Global Healthy Snacks Market

Market Size in USD Billion

CAGR :

%

USD

95.56 Billion

USD

122.18 Billion

2024

2032

USD

95.56 Billion

USD

122.18 Billion

2024

2032

| 2025 –2032 | |

| USD 95.56 Billion | |

| USD 122.18 Billion | |

|

|

|

|

Healthy Snacks Market Size

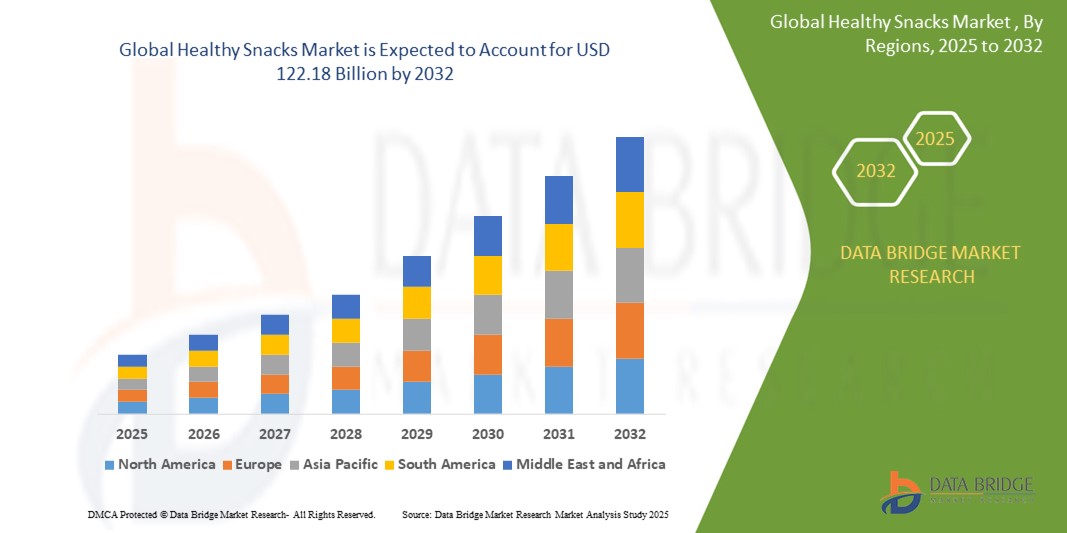

- The global healthy snacks market was valued at USD 95.56 billion in 2024 and is expected to reach USD 122.18 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.12%, primarily driven by rising consumer awareness of the importance of balanced diets and wellness

- This growth is driven by increasing prevalence of busy lifestyles, especially in urban areas, has led to a surge in on-the-go healthy snacking habits

Healthy Snacks Market Analysis

- The healthy snacks market is experiencing robust growth driven by rising health awareness, increasing demand for functional foods, and a shift toward preventive healthcare practices. Consumers are prioritizing nutrient-dense, organic, and clean-label products, compelling brands to innovate with superfoods, protein-enriched snacks, and fortified offerings. Collaborations between food companies and wellness brands are creating integrated health solutions, personalizing snack options, and enhancing consumer loyalty, thereby expanding the overall market landscape

- The rapid growth of online retail and mobile grocery apps is making healthy snacks products more accessible to a broader audience. Urbanization, coupled with an increase in disposable incomes and a growing inclination towards fitness and mindful eating, is reshaping consumer preferences. Emerging trends such as vegan snacks, keto-friendly products, and probiotic-rich foods are gaining traction, while sustainability initiatives such as biodegradable packaging and ethical sourcing practices are strengthening brand value among environmentally aware consumers

- For instance, in March 2025, General Mills announced the launch of a new range of organic, protein-packed snack bars under the Nature Valley brand, aiming to meet the rising demand for clean, sustainable, and health-oriented snack options across North America and Europe

- Globally, the healthy snacks market is being transformed by technological innovations such as AI-powered personalized nutrition, blockchain for supply chain transparency, and advancements in food preservation techniques. Supportive government policies promoting healthy eating habits and increased investments in sustainable food tech startups are further fueling market expansion. As consumer priorities continue to evolve towards wellness, convenience, and environmental responsibility, the healthy snacks sector is emerging as a key pillar of the future global food economy

Report Scope and Healthy Snacks Market Segmentation

|

Attributes |

Healthy Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Healthy Snacks Market Trends

“Rise of Plant-Based and Vegan Healthy Snacks”

- Consumers are increasingly adopting plant-based and flexitarian diets, leading to a surge in demand for vegan-friendly healthy snacks options that are free from animal-derived ingredients. This shift is driven by health, ethical, and environmental concerns, encouraging brands to create innovative snacks using legumes, seeds, nuts, fruits, and vegetables

