 mm to 300 mm in the semiconductor industry. In recent years, wafer sizes have increased by 25% to 50% within the semiconductor industry due to the technological advancements in ion implant machines. The growth in semiconductor demand is expected to drive demand for ion implanters. As a result, the demand for ion implanters is estimated to boost during the forecast period.

- Next-Generation Ion Implanters Offering

The Internet of Things (IoT), self-driving cars and smart homes are all creating growth for ion implanter manufacturers. Companies are broadening their expertise in a wide range of equipment types and vintages in order to offer cost-effective upgrades and retrofit services. Next-generation ion implanters aid in equipment maintenance and retrofitting. Stakeholders are supporting innovations in power components, solar panels, and batteries as part of the field of energy efficiency. The companies can now offer both outsourced and manufacturing services due to the next-generation ion implanters. As a result, the ion implanter market is estimated to have accelerated growth.

- Increased Utilization of Ion Implanters for various Applications

Ion implantation is most commonly used to create silicon microchips. The growing demand for electronic devices and the semiconductor industry's reliance on silicon substrates have fueled the global ion implanter market's expansion. Ion implant is required for the production of plasmatic nanocomposites with light management applications such as photovoltaic cell light trapping and local refractive index sensing. The ion-implantation process is used to produce noble metal nanoparticles with high stability, which is in high demand. This is also expected to increase demand for various types of ion implantation processes in the near future. Furthermore, the use of ion implantation in industrial applications for strengthening steel used in various machineries and the IT industry for circuit board production is expected to boost the ion implanter market.

Furthermore, the increasing demand for ion implants for plasmatic nanocomposite manufacturing also accelerates the market growth. Also, during the forecast period, the rising demand for noble metal nanoparticles via the ion-implantation process is expected to catalyze the rising demand for various forms of ion implantation.

Opportunities

- Developments and Investments

Furthermore, the development of high-performance PV (photovoltaic) modules based on thin crystalline silicon solar cells is a result of advances in ion implantation for solar cells, which further extends profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the manufacturers are investing more in self-aligning processes for ion implantation-based interdigitated back contact (IBC) solar cell fabrication, which will further expand the future growth of the ion implanter market.

Restraints/Challenges

- High Initial Costs

The high initial investment associated with procurement and aftersales services of Ion implantation machines, on the other hand, is expected to limit the market's growth. Ion implantation machines are costly and have a long life cycle, rarely replace them. The global ion implantation machine market is largely hampered due to this factor.

- Limitations within Market

However, rising demand for refurbished and used ion implanters, a high reliance on a small group of customers, and the electronics industry's recession and highly cyclic nature could limit the ion implanter industry's growth over the forecast period. Therefore, these limitations will challenge the ion implanter market growth rate.

This ion implanter market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ion implanter market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Ion Implanter Market

The recent outbreak of coronavirus had a significant impact on the ion implanter market. Government-imposed various restrictions such as lockdowns and social distancing that resulted in a significant drop in major industry production. Electronics demand has dropped dramatically as a result of the pandemic's economic slowdown. The electronics industry has restrained the global ion implanter market, which is a major end-user industry. Furthermore, supply chain disruptions caused by national and international transportation restrictions have had an impact on the ion implanter market's operations. Furthermore, consumer demand has decreased as people are now more focused on removing non-essential expenses from their budgets since the general economic situation of most people has been badly impacted by the outbreak.

On the brighter side, the COVID-19 outbreak has been discovered to have a lower impact on industries such as semiconductors, metal finishing, and material science research. The 23rd International Conference on Ion Implantation Technology, for instance, has been rescheduled for September 25-29, 2022, in San Diego. As a result, stakeholders are doubling down on mission-critical projects in the semiconductor and metal finishing industries in order to maintain business continuity even during the pandemic.

Global Ion Implanter Market Scope

The ion implanter market is segmented on the basis of technology and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Low-energy Implanter

- Medium-energy Implanter

- High-energy Implanter

Application

- Semiconductor Fabrication

- Metal Finishing

- Others

Ion Implanter Market Regional Analysis/Insights

The ion implanter market is analyzed and market size insights and trends are provided by country, technology and application as referenced above.

The countries covered in the ion implanter market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the ion implanter market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The market growth over this region is attributed to the wide use of semiconductors fabrication and increasing developments within the region.

On the other hand, Asia-Pacific is estimated to show lucrative growth over the forecast period of 2022-2029, due to the high demands for microelectronics and increasing demand for ion implants for plasmatic nanocomposite manufacturing in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Ion Implanter Market Share Analysis

The ion implanter market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ion implanter market.

Some of the major players operating in the ion implanter market are

- Applied Materials, Inc., (U.S.)

- Axcelis Technologies (U.S.)

- Varian Inc. (U.S.)

- Nissin Ion Equipment Co. Ltd. (U.S.)

- Sumitomo Heavy Industries Ltd., (Japan)

- Amtech Systems Inc. (U.S.)

- Intevac Inc. (U.S.)

- ULVAC Inc., (Japan)

- Ion beam services SA (France)

- Nissin Electric Co. Ltd. (Japan)

- High Voltage Engineering Europa B.V. (Netherlands)

- II-VI Incorporated (U.S.)

- CuttingEdge Ions (U.S.)

- Phoenix (U.S.)

- MKS Instruments (U.S.)

- Kingstone Semiconductor Joint Stock Company Ltd (China)

SKU-