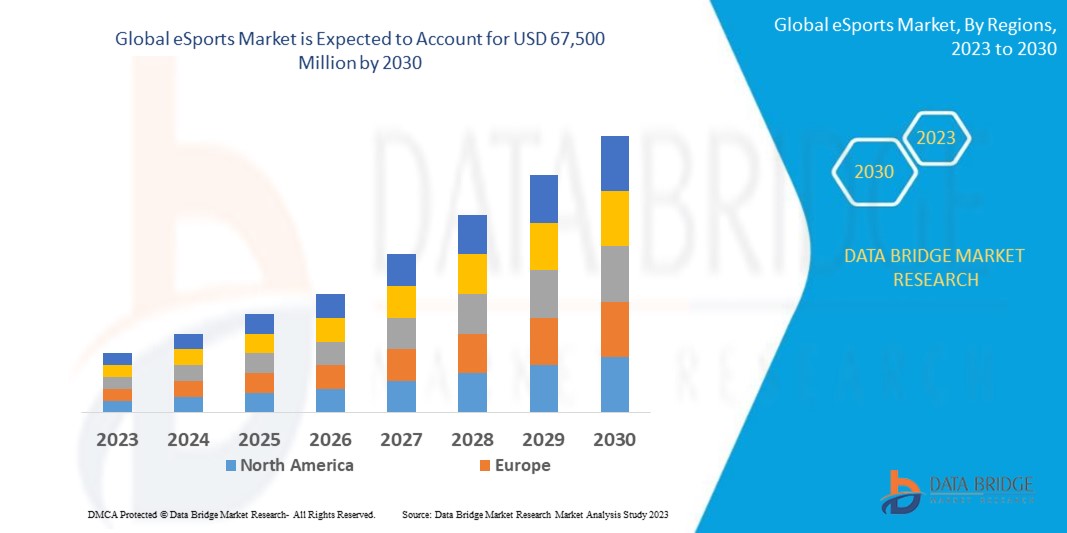

Global Esports Market

Market Size in USD Million

CAGR :

%

USD

11,450.00 Million

USD

67,500.00 Million

2022

2030

USD

11,450.00 Million

USD

67,500.00 Million

2022

2030

| 2023 –2030 | |

| USD 11,450.00 Million | |

| USD 67,500.00 Million | |

|

|

|

|

eSports Market Analysis and Size

The global esports market continues to surge, driven by a confluence of factors. One of the primary drivers is the increasing accessibility of high-speed internet and the proliferation of smartphones and gaming devices, which have democratized gaming participation worldwide. Additionally, the rise of streaming platforms like Twitch and YouTube gaming has facilitated the widespread dissemination of esports content, fostering a vibrant community and attracting a diverse audience. However, amidst this growth, challenges such as regulatory hurdles and concerns over player health and well-being have emerged.

