Global Headlight Market

Market Size in USD Billion

CAGR :

%

USD

7.74 Billion

USD

12.53 Billion

2024

2032

USD

7.74 Billion

USD

12.53 Billion

2024

2032

| 2025 –2032 | |

| USD 7.74 Billion | |

| USD 12.53 Billion | |

|

|

|

|

Headlight Market Size

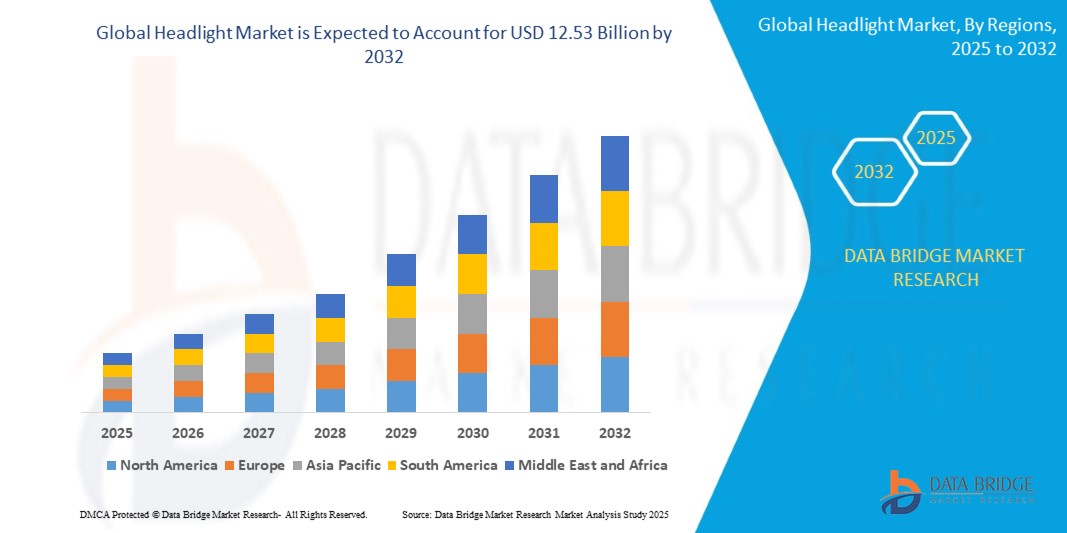

- The global headlight market size was valued at USD 7.74 billion in 2024 and is expected to reach USD 12.53 billion by 2032, at a CAGR of 6.20% during the forecast period

- This growth is driven by factors such as the increasing demand for advanced driver assistance systems (ADAS), rising automotive production, growing consumer preference for premium vehicles with enhanced lighting features, and continuous advancements in LED and laser headlight technologies

Headlight Market Analysis

- The headlight market is steadily evolving with a strong focus on advanced lighting technologies such as LED and laser, which enhance vehicle aesthetics and provide better visibility without compromising energy efficiency

- There is a clear shift towards intelligent and sustainable lighting systems, with manufacturers prioritizing eco-friendly solutions that adapt to real-time driving conditions

- North america is expected to dominate the Headlight Market market with 6.65% CAGR due to its strict automotive safety regulations and early adoption of energy-efficient technologies

- Asia-Pacific is expected to be the fastest growing region in the Headlight market during the forecast period due to surge in electric vehicle adoption and the integration of smart and connected lighting systems are key factors driving rapid market expansion

- The LED segment is expected to dominate the headlight market with the largest share of 46.9% in 2025 due to its superior energy efficiency, longer operational lifespan, compact design flexibility, and growing adoption in both passenger and commercial vehicles for enhanced visibility and safety

Report Scope and Headlight Market Segmentation

|

Attributes |

Headlight Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Headlight Market Trends

“Advancements in Adaptive Headlight Technology Systems”

- The global headlight market is witnessing a significant shift towards advanced lighting technologies, with a strong emphasis on adaptive driving beam systems that enhance nighttime visibility and reduce glare for oncoming traffic

- Manufacturers are increasingly integrating micro and mini LED modules into headlight designs, allowing for precise control over illumination patterns and contributing to improved road safety

- The adoption of matrix LED configurations in adaptive driving beam headlights is becoming more prevalent, offering drivers a broader field of view and quicker response times to obstacles

- Automotive lighting companies are focusing on developing high-resolution pixel arrays within headlights, enabling dynamic adjustments to lighting based on real-time driving conditions

- For instance, some modern vehicles now feature headlights capable of projecting safety warnings and images onto the road surface, providing drivers with additional information to navigate safely

- In conclusion, the growing focus on adaptive driving beam technology reflects a broader trend toward smarter, safer automotive lighting

Headlight Market Dynamics

Driver

“Rising Demand for Vehicle Safety and Visibility”

- The growing focus on road safety among consumers and regulators is pushing automakers to prioritize headlights as essential safety components rather than just aesthetic features

- Advanced systems such as adaptive driving beam and automatic headlights are gaining popularity for their ability to adjust brightness and direction based on driving conditions and surroundings

- Consumer preference is shifting toward premium lighting technologies even in mid-range vehicles, as awareness rises about the risks of poor visibility during night driving or in bad weather

- For instance, Audi’s Matrix LED headlights dynamically adjust beams to avoid dazzling oncoming traffic while still providing full illumination of the road ahead

- In conclusion, the regulatory bodies are supporting this trend by enforcing stricter safety norms that encourage the adoption of smarter headlight systems in new models

- In conclusion, the market is steadily moving toward intelligent lighting solutions with enhanced safety features

