Europe Blockchain Identity Management Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

197.04 Billion

2024

2032

USD

1.20 Billion

USD

197.04 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 197.04 Billion | |

|

|

|

|

Blockchain Identity Management Market Size

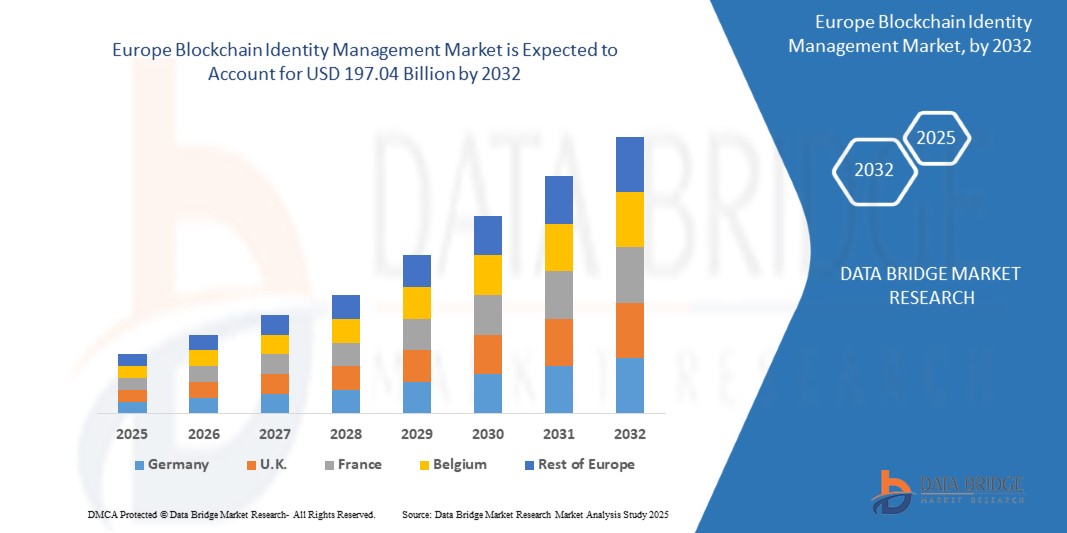

- The Europe Blockchain Identity Management market size was valued at USD 1.2 billion in 2024 and is expected to reach USD 197.04 billion by 2032, at a CAGR of 89.20% during the forecast period

- The market's rapid expansion is primarily driven by increasing digital transformation efforts across sectors such as finance, government, and healthcare, where secure and tamper-proof identity verification is becoming critical.

- Europe’s focus on data protection laws like the General Data Protection Regulation (GDPR) has accelerated the adoption of Blockchain Identity Management solutions due to their decentralized, user-controlled nature, which aligns with stringent compliance requirements.

Blockchain Identity Management Market Analysis

- Blockchain Identity Management solutions are transforming digital access and identity verification processes across sectors such as finance, government, education, and healthcare in Europe. These systems offer enhanced privacy, data security, and decentralized user control—core advantages in an era increasingly concerned with cyber threats and regulatory compliance.

- The market is experiencing accelerated growth due to the rising demand for self-sovereign identity (SSI) solutions, which give users full ownership over their digital identities. Blockchain-based platforms ensure that identity data is immutable, tamper-proof, and easily verifiable without relying on centralized authorities.

- Germany dominates the Europe Blockchain Identity Management market, accounting for 40.01% of the total regional revenue share in 2024. This leadership stems from the country’s early adoption of digital ID programs, strong government support for blockchain innovation, and its robust infrastructure for IT and cybersecurity services.

- The U.K. is anticipated to witness the fastest CAGR from 2025 to 2032, driven by government-backed initiatives such as the UK Digital Identity and Attributes Trust Framework, which promotes trusted digital identity ecosystems. Additionally, a growing fintech sector and increasing instances of data breaches have prompted enterprises to invest in advanced identity protection technologies.

