Global Flow Sensor Market

Market Size in USD Billion

CAGR :

%

USD

4.29 Billion

USD

6.46 Billion

2024

2032

USD

4.29 Billion

USD

6.46 Billion

2024

2032

| 2025 –2032 | |

| USD 4.29 Billion | |

| USD 6.46 Billion | |

|

|

|

|

Flow Sensor Market Size

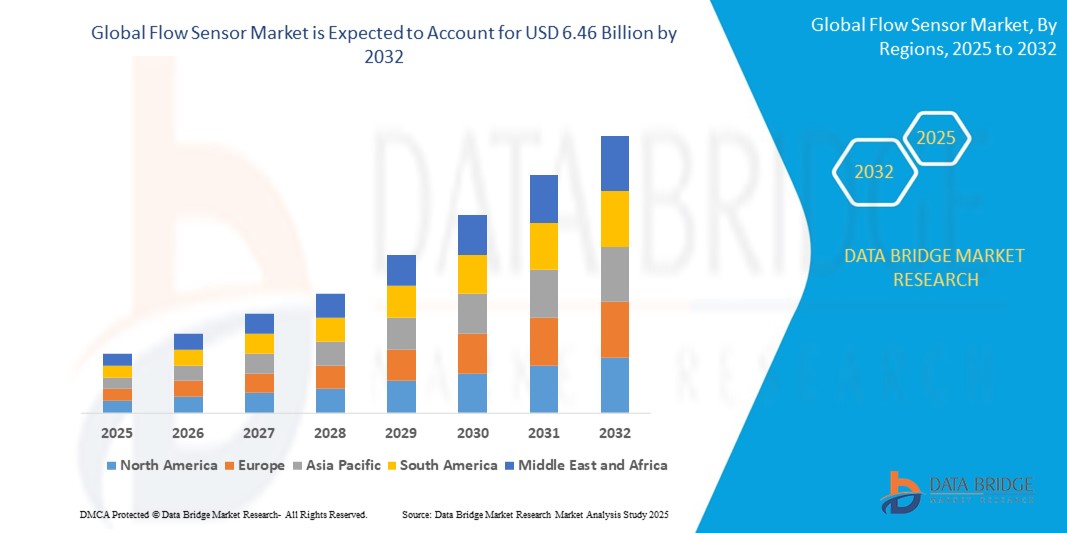

- The global Flow Sensor market size was valued at USD 4.29 billion in 2024 and is expected to reach USD 6.46 billion by 2032, at a CAGR of 5.24% during the forecast period

- This growth is driven by the increasing adoption of flow sensors across industries such as oil and gas, water management, and HVAC, fueled by the demand for efficient resource management, industrial automation, and environmental monitoring.

- The integration of IoT and wireless technologies in flow sensors, along with advancements in sensor miniaturization and accuracy, is further propelling market expansion, particularly in smart cities and industrial automation applications.

Flow Sensor Market Analysis

- Flow sensors are sophisticated devices designed to measure the flow rate of liquids or gases in pipelines, ducts, or open channels, converting these measurements into electrical signals for real-time monitoring, process control, and data analysis. These sensors play a pivotal role in industries such as oil and gas, water and wastewater, chemical manufacturing, and power generation, ensuring operational efficiency, safety, and compliance with environmental and regulatory standards.

- The escalating demand for flow sensors is driven by their ability to provide highly accurate and reliable flow measurements in complex industrial systems, supported by advanced technologies such as ultrasonic, electromagnetic, and Coriolis flow sensors. The global push for automation, driven by Industry 4.0, coupled with stringent environmental regulations aimed at reducing emissions and optimizing resource usage, is significantly boosting the adoption of flow sensors worldwide.

- North America dominated the global flow sensor market with a commanding revenue share of 34.5% in 2024, driven by its advanced industrial infrastructure, significant investments in research and development, and high adoption rates in critical sectors like oil and gas, chemical processing, and power generation. The United States, in particular, has emerged as a leader due to its robust manufacturing ecosystem and supportive government initiatives promoting renewable energy and smart manufacturing.

- The Asia-Pacific region is anticipated to experience the fastest growth rate, with a projected CAGR of 6.1% from 2025 to 2032, propelled by rapid industrialization, urbanization, and government-led initiatives to address environmental challenges in countries such as China, India, and Japan. The region’s focus on smart cities and sustainable infrastructure is further driving demand for flow sensors in water management and energy applications.

