Global Identity Verification Market

Market Size in USD Billion

CAGR :

%

USD

12.89 Billion

USD

40.38 Billion

2024

2032

USD

12.89 Billion

USD

40.38 Billion

2024

2032

| 2025 –2032 | |

| USD 12.89 Billion | |

| USD 40.38 Billion | |

|

|

|

|

Identity Verification Market Size

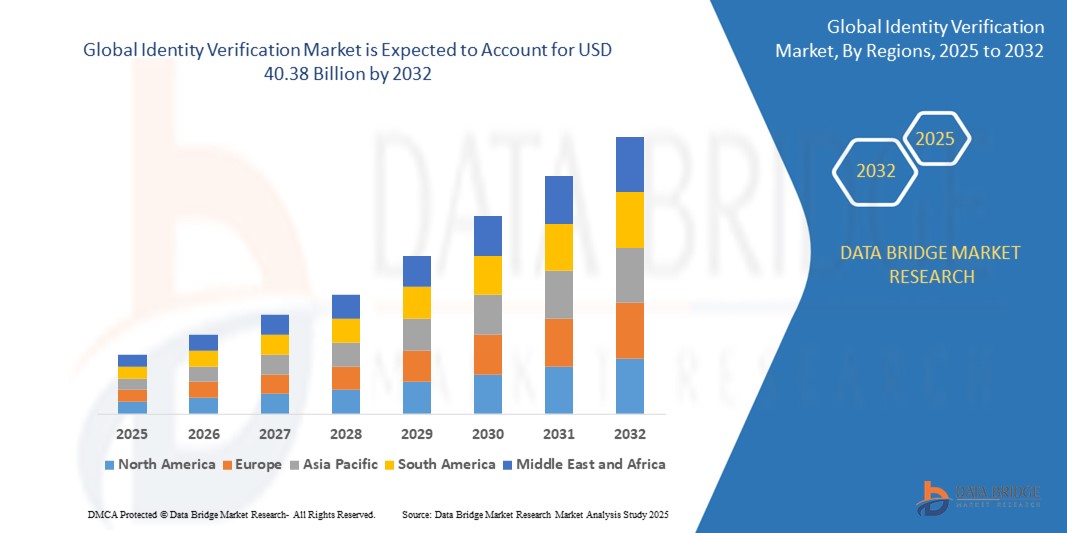

- The global identity verification market size was valued at USD 12.89 billion in 2024 and is expected to reach USD 40.38 billion by 2032, at a CAGR of 15.34% during the forecast period

- The market growth is largely fuelled by the increasing adoption of digital identity solutions across banking, financial services, healthcare, and e-commerce sectors due to rising instances of identity fraud and the need for regulatory compliance

- The rise in remote onboarding and digital transformation across industries is accelerating the demand for identity verification solutions, as businesses seek secure and seamless ways to authenticate users without physical interaction

Identity Verification Market Analysis

- The identity verification market is seeing rapid growth due to increased digitization and the need for secure authentication across sectors such as banking, healthcare, and e-commerce

- Companies are investing in advanced biometric and AI-driven technologies to improve verification speed, accuracy, and user experience

- North America dominated the identity verification market with the largest revenue share of 42.1% in 2024, driven by the presence of advanced digital infrastructure, stringent regulatory frameworks such as KYC and AML, and a high incidence of identity-related fraud

- The Asia-Pacific region is expected to witness the highest growth rate in the global identity verification market, driven by increasing digital transformation across emerging economies, rising adoption of e-KYC processes, and supportive government initiatives promoting digital identification

- The credit card fraud segment accounted for the largest market revenue share in 2024, driven by increasing online transactions and the rise in card-not-present frauds. Financial institutions are increasingly adopting multi-layered verification technologies to curb fraudulent card activities and improve customer trust

Report Scope and Identity Verification Market Segmentation

|

Attributes |

Identity Verification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Identity Verification Market Trends

“Adoption of AI-Powered Biometric Verification Solutions”

- AI enhances biometric accuracy by learning from interactions, continuously improving verification outcomes and minimizing false positives. For instance, Mastercard's AI-driven biometric authentication enhances transaction security in digital banking

- Facial recognition and iris scanning help reduce manual errors and human intervention in identity checks, ensuring faster and more reliable verification processes

- Financial institutions are leveraging AI for KYC compliance, streamlining onboarding and fraud detection. For instance, HSBC uses facial recognition in its mobile app to verify customer identity securely

- Healthcare providers utilize biometric tools to secure patient data access, ensuring only authorized personnel can access sensitive information and improving regulatory compliance