- The Software segment leads the Europe market, holding 43.2% of the market share in 2024, due to its critical role in identity authentication, credential management, and integration with enterprise IT systems. As more organizations adopt blockchain-as-a-service (BaaS) offerings from providers like IBM and Microsoft, demand for scalable and interoperable identity software platforms continues to rise.

Report Scope and Blockchain Identity Management Market Segmentation

|

Attributes |

Blockchain Identity Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blockchain Identity Management Market Trends

“Enhanced Convenience Through AI and Voice Integration”

A prevailing trend in the Europe Blockchain Identity Management market is the widespread adoption of AI and voice assistant integration, which is transforming the way users interact with digital access systems. These integrations enhance personalization, streamline control, and elevate user convenience in both residential and commercial settings.

In January 2024, August Home expanded the functionality of its Wi-Fi Smart Lock, deepening integration with Amazon Alexa, Google Assistant, and Apple HomeKit. Users can now issue voice commands for locking/unlocking and receive real-time updates via mobile applications, boosting usability and smart home compatibility.

The Level Lock+, introduced in late 2023 in collaboration with Apple, supports Home Key—a feature that enables unlocking doors using iPhones or Apple Watches. This has gained notable traction in urban households and luxury apartments across the U.K. and Germany.

AI-powered systems like the Ultraloq U-Bolt Pro WiFi, which launched enhancements in Q4 2023, utilize adaptive learning algorithms to refine fingerprint accuracy and detect unusual access patterns, improving both convenience and security for European multi-tenant buildings.

In December 2023, WELOCK introduced a line of AI-integrated smart locks with features like proximity-based auto-unlock and native voice assistant compatibility, addressing rising demand for intelligent, touch-free access systems in countries like France and the Netherlands.

These innovations are increasingly expected as standard features by European consumers, influencing both product development and purchasing behavior in the region

Blockchain Identity Management Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- Rising urbanization and smart home adoption are driving the demand for secure, seamless access systems across Europe. Increased awareness of security risks and a preference for contactless, customizable access are compelling residential and commercial sectors to adopt Blockchain Identity Management solutions.

- In April 2024, Onity, Inc. (Honeywell subsidiary) launched upgraded smart sensors for its Passport IoT-based access platform, expanding its use across European self-storage, apartment, and hotel chains for real-time monitoring and secure access control.

- European consumers are gravitating toward models offering remote access, temporary codes, mobile-based control, and geofencing. For example, Yale Assure Lock 2, launched in 2023, integrates with SmartThings, Apple Home, and Google Home, becoming popular among property managers in Spain and the U.K.

- The DIY installation trend, especially in mid-income countries like Poland and Italy, has further lowered the barrier to adoption. Affordable models like Wyze Lock Bolt have seen rising sales due to their smartphone-enabled operation and ease of setup.

- The growing integration of Blockchain Identity Managements in smart city frameworks across Europe—like Amsterdam and Vienna—underlines their evolving role in both private and public digital infrastructure.

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Despite growing adoption, cybersecurity threats remain a key concern in Europe. Vulnerabilities such as default credentials and insufficient encryption have prompted regulatory discussions around standardizing IoT and smart lock security.

- A 2023 Consumer Reports study revealed exploitable flaws in several smart lock brands, intensifying scrutiny from privacy advocates and regulators, especially under the EU's GDPR and upcoming Cyber Resilience Act.

- In response, companies like August Home and Level Home now emphasize their use of AES-128 encryption, two-factor authentication, and cloud infrastructure with secure key exchange protocols to reassure European customers.

- High upfront costs for advanced systems—especially those with biometric scanning, HD cameras, or multi-device syncing—remain a barrier in price-sensitive regions like Eastern Europe. Premium models often range from €250 to €400, restricting their appeal to affluent markets.