- Among product types, the differential pressure flow sensor segment held the largest market share of 25.2% in 2024, valued at USD 0.69 billion, attributed to its widespread use in measuring flow rates in complex systems like oil and gas pipelines and HVAC applications due to its reliability, cost-effectiveness, and compatibility with various fluids.

Report Scope and Flow Sensor Market Segmentation

|

Attributes |

Flow Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flow Sensor Market Trends

“Advancements in IoT and Sensor Miniaturization”

- A prominent and transformative trend in the global flow sensor market is the integration of Internet of Things (IoT) and wireless technologies, which enable real-time data monitoring, predictive maintenance, and remote accessibility. This is particularly impactful in smart factories, water management systems, and energy-efficient HVAC applications, where flow sensors provide critical data for process optimization.

- For instance, in March 2024, Badger Meter Inc. launched the SoloCUE Flow Device Manager app, a Bluetooth-enabled solution that allows operators to commission, configure, and troubleshoot flow meters remotely, significantly enhancing operational efficiency and reducing downtime in industrial settings.

- The miniaturization of flow sensors, driven by advancements in Micro-Electro-Mechanical Systems (MEMS) technology, is expanding their adoption in compact and space-constrained applications such as medical devices (e.g., ventilators and infusion pumps) and automotive fuel injection systems, with efficiency improvements projected to reach 15-20% by 2032.

- The adoption of smart flow sensors equipped with artificial intelligence (AI)-based analytics is revolutionizing industries by enabling precise control over fluid dynamics, reducing resource wastage, and improving energy efficiency in critical sectors like HVAC, power generation, and chemical processing. These smart sensors analyze flow patterns in real time, providing actionable insights for predictive maintenance and system optimization.

Flow Sensor Market Dynamics

Driver

“Rising Demand for Industrial Automation, Environmental Compliance, and Smart Infrastructure”

- The surge in industrial automation, propelled by the global adoption of Industry 4.0 principles and smart manufacturing initiatives, is a significant driver for the flow sensor market. Precise flow measurement is critical for optimizing processes in industries such as oil and gas, chemical manufacturing, and food and beverage production, where even minor inefficiencies can lead to substantial losses. The global industrial automation market, valued at USD 58 billion in 2022, is projected to reach USD 96 billion by 2030, significantly boosting demand for advanced flow sensors.

- Stringent environmental regulations, such as India’s National Clean Air Programme and the European Union’s environmental standards, are increasing the adoption of flow sensors for monitoring emissions, wastewater flow, and energy consumption in power plants, water treatment facilities, and industrial processes, ensuring compliance with sustainability mandates.

- The growing need for real-time data in smart water management systems, valued at USD 16.3 billion in 2022 and projected to reach USD 53.6 billion by 2031, is driving demand for flow sensors in smart cities, agricultural irrigation, and municipal water distribution systems, enabling efficient resource allocation and leakage detection.

- Increasing adoption of smart HVAC systems, which rely on flow sensors to optimize air and water flow, is enhancing energy efficiency in commercial and residential buildings, driven by global initiatives to reduce carbon footprints and improve building sustainability standards.

Restraint/Challenge

“High Costs, Supply Chain Disruptions, and Technical Complexities”

- The high implementation and maintenance costs associated with advanced flow sensors, particularly those incorporating IoT, AI, and wireless technologies, pose significant challenges to widespread adoption, especially for small and medium enterprises (SMEs) operating in cost-sensitive markets. These costs include not only the initial purchase but also ongoing expenses for calibration, software updates, and system integration.

- Supply chain disruptions, exacerbated by global events such as the COVID-19 pandemic, have led to shortages of critical raw materials like semiconductors and specialized alloys, resulting in reduced production rates and delayed deliveries, which have negatively impacted market growth. For instance, the pandemic caused a temporary decline in flow sensor demand due to restricted industrial activities and supply chain bottlenecks.

- The complexity of integrating advanced flow sensors with legacy industrial systems, coupled with the need for skilled professionals to manage IoT-enabled devices and interpret complex data outputs, creates significant barriers, particularly in emerging markets with limited technical expertise and training infrastructure.

- Stringent calibration requirements, as flow sensors require regular and precise calibration to maintain accuracy in demanding applications like oil and gas or pharmaceutical manufacturing, increase operational costs and complexity, often requiring specialized equipment and trained personnel, which can deter adoption in smaller organizations.

Flow Sensor Market Scope

The global flow sensor market is segmented on the basis of product type, component, application, technology, and end-user.

