Global Glucose Monitoring Devices Market, By Product Type (Self-Monitoring Blood Glucose Devices, Continuous Glucose Monitoring Devices), Distribution Channel (Retail, Online), End User (Hospital, Clinics, Diagnostic Centers, Home Healthcare, Others) – Industry Trends and Forecast to 2030.

Glucose Monitoring Devices Market Analysis and Size

Diabetes is a growing problem worldwide. Awareness associated with the benefits of blood glucose monitoring devices increased among consumers in the recent years due to the increasing prevalence of diabetes. During the pandemic, there had been a huge trend of virtual clinics and telemedicine for different diseases which includes diabetic management as well. The hospital segment held the largest share in the end-user segment of the global glucose monitoring devices market as several patients are admitted due to the severe diabetes issues and other associated concomitant diseases.

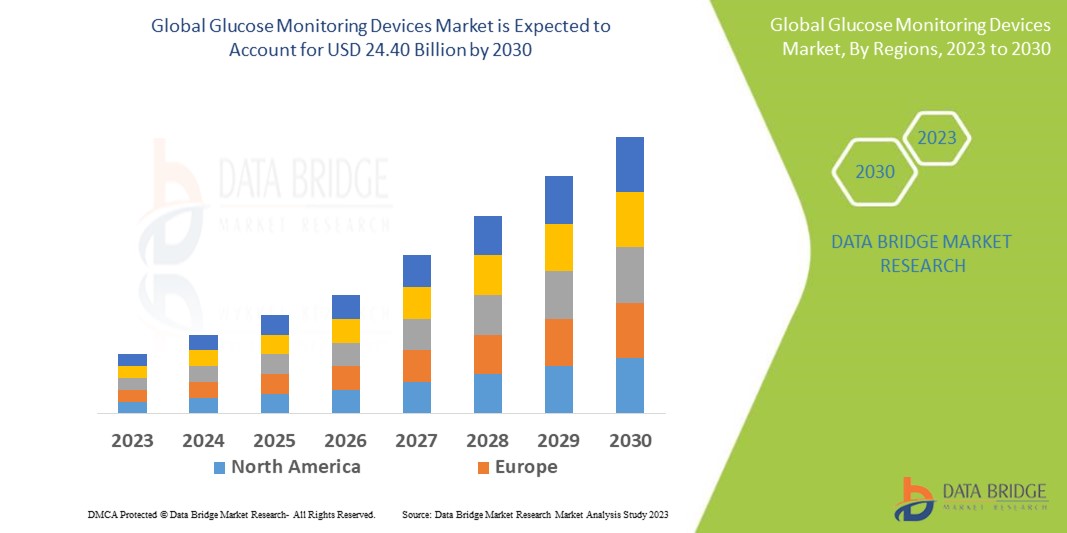

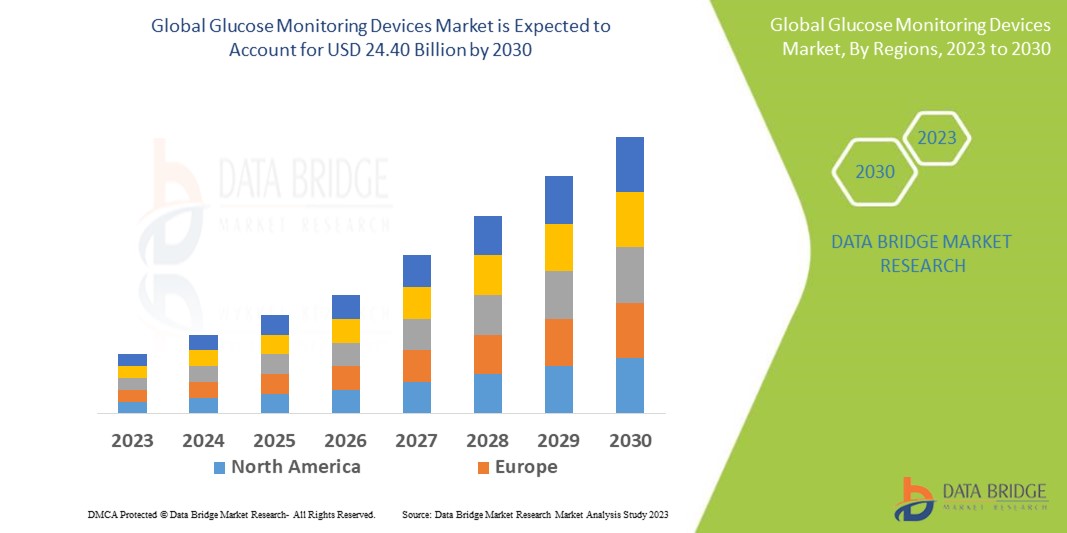

Data Bridge Market Research analyses that the global glucose monitoring devices market, which was USD 12.7 billion in 2022, would rise to USD 24.40 billion by 2030 and is expected to undergo a CAGR of 8.5% during the forecast period from 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Glucose Monitoring Devices Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product Type (Self-Monitoring Blood Glucose Devices, Continuous Glucose Monitoring Devices), Distribution Channel (Retail, Online), End User (Hospital, Clinics, Diagnostic Centers, Home Healthcare, Others)

|

|

Countries Covered

|

U.S., Canada, and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

DiaMonTech AG (Germany), Abbott (U.S.), GlySens Incorporated (U.S.)., Novo Nordisk A/S (Denmark), Nemaura (U.S.), PHC Holdings Corporation (Japan), TaiDoc Technology Corporation (Taiwan), AgaMatrix (U.S.), Dexcom, Inc.(U.S.)., ACON Laboratories, Inc.(U.S.)., Ascensia Diabetes Care Holdings AG (Switzerland), Bayer AG (Germany), and F. Hoffmann-La Roche Ltd (Switzerland), Insulet Corporation (U.S.), Ypsomed AG (Switzerland), GlySens Incorporated (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Glucose monitoring devices are used to detect the sugar level in the blood and are of numerous types, such as glucose meters, testing strips, and lancets. These devices provide the facility of self-testing by using a single glucose meter and different strips. These devices allow patients and clinicians to identify high or low blood glucose levels. It also allows for therapy modifications and protecting patients by promptly confirming acute hypoglycemia or hyperglycemia and offering patients greater self-care.