Opportunity

“Integration of Smart and Connected Lighting Systems”

- The integration of smart and connected headlights in vehicles is creating new opportunities by transforming lighting into an intelligent system that interacts with both the vehicle and its environment

- These systems are equipped with sensors and software that allow headlights to adjust beam patterns automatically based on traffic, speed, and road conditions for improved safety and comfort

- Automakers are leveraging data from cameras, radar, and navigation tools to power adaptive headlights that can respond in real time to potential hazards and road layouts

- For instance, Mercedes-Benz has introduced Digital Light technology that enables headlights to project warning symbols such as pedestrian alerts or lane departure signals directly onto the road

- As electric and self-driving vehicles grow in popularity, smart headlights are playing a more critical role in enhancing vehicle communication and environmental awareness

- In conclusion, smart lighting systems are becoming a central element in the shift toward connected and autonomous mobility

Restraint/Challenge

“High Cost of Advanced Lighting Technologies”

- The high cost of advanced lighting technologies such as matrix LED and laser systems remains a major barrier, making them less accessible for mid-range or budget vehicle segments

- These systems require sophisticated components and software, which raise manufacturing and integration expenses, often limiting them to premium or luxury vehicle models

- For instance, BMW’s Laserlight technology offers superior range and precision but is available mostly in high-end variants due to its premium pricing and production requirements

- Maintenance and repair costs for advanced headlights are also considerably higher, which discourages many consumers from choosing or upgrading to such systems

- Smaller service providers and workshops often lack the expertise or equipment to handle complex headlight repairs, adding to the post-purchase challenges faced by owners

- In conclusion, while these technologies offer long-term value, their high upfront and maintenance costs slow down mainstream adoption

Headlight Market Scope

The market is segmented on the basis of technology, vehicle type, propulsion type, and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Vehicle Type |

|

|

By Propulsion Type |

|

|

By Sales Channel

|

|

In 2025, the LED segment is projected to dominate the market with a largest share in technology segment

The LED segment is expected to dominate the Headlight market with the largest share of 46.9% in 2025 due to its superior energy efficiency, longer operational lifespan, compact design flexibility, and growing adoption in both passenger and commercial vehicles for enhanced visibility and safety. LED headlights offer significantly higher energy efficiency compared to traditional halogen or xenon lights, reducing overall vehicle power consumption—an especially important factor in electric and hybrid vehicles. Their extended operational lifespan not only minimizes maintenance needs but also enhances long-term cost-effectiveness for both consumers and fleet operators.

The xenon segment is expected to account for the largest share during the forecast period in technology segment segment

In 2025, the xenon segment is expected to dominate the market with the largest market due to its high-intensity illumination, better road visibility in low-light conditions, and increasing use in premium and luxury vehicles for enhanced driving experience. Its widespread use in premium and luxury vehicles enhances the overall driving experience, making it a preferred choice among automakers aiming for performance and style.

Headlight Market Regional Analysis

“North America Holds the Largest Share in the Headlight Market”

- North America leads the headlight market with 6.65% CAGR due to strong automotive production capabilities with companies like General Motors and Ford adopting advanced lighting technologies in their latest vehicle models

- Regulatory requirements such as FMVSS in the US push automakers to implement high-quality and energy-efficient headlights ensuring road safety compliance

- Increased consumer demand for high-performance vehicles including pickup trucks and luxury SUVs in markets like the US and Canada drives the adoption of LED and adaptive headlights

- Leading manufacturers like Tesla and Jeep integrate cutting-edge headlight systems including matrix LED and laser lighting for enhanced driving experience and safety

- The presence of top-tier technology providers such as Hella and Lumileds in the region accelerates the pace of headlight innovation and implementation

“Asia-Pacific is Projected to Register the Highest CAGR in the Headlight Market”

- Asia-Pacific is not only the dominant region but also the fastest-growing in the global headlight market, with significant growth observed in emerging economies

- The surge in electric vehicle adoption and the integration of smart and connected lighting systems are key factors driving rapid market expansion

- Rising consumer awareness about vehicle safety and the benefits of advanced lighting technologies are accelerating demand

- Investments in infrastructure and favorable regulatory policies are creating a conducive environment for market growth

- The combination of these factors positions Asia-Pacific as the fastest-growing region in the global headlight market

Headlight Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Spyder (U.S.)

- Hella (Germany)

- Philips (Netherlands)

- Anzo (U.S.)

- Oracle (U.S.)

- Sylvania (U.S.)

- GMC (U.S.)

- KC HiLiTES (U.S.)

- Spec-D (U.S.)

- CG (China)

- Eyourlife (China)

- Car Rover (China)

- Rampage (U.S.)

- JDM ASTAR (U.S.)

- Xtralights (U.S.)

- Koito Manufacturing Co., Ltd. (Japan)

- Valeo SA (France)

- ZKW Group (Austria)

- Magna International Inc. (Canada)

- Hyundai Mobis (South Korea)

Latest Developments in Global Headlight Market

- In June 2024, Melexis launched MLX81123 IC to extend its LIN RGB family, offering a smaller SOIC8 and DFN-8 3mm x 3mm package. The miniaturization of the LED driver enables ambient lighting in more locations within the vehicle, overcoming previous space constraints

- In January 2024, OLEDWorks launched a new brand, Atala, in the automotive lighting industry. Atala aims to provide a more tailored experience for the unique relationship required when designing OLED lighting for automotive applications and provide cutting-edge OLED lighting solutions that meet the automotive industry's stringent requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Headlight Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Headlight Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Headlight Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.