Global Insulin Market

Market Size in USD Billion

CAGR :

%

USD

20.74 Billion

USD

28.17 Billion

2024

2032

USD

20.74 Billion

USD

28.17 Billion

2024

2032

| 2025 –2032 | |

| USD 20.74 Billion | |

| USD 28.17 Billion | |

|

|

|

|

Insulin Market Size

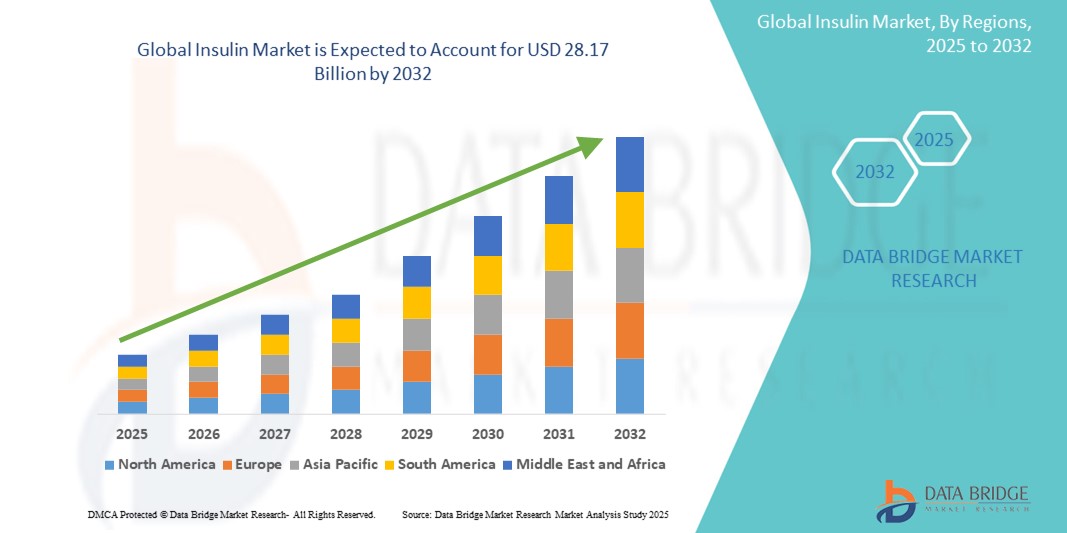

- The global insulin market size was valued at USD 20.74 billion in 2024 and is expected to reach USD 28.17 billion by 2032, at a CAGR of 3.90% during the forecast period

- The market growth is largely fueled by the rising global prevalence of diabetes, growing awareness about effective glucose management, and increasing adoption of advanced insulin delivery devices such as insulin pens, pumps, and smart insulin systems. These developments are contributing to a shift toward more patient-centric diabetes care

- Furthermore, strong demand for long-acting, ultra-rapid, and biosimilar insulin options, along with government initiatives to improve diabetes treatment accessibility, is establishing insulin therapy as the cornerstone of modern diabetes management. These converging factors are accelerating the uptake of insulin solutions, thereby significantly boosting the industry's growth

Insulin Market Analysis

- Insulin, a vital therapy for diabetes management, is becoming increasingly crucial globally due to its role in maintaining blood glucose levels and preventing complications such as neuropathy, kidney failure, and cardiovascular disease

- The rising prevalence of diabetes, increasing healthcare awareness, and technological advancements in insulin delivery devices (such as pens, pumps, and smart systems) are driving a shift towards more patient-friendly and effective diabetes care

- North America dominated the insulin market with a revenue share of 44.6% in 2024, benefiting from high diabetes prevalence, advanced healthcare infrastructure, significant R&D investment, and robust adoption of insulin analogs and delivery devices

- Asia-Pacific is the fastest-growing region in the insulin market, with a projected CAGR of 11.8% from 2025 to 2032, driven by increasing diabetes burden, rising disposable incomes, and greater insulin awareness across China, India, Japan, and Australia