- Biometric verification enables fast, contactless onboarding, which is especially valuable for remote services such as digital wallets, online banking, and telehealth platforms

Identity Verification Market Dynamics

Driver

“Rising Cybersecurity Threats and Regulatory Compliance Requirements”

- Rising cyberattacks and online fraud drive demand for secure identity verification, as digital platforms become more vulnerable to data breaches and identity theft

- Businesses are investing in advanced authentication solutions to ensure secure, efficient user verification and reduce the risk of unauthorized access

- Global regulations such as KYC, AML, and GDPR mandate identity verification, compelling organizations, especially in finance and healthcare, to implement stringent compliance measures

- The European Union’s eIDAS regulation fosters trusted digital identities, promoting secure online interactions and public trust in digital services

- Identity verification platforms help build consumer trust and ensure compliance, offering reliable tools to safeguard sensitive information and prevent misuse

Restraint/Challenge

“High Implementation Costs and Privacy Concerns”

- High implementation costs hinder adoption of identity verification technologies, especially among small and medium-sized enterprises (SMEs) with limited budgets

- Advanced systems such as AI-driven facial recognition and biometric verification require major investments, along with costs for software updates, integration, and employee training

- Privacy concerns surrounding the handling of biometric and personal data are rising, as consumers and regulators demand stronger protections for sensitive information

- Legal risks from data breaches are increasing, with instances such as class action lawsuits in the U.S. against firms mishandling biometric data underscoring the potential liabilities

- To enable broader adoption, organizations must focus on transparent data governance and cost-effective solutions, ensuring both compliance and consumer trust across sectors

Identity Verification Market Scope

The global identity verification market is segmented on the basis of application, component, type, deployment mode, organization size, and vertical.

- By Application

On the basis of application, the identity verification market is segmented into credit card fraud, bank fraud, phone or utility fraud, and employment or tax-related fraud. The credit card fraud segment accounted for the largest market revenue share in 2024, driven by increasing online transactions and the rise in card-not-present frauds. Financial institutions are increasingly adopting multi-layered verification technologies to curb fraudulent card activities and improve customer trust.

The employment or tax-related fraud segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing incidence of identity theft for unlawful employment and tax return claims. Governments and enterprises are now investing in robust KYC procedures to mitigate risks.

- By Component

On the basis of component, the identity verification market is segmented into solution and services. The solution segment held the largest market share in 2024 due to the widespread deployment of digital ID verification tools such as document verification, facial recognition, and database validation. These tools offer real-time authentication, scalability, and integration with legacy systems.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, as organizations seek specialized support in deployment, consulting, and training services to optimize verification workflows and stay compliant with data protection regulations.

- By Type

On the basis of type, the identity verification market is segmented into non-biometrics and biometrics. The biometrics segment dominated the market in 2024 due to the rising adoption of fingerprint scanning, facial recognition, and voice analysis across sectors such as BFSI and government. Biometrics provide enhanced accuracy and user convenience, making them ideal for high-security environments.

The non-biometrics segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in low-risk applications and regions with strict privacy laws, where document and database-based verification remain prevalent.

- By Deployment Mode

On the basis of deployment mode, the identity verification market is categorized into on-premise and cloud. The cloud segment held the dominant share in 2024, supported by its flexibility, scalability, and reduced infrastructure costs. Cloud-based identity verification enables real-time data processing, system updates, and remote accessibility, making it highly preferred by SMEs.

The on-premise segment is expected to witness the fastest growth rate from 2025 to 2032, due to its use in sectors such as defense and government, where data security and local control are prioritized.

- By Organization Size

The identity verification market is segmented by organization size into large enterprises and SMEs. Large enterprises captured the largest market share in 2024 owing to their extensive customer bases, regulatory compliance requirements, and substantial IT budgets to invest in sophisticated ID verification solutions.

The SME segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing digitization of operations and the need to combat cyber threats while ensuring smooth customer onboarding.

- By Vertical

On the basis of vertical, the market is segmented into BFSI, government & defense, energy & utilities, retail & ecommerce, IT & telecom, healthcare, gaming, and others. The BFSI segment held the largest revenue share in 2024, driven by stringent KYC norms and growing incidences of financial frauds. Banks and financial institutions are adopting AI-powered ID verification to secure transactions and build customer trust.

The gaming segment is expected to witness the fastest growth rate from 2025 to 2032, as the industry increasingly requires robust age and identity verification systems to ensure regulatory compliance and prevent underage access and fraud in online gaming environments.