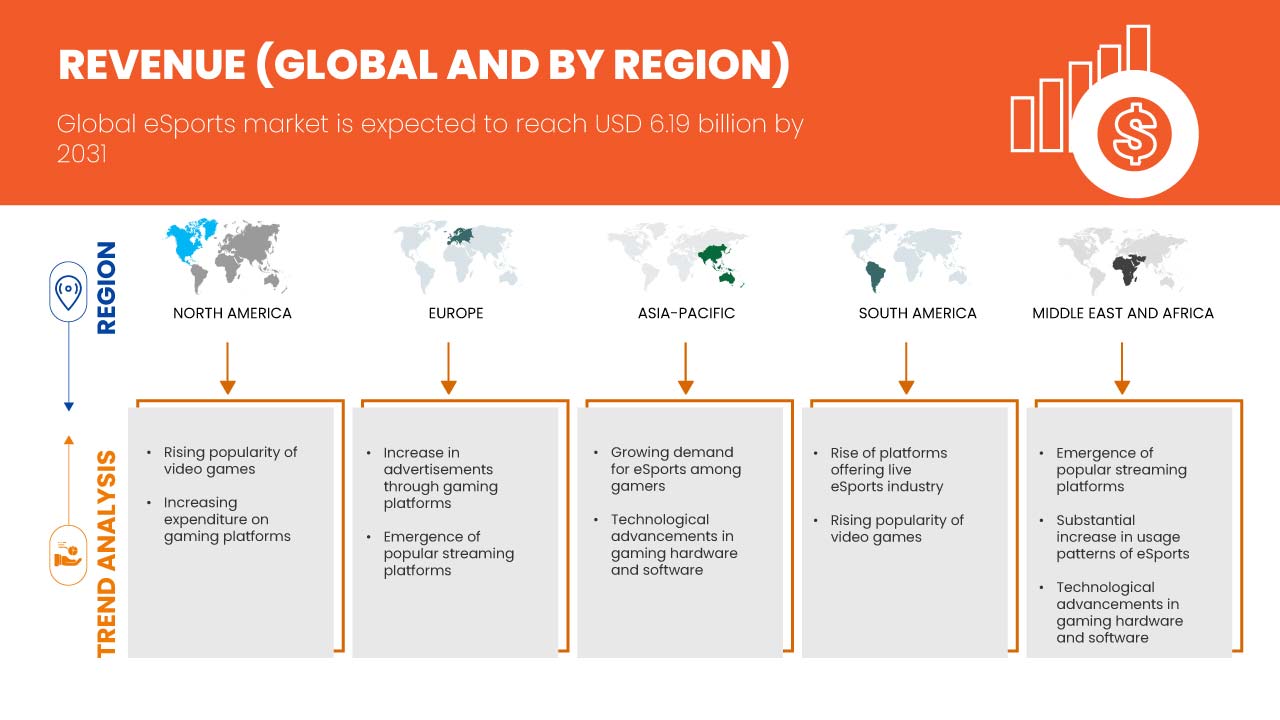

Data Bridge Market Research analyzes that the global eSports market is expected reach USD 6.19 billion by 2031 from USD 1.58 billion in 2023, growing with CAGR of 18.8% during forecast period of 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Revenue Streams (Sponsorships and Direct Advertisements, Media Rights, Publisher Fees, Tickets and Merchandise, Digital, and Streaming), Games (First/Third Person Shooters (FPS/TPS), Multiplayer Online Battle Arena (MOBA), Real Time Strategy (RTS), Fighting Games, Sports Simulations, Player Vs. Player (PvP), and Others), E-Platform (Mobile and Tablets, Consoles-Based eSports, PC-based eSports) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, Italy, U.K., Netherlands, Belgium, Spain, Switzerland, Russia, Turkey, Rest of Europe, China, Japan, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Saudi Arabia, South Africa, U.A.E., Egypt, Israel, and Rest of Middle East And Africa |

|

Market Players Covered |

FaZe Holdings Inc., X1 Entertainment Group, ESL FACEIT GROUP, CLOUD9, Activision Blizzard, Gfinity, NODWINGAMING, G ESports Holding GmbH., Team Liquid, Challonge, LLC, Battlefy, Inc., Play Versus, Inc., OPTIC GAMING, ESports Battle, and ESports Tower LLC. among others |

Market Definition

eSports, short for electronic sports, refers to competitive video gaming organized in a professional or semi-professional setting. Players or teams compete against each other in various video games, often in multiplayer formats, with tournaments and leagues organized on local, national, and international levels. eSports has gained significant popularity in recent years, with professional players, teams, and organizations competing for prize money, sponsorships, and recognition. Games commonly played in eSports include popular titles like League of Legends, Counter-Strike: Global Offensive, Dota 2, Overwatch, and many others across a range of genres such as first-person shooters, real-time strategy, and multiplayer online battle arena (MOBA) games.