- The long acting insulin segment dominated the market, accounting for 42.7% market share in 2024, owing to its prolonged duration of action, reduced injection frequency, and high patient compliance in both Type 1 and Type 2 diabetes management

Report Scope and Insulin Market Segmentation

|

Attributes |

Insulin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insulin Market Trends

“Widespread Adoption of Connected Health Devices and Insulin Delivery Innovations”

- A significant and accelerating trend in the global insulin market is the growing integration of insulin therapies with connected health devices, including continuous glucose monitors (CGMs), insulin pumps, and mobile health applications. This technological convergence is enabling more accurate, personalized, and data-driven diabetes management for patients

- For instance, the Tandem t:slim X2 insulin pump, when integrated with Dexcom CGMs, enables automated insulin delivery adjustments based on real-time glucose readings. This closed-loop functionality, often referred to as an “artificial pancreas,” enhances glycemic control and reduces the burden on patients

- In addition, companies such as Medtronic have developed smart insulin delivery systems that use predictive algorithms to minimize hypoglycemic episodes by automatically suspending insulin delivery when low glucose levels are anticipated

- The rising popularity of mobile applications designed for insulin tracking and dose calculation, such as mySugr and Glooko, is also contributing to the modernization of diabetes care. These apps sync with wearable devices to log glucose levels, carbohydrate intake, and physical activity, helping both patients and healthcare providers make informed decisions

- Pharmaceutical leaders including Eli Lilly and Novo Nordisk are actively developing connected insulin pens that record dosage data and transmit it to mobile apps, supporting real-time monitoring and improved treatment adherence. For instance, NovoPen 6 and NovoPen Echo Plus are already gaining traction in Europe and North America

- This shift towards integrated digital solutions is transforming traditional insulin delivery into a holistic, tech-enabled experience, driving demand across both advanced and emerging healthcare systems. As a result, healthcare providers are increasingly embracing these innovations to improve patient outcomes and streamline diabetes management

Insulin Market Dynamics

Driver

“Growing Need Due to Rising Diabetes Prevalence and Therapeutic Advancements”

- The global burden of diabetes is rising rapidly, driven by lifestyle changes, aging populations, and increasing obesity rates. This surge in diabetes cases is a major driver for the growing demand for effective and accessible insulin therapies worldwide

- For instance, in April 2024, Novo Nordisk expanded its manufacturing capacity in Denmark to meet the increasing global demand for insulin, particularly in emerging markets. Such strategic investments by key players are expected to fuel insulin market growth in the forecast period

- Increasing awareness of early diabetes diagnosis and timely intervention is prompting healthcare providers and governments to strengthen diabetes care programs. This has led to improved access to insulin, especially through national reimbursement schemes and public health initiatives

- Furthermore, the growing preference for patient-centric, convenient insulin delivery systems—such as insulin pens, patches, and pumps—is contributing to the widespread adoption of modern insulin formulations

- Technological innovations in insulin therapies, such as ultra-long-acting and rapid-acting analogs, provide better glycemic control, improved patient compliance, and fewer side effects. These innovations are attracting more patients toward initiating and maintaining insulin therapy

- The expansion of online pharmacies and e-health platforms has also made insulin more accessible to patients in remote or underserved regions, enhancing treatment continuity and driving market penetration across diverse demographic

Restraint/Challenge

“High Treatment Costs and Limited Affordability in Low-Income Regions”

- The relatively high cost of insulin therapy, especially for newer analog formulations, poses a significant barrier to widespread adoption—particularly in low- and middle-income countries where healthcare infrastructure and insurance coverage are limited

- For instance, despite efforts to regulate prices, reports from the U.S. and parts of Africa and Asia highlight continued struggles among diabetic patients to afford regular insulin supplies, leading to non-compliance or rationing

- Governments and global health organizations are increasingly pressured to expand subsidies, include insulin in essential medicines lists, and collaborate with pharmaceutical companies to lower prices through public-private partnerships

- Moreover, access to advanced insulin delivery devices—such as smart pens and insulin pumps—remains restricted in many regions due to cost and availability, hindering optimal diabetes management for a large patient population

- Complexities in storage and transportation of insulin, especially cold chain requirements, add logistical and financial burdens, particularly in rural or resource-limited settings

- To address these challenges, key players are investing in biosimilar insulin development, low-cost manufacturing, and region-specific pricing models to increase affordability and ensure equitable access. Overcoming these barriers will be critical to achieving sustainable market expansion and improved patient outcomes worldwide

Insulin Market Scope

The market is segmented on the basis of product type, source, disease type, delivery devices, and end users.