- Healthy Snacks brands are expanding their portfolios with plant-based protein bars, dairy-free yogurts, meat-free jerky, and vegetable chips to cater to this growing segment. Many products now highlight high-protein, high-fiber, and allergen-free claims to appeal to diverse consumer needs, particularly among millennials and Gen Z

- Marketing efforts are increasingly highlighting the sustainability benefits of plant-based snacks, including lower carbon footprints, reduced water usage, and cruelty-free sourcing. Certifications such as vegan, non-GMO, and organic are becoming critical purchase drivers and are prominently displayed on packaging

For instance,

- In 2024, Kellanova’s RXBAR brand launched “RXBAR Plant,” a new vegan protein bar made with pea and almond protein, targeting health-conscious consumers seeking plant-based alternatives

- Mondelez expanded its "Perfect Snacks" brand by introducing plant-based refrigerated protein bars with clean, simple ingredients

- PepsiCo’s Off The Eaten Path brand unveiled a new line of plant-based snack crisps made from legumes and vegetables to meet the rising demand for healthy, plant-forward snacking options

- As plant-based lifestyles continue to gain mainstream acceptance, the introduction of innovative, sustainable, and tasty vegan snacks will remain a key driver in the healthy snacks market, enabling brands to tap into a larger, ethically aware consumer base and secure long-term growth

Healthy Snacks Market Dynamics

Driver

“Expansion of Health and Wellness Lifestyle Trends”

- The global rise in health and wellness consciousness is significantly propelling the Healthy Snacks market. Consumers are actively seeking snacks that align with broader lifestyle goals such as weight management, fitness, mental well-being, and preventive healthcare, making nutritious snacking an integral part of daily routines

- Brands are capitalizing on this trend by offering snacks tailored for specific wellness needs from protein-rich bars supporting muscle recovery to snacks infused with calming herbs for stress relief. The alignment of snack offerings with fitness trends, mindfulness practices, and holistic health movements is strengthening brand relevance and consumer engagement

- Digital platforms, fitness apps, and wellness influencers are playing a pivotal role in promoting healthy snacking habits, encouraging consumers to make informed dietary choices and prefer brands that align with their personal health journeys

For instance,

- In 2024, General Mills launched a new campaign for its Nature Valley brand, positioning it as a wellness companion for active lifestyles, including partnerships with fitness studios and wellness retreats

- PepsiCo’s Health Warrior brand introduced a line of chia bars and pumpkin seed snacks designed specifically for post-workout recovery and sustained energy, responding to the growing fitness and wellness market

- In early 2025, Nestlé partnered with leading digital wellness platform Noom to offer personalized healthy snack recommendations, blending nutrition with behavioral coaching

- As the health and wellness movement continues to redefine consumer expectations, aligning healthy snacks products with these lifestyle trends will be critical for brands seeking to capture market share, drive innovation, and build lasting consumer loyalty

Opportunity

“Rising Demand for Personalized Nutrition and Customization”

- The increasing consumer desire for personalized nutrition presents a lucrative opportunity for healthy snacks brands. Shoppers are seeking snacks tailored to their individual health goals, dietary preferences, and genetic profiles, driving the rise of customized, on-demand food solutions that offer targeted functional benefits such as energy boost, stress relief, gut health, or weight management

- Companies are leveraging AI, wearable health tech, and DNA-based nutrition analysis to create personalized snack boxes, customizable ingredient blends, and nutrition plans. This approach enhances consumer engagement and promotes premiumization, as consumers are willing to pay more for products that align precisely with their personal needs and lifestyle goals

- Collaborations between food brands and health-tech startups, along with advances in digital health platforms, are accelerating the development of data-driven, hyper-personalized snack offerings across both retail and direct-to-consumer (D2C) channels

For instance,

- In 2024, PepsiCo’s accelerator program supported emerging startups focused on personalized nutrition, including a D2C platform offering customized healthy snack subscriptions based on users' health data

- Nestlé Health Science expanded its investment in Persona Nutrition, providing personalized vitamin packs and tailored snack recommendations using AI-driven assessments

- MyFitFuel, an Indian nutrition brand, introduced personalized snack kits in 2025 based on fitness goals and dietary preferences, targeting athletes and health enthusiasts

- As consumers increasingly demand precision nutrition aligned with their unique wellness aspirations, the healthy snacks market has immense potential to capitalize on personalization trends, fostering deeper brand loyalty and driving premium market growth

Restraint/Challenge

“Short Shelf Life and Preservation Issues in Natural Snack Products”

- The absence of artificial preservatives in healthy and clean-label snacks often results in shorter shelf life, posing a major challenge for manufacturers and retailers. Maintaining product freshness, texture, and flavor over extended periods without compromising on natural ingredient integrity becomes increasingly difficult, especially for minimally processed products