Global eSports Market Dynamics

Drivers

- Rising Popularity of Video Games

The rising popularity of video games serves as a significant driver for the global eSports market, fueling its rapid growth and expanding its reach to new audiences worldwide. As video games continue to evolve and attract a diverse range of players, the potential for competitive gaming as a form of entertainment has surged. With advancements in technology, particularly in internet connectivity and gaming platforms, players can easily connect and compete with others from around the globe. The rising popularity of video games not only attracts new participants and spectators to eSports events but also cultivates a vibrant ecosystem of content creators, influencers, and community engagement platforms. Consequently, eSports benefits from this symbiotic relationship with the broader gaming industry, experiencing a surge in viewership, sponsorship deals, and investment opportunities.

- Technological Advancements in Gaming Hardware and Software

The continuous innovation and improvement in gaming technology have led to enhanced gaming experiences, which directly impact the competitiveness and appeal of eSports. Firstly, advancements in gaming hardware, such as graphics processing units (GPUs), central processing units (CPUs), and peripherals like high-performance gaming mice and keyboards, enable players to achieve higher levels of precision, responsiveness, and immersion during gameplay. These technological improvements not only enhance the skill for players but also contribute to the overall spectacle and excitement of eSports events, attracting larger audiences and sponsors.

Furthermore, advancements in gaming software, including game engines, graphics rendering techniques have revolutionized the way eSports competitions are organized and experienced. Game engines allow developers to create visually stunning and immersive environments, enhancing the spectator experience and blurring the line between virtual and physical reality. Additionally, robust online matchmaking systems and dedicated eSports modes within games facilitate fair and competitive gameplay, enabling players from around the world to compete against each other seamlessly.