Global Glucose Monitoring Devices Market Dynamics

Drivers

- Increasing Prevalence of Diabetes

The growing prevalence of diabetes is likely to contribute to this market's growth during the forecast period 2023-2030. According to the International Diabetes Federation Report for 2017, about 66.0 million people worldwide had diabetes, which is expected to rise to 81.0 million by 2045. In North America, it has been observed that there are more than 29 million diabetic patients, and this number is expected to increase to 34 million by 2027. This increasing prevalence leads to the higher adoption of glucose monitoring devices.

- Growth in Obesity Rates

Obesity is one of the leading causes of diabetes in the general population. As per the records of WHO, about 50% of the global population was overweight in 2014, with more than 20% of the population obese. Obesity is more incident in men. Several risk factors, such as the increasing occurrence of obesity, are directly related to the increasing incidence of diabetes. Therefore, the number of glucose monitoring devices is also increasing. Thus, this factor boosts market growth.

Opportunities

- Increasing Strategic Developments by Market Players

Increasing strategic developments, such as collaborations, lead to market growth. For instance, Roche collaborated with Eli Lilly and Company to work towards enhancing the management of insulin pen therapy in 2021. With this collaboration, Roche followed its aim to create an open ecosystem that includes its solutions, partner devices, and services across the continuum of care in diabetes. Thus, this factor boosts market growth.

- Growing Rate of Product Launches

There is a higher rate of product launches that leads to market growth. For instance, Roche announced the launch of the new Accu-Chek Instant system in 2021. This is a new "connected" blood glucose monitoring (BGM) system, which supports and allows Roche's approach of integrated personalized diabetes management (iPDM). It also features Bluetooth-enabled connectivity to the mySugr app, enabling the wireless transfer of blood glucose results to the mySugr app. Thus, this factor boosts market growth.

Restraints/Challenges

- High-Cost Nature and Complications for Monitoring Devices

The glucose monitoring device is costly and can be painful. Many a time, the results of diabetes care devices are not always accurate. In addition, many of the hospitals and healthcare centers do not cover diabetes by insurance. Insurance coverage or qualifications for coverage is a rising issue. Thus, this factor impedes the market growth. There are several complications associated with glucose monitoring devices that hinder the market. Effects such as disruptive alerts lost signals, leading to data gaps, skin irritation, and adhesive issues generated by glucose monitoring devices that were difficult to interpret all altogether led to market hindrance. Thus, this factor impedes market growth.

This glucose monitoring devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the glucose monitoring devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2022, DexCom announced the launch of a CE Mark for its G7 CGM system in Europe, intended for people who have diabetes and are two years and older, which includes pregnant women. With this approval, the world's popular and best-selling real-time CGM is now more powerful and easier to use with a small, all-in-one wearable and completely redesigned mobile app.

Global Glucose Monitoring Devices Market Scope

The glucose monitoring devices market is segmented on the basis of product type, distribution channel, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Self-Monitoring Blood Glucose Devices

- Glucose strips

- Glucose meter

- Lancets

- Continuous Glucose Monitoring Devices

Distribution Channel

- Retail

- Specialty Stores

- Drug Stores/Pharmacies

- Online

End User

- Hospital

- Clinics

- Diagnostic Centers

- Home Healthcare

- Others

Glucose Monitoring Devices Market Regional Analysis/Insights

The glucose monitoring devices market is analyzed and market size insights and trends are provided by product type, distribution channel and end user as referenced above.

The countries covered in the glucose monitoring devices market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to grow the glucose monitoring devices market during the forecast period due to the growing demand for minimally invasive surgeries and huge growth in the advanced healthcare infrastructure. Also, growing research activities on endoscopic cameras, mainly in Japan within this region, boost the market growth.

North America dominates the market in the forecast to the effectual reimbursement policies and rises in the awareness of diabetes. Also, the region's well-developed healthcare infrastructure and favourable reimbursement policies lead to market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The glucose monitoring devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for glucose monitoring devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the glucose monitoring devices market. The data is available for historic period 2011-2021.

Competitive Landscape and Glucose Monitoring Devices Market Share Analysis

The glucose monitoring devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to glucose monitoring devices market.

Some of the major players operating in the glucose monitoring devices market are:

- DiaMonTech AG (Germany)

- Abbott (U.S.)

- GlySens Incorporated (U.S.)

- Novo Nordisk A/S (Denmark)

- Nemaura (U.S.)

- PHC Holdings Corporation (Japan)

- TaiDoc Technology Corporation (Taiwan)

- AgaMatrix (U.S.)

- Dexcom, Inc. (U.S.).

- ACON Laboratories, Inc.(U.S.).

- Ascensia Diabetes Care Holdings AG (Switzerland)

- Bayer AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Insulet Corporation (U.S.)

- Ypsomed AG (Switzerland)

- GlySens Incorporated (U.S.)

SKU-