- Shorter shelf life can lead to higher rates of product spoilage, wastage, and returns, negatively impacting profitability and supply chain efficiency. This is particularly challenging in global distribution networks where longer transit times and varying storage conditions can affect product quality

- Developing natural preservation techniques, such as high-pressure processing (HPP), vacuum packaging, or the use of natural antioxidants, requires significant investment in R&D and production infrastructure, adding to operational costs for brands striving to maintain clean-label claims

For instance,

- In 2024, KIND Snacks faced spoilage issues during the summer months in certain markets due to the absence of preservatives in their nut-based snack bars, prompting them to revisit packaging solutions

- Hippeas, a plant-based snack brand, launched a new line in 2023 but had to reformulate within a year due to consumer complaints about staleness and reduced shelf life

- The Food and Agriculture Organization (FAO) reported in 2024 that food waste from perishable, natural products, including snacks, increased by 8% globally due to inadequate cold chain infrastructure in emerging markets

- As consumer preference for preservative-free products grows, healthy snacks providers must invest in advanced, natural preservation technologies and smarter packaging innovations to overcome shelf-life limitations and ensure consistent product quality across diverse markets

Healthy Snacks Market Scope

The market is segmented on the basis of product, claim, distribution channel, and packaging.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Claim |

|

|

By Distribution Channel |

|

|

By Packaging |

|

Healthy Snacks Market Regional Analysis

“North America is the Dominant Region in the Healthy Snacks Market”

- North America is witnessing a shift in consumer habits, with more individuals snacking between meals or even replacing traditional meals with snacks

- The rising demand for healthier snack alternatives is fueling strong growth, as consumers seek snacks that align with their wellness goals

- Growing health awareness and hectic daily routines are boosting the popularity of convenient, yet nutritious snack choices across the region

- These evolving consumption patterns are positioning North America as a key driver of growth in the healthy snacks market during the forecast period

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to witness the most rapid growth in the healthy snacks market from 2025 to 2032

- Modernization trends and a growing preference for convenient snacking options in emerging economies such as India and China are key drivers of this demand

- Rising urbanization and increasingly busy lifestyles are encouraging consumers to choose healthier, accessible snack alternatives

- These factors are positioning Asia-Pacific as a pivotal region for expansion within the healthy snacks industry during the forecast period

Healthy Snacks Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ITC Limited (India)

- Kambly SA (Switzerland)

- Mondelēz International (U.S.)

- PepsiCo (U.S.)

- The Kraft Heinz Company (U.S.)

- General Mills Inc. (U.S.)

- Parle Products Pvt. Ltd. (India)

- Patanjali Ayurved Limited (India)

- Britannia Industries (India)

- Kellanova (U.S.)

- pladis global (U.K.)

- Walker's Shortbread (U.K.)

- Lotus Bakeries Corporate (Belgium)

- Nestlé (Switzerland)

- Burton's Biscuits Co (U.K.)

Latest Developments in Global Healthy Snacks Market

- In October 2024, Zydus Wellness announced its entry into the healthy snacks industry by acquiring Naturell India, the maker of protein-rich Ritebite snacks, for USD 42.3 million, including 100% equity shares and its subsidiary, strengthening its consumer wellness portfolio and boosting expected earnings per share (EPS) from the first year post-acquisition

- In December 2023, Farmley, a healthy snacking startup, raised USD 6.7 million in pre-Series B funding to enhance its offline retail presence and drive product innovation, positioning itself for accelerated growth in the health-focused snacking segment

- In September 2023, Danone UK&I unveiled a new range of high-protein dairy snacks under the brand name GetPRO, offering products such as high-protein yogurts, mousses, puddings, and beverages with no added sugars and low or 0% fat, catering to fitness enthusiasts and expanding its healthy snacking portfolio

- In September 2023, Kellanova’s RXBAR brand collaborated with podcaster Maria Menounos to launch a limited edition RXBAR ManifX bars with customizable wrappers, featuring the Chocolate Sea Salt flavor with 12g of protein, enhancing its brand engagement and consumer appeal

- In June 2023, Unilever announced the acquisition of Yasso Holdings, Inc., a brand known for premium frozen Greek yogurt in the U.S., aligning with its premiumization strategy and expanding its Ice Cream Business Group with healthier and indulgent frozen snack options

- In March 2022, CLIF expanded its snack offerings by introducing CLIF Thins, a crispy and crunchy version of the original CLIF BAR, crafted with plant-based ingredients, broadening its product range to attract health-conscious consumers seeking lighter snacking alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Healthy Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Healthy Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Healthy Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.