Global Healthcare Biometrics Market, By Technology (Fingerprint Recognition, Face Recognition, Palm Recognition, Iris Recognition, Behavioral Recognition, Vein Recognition, and Others), Application (Healthcare Record Security, Patient Tracking, Remote Patient Monitoring, Workforce Management, and Others), End User (Healthcare Providers, Healthcare Organizations, and Research and Academic Institutes) – Industry Trends and Forecast to 2031.

Healthcare Biometrics Market Analysis and Size

The market growth is propelled by the rising adoption of electronic health records (EHR) systems and the digitization of healthcare processes, which require robust identity verification measures. For instance, in August 2022, the French parliament (Assemblée Nationale) approved Project 242-95, allocating EUR 20 million (approximately USD 20.4 million) aimed at developing a biometric iteration of citizens' health cards (Carte Vitale). This initiative underscores the market's momentum, driven by the increasing uptake of electronic health records (EHR) systems and the ongoing digitization of healthcare processes.

Global healthcare biometrics market size was valued at USD 8.75 billion in 2023 and is projected to reach USD 37.87 billion by 2031, with a CAGR of 20.10% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Technology (Fingerprint Recognition, Face Recognition, Palm Recognition, Iris Recognition, Behavioral Recognition, Vein Recognition, and Others), Application (Healthcare Record Security, Patient Tracking, Remote Patient Monitoring, Workforce Management, and Others), End User (Healthcare Providers, Healthcare Organizations, and Research and Academic Institutes)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America

|

|

Market Players Covered

|

Zkteco, Inc (China), Thales Group (France), Bio-Key International Inc (U.S.), Crossmatch Technologies Inc (U.S.), Fujitsu Limited (Japan), Imprivata Inc (U.S.), Lumidigm (U.S.), Morpho (France), NEC Corporation (Japan), Suprema Inc (South Korea), Integrated Biometrics (U.S.), Facetec Inc. (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Healthcare biometrics refers to the application of biometric technology in healthcare settings for verifying and authenticating the identity of individuals based on their unique biological traits. These traits may include fingerprints, palm prints, iris patterns, facial recognition, voice recognition, or even behavioral characteristics like gait or typing rhythm.

Healthcare Biometrics Market Dynamics

Drivers

- Increasing Need for Patient Data Security

Rising concerns over data breaches and medical identity theft have compelled healthcare facilities to embrace biometric solutions as a cornerstone of their security strategies. Biometric technologies such as fingerprint recognition, iris scanning, and facial recognition offer unparalleled accuracy in verifying patient identities, ensuring only authorized personnel have access to sensitive health information. By implementing biometric authentication, healthcare providers can mitigate the risks associated with traditional methods like passwords or ID cards, thereby enhancing patient data security and compliance with stringent privacy regulations.

- Integration with Electronic Health Records (EHR)

The seamless integration of biometric authentication with electronic health records (EHR) systems represents a transformative leap in healthcare efficiency and patient care quality. By linking biometric identifiers with patient records, healthcare facilities streamline the identification and authentication process, reducing administrative burdens and minimizing errors associated with manual data entry. This integration enhances the accuracy and accessibility of patient information across healthcare settings, facilitating quicker diagnoses, personalized treatment plans, and improved care coordination among multidisciplinary teams. Moreover, biometric-enabled EHR systems enable secure and convenient access to medical histories and treatment protocols, empowering healthcare providers to deliver timely driving the market growth.

Opportunities

- Rise in Healthcare IT Spending

As healthcare systems worldwide undergo digital transformation, there is an increasing emphasis on enhancing patient care delivery, improving operational efficiencies, and ensuring data security. Investments in advanced IT infrastructure, including electronic health records (EHR) systems, telemedicine platforms, and patient management solutions, create a conducive environment for the adoption of biometric technologies. By integrating biometric authentication with these systems, healthcare organizations can strengthen their security protocols, streamline workflow processes, and enhance patient satisfaction through more personalized and efficient healthcare services. The rise in healthcare IT spending presents a significant growth opportunity for biometric solution providers aiming to expand their market presence.

- Technological Innovations in Biometric Technology

Advancements such as AI-driven biometrics and biometric wearables are revolutionizing how patient identities are verified and managed within healthcare settings. Biometric wearables, capable of continuous monitoring and data collection, offer real-time insights into patient health metrics, enabling proactive healthcare interventions and personalized treatment plans. For instance, Caregility introduced enhancements to its telehealth platform in June 2020, incorporating single sign-on (SSO) and multi-factor authentication (MFA) capabilities. These updates enable secure access for end users using unified credentials, providing streamlined entry to authorized applications, websites, and data sources. These technological innovations not only improve the efficiency of healthcare delivery but also contribute to better patient outcomes. Ongoing research and development in biometric technology are creating opportunities for transformative innovations tailored for specific healthcare applications.

Restraints/Challenges

- High Implementation Costs of Biometric Technology

High implementation costs remain a significant barrier to the adoption of biometric systems in healthcare, particularly impacting smaller providers with limited budgets. The initial setup expenses for acquiring biometric hardware and software, along with the costs of deployment and staff training, can strain financial resources. Moreover, ongoing maintenance expenses, including software updates, technical support, and system upgrades, add to the total cost of ownership. Despite the long-term benefits of enhanced security and operational efficiency, these upfront costs may deter some healthcare organizations from investing in biometric solutions, especially when competing priorities for healthcare spending are considered.