- To mitigate this, vendors are launching modular upgrade kits, subscription-based advanced features, and educational campaigns—especially in Germany and the Nordics—to raise awareness on secure usage and system benefits.

Blockchain Identity Management Market Scope

The market is segmented on the basis of component, provider, network, organization size, vertical.

- By Component

Software held a substantial share of the European Blockchain Identity Management market in 2024, owing to the widespread demand for cloud-based identity platforms, decentralized identifiers (DIDs), and user authentication apps across banking, healthcare, and public services. In February 2024, Verimi GmbH (Germany-based digital identity provider) expanded its platform capabilities, offering secure integration with the EU Digital Identity Wallet, enhancing interoperability across European services.

The services segment is witnessing steady growth, fueled by the need for deployment, system integration, identity verification services, and regulatory consulting in industries like BFSI and healthcare. In July 2023, Atos SE partnered with IDnow to deliver enhanced identity verification services compliant with eIDAS and GDPR, supporting the European shift to compliant blockchain-based identity systems.

- By Provider

Application Providers dominate the European market due to the proliferation of user-centric identity solutions and blockchain-based access control apps. In December 2023, Spherity GmbH launched its new Decentralized Identity Management application, enabling seamless identity transactions in pharmaceutical and supply chain use cases.

Middleware Providers play a key role by enabling interoperability between legacy systems and decentralized ID platforms. Finema Europe, in Q1 2024, expanded middleware offerings to streamline identity federation and integrate with EU digital identity infrastructure.

Infrastructure Providers are also gaining momentum as adoption scales. In March 2024, EuropeChain deployed new permissioned blockchain nodes across France and Italy, supporting sovereign data hosting and national ID frameworks, addressing Europe’s strong data residency and privacy requirements.

- By Network

Permissioned blockchains are the preferred architecture in Europe, dominating in 2024 due to their compliance with regional data privacy regulations (GDPR, eIDAS) and ability to limit access to verified participants. For instance, Hyperledger Fabric-based implementations are used by several national digital ID pilots in Germany and the Netherlands.

Permissionless networks are growing slowly, used mainly in academic research, non-profit digital identity initiatives, or cross-border authentication projects. However, scalability and trust concerns limit their widespread adoption in regulated industries.

- By Organization Size

Large Enterprises account for the majority of the European market share, leveraging Blockchain Identity Management platforms for employee credentialing, secure client onboarding, and cross-border compliance. In January 2024, ING Bank deployed a decentralized identity system for internal access management and KYC processes, streamlining authentication and audit trails.

Small and Medium Enterprises (SMEs) are adopting Blockchain Identity Management at a growing pace, driven by affordable SaaS-based identity solutions and plug-and-play integration tools. In October 2023, Lissi GmbH launched a lightweight blockchain-based ID system tailored for SMEs across Austria and Switzerland, helping reduce identity fraud while maintaining operational simplicity.

- By Vertical

The BFSI sector leads adoption in Europe, driven by regulatory compliance (AML/KYC), fraud prevention, and secure customer onboarding. In 2024, Société Générale piloted blockchain-based identity verification tools across its online banking units to improve customer trust and transaction transparency.

The government vertical is growing rapidly with national eID initiatives and digital passports. In February 2024, Estonia expanded its e-Residency program to incorporate blockchain-based authentication, offering enhanced cross-border digital services for EU and non-EU citizens.

The healthcare sector is seeing strong uptake for patient record management, e-prescription validation, and identity-proofed access to medical portals. In April 2024, Gematik GmbH began testing decentralized IDs for secure electronic health record (EHR) access across German clinics.

The telecom & IT sector uses Blockchain Identity Management for SIM card registration, device authentication, and user credentialing. In 2023, Deutsche Telekom collaborated with the IDunion project to develop a decentralized identity framework for telecom service providers.

The retail & e-commerce sector is leveraging blockchain IDs for loyalty program authentication, secure transactions, and age verification, especially in online alcohol and pharma retail. Zalando, in Q4 2023, began testing decentralized IDs for frictionless customer checkout and returns.