- By Product Type

On the basis of product type, the flow sensor market is segmented into differential pressure flow sensors, positive displacement flow sensors, mass flow sensors, open channel flow sensors, velocity flow sensors, and others. The differential pressure flow sensor segment dominated the market with a commanding revenue share of 25.2% in 2024, valued at USD 0.69 billion, driven by its reliability, cost-effectiveness, and versatility in measuring flow rates in complex systems such as oil and gas pipelines, HVAC systems, and chemical processing plants.

The mass flow sensor segment is anticipated to witness the fastest CAGR of 6.8% from 2025 to 2032, fueled by its high precision in applications requiring accurate measurement of gas and liquid flows, such as in chemical processing, power generation, and pharmaceutical manufacturing.

- By Component

On the basis of component, the flow sensor market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share of 60.3% in 2024, driven by the widespread deployment of physical flow sensors in industrial applications, including oil and gas, water management, and manufacturing.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the growing demand for IoT-enabled analytics platforms and real-time monitoring software that enhance the functionality of flow sensors by providing actionable insights and predictive maintenance capabilities.

- By Application

On the basis of application, the flow sensor market is segmented into oil and gas, water and wastewater, chemical and pharmaceutical, food and beverage, power generation, HVAC and energy, automotive, and others. The oil and gas segment accounted for the largest market revenue share of 28.6% in 2024, driven by the critical need for precise flow measurement in upstream, midstream, and downstream operations, including pipeline monitoring and refining processes.

The water and wastewater segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing investments in smart water management systems, leak detection technologies, and municipal water distribution networks in response to global water scarcity challenges.

- By Technology

On the basis of technology, the flow sensor market is segmented into Coriolis, ultrasonic, electromagnetic, thermal, mechanical, and others. The ultrasonic segment held the largest market share in 2024, driven by its non-invasive measurement capabilities, high accuracy, and widespread adoption in water management, power generation, and chemical processing applications. The Coriolis segment is expected to witness the fastest CAGR from 2025 to 2032, attributed to its superior precision in mass flow measurement for high-value applications in the chemical, oil and gas, and pharmaceutical industries, where even minor discrepancies can lead to significant operational losses.

- By End-User

On the basis of end-user, the flow sensor market is segmented into industrial, commercial, and residential. The industrial segment dominated the market with a significant revenue share of 61.4% in 2024, driven by the high demand for flow sensors in manufacturing, energy, and chemical processing sectors, where precise flow measurement is critical for operational efficiency and safety.

The residential segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by the increasing adoption of flow sensors in smart home water management systems, such as smart meters and leak detection devices, driven by consumer awareness of water conservation and sustainability.

Flow Sensor Market Regional Analysis

North America

North America dominated the global flow sensor market with a revenue share of 34.5% in 2024, driven by its advanced industrial infrastructure, stringent environmental regulations, and high adoption rates in key industries such as oil and gas, chemical processing, and power generation. The region’s robust manufacturing ecosystem, coupled with significant investments in renewable energy and smart manufacturing, supports the widespread deployment of flow sensors. The oil and gas segment accounted for the largest application share of 30.1% in 2024, driven by the need for precise flow measurement in exploration, production, and refining processes. The water and wastewater segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing investments in smart water management and environmental monitoring initiatives across the region.

U.S. Flow Sensor Market Insight

The United States captured the largest revenue share of 85.6% within North America in 2024, driven by its leadership in industrial automation, renewable energy, and smart infrastructure development. The U.S. benefits from a robust manufacturing base, significant government funding for renewable energy projects, and the presence of leading flow sensor manufacturers like Emerson Electric Co. and Honeywell International Inc. The U.S. Department of Energy projects the hydropower industry to grow from 101 GW to 150 GW by 2050, significantly boosting demand for flow sensors in energy applications. The growing adoption of IoT-enabled flow sensors for real-time monitoring and predictive maintenance in industries like oil and gas, chemical processing, and HVAC further propels market growth in the U.S.

Europe Flow Sensor Market Insight

The Europe flow sensor market, driven by stringent environmental regulations, increasing adoption in automotive and chemical industries, and the region’s focus on sustainable infrastructure development. Countries like Germany, the United Kingdom, and France are key contributors, with growth fueled by automation, smart city initiatives, and the need for precise flow measurement in energy-efficient systems. The automotive sector is increasingly adopting flow sensors for fuel efficiency and emissions monitoring, while the water and wastewater segment benefits from regulatory mandates to reduce water wastage and improve treatment processes.