• By Product Type

On the basis of product type, the Insulin market is segmented into intermediate-acting insulin, short-acting insulin, rapid-acting insulin, and long-acting insulin. The long-acting insulin segment dominated the market with a revenue share of 42.7% in 2024, driven by its extended glucose control and reduced injection frequency, which improves adherence in both type 1 and type 2 diabetes patients.

The rapid-acting insulin segment is anticipated to witness the fastest CAGR of 6.9% from 2025 to 2032, owing to increasing adoption for managing post-meal blood glucose levels and rising demand for intensive insulin therapy.

• By Source

On the basis of source, the insulin market is segmented into human recombinant insulin and insulin analogs. The insulin analogs segment held the largest market revenue share of 63.1% in 2024, supported by their superior pharmacokinetics, better glycemic control, and lower hypoglycemia risks compared to human insulin.

The human recombinant insulin segment accounted for 36.9% of the market and is expected to grow steadily, driven by affordability and continued use in cost-sensitive regions.

• By Disease Type

On the basis of disease type, the Insulin market is segmented into type 1 diabetes, type 2 diabetes, gestational diabetes, and prediabetes. The type 2 diabetes segment dominated with a market share of 72.4% in 2024, due to the widespread prevalence of the condition and increasing insulin dependency in advanced stages.

The gestational diabetes segment is projected to register the fastest CAGR of 7.2% from 2025 to 2032, driven by rising maternal obesity, higher maternal age, and increased screening initiatives during pregnancy.

Insulin Market Regional Analysis

- North America dominated the insulin market with the largest revenue share of 44.6% in 2024, driven by the high prevalence of diabetes, robust healthcare infrastructure, and strong adoption of advanced insulin delivery technologies such as insulin pens and pumps

- The region benefits from favorable reimbursement policies, growing awareness about diabetes management, and the presence of key industry players such as Eli Lilly and Novo Nordisk, which further accelerates innovation and market growth

- In addition, North America’s focus on patient-centric care, increased use of digital diabetes management platforms, and rising cases of obesity and sedentary lifestyles contribute significantly to the region’s leadership in the insulin market

U.S. Insulin Market Insight

The U.S. insulin market captured the largest revenue share of 80.2% in 2024 within North America, fueled by the high prevalence of diabetes and widespread adoption of innovative insulin delivery systems. The country benefits from well-established healthcare infrastructure, high healthcare expenditure, and favorable reimbursement policies, which support the adoption of advanced products such as insulin pens and pumps. Moreover, continuous product launches, technological advancements, and a strong presence of key players such as Eli Lilly and Novo Nordisk are major contributors to market dominance.

Europe Insulin Market Insight

The Europe insulin market is projected to expand at a CAGR of 9.3% from 2025 to 2032, primarily driven by a rising geriatric population, increasing type 2 diabetes cases, and improved access to healthcare services. The region emphasizes cost-effective diabetes care, driving the demand for biosimilar insulins and self-administered devices. Growing awareness about insulin analogs, along with strong governmental support for diabetes management programs, continues to foster market growth across both Western and Eastern Europe.

U.K. Insulin Market Insight

The U.K. insulin market is anticipated to grow at a CAGR of 8.6% during the forecast period, supported by increasing obesity rates, a sedentary lifestyle, and rising awareness of early diabetes management. NHS initiatives promoting the use of modern insulin therapies and convenient delivery systems—such as insulin pens—are propelling demand. In addition, the U.K. is witnessing a gradual shift from vial-and-syringe methods to more advanced, user-friendly devices.

