Global Industrial Valves Market

Market Size in USD Billion

CAGR :

%

USD

82.82 Billion

USD

113.87 Billion

2024

2032

USD

82.82 Billion

USD

113.87 Billion

2024

2032

| 2025 –2032 | |

| USD 82.82 Billion | |

| USD 113.87 Billion | |

|

|

|

|

Industrial Valves Market Analysis

The global industrial valves market is undergoing a transformation fueled by technological advancements and increasing demand for efficiency and sustainability. The adoption of the Industrial Internet of Things (IoT) enables real-time monitoring, predictive maintenance, and automation, optimizing valve performance and operational safety. Innovations in materials, such as corrosion-resistant alloys and coatings, enhance valve longevity, especially in extreme conditions. Moreover, additive manufacturing (3D printing) is revolutionizing valve production by offering greater customization and cost efficiency. As industries push for greener solutions, energy-efficient valves are gaining popularity, aligning with sustainability goals. Robotics and automation in valve manufacturing ensure improved precision and productivity. Together, these trends are positioning the industrial valve market for continued growth across industries such as oil and gas, water management, and energy production, where advanced and reliable valve technologies are crucial.

Industrial Valves Market Size

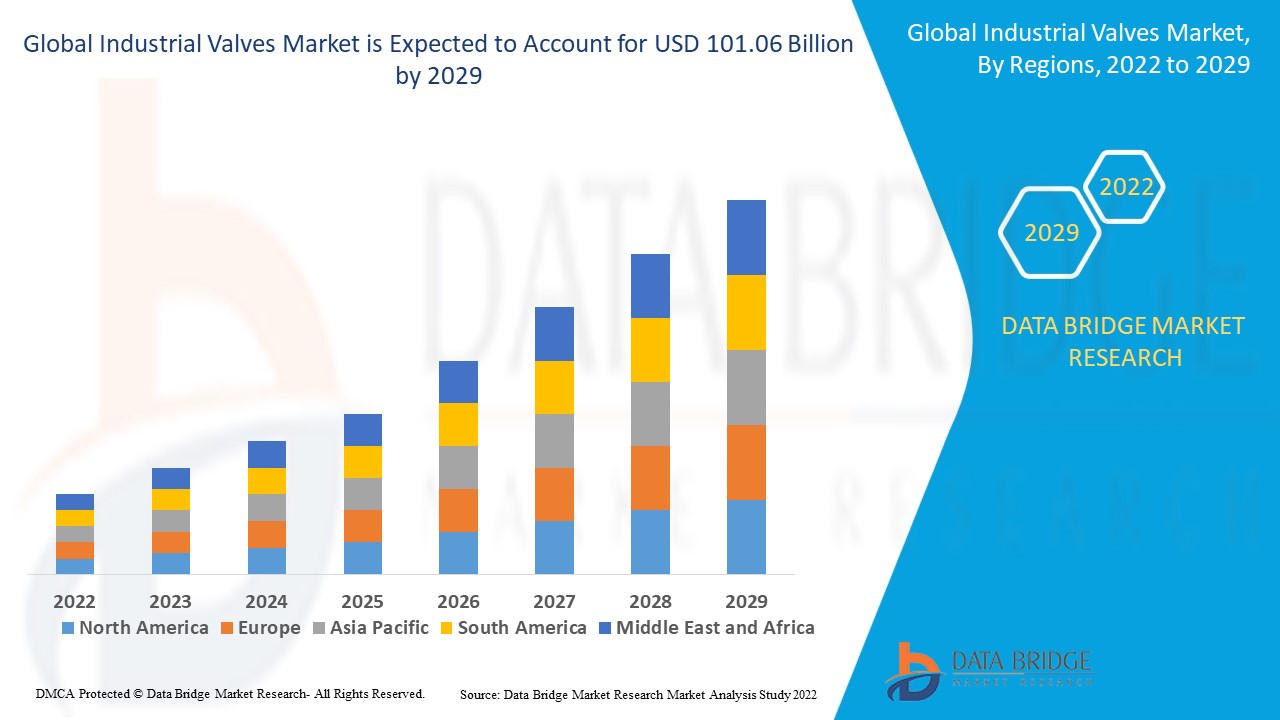

The global industrial valves market size was valued at USD 82.82 billion in 2024 and is projected to reach USD 113.87 billion by 2032, with a CAGR of 4.06% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Industrial Valves Market Trends