U.K. Flow Sensor Market Insight

The United Kingdom flow sensor market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by its strong automotive, manufacturing, and HVAC sectors, as well as increasing investments in smart water management systems. The U.K.’s commitment to reducing carbon emissions, supported by initiatives like the Net Zero Strategy, is driving demand for flow sensors in power generation and environmental monitoring applications. The integration of IoT and AI technologies in flow sensors is enhancing their adoption in smart factories and municipal water systems, where real-time data is critical for operational efficiency and regulatory compliance.

Germany Flow Sensor Market Insight

The Germany flow sensor market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s leadership in industrial automation, chemical manufacturing, and precision engineering. Germany’s focus on Industry 4.0 and smart manufacturing is driving the adoption of advanced flow sensors in applications like chemical processing and automotive production. The integration of ultrasonic and Coriolis flow sensors, known for their high accuracy and reliability, is becoming increasingly prevalent, aligning with Germany’s emphasis on sustainable and efficient industrial processes. The country’s strong regulatory framework for environmental protection further supports market growth.

Asia-Pacific Flow Sensor Market Insight

The Asia-Pacific flow sensor market is poised to grow at the fastest CAGR of approximately 6.0% during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and government-led initiatives to address environmental challenges in countries such as China, India, and Japan. The region’s market, valued at USD 1.5 billion in 2024, is expected to reach USD 2.35 billion by 2032, propelled by the growing adoption of flow sensors in smart cities, water management systems, and industrial automation. Government initiatives like India’s Smart Cities Mission and China’s 14th Five-Year Plan are driving investments in smart water and energy infrastructure, boosting demand for advanced flow sensors.

Japan Flow Sensor Market Insight

The Japan flow sensor market is gaining momentum due to the country’s advanced manufacturing and automotive sectors, coupled with a strong focus on environmental monitoring and smart infrastructure development. The integration of IoT and AI technologies in flow sensors is enhancing their adoption in smart factories, water management systems, and energy-efficient applications. Japan’s Act Promoting Measures to Address Global Warming is driving demand for flow sensors in emissions monitoring and renewable energy projects, such as solar and hydropower systems. The presence of leading manufacturers like Yokogawa Electric Corporation and Azbil Corporation further supports market growth.

China Flow Sensor Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its rapid industrial expansion, thriving chemical and electronics sectors, and government initiatives to reduce pollution and improve resource efficiency. The adoption of smart flow sensors in manufacturing, water management, and energy applications is fueled by China’s focus on sustainable development and smart city projects. The country’s 14th Five-Year Plan emphasizes environmental protection and industrial automation, driving demand for advanced flow sensors in wastewater treatment, power generation, and chemical processing. Domestic manufacturers and government support further propel market growth.

Flow Sensor Market Share

- The Flow Sensor industry is primarily led by well-established companies, including:

- Siemens AG (Germany)

- Emerson Electric Co. (United States)

- Honeywell International Inc. (United States)

- Badger Meter Inc. (United States)

- Yokogawa Electric Corporation (Japan)

- Endress+Hauser Management AG (Switzerland)

- Krohne Messtechnik GmbH (Germany)

- ABB Ltd. (Switzerland)

- Azbil Corporation (Japan)

- First Sensor AG (Germany)

- OMEGA Engineering (United States)

- Schneider Electric (France)

- Keyence Corporation (Japan)

- Hach Company (United States)

- Bopp & Reuther Messtechnik GmbH (Germany)

- Faure Herman (France)

Latest Developments in Global Flow Sensor Market

- In March 2024, Badger Meter Inc. launched the SoloCUE Flow Device Manager app, a Bluetooth-enabled solution that allows operators to commission, configure, and troubleshoot flow meters remotely, improving operational efficiency in water management and industrial applications.

- In March 2024, Emerson Electric Co. introduced the Rosemount 9195 Wedge Flow Meter, a robust solution combining a wedge sensor and pressure transmitter for accurate flow measurement in heavy industry applications like oil and gas and chemical processing.

- In January 2023, Endress+Hauser Management AG launched five new liquid analytical sensors (CPL59E, CPL57E, CPL53E, COL37E, CLL47E), designed for enhanced flow measurement in laboratory and industrial settings, improving accuracy and reliability.

- In March 2023, ATO Flow Meter introduced a new magnetic flow meter tailored for liquid, gas, and steam applications across industries like oil and gas, water management, and chemical processing, offering improved durability and precision.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flow Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flow Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flow Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.