Global Homologation Market

Market Size in USD Billion

CAGR :

%

USD

1.53 Billion

USD

2.28 Billion

2024

2032

USD

1.53 Billion

USD

2.28 Billion

2024

2032

| 2025 –2032 | |

| USD 1.53 Billion | |

| USD 2.28 Billion | |

|

|

|

|

Homologation Market Size

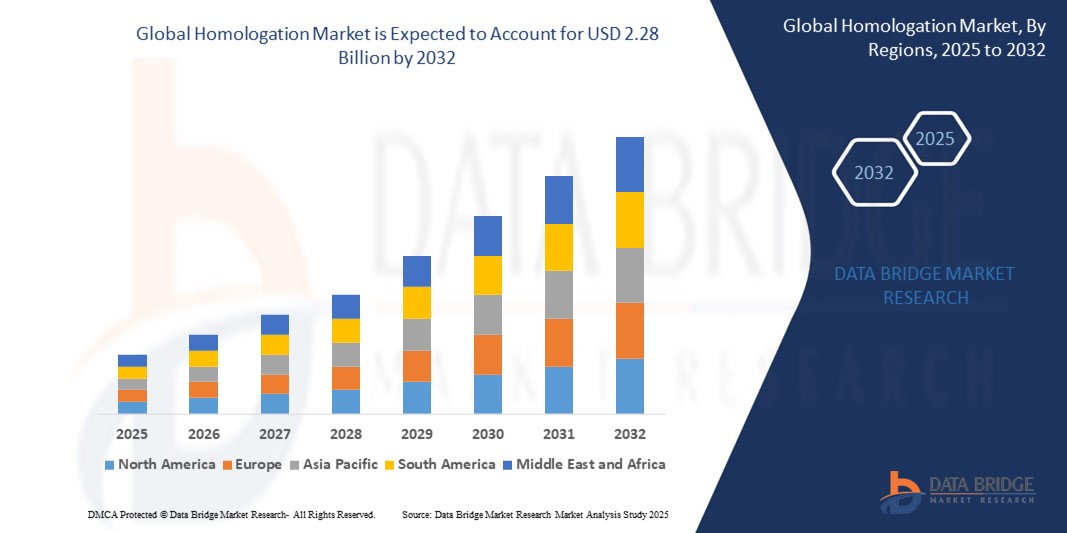

- The global homologation market size was valued at USD 1.53 billion in 2024 and is expected to reach USD 2.28 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the increasing globalization of automotive trade, rising demand for vehicle exports, and stringent government regulations related to safety, emissions, and environmental compliance across major economies

- In addition, technological advancements in testing and certification services, coupled with expanding electric and autonomous vehicle markets, are further propelling the demand for homologation services worldwide

Homologation Market Analysis

- The global homologation market is experiencing consistent growth as regulatory standards across automotive, aerospace, and machinery sectors become more unified and stringent, especially in regions such as Europe, North America, and Asia-Pacific

- Companies involved in manufacturing and exporting vehicles and components must ensure compliance with specific local standards, creating a sustained need for certification, testing, and approval services

- Europe dominated the homologation market with the largest revenue share in 2024, driven by stringent regulatory frameworks such as UNECE standards and high export volumes of vehicles across borders

- Asia-Pacific region is expected to witness the highest growth rate in the global homologation market, driven by expanding automotive production, rising vehicle exports, and increasing alignment of national regulations with international standards

- The full vehicle homologation segment accounted for the largest revenue share in 2024, driven by increasing international trade in automobiles and growing regulatory demands for complete vehicle certification across regions. Automakers are compelled to comply with evolving emissions, safety, and environmental standards when exporting vehicles, boosting the demand for end-to-end homologation services. OEMs prefer full vehicle approvals to streamline global market entry and reduce redundant testing

Report Scope and Homologation Market Segmentation

|

Attributes |

Homologation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Homologation Market Trends

“Integration Of Digital Tools And Automation In Testing Processes”

- Digital platforms are increasingly being adopted to streamline compliance management, reducing documentation errors and improving audit readiness

- Automation in testing processes enhances the speed and accuracy of evaluations, allowing manufacturers to shorten product launch timelines

- AI and machine learning are being used to analyze large volumes of test data, enabling predictive compliance and risk assessment

- Digital twin technology is allowing companies to conduct virtual homologation simulations, reducing the need for repeated physical trials

