Global High Barrier Packaging Films For Pharmaceuticals Market

Market Size in USD Million

CAGR :

%

USD

413.22 Million

USD

653.66 Million

2021

2029

USD

413.22 Million

USD

653.66 Million

2021

2029

| 2022 –2029 | |

| USD 413.22 Million | |

| USD 653.66 Million | |

|

|

|

|

High Barrier Packaging Films for Pharmaceuticals Market Analysis and Size

As hazardous viruses and germs are becoming more common, people all around the world are becoming more health-conscious. The pharmaceutical and medical industries have benefited from the trend toward leading healthy lifestyles and consumers' growing preference for safe and hygienic products. Additionally, to satisfy consumer requests, producers must also strictly adhere to ISO standards, such as ISO 9001 quality management certifications. Therefore, the high barrier packaging films for pharmaceuticals are better suited for pharmaceutical packaging, thus expanding the market worldwide.

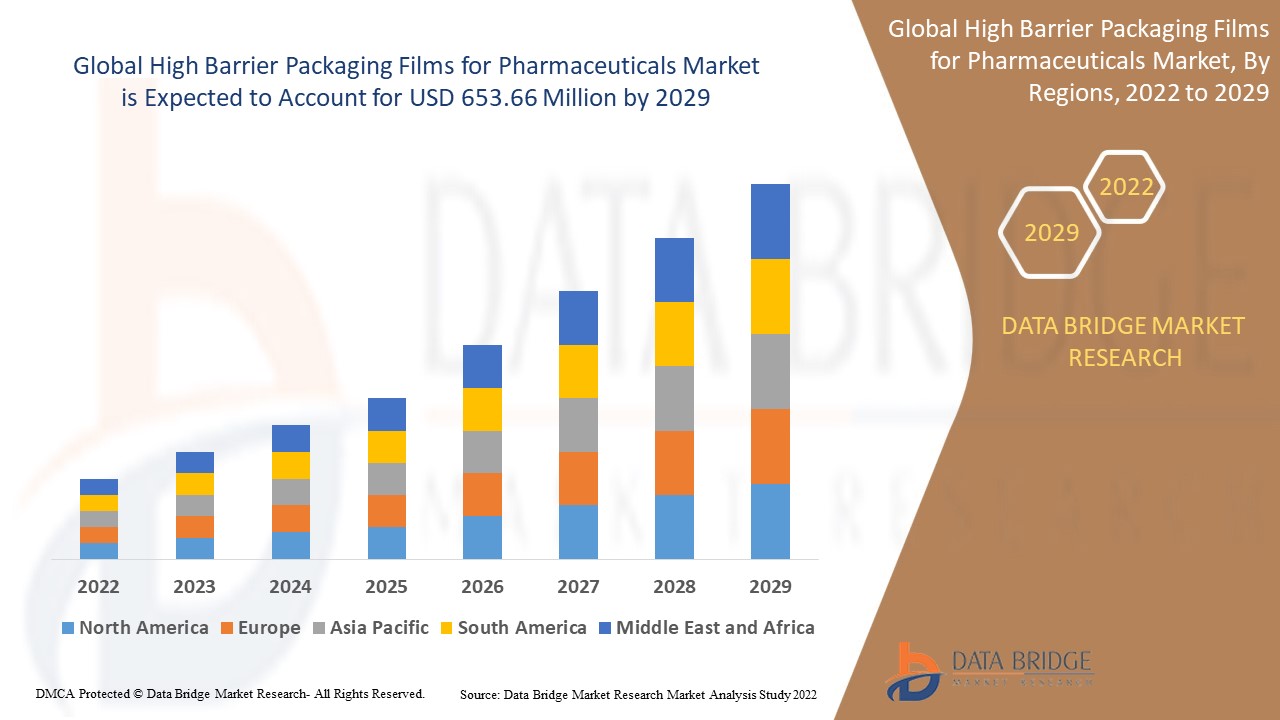

Global high barrier packaging films for pharmaceuticals market was valued at USD 413.22 million in 2021 and is expected to reach USD 653.66 million by 2029, registering a CAGR of 5.90% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