“Increasing Integration of Digital Technologies in Valve Systems”

The industrial valves market is experiencing substantial growth, driven by increasing demands from key sectors such as energy, water treatment, and chemical processing. A notable trend in the market is the integration of digital technologies in valve systems, which enhances operational efficiency and predictive maintenance. For instance, smart valves, equipped with IoT sensors, allow for real-time monitoring of system performance, preventing failures and reducing downtime. In addition, as the global demand for energy continues to rise, especially with renewable energy sources becoming more prevalent, there is a heightened need for high-performance valves in power generation facilities. The Asia-Pacific region, particularly countries such as India and China, is leading the growth, fueled by infrastructural development and a focus on improving wastewater management system. This convergence of technology and infrastructure is shaping the future of the industrial valves market.

Report Scope and Industrial Valves Market Segmentation

|

Attributes |

Industrial Valves Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Emerson Electric Co. (U.S.), SLB (U.S.), Flowserve Corporation (U.S.), IMI (India), Metso (Finland), GE VALVE (India), Curtiss-Wright Corporation (U.S.), Crane Company (U.S.), Neway Valve (China), McWane, Inc. (U.S.), ALFA LAVAL (Sweden), Rotork (U.K.), KITZ Corporation (Japan), KSB SE & Co. KGaA (Germany), Velan Inc. (Canada), Honeywell International Inc. (U.S.), Spirax Sarco Limited (U.K.), SAMSON AKTIENGESELLSCHAFT (Germany), and Swagelok Company (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial Valves Market Definition

Industrial valves are mechanical devices used to control the flow of liquids, gases, or slurries in pipelines or systems. They regulate, direct, or start/stop the flow of fluids by opening, closing, or partially obstructing passageways. These valves are critical components in industries such as oil and gas, water treatment, power generation, and manufacturing, ensuring system efficiency, safety, and reliability.

Industrial Valves Market Dynamics

Drivers

- Surging Global Industrialisation

The global industrialization surge in sectors such as oil and gas, chemical processing, power generation, and water treatment is significantly driving the demand for industrial valves. These valves are essential for managing fluid flow and ensuring system regulation across complex industrial processes. For instance, the increasing production and exploration in the oil and gas industry, particularly in regions such as North America, with the U.S. breaking production records, has highlighted the need for high-performance valves. Similarly, the rise in power generation infrastructure in Asia, particularly China and India, fuels the demand for valves that can handle extreme pressures and temperatures in energy plants. The global trend of modernizing power plants, upgrading refineries, and expanding water treatment systems further pushes this market's growth.

- Growing Demand for Energy

The growing demand for energy, driven by both conventional and renewable sources, is a significant market driver for industrial valves. In the oil and gas industry alone, valves are essential for managing the flow of crude oil, natural gas, and refined products through pipelines, ensuring that production and transportation processes are safe, efficient, and meet regulatory standards. According to a report by the International Energy Agency (IEA), global energy demand is expected to grow by nearly 25% between 2022 and 2040, with oil and gas continuing to dominate the energy mix, even as renewables expand. For instance, the construction of liquefied natural gas (LNG) terminals and offshore platforms requires a wide range of industrial valves to control the flow and pressure of natural gas. In the power generation sector, industrial valves are used extensively in steam, water, and gas systems within thermal and nuclear power plants, where they regulate fluid flow and prevent system failures. The transition to renewable energy also drives the demand for specialized valves, such as those used in geothermal and biomass power plants. This growing energy demand, coupled with the need for infrastructure development, directly influences the expansion of the industrial valves market, driving innovation in valve technologies for enhanced performance and safety.