Germany Insulin Market Insight

The Germany insulin market is expected to expand at a CAGR of 8.9% from 2025 to 2032, driven by a well-structured healthcare system, high diagnosis rates of diabetes, and robust adoption of biosimilars. Germany's inclination toward cost-effective solutions has made it a leader in insulin biosimilars adoption, while demand for long-acting insulin analogs continues to rise. Moreover, increasing investments in diabetes care and R&D support sustained growth.

Asia-Pacific Insulin Market Insight

The Asia-Pacific insulin market is poised to grow at the fastest CAGR of 11.8% from 2025 to 2032, driven by the surging prevalence of diabetes in densely populated countries such as China, India, and Japan. Increasing healthcare access, government initiatives for diabetes awareness, and the rapid expansion of local manufacturing capacity are key growth enablers. The region is also witnessing a rise in digital diabetes management tools, supporting insulin therapy adherence and expanding user base.

Japan Insulin Market Insight

The Japan insulin market is gaining momentum, driven by a high proportion of elderly patients, a culture of preventive healthcare, and early adoption of medical technologies. The market benefits from national diabetes control initiatives and favorable insurance coverage for modern insulin therapies. With an aging population demanding convenient and effective insulin options, Japan sees increasing uptake of insulin pens, pumps, and analog formulations.

China Insulin Market Insight

The China insulin market accounted for the largest revenue share in Asia Pacific at 36.4% in 2024, attributed to a massive diabetes-affected population and expanding healthcare reforms. The country is witnessing growing use of both human recombinant insulin and analogs, supported by government price controls and expanding public insurance. Domestic players are significantly strengthening local manufacturing and affordability, while international collaborations are increasing access to next-generation insulin therapies.

Insulin Market Share

The insulin industry is primarily led by well-established companies, including:

- Sanofi (France)

- Novo Nordisk A/S (Denmark)

- Lilly (U.S.)

- Biocon (India)

- Julphar (UAE)

- Ypsomed AG (Switzerland)

- BD (U.S.)

- Wockhardt Ltd. (India)

- B. Braun SE (Switzerland)

- Biodel AG (U.S.)

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (China)

- Tonghua Dongbao Pharmaceutical Co., Ltd. (China)

What are the Recent Developments in Global Insulin Market?

- In April 2023, Eli Lilly and Company launched a strategic initiative in South Africa aimed at improving access to affordable insulin therapies for diabetic patients in underserved regions. This initiative underscores the company’s dedication to equitable healthcare by expanding its low-cost insulin programs and educational outreach to support proper diabetes management. By leveraging its global footprint and patient-centric approach, Eli Lilly is reinforcing its leadership in the rapidly growing global insulin market

- In March 2023, Biocon Biologics Ltd., a subsidiary of Biocon Ltd., announced the successful rollout of its interchangeable biosimilar insulin glargine (Semglee) in key global markets, including the U.S. and parts of Europe. This biosimilar offers a more affordable alternative to branded insulins, enhancing patient access to long-acting insulin therapies. The move aligns with global efforts to reduce diabetes care costs and broaden treatment availability

- In March 2023, Novo Nordisk announced the expansion of its insulin production facility in Clayton, North Carolina, U.S., to meet the surging global demand for both human insulin and insulin analogs. The investment reflects the company’s long-term commitment to manufacturing scale and supply chain reliability, ensuring uninterrupted access to life-saving insulin therapies for millions of patients worldwide

- In February 2023, Sanofi partnered with the Indian government to support national diabetes management efforts by donating thousands of insulin pens and launching awareness campaigns across rural areas. This public-private collaboration is designed to address the rising burden of diabetes and promote early diagnosis and treatment through accessible insulin delivery solutions

- In January 2023, Wockhardt Ltd. unveiled its new line of recombinant human insulin products in emerging markets across Latin America and Southeast Asia. The launch is part of the company’s broader global strategy to deliver cost-effective diabetes care solutions and expand its presence in high-growth insulin markets. The initiative demonstrates Wockhardt’s continued commitment to innovation, affordability, and accessibility in diabetes management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.