High Barrier Packaging Films for Pharmaceuticals Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Metalized Films, Clear Films, Organic Coating Films, Inorganic Oxide Coating Films), Product (Cold-Formable Films, Coextruded Films, Thermo-Formable Films), Material (Aluminum, Plastics), Technology (Multi-Layer Film, Sustainable Barrier Coatings, Besela Barrier Film and Others), Application (Pouches, Bags, Lids, Shrink Films, Laminated Tubes, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia- Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Amcor plc (Switzerland), Mondi (U.K.), Huhtamaki (Finland), Sealed Air (U.S.), Jindal Poly Films Limited (India), Toppan Inc., (Japan), Kureha Corporation (Japan), HPM Global, Inc. (South Korea), Flair Flexible Packaging Corporation (U.S.), Constantia Flexibles (Austria), MULTIVAC (Germany), DuPont (U.S.), Wihuri Group (Finland), BERNHARDT Packaging & Process (France), Borealis AG (Austria), Schott (Germany), Dow (U.S.), Sonoco Products Company (U.S.), Bemis Company Inc. (U.S.), Huhtamaki Group (Finland) and Uflex Limited (India) |

|

Market Opportunities |

|

Market Definition

High barrier packaging films for pharmaceuticals are the films used across the pharmaceutical sector. The high barrier packaging films limit the impact of mineral oil and UV light while assisting in preventing contact with oxygen, carbon dioxide, or moisture. Food attributes including color, taste, texture, aroma, and flavor are retained by the strong barrier formed by the functional elements employed in the packaging film. High barrier films are essential for giving items the necessary qualities and extending their shelf life.

High Barrier Packaging Films for Pharmaceuticals Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growth In Demand for Multi-layered Packaging Films

High barrier packaging films have multiple layers that limit the effects of mineral oil and UV light as well as interaction with oxygen, moisture, and other gases like carbon dioxide. This strong barrier, which was built utilizing functional materials, aids in maintaining the integrity of the substances housed therein, such as the quality, including color, taste, texture, aroma, and flavor. It is crucial to give products crucial barrier features including moisture, gas, and fragrance in order for them to maintain their integrity. Products with these necessary qualities are largely provided by high barrier films. High-barrier films are solvent-free and won't react with packaged goods within the pharmaceuticals because of their impermeable co-extruded and robust structure.

- Surge in Need for High Barrier Packaging Films across Pharmaceutical Sector

Pharmaceutical companies have different needs for packaging solutions than other industries, including isolation from the outside environment, high levels of protection, cost effectiveness, and ease of handling. High barrier packaging films are so commonly utilized since they prevent gas exchange across the packaging and regulate the temperature inside the package, both of which contribute to the market's expansion. Plastic is the main packaging material because it shields pharmaceutical products from bacteria, moisture, contamination, oxygen, and odor. Polypropylene material is a good option for high-barrier packaging because of these qualities.

Furthermore, the widespread utilization high barrier packaging films for pharmaceuticals for packaging and the increasing the demand for high-quality pharmaceutical packaging will further propelled the growth rate of high barrier packaging films for pharmaceuticals market. The films’ ability to increase these products' shelf life by protecting them from moisture, light, gases, biological contamination, and mechanical damage will drive market value growth. The utilization of these films in pharmaceutical and healthcare sector are other market growth determinants.

Opportunities

- Development of Innovative Recyclable Films

The market for high barrier packaging films for pharmaceuticals is anticipated to expand over the forecast period as material manufacturers continue to develop new and improved plastic films and additives for packaging manufacturing in response to recyclable concerns and biodegradable innovative packaging solutions. These comprise sealant films, high-barrier and foil replacement films, as well as more readily recyclable and naturally degradable films. Another major trend in the packaging and pouch-making industry is to use less material, either by using thinner films or fewer layers of film. These factors will largely extend profitable opportunities to the market players in the forecast period of 2022 to 2029.

- Burgeoning Demand for Customer Friendly Packaging

Additionally, consumers consider a few important factors before choosing the packaging films. Some of them are sanitation and food safety, durability, convenience of use, shelf life, label information, appearance, and environmental effects. The fiber-based packaging made of recycled and recyclable plastic is more appealing to consumers. Thus, there is a huge opportunity for the market for high barrier packaging films to capitalize on in order to experience considerable growth in the future due to the rising trend and need for consumer-friendly packaging.

Restraints/Challenges

- Vulnerability to Degradation

Plastic films' oxidation mechanisms can alter when exposed to heat. Biodegradable polymers, however, can only be completely broken down under carefully controlled conditions, such as elevated temperatures and pressures, which are absent from the natural environment, such as aquatic and marine ecosystems. Thus, these high barrier packing films are expected to deteriorate and lose their qualities under less than ideal circumstances. The global high barrier packaging films for pharmaceuticals market's growth may be hampered as a result.

- Volatile of Raw Material Prices

The high barrier packaging films for pharmaceuticals are made from raw materials such as aluminum, plastics like polyethylene and polypropylene, and a variety of others. These materials are hazardous to the environment, including water and land, non-biodegradable, difficult to recycle, and non-biodegradable. Therefore, the market is projected to have a restricted growth rate.