- Integration with Healthcare IT Infrastructure

The integration of biometric systems with existing healthcare IT infrastructure poses significant challenges due to its complexity and potential interoperability issues. Healthcare facilities often operate multiple systems and platforms, each with its own data formats, protocols, and security requirements. Integrating biometric technologies such as fingerprint or facial recognition into these heterogeneous environments requires meticulous planning, customization, and testing to ensure seamless operation and data integrity. Compatibility with legacy systems further complicates integration efforts, as older technology may not support modern biometric standards or require additional software adaptations. These complexities can delay implementation timelines and increase project costs, hindering the adoption of biometric solutions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In March 2022, BioIntelliSense introduced the BioButton Rechargeable, a medical-grade wearable device capable of continuously monitoring over 20 vital signs and physiological biometrics for up to 30 days on a single charge, depending on the configuration

- In January 2022, Mitsubishi Electric Corporation unveiled HealthCam, a facial recognition health monitoring system designed to track an individual's heart rate, blood oxygen levels, temperature, and other health indicators

Healthcare Biometrics Market Scope

The market is segmented on the basis of technology, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Fingerprint Recognition

- Face Recognition

- Palm Recognition

- Iris Recognition

- Behavioral Recognition

- Vein Recognition

- Others

Application

- Healthcare Record Security

- Patient Tracking

- Remote Patient Monitoring

- Workforce Management

- Others

End User

- Healthcare Providers

- Healthcare Organizations

- Research and Academic Institutes

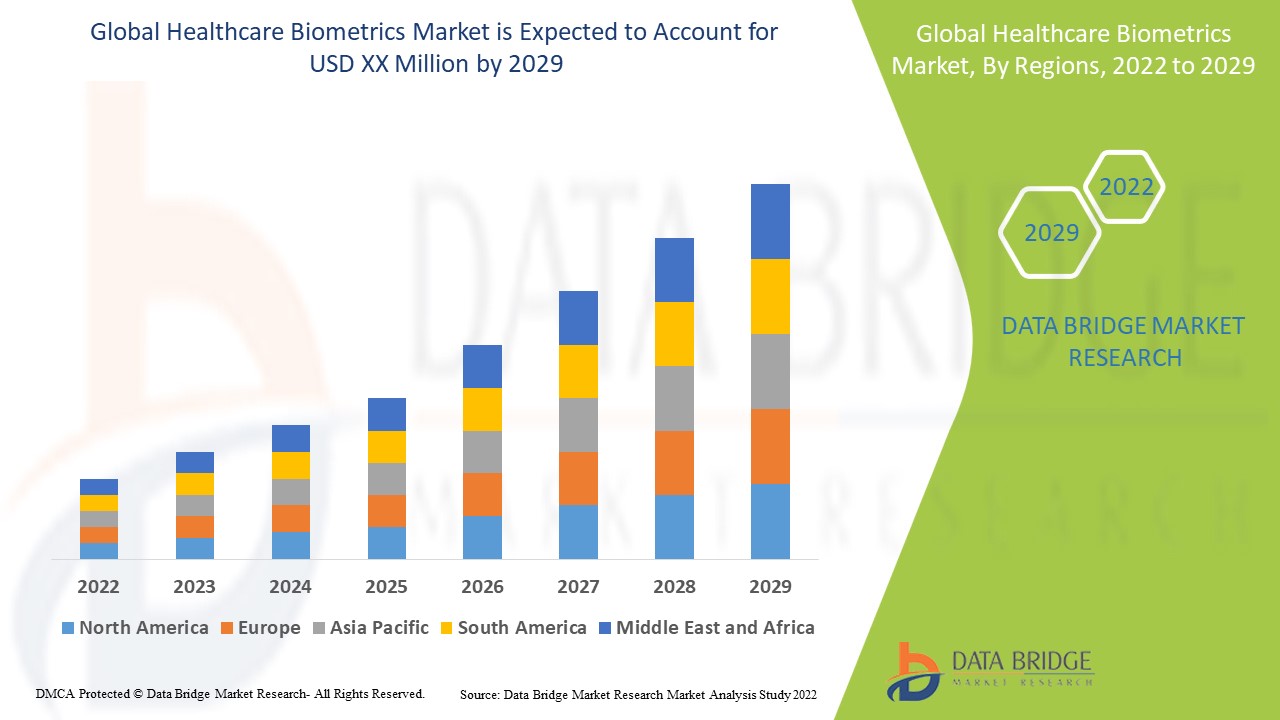

Healthcare Biometrics Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, technology, application, and end user as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market due to the presence of major key players and a higher concentration of healthcare institutions in the region. In addition, the increasing demand for biometrics is driven by the rising incidents of healthcare data breaches, further stimulating market growth in North America.

Asia-Pacific is expected to witness significant growth during the forecast period due to government initiatives aimed at enhancing healthcare infrastructure across the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Healthcare Biometrics Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- Zkteco, Inc (China)

- Thales Group (France)

- Bio-Key International Inc (U.S.)

- Crossmatch Technologies Inc (U.S.)

- Fujitsu Limited (Japan)

- Imprivata Inc (U.S.)

- Lumidigm (U.S.)

- Morpho (France)

- NEC Corporation (Japan)

- Suprema Inc (South Korea)

- Integrated Biometrics (U.S.)

- Facetec Inc. (U.S.)

SKU-