Opportunities

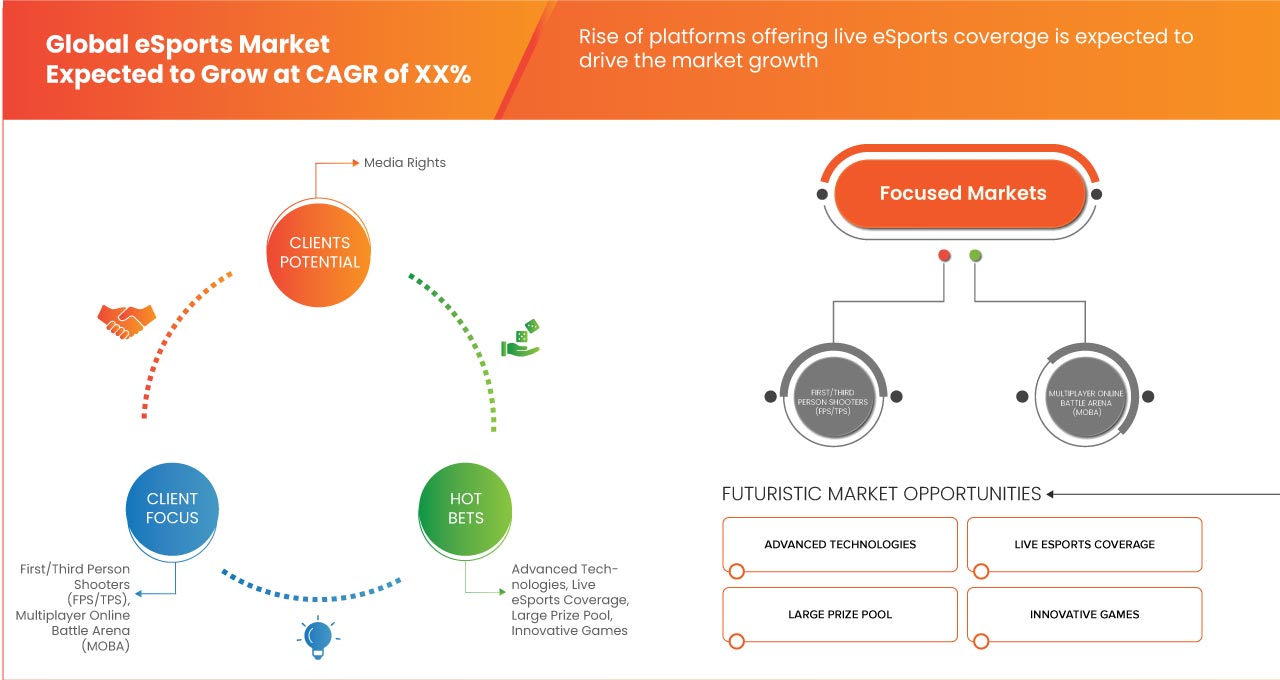

- Rise of Platforms Offering Live ESports Coverage

The eSports industry has seen tremendous growth over the years, both in terms of viewership and revenue. The increasing viewership is what mainly contributed to the revenue growth – and it's not just because those viewers are generating revenue. Seeing the potential of reaching a large and engaged audience, brands are investing in eSports marketing, both directly and indirectly. With the exponential growth of the eSports industry, there has been a corresponding surge in platforms offering live coverage of eSports events. These platforms range from dedicated eSports streaming websites to mainstream media channels and have become key players in the dissemination of eSports content to a global audience. This presents a significant opportunity to collate and analyze viewership data, engagement metrics, and audience demographics across various platforms.

The rise of platforms offering live eSports coverage represents a monumental shift in how audiences consume gaming content. Platforms such as Twitch, YouTube Gaming, and Facebook Gaming also have democratized access to eSports events, allowing fans to watch their favourite games and players in real-time from anywhere in the world. For Instance, Twitch, has emerged as a dominant force in the eSports streaming landscape, boasting millions of active users and hosting a wide array of gaming content.

Restraint/Challenge

- Health and Addiction Concerns in eSports

Health and addiction concerns in the eSports market are significant considerations given the immersive nature of gaming and the intense competition involved. Prolonged gaming sessions can lead to various physical health issues such as eye strain, repetitive strain injuries (RSI), and musculoskeletal problems due to prolonged sitting or improper posture. Additionally, excessive gaming can have adverse effects on mental health, including increased stress, anxiety, and depression, particularly among professional players who face intense pressure to perform.

Furthermore, addiction to gaming, known as gaming disorder, is recognized as a legitimate concern by the World Health Organization (WHO). Gaming addiction can lead to social withdrawal, neglect of personal hygiene, disrupted sleep patterns, and academic or occupational impairment. It can also strain relationships with family and friends.

Recent Developments

- In October 2022, according to an article by ResearchGate GmbH., The realm of eSports presents a promising avenue for advertisers, with players generally perceiving ads within video games positively, This increase in advertising through the gaming industry serves as a driving force for the global eSports market, enhancing revenue streams, fostering brand engagement, and bolstering the overall growth and sustainability of the eSports ecosystem

- In June 2021, according to an article by National Library of Medicine, The surge in advertising through the gaming industry serves as a significant driver for the global eSports market. Advertisers recognize eSports as a prime opportunity due to the positive reception of ads by players, who perceive them favorably if they seamlessly blend into the gaming experience without disrupting gameplay. This approach mirrors the concept of "product placement," where brands are integrated into entertainment content. As advertising within gaming continues to evolve, it not only generates revenue but also enhances the overall eSports experience, contributing to the industry's continued growth and commercial success

Global Esports Market Scope

The global eSports market is segmented into three notable segments based on revenue streams, games and e-platform. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Revenue Streams

- Sponsorships and Direct Advertisements

- Media Rights

- Publisher Fees

- Tickets and Merchandise

- Digital

- Streaming

On the basis of revenue streams, the market is segmented into sponsorships and direct advertisements, media rights, publisher fees, tickets and merchandise, digital, and streaming.