Others includes education, logistics, and utilities, where Blockchain Identity Managements are increasingly being used for digital diplomas, supply chain tracking, and utility customer ID management. In 2023, TU Delft launched blockchain-verified certificates for graduates, strengthening credential authenticity across European borders.

Blockchain Identity Management Market Regional Analysis

- Europe is a key region in the Blockchain Identity Management market, projected to grow at a CAGR of 89.20%. The surge is fueled by robust smart infrastructure adoption, data privacy regulations (like GDPR), and widespread rollout of e-government digital ID programs.

- Countries across Western Europe are increasingly implementing decentralized identity systems to support secure digital transactions, smart home automation, and citizen services, especially under the EU Digital Identity Wallet initiative.

- A rise in cybersecurity awareness, green building codes, and urban modernization efforts is pushing demand for blockchain-based access and identity verification systems across both residential and industrial applications.

U.K. Blockchain Identity Management Market Insight

The U.K. is witnessing strong growth, driven by rising urban security needs, a tech-savvy population, and rapid expansion of smart city initiatives across metropolitan areas like London, Birmingham, and Manchester. In 2023, Yale UK launched its Linus Smart Lock in partnership with Amazon Key and Apple Home, enhancing integration with voice platforms and app-based control, further expanding its residential market footprint. Regulatory focus on tenant safety, property access compliance, and identity theft prevention is encouraging adoption of decentralized access management tools in both housing and commercial leasing sectors.

Germany Blockchain Identity Management Market Insight

Germany is a major player in Europe’s Blockchain Identity Management landscape, thanks to its rigorous data protection laws, early adoption of smart building technologies, and industrial automation standards. In 2024, several smart commercial buildings across Berlin and Munich began implementing blockchain-enabled access systems aligned with sustainability goals and ISO 27001 data security standards. The industrial and manufacturing sectors are leading adopters due to strict compliance with worker safety protocols, real-time surveillance, and emergency response automation. Key players like Bosch Building Technologies and Siemens Smart Infrastructure are piloting Blockchain Identity Managements as part of Industry 4.0 transitions.

Blockchain Identity Management Market Share

The Blockchain Identity Management industry is primarily led by well-established companies, including:

- Bosch Security Systems, Inc. (Germany)

- Honeywell International Inc. (U.S.)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Johnson Controls (Ireland)

- General Electric Co. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Axis Communications AB (Sweden)

- Emerson Electric Co. (U.S.)

Latest Developments in Europe Blockchain Identity Management Market

- In January 2024, Yale UK launched the Yale Smart Cabinet Lock across the U.K. and Germany, expanding its product portfolio beyond traditional door locks. The device integrates with Apple HomeKit and Google Assistant, enabling secure storage for medicine cabinets, toolboxes, and high-value personal storage—demonstrating diversification of Blockchain Identity Managements in household applications.

- In December 2023, Nuki Home Solutions GmbH, an Austria-based smart access solutions provider, unveiled the Nuki Smart Lock 4.0 Pro. Designed specifically for the European market, the lock features Matter compatibility, Thread protocol support, and real-time biometric alerts, making it highly suitable for connected European households. The launch reinforces the region’s commitment to interoperable, secure smart home ecosystems.

- In November 2023, Bosch Building Technologies announced the expansion of its blockchain-based access management platform for European commercial buildings. The system, piloted in Germany and the Netherlands, uses decentralized identity verification and smart contracts to regulate multi-tenant access, reducing administrative burden and boosting security across office spaces.

- In October 2023, ASSA ABLOY EMEA rolled out its Aperio H100 wireless door handle with mobile access credentials in France, Spain, and Italy. The solution allows seamless entry using smartphones or smartcards, aligning with the EU’s push for contactless and digital public access infrastructure under the Digital Europe Programme..

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.