- Stringent Regulation Associated with the Packaging

Plastic polymers, such as polyethylene, polypropylene, among others are the primary ingredients of high barrier packaging films. These materials are hazardous to the environment, including water and land, non-biodegradable, difficult to recycle, and non-biodegradable. Governments, regulatory agencies, and environmentalists have been raising awareness of the risks of watching such films. Over 40% of plastic is used in the packaging industry. Numerous nations oppose the use and usage of plastic since it takes a long time for it to degrade. Consequently, these regulations will pose as a challenge over the forecasted timeline.

This high barrier packaging films for pharmaceuticals market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the high barrier packaging films for pharmaceuticals market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on High Barrier Packaging Films for Pharmaceuticals Market

The recent outbreak of coronavirus had a significant influence on the high barrier packaging films for pharmaceuticals market.

During the first phase, COVID-19 affected various manufacturing businesses since it caused workplace closures, supply chain disruptions, and transit limitations. However, a considerable impact was noted on the market for high barrier packaging films for pharmaceuticals. Multiple manufacturing facilities were still in use in the area for the operations and supply chain of high barrier packaging films. Following sanitary and safety precautions in the post-COVID environment, the service providers kept providing high barrier packaging films. Since the COVID-19 outbreak, people have been more concerned about their health, hygiene, and safety. Medicines are life-saving drugs that demand the greatest levels of safety and environmental effect protection. High barrier packaging films strengthen the protection of medications from air, water, light, moisture, chemical, bacteria, and germs. As a result, the market was positively impacted by the outbreak of the coronavirus.

Recent Development

- In May 2021, DuPont Mobility & Materials announced it would invest $5 million in capital and operating resources at its manufacturing plants in Germany and Switzerland in order to enhance production of its high-performance automotive adhesives. The investment will increase capacity to meet the rising demand for cutting-edge mobility options for the electrification of vehicles.

- In August 2020, Raven Industries Inc. has introduced the BioFlex I-series, a new product in its plastic film line. It is used in personal defence equipment (PPE). This latex-free film is used in hospitals and laboratories to prevent hospital acquired infections (HAIs). This product adds to the company's product line.

Global High Barrier Packaging Films for Pharmaceuticals Market Scope

The high barrier packaging films for pharmaceuticals market is segmented on the basis of type, product, material, technology and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Metalized Films

- Clear Films

- Organic Coating Films

- Inorganic Oxide Coating Films

Product

- Cold-Formable Films

- Coextruded Films

- Thermo-Formable Films

Material

- Aluminum

- Plastics

Technology

- Multi-Layer Film

- Sustainable Barrier Coatings

- Besela Barrier Film

- Others

Application

- Pouches

- Bags

- Lids

- Shrink Films

- Laminated Tubes

- Others

High Barrier Packaging Films for Pharmaceuticals Market Regional Analysis/Insights

The high barrier packaging films for pharmaceuticals market is analyzed and market size insights and trends are provided by country, type, product, material, technology and application as referenced above.

The countries covered in the high barrier packaging films for pharmaceuticals market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the high barrier packaging films for pharmaceuticals market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The market growth over this region is attributed to the growth of the pharmaceutical industry along with prevalence of various manufacturing companies within the region.

Asia-Pacific on the other hand, is estimated to show lucrative growth over the forecast period of 2022-2029, due to the favorable government policies as well as the huge production of drugs at large scale in India, and China in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and High Barrier Packaging Films for Pharmaceuticals Market Share Analysis

The high barrier packaging films for pharmaceuticals market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to high barrier packaging films for pharmaceuticals market.

Some of the major players operating in the high barrier packaging films for pharmaceuticals market are

- Amcor plc (Switzerland)

- Mondi (U.K.)

- Huhtamaki (Finland)

- Sealed Air (U.S.)

- Jindal Poly Films Limited (India)

- Toppan Inc., (Japan)

- Kureha Corporation (Japan)

- HPM Global, Inc. (South Korea)

- Flair Flexible Packaging Corporation (U.S.)

- Constantia Flexibles (Austria)

- MULTIVAC (Germany)

- DuPont (U.S.)

- Wihuri Group (Finland)

- BERNHARDT Packaging & Process (France)

- Borealis AG (Austria)

- Schott (Germany)

- Dow (U.S.)

- Sonoco Products Company (U.S.)

- Bemis Company Inc. (U.S.)

- Huhtamaki Group (Finland)

- Uflex Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Barrier Packaging Films For Pharmaceuticals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Barrier Packaging Films For Pharmaceuticals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Barrier Packaging Films For Pharmaceuticals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.