Games

- First/Third Person Shooters (FPS/TPS)

- Multiplayer Online Battle Arena (MOBA)

- Real Time Strategy (RTS)

- Fighting Games

- Sports Simulations

- Player Vs. Player (PVP)

- Others

On the basis of games, the market is further segmented into First/Third Person Shooters (FPS/TPS), Multiplayer Online Battle Arena (MOBA), Real Time Strategy (RTS), fighting games, sports simulations, player vs. player (PVP) and others.

E-Platform

- Mobile and Tablets

- Consoles-Based eSports

- Pc-Based Esports

On the basis of E-platform, the market is segmented into mobile and tablets, consoles-based esports and PC-based esports.

Global eSports Market Regional Analysis/Insights

The global eSports market is segmented on the basis of revenue streams, games and E-platform.

The countries covered in Global eSports market report are U.S., Canada, Mexico, Germany, France, Italy, U.K., Netherlands, Belgium, Spain, Switzerland, Russia, Turkey, rest of Europe, China, Japan, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, rest of Asia-Pacific, Brazil, Argentina, rest of South America, Saudi Arabia, South Africa, U.A.E., Egypt, Israel, and rest of Middle East and Africa.

Asia-Pacific is expected to dominate in this market due to rapid industrialization, increasing construction activities, and high demand for paints, coatings, and adhesives, supported by growing infrastructure development and manufacturing sectors in the region. China is expected to dominate in Asia-Pacific because increase in advertisements through gaming platforms. U.S. is expected to dominate in North America due to rise in demand for video games. Germany is expected to dominate in Europe due to increasing number of streaming platforms.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global eSports Market Share Analysis

The global eSports market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Global Surfactants Market.

Some of the prominent participants operating in the global eSports market are FaZe Holdings Inc., X1 Entertainment Group, ESL FACEIT GROUP, CLOUD9, Activision Blizzard, Gfinity PLC., NODWINGAMING, G ESports Holding GmbH., Team Liquid, Challonge, LLC, Battlefy, Inc., Play Versus, Inc., OPTIC GAMING, ESports Battle, and ESports Tower LLC. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING POPULARITY OF VIDEO GAMES