Identity Verification Market Regional Analysis

- North America dominated the identity verification market with the largest revenue share of 42.1% in 2024, driven by the presence of advanced digital infrastructure, stringent regulatory frameworks such as KYC and AML, and a high incidence of identity-related fraud

- The region's enterprises are prioritizing robust verification technologies to ensure compliance, enhance customer onboarding, and mitigate cyber threats

- The widespread adoption of AI-powered and biometric authentication tools across BFSI, healthcare, and government sectors further supports market dominance

U.S. Identity Verification Market Insight

The U.S. identity verification market accounted for the largest revenue share in North America in 2024, supported by rapid digitization across industries, growing data privacy concerns, and frequent instances of identity theft. Financial institutions, in particular, are investing in multi-factor authentication and biometric technologies to secure remote onboarding and reduce fraud. The presence of major market players and continuous innovation also contribute to the country’s leading position.

Asia-Pacific Identity Verification Market Insight

The Asia-Pacific identity verification market is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding digital economies, government e-ID initiatives, and rising internet penetration in emerging markets. Countries such as China, India, and Japan are seeing significant adoption across BFSI, telecom, and public sectors. The push toward smart cities and secure digital governance is fueling demand for reliable identity verification solutions.

China Identity Verification Market Insight

The China identity verification market held the largest revenue share in Asia-Pacific in 2024, driven by strong government support for digital identification, rapid growth in online services, and increasing investments in surveillance and AI technologies. Identity verification is widely adopted across banking, social media, and public security applications, supported by domestic tech giants and regulatory frameworks.

Japan Identity Verification Market Insight

The Japan identity verification market is expected to witness the fastest growth rate from 2025 to 2032, fueled by a tech-oriented population, strong demand for digital banking, and the government's push for national digital ID systems. Adoption is also rising in the insurance and healthcare sectors, with a focus on user-friendly, secure access solutions integrated with other smart systems.

Europe Identity Verification Market Insight

The Europe identity verification market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by the implementation of GDPR and eIDAS standards that mandate secure digital identification. Growing demand for cross-border digital services and privacy-focused solutions is fostering adoption, particularly in finance, travel, and government sectors.

Germany Identity Verification Market Insight

The Germany identity verification market is expected to witness the fastest growth rate from 2025 to 2032due to strong regulatory compliance, high digital literacy, and widespread e-Government initiatives. The adoption of eID cards and secure identity platforms is driving market growth across public administration and private enterprises.

U.K. Identity Verification Market Insight

The U.K. identity verification market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising need for fraud prevention, digital onboarding in banking and fintech, and government-backed initiatives such as GOV.UK Verify. The country’s focus on seamless, secure digital experiences is propelling investments in biometric and AI-based solutions.

Identity Verification Market Share

The Identity Verification industry is primarily led by well-established companies, including:

- Experian (Ireland),

- G.B. Group plc (‘GBG’) (U.K.),

- Equifax, Inc. (U.S.),

- Mitek Systems, Inc. (U.S.),

- Thales (France)

- LexisNexis Risk Solutions (U.S.)

- Onfido (U.K.)

- Trulioo (Canada)

- Acuant, Inc. (U.S.)

- IDEMIA (France)

- Jumio (U.S.)

- TransUnion LLC (U.S.)

- AU10TIX (Israel)

- IDology (U.S.)

- Innovatrics (Slovakia)

- Applied Recognition (Canada)

- Signicat (Norway)

- SecureKey Technologies Inc. (Canada)

- Baldor Technologies Pvt Ltd (India)

Latest Developments in Global Identity Verification Market

- In February 2024, AU10TIX introduced a new Know Your Business (KYB) solution aimed at enhancing partner verification and risk mitigation. By integrating KYB with Know Your Customer (KYC) processes, this solution offers comprehensive identity verification capabilities, supporting secure business engagements and boosting trust in financial transactions

- In January 2024, Onfido launched an all-in-one identity verification solution designed to help enterprises streamline customer onboarding. The platform enables businesses to comply with local regulatory standards, facilitating smooth expansion into new markets and improving user acquisition

- In December 2023, HireRight, LLC released “Global ID,” a digital identity verification tool featuring biometric face matching and digital liveness detection. This innovation strengthens the hiring process by ensuring candidate authenticity, thus improving compliance and reducing the risk of identity fraud

- In October 2023, Veriff unveiled two fraud prevention tools to expand its identity verification suite. Leveraging machine learning, behavioral analysis, and biometric verification, these tools help businesses detect and block fraudulent activities, enhancing overall security

- In October 2023, IDology, a GBG company, expanded its identity solutions for the gaming industry, focusing on player acquisition, retention, and fraud prevention. This development enhances regulatory compliance and operational efficiency, offering gaming operators a more secure and user-friendly experience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.