- Cloud-based systems are enabling real-time updates on evolving standards and seamless coordination between OEMs and certifiers

- For instance, TÜV SÜD adopted AI-powered automated testing labs that reduced certification turnaround time by nearly 30%, boosting productivity for several automotive clients

Homologation Market Dynamics

Driver

“Rising Global Vehicle Export and Evolving Regulatory Standards”

- Increased international vehicle trade is prompting OEMs to seek certification in multiple jurisdictions to remain competitive

- Stringent emissions and safety regulations in regions such as Europe and the U.S. are expanding the demand for expert homologation services

- The rise of EVs and ADAS technologies is introducing new testing parameters that require advanced compliance evaluation

- International organizations such as UNECE are promoting harmonized frameworks, though regional differences still necessitate localized approvals

- The growing complexity of vehicle components, software, and electronics has made certification more technical and recurring

- For instance, the introduction of the Worldwide Harmonized Light Vehicles Test Procedure (WLTP) in the EU led to increased homologation efforts across automakers exporting to Europe

Restraint/Challenge

“High Cost and Time-Intensive Approval Process”

- Homologation requires significant capital investment in testing infrastructure, certifications, and specialized personnel

- Approval timelines can be lengthy, delaying time-to-market and increasing opportunity costs for OEMs

- Lack of harmonization among countries results in duplicate testing efforts, adding to the financial burden

- Smaller firms and startups often struggle to afford the repeated costs of testing and documentation required for each new market

- Continuous updates to regulatory frameworks demand additional rounds of testing, often straining limited budgets and resources

- For instance, Several electric two-wheeler manufacturers in Southeast Asia postponed entry into the European market due to the cost and time needed for homologating battery systems under strict EU safety standards

Homologation Market Scope

The market is segmented on the basis of service type, application, and vehicle type.

• By Service Type

On the basis of service type, the homologation market is segmented into full vehicle homologation and components and system homologation. The full vehicle homologation segment accounted for the largest revenue share in 2024, driven by increasing international trade in automobiles and growing regulatory demands for complete vehicle certification across regions. Automakers are compelled to comply with evolving emissions, safety, and environmental standards when exporting vehicles, boosting the demand for end-to-end homologation services. OEMs prefer full vehicle approvals to streamline global market entry and reduce redundant testing.

The components and system homologation segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing complexity of vehicle subsystems and integration of electronic components. With the rise of electric and autonomous vehicles, demand for component-level testing—such as battery systems, ADAS modules, and powertrains—has surged. Tier-1 and Tier-2 suppliers are increasingly engaging in specialized homologation to ensure compliance of individual parts across geographies.

• By Application

On the basis of application, the homologation market is segmented into domestic homologation and export oriented homologation. The export oriented homologation segment dominated the market in 2024 due to a sharp rise in cross-border vehicle sales, especially in Europe, Asia-Pacific, and North America. Global automakers rely on export approvals to meet differing regional requirements, and this is particularly critical for companies entering highly regulated markets such as the U.S. and EU.

The domestic homologation segment is expected to witness the fastest growth rate from 2025 to 2032, supported by national regulatory reforms and stricter compliance enforcement in emerging economies. As countries align their standards with global frameworks, local manufacturers are increasingly required to obtain certifications even for vehicles sold domestically.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into motorcycle, passenger vehicles, commercial vehicles, trailers, and agricultural equipment. The passenger vehicles segment held the largest revenue share in 2024, backed by the dominance of passenger car exports and the rising incorporation of advanced safety and infotainment technologies. The need to certify a broad range of features—such as emissions, lighting, crashworthiness, and electronics—makes homologation vital for passenger cars.

The motorcycle segment is expected to witness the fastest growth rate from 2025 to 2032, particularly due to growing two-wheeler exports from Asia-Pacific countries such as India and China. New emission norms such as Euro 5 and evolving electric mobility mandates are prompting manufacturers to seek rapid and cost-efficient homologation services to maintain market competitiveness.