5.1.2 TECHNOLOGICAL ADVANCEMENTS IN GAMING HARDWARE AND SOFTWARE

5.1.3 EMERGENCE OF POPULAR STREAMING PLATFORMS

5.1.4 INCREASE IN ADVERTISEMENTS THROUGH GAMING PLATFORMS

5.2 RESTRAINTS

5.2.1 HEALTH AND ADDICTION CONCERNS IN ESPORTS

5.2.2 LACK OF STANDARDIZATION IN THE ESPORTS INDUSTRY

5.3 OPPORTUNITIES

5.3.1 RISE OF PLATFORMS OFFERING LIVE ESPORTS COVERAGE

5.3.2 INCREASING NUMBER OF EVENTS WITH LARGE PRIZE POOL

5.4 CHALLENGES

5.4.1 INTELLECTUAL PROPERTY RIGHTS ISSUES

5.4.2 SUSTAINABILITY, DATA PRIVACY AND INTEGRITY CONCERNS

6 GLOBAL ESPORTS MARKET, BY REVENUE STREAMS

6.1 OVERVIEW

6.2 SPONSORSHIPS AND DIRECT ADVERTISEMENTS ESPORTS

6.3 MEDIA RIGHTS

6.4 PUBLISHER FEES

6.5 TICKETS AND MERCHANDISE

6.6 DIGITAL

6.7 STREAMING

7 GLOBAL ESPORTS MARKET, BY GAMES

7.1 OVERVIEW

7.2 FIRST/THIRD PERSON SHOOTERS (FPS/TPS)

7.3 MULTIPLAYER ONLINE BATTLE ARENA (MOBA)

7.4 REAL TIME STRATEGY (RTS)

7.5 FIGHTING GAMES

7.6 SPORTS SIMULATIONS

7.7 PLAYER VS. PLAYER (PVP)

7.8 OTHERS

8 GLOBAL ESPORTS MARKET, BY E-PLATFORM

8.1 OVERVIEW

8.2 MOBILE AND TABLETS

8.3 CONSOLES-BASED ESPORTS

8.4 PC-BASED ESPORTS

9 GLOBAL ESPORTS MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 SOUTH KOREA

9.2.3 JAPAN

9.2.4 INDIA

9.2.5 AUSTRALIA

9.2.6 INDONESIA

9.2.7 MALAYSIA

9.2.8 PHILIPPINES

9.2.9 SINGAPORE

9.2.10 THAILAND

9.2.11 REST OF ASIA-PACIFIC

9.3 NORTH AMERICA

9.3.1 U.S.

9.3.2 CANADA

9.3.3 MEXICO

9.4 EUROPE

9.4.1 GERMANY

9.4.2 U.K.

9.4.3 SPAIN

9.4.4 FRANCE

9.4.5 RUSSIA

9.4.6 ITALY

9.4.7 NETHERLANDS

9.4.8 TURKEY

9.4.9 BELGIUM

9.4.10 SWITZERLAND

9.4.11 REST OF EUROPE

9.5 MIDDLE EAST AND AFRICA

9.5.1 SAUDI ARABIA

9.5.2 U.A.E.

9.5.3 EGYPT

9.5.4 SOUTH AFRICA

9.5.5 ISRAEL

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL ESPORTS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: EUROPE

10.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ACTIVISION BLIZZARD

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 ESL FACEIT GROUP

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 BRAND PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 TEAM LIQUID

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 BRAND PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 PLAY VERSUS, INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 FAZE HOLDINGS INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 SERVICE PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 BATTLEFLY, INC.

12.6.1 COMPANY SNAPSHOT

12.6.2 BRAND PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 CHALLONGE, LLC

12.7.1 COMPANY SNAPSHOT

12.7.2 BRAND PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 CLOUD9

12.8.1 COMPANY SNAPSHOT

12.8.2 BRAND PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 ESPORTS BATTLE

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 ESPORTS TOWER LLC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 G ESPORTS HOLDING GMBH.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 GFINITY PLC.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT UPDATES