Opportunities

- Growing Technological Advancements

Technological advancements, particularly the development of smart valves, present a significant opportunity in the industrial valves market. Smart valves, equipped with integrated sensors, actuators, and control systems, allow for precise monitoring and automated control over flow rates, pressure, and temperature, enhancing operational efficiency and safety in industries such as chemicals, oil & gas, and manufacturing. These smart valves can transmit real-time data to centralized systems, enabling predictive maintenance and reducing the risk of operational downtime. For instance, in the oil and gas sector, smart valves installed in remote pipelines can detect and relay information on pressure fluctuations, leaks, or blockages, allowing operators to take timely corrective action and avoid costly shutdowns. The global smart valve market is anticipated to grow as industries increasingly invest in Internet of Things (IoT)-enabled systems and smart factories. This trend creates a robust opportunity for industrial valve manufacturers to cater to the demand for advanced automation solutions across various sectors, further fueling market expansion and technological innovation.

- Increasing Stricter Environmental and Safety Regulations

Stricter environmental and safety regulations across industries, especially in oil and gas, power, and chemicals, are driving the demand for high-performance industrial valves, creating a strong market opportunity. As governments and regulatory bodies impose more rigorous standards to protect the environment and ensure worker safety, companies are increasingly investing in advanced valves that can handle high pressures, temperatures, and corrosive materials while maintaining safe and efficient operation. For instance, the oil and gas industry must comply with regulations that limit emissions and prevent leakage of hazardous substances. This has led to a rise in demand for specialized valves such as high-integrity pressure protection systems (HIPPS) and zero-emission valves, which prevent the release of toxic or combustible gases. In the power sector, valve systems that meet stringent safety criteria are essential for handling pressurized steam in power plants and controlling emissions. Additionally, in chemical manufacturing, where processes involve handling reactive and dangerous substances, safety-regulated valves are required to prevent leaks and spills, reducing the risk of accidents. As regulatory frameworks continue to evolve worldwide, the need for compliant, high-performance valves presents a lucrative market opportunity for valve manufacturers.

Restraints/Challenges

- High Initial Costs and Ongoing Maintenance Requirements

High initial costs and ongoing maintenance requirements present a substantial challenge in the industrial valves market, particularly for smaller or cost-sensitive enterprises. Industrial valves, especially high-performance types used in sectors such as oil and gas or chemical manufacturing, are typically built with advanced materials such as stainless steel or exotic alloys and incorporate complex engineering to withstand extreme temperatures, high pressures, or corrosive substances. For instance, subsea valves used in offshore oil drilling can cost significantly more than standard valves due to the need for durability under harsh conditions, making them a major upfront investment. Furthermore, regular maintenance is essential to prevent wear and tear or catastrophic failures, which could halt operations and result in costly repairs and revenue loss. This issue is especially challenging for small and mid-sized enterprises that may lack the budget for expensive valves or the resources for intensive maintenance schedules, making it difficult for them to invest in high-end, durable valves without impacting operational costs. This challenge limits the adoption of advanced valve systems among smaller players, impacting market penetration and driving demand for more cost-effective valve solutions.

- Unplanned Downtime

Unplanned downtime is a major challenge in industries that rely on industrial valves, as even short interruptions can lead to significant financial losses and operational disruptions. In sectors such as oil and gas, power generation, and chemical manufacturing, industrial valves play a critical role in controlling fluid and gas flows. When valves fail unexpectedly, they can halt production, disrupt supply chains, and compromise safety. Additionally, unplanned downtime often incurs costs beyond production loss, including emergency repairs, replacement parts, and potential regulatory fines if environmental compliance is impacted. Because of these high stakes, industries are increasingly investing in predictive maintenance and smart valve systems to monitor valve performance and pre-emptively address issues before they escalate. However, implementing these solutions involves significant upfront costs and technological adaptation, which can be challenging, particularly for companies that lack the resources for advanced monitoring systems. This concern over unplanned downtime drives the need for reliable, high-quality valves and robust maintenance strategies, posing a challenge for valve manufacturers to meet stringent reliability standards.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Industrial Valves Market Scope

The market is segmented on the basis of type, function, material, accessories, size, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Gate Valve