Homologation Market Regional Analysis

• Europe dominated the homologation market with the largest revenue share in 2024, driven by stringent regulatory frameworks such as UNECE standards and high export volumes of vehicles across borders

• OEMs and component manufacturers in the region are heavily reliant on type approval processes, with countries such as Germany, France, and Italy being central to certification procedures

• The growing focus on safety, emission control, and sustainable mobility, along with increasing complexity in automotive technologies, has reinforced the importance of consistent homologation across both domestic and international markets

Germany Homologation Market Insight

The Germany homologation market accounted for the highest revenue share in Europe in 2024, driven by the country’s position as a global automotive manufacturing hub. The need to comply with both EU and global regulations has intensified homologation activities. With its advanced testing infrastructure and regulatory leadership, Germany continues to set benchmarks for type approval, particularly in emerging segments such as electric and autonomous vehicles. The presence of major OEMs and Tier-1 suppliers further accelerates the demand for system-level and full vehicle certifications.

U.K. Homologation Market Insight

The U.K. homologation market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s adherence to stringent safety and environmental standards. Following Brexit, the U.K. has implemented its own vehicle type approval scheme (UKTA), prompting manufacturers to undergo separate certification processes for the U.K. and EU markets. This dual compliance requirement has increased the demand for localized homologation services. In addition, the country’s strong automotive R&D capabilities and growing EV sector are contributing to the rise in component and system approvals.

Asia-Pacific Homologation Market Insight

The Asia-Pacific homologation market is expected to witness the fastest growth rate from 2025 to 2032, driven by surging vehicle production, rising exports, and adoption of global standards by countries such as India, China, and Japan. Governments in the region are increasingly aligning with international certification protocols, enhancing the role of homologation service providers. In addition, growth in electric mobility and cross-border trade is creating a favorable landscape for component and full-vehicle approvals.

China Homologation Market Insight

China captured the largest market share in the Asia-Pacific homologation market in 2024, attributed to its vast vehicle production base and rising exports to Europe, Southeast Asia, and Latin America. The government’s efforts to harmonize local standards with international frameworks, along with its leadership in EV production, have heightened the need for both domestic and export-oriented certifications. The growing role of digital tools and automated testing platforms is also modernizing the homologation process across the country.

North America Homologation Market Insight

North America holds a significant share of the global homologation market, fueled by regulatory oversight from agencies such as the U.S. National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA). Automakers must navigate complex rules to enter both domestic and foreign markets. The region's strong focus on safety, emission standards, and vehicle connectivity continues to increase the scope of homologation.

U.S. Homologation Market Insight

The U.S. homologation market dominated North America in 2024, due to the country's strong vehicle export base and robust automotive innovation. U.S. regulatory requirements such as FMVSS and CARB drive high demand for certification across a wide range of vehicles and components. The growing presence of electric and autonomous vehicle startups is further supporting the need for specialized and flexible homologation services.

Homologation Market Share

The Homologation industry is primarily led by well-established companies, including:

- Applus+ (Spain)

- Lloyd's Register Group Services Limited (U.K.)

- TÜV SÜD (Germany)

- Eurofins Scientific (Luxembourg)

- Formel D (Germany)

- Bureau Veritas (France)

- DEKRA India Private Limited (Germany)

- MISTRAS Group (U.S.)

- SGS SA (Switzerland)

- Intertek Group plc (U.K.)

- CIRT (India)

- Splan Corporate Solutions LLP (India)

- TASS International (Netherlands)

- Eleos Compliance (U.S.)

Latest Developments in Global Homologation Market

- In July 2023, UTAC and SMVIC strengthen collaboration as SMVIC's test center attains Euro NCAP approval in China, underscoring a leap forward in global vehicle safety. An MOU signing reaffirms UTAC's dedication to bolster Testing, Type Approval, and Certification endeavors, consolidating its role as a mobility safety authority

- In July 2023, UL LLC. earns Certification Body Testing Laboratory status for Battery and Electric Vehicle Charger Services in Taiwan, offering extensive testing solutions for e-mobility and energy sector manufacturers, fortifying product safety and compliance in evolving markets

- In May 2023, FORVIA CLD achieves pivotal Type IV tank certification from the Chinese government, bolstering Faurecia's standing in hydrogen mobility. With CLD's lightweight design and growth prospects, Faurecia primes to propel hydrogen mobility in China, solidifying its market presence and influence

- In March 2023, SGS Société Générale de Surveillance SA invested significantly in a state-of-the-art bioanalytical testing facility in Pudong, Shanghai, amplifying support for the bio/pharmaceutical sector. This initiative promises streamlined IND and NDA processes, accentuating SGS's commitment to advancing drug R&D and quality standards in collaboration with industry leaders

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.