- Globe Valve

- Ball Valve

- Butterfly Valve

- Diaphragm Valve

- Check Valve

- Plug Valve

- Pinch Valve

- Needle Valve

- Pressure Relief Valve

- Others

Function

- Isolation

- Regulation

- Safety Relief Valve

- Special Purpose

- Non-Return

Material

- Ductile Iron

- Carbon Steel

- Plastic

- Brass

- Bronze

- Copper

- Aluminium

- Others

Accessories

- Hydraulic Filter

- Power Cable

- Mounting Screw and Bolts

- Seal Kits

- Dust Protection Cover

- Others

Size

- 1 Inch to 6 Inch

- 6 Inch to 12 Inch

- 12 Inch to 24 Inch

- 24 Inch to 48 Inch

- Above 48 Inch

Application

- Oil and Gas

- Water and Waste Treatment

- Chemical

- Energy and Utilities

- Food and Beverages

- Pharmaceutical

- Agriculture

- Marine

- Automotive

- Metals and Mining

- Paper and Pulp

- Others

Industrial Valves Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, function, material, accessories, size, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific (APAC) is the dominant region in the industrial valves market, driven by its rapid urbanization and ongoing industrialization. As countries such as China, India, and Japan continue to expand their manufacturing and infrastructure sectors, the demand for industrial valves to support these industries has surged. The region’s growing focus on energy, water treatment, and manufacturing has further boosted the market for valves in various applications. Additionally, favorable government policies and investments in infrastructure development are fueling the growth of the industrial valves market across APAC.

North America is projected to experience substantial growth in the industrial valves market from 2025 to 2032, driven by the presence of leading biopharmaceutical companies and the region’s access to cutting-edge technologies. The demand for industrial valves is particularly strong in sectors such as pharmaceuticals, energy, and chemicals, where advanced, high-performance solutions are critical. Additionally, ongoing investments in infrastructure and manufacturing further fuel market expansion. With a robust innovation ecosystem and a highly developed industrial base, North America is poised to maintain its competitive edge in the industrial valves market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Industrial Valves Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Industrial Valves Market Leaders Operating in the Market Are:

- Emerson Electric Co. (U.S.)

- SLB (U.S.)

- Flowserve Corporation (U.S.)

- IMI (India)

- Metso (Finland)

- GE VALVE (India)

- Curtiss-Wright Corporation (U.S.)

- Crane Company (U.S.)

- Neway Valve (China)

- McWane, Inc. (U.S.)

- ALFA LAVAL (Sweden)

- Rotork (U.K.)

- KITZ Corporation (Japan)

- KSB SE & Co. KGaA (Germany)

- Velan Inc. (Canada)

- Honeywell International Inc. (U.S.)

- Spirax Sarco Limited (U.K.)

- SAMSON AKTIENGESELLSCHAFT (Germany)

- Swagelok Company (U.S.)

Latest Developments in Industrial Valves Market

- In January 2024, PJ Valves, a leading global player in the valve and actuator industry, completed a significant expansion of its factory in Pune, India. This expansion highlights the company's commitment to innovation and enhances its production capabilities, particularly increasing its manufacturing capacity for ball and butterfly valves by over 2.5 times to meet growing customer demands

- In January 2024, Emerson Electric Co. launched the Fisher 63EGLP-16 Pilot Operated Relief Valve, specifically designed for use in pressurized bullet tanks that store liquid propane and anhydrous ammonia. Certified by UL132 and the American Society of Mechanical Engineers, this valve is tailored for the chemical industry and will be crucial for the forecasted demand in this sector

- In October 2023, AVK Group acquired several companies, including Bayard S.A.S, Talis Flow Control (Shanghai) Co. Ltd., Belgicast International S.L., as well as sales companies in Italy and Portugal proficient in manufacturing Industrial Valves. This strategic acquisition is expected to support the company’s growth and expansion in the global market

- In October 2023, Burhani Engineers Ltd. launched a valves testing and rehabilitation hub in Nairobi, Kenya. The facility aims to reduce repair and maintenance costs for existing valves in industries such as oil and gas, power, mining, and others

- In June 2023, Flowserve Corporation introduced its Valtek Valdisk high-performance butterfly valve. Designed for use in chemical plants, oil refineries, and other facilities requiring control valves, this new product offers enhanced reliability and performance for critical industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Valves Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Valves Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Valves Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.