12.13 NODWINGAMING

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATES

12.14 OPTIC GAMING

12.14.1 COMPANY SNAPSHOT

12.14.2 BRAND PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 X1 ENTERTAINMENT GROUP

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 BRAND PORTFOLIO

12.15.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 GLOBAL ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 2 GLOBAL SPONSORSHIPS AND DIRECT ADVERTISEMENTS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 3 GLOBAL MEDIA RIGHTS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 4 GLOBAL PUBLISHER FEES IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 GLOBAL TICKETS AND MERCHANDISE IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 6 GLOBAL DIGITAL IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL STREAMING IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL FIRST/THIRD PERSON SHOOTERS (FPS/TPS) IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL MULTIPLAYER ONLINE BATTLE ARENA (MOBA) IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL REAL TIME STRATEGY (RTS) IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 GLOBAL FIGHTING GAMES IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 GLOBAL SPORTS STIMULATION IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 14 GLOBAL PLAYER VS. PLAYER (PVP) IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 GLOBAL OTHERS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 16 GLOBAL ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 17 GLOBAL MOBILE AND TABLETS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 18 GLOBAL CONSOLES-BASED ESPORTS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 GLOBAL PC-BASED ESPORTS IN ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 20 GLOBAL ESPORTS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 25 CHINA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 26 CHINA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 27 CHINA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 28 SOUTH KOREA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 29 SOUTH KOREA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 30 SOUTH KOREA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 31 JAPAN ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 32 JAPAN ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 33 JAPAN ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 34 INDIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 35 INDIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 36 INDIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 37 AUSTRALIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 38 AUSTRALIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 39 AUSTRALIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 40 INDONESIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 41 INDONESIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 42 INDONESIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 43 MALAYSIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 44 MALAYSIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 45 MALAYSIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 46 PHILIPPINES ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 47 PHILIPPINES ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 48 PHILIPPINES ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 49 SINGAPORE ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 50 SINGAPORE ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 51 SINGAPORE ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 52 THAILAND ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 53 THAILAND ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 54 THAILAND ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 55 REST OF ASIA-PACIFIC ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 56 NORTH AMERICA ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 57 NORTH AMERICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 58 NORTH AMERICA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 59 NORTH AMERICA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 60 U.S. ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 61 U.S. ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 62 U.S. ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 63 CANADA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 64 CANADA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 65 CANADA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 66 MEXICO ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 67 MEXICO ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 68 MEXICO ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 69 EUROPE ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 70 EUROPE ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 71 EUROPE ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 72 EUROPE ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 73 GERMANY ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 76 U.K. ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 77 U.K. ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 78 U.K. ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 79 SPAIN ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 80 SPAIN ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 81 SPAIN ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 82 FRANCE ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 83 FRANCE ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 84 FRANCE ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 85 RUSSIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 86 RUSSIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 87 RUSSIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 88 ITALY ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 89 ITALY ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 90 ITALY ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 91 NETHERLANDS ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 92 NETHERLANDS ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 93 NETHERLANDS ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 94 TURKEY ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 95 TURKEY ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 96 TURKEY ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 97 BELGIUM ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 98 BELGIUM ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 99 BELGIUM ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 100 SWITZERLAND ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 101 SWITZERLAND ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 102 SWITZERLAND ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 103 REST OF EUROPE ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 108 SAUDI ARABIA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 109 SAUDI ARABIA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 110 SAUDI ARABIA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 111 U.A.E. ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 112 U.A.E. ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 113 U.A.E. ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 114 EGYPT ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 115 EGYPT ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 116 EGYPT ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 117 SOUTH AFRICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 118 SOUTH AFRICA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 119 SOUTH AFRICA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 120 ISRAEL ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 121 ISRAEL ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 122 ISRAEL ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 123 REST OF MIDDLE EAST AND AFRICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 124 SOUTH AMERICA ESPORTS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 125 SOUTH AMERICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 126 SOUTH AMERICA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 127 SOUTH AMERICA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 128 BRAZIL ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 129 BRAZIL ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 130 BRAZIL ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 131 ARGENTINA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

TABLE 132 ARGENTINA ESPORTS MARKET, BY GAMES, 2022-2031 (USD THOUSAND)

TABLE 133 ARGENTINA ESPORTS MARKET, BY E-PLATFORM, 2022-2031 (USD THOUSAND)

TABLE 134 REST OF SOUTH AMERICA ESPORTS MARKET, BY REVENUE STREAMS, 2022-2031 (USD THOUSAND)

List of Figure

FIGURE 1 GLOBAL ESPORTS MARKET

FIGURE 2 GLOBAL ESPORTS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ESPORTS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ESPORTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL ESPORTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ESPORTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL ESPORTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL ESPORTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL ESPORTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL ESPORTS MARKET: SEGMENTATION

FIGURE 11 RISING POPULARITY OF VIDEO GAME IS EXPECTED TO DRIVE THE GLOBAL ESPORTS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE SPONSORSHIPS AND DIRECT ADVERTISEMMENTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ESPORTS MARKET IN 2024 AND 2031

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MARKET

FIGURE 14 GLOBAL ESPORTS MARKET: BY REVENUE STREAMS, 2023

FIGURE 15 GLOBAL ESPORTS MARKET: BY GAMES, 2023

FIGURE 16 GLOBAL ESPORTS MARKET: BY E-PLATFORM, 2023

FIGURE 17 GLOBAL ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 18 ASIA-PACIFIC ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 19 NORTH AMERICA ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 20 EUROPE ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 21 MIDLE EAST AND AFRICA ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 22 SOUTH AMERICA ESPORTS MARKET: SNAPSHOT (2023)

FIGURE 23 GLOBAL ESPORTS MARKET: COMPANY SHARE 2023 (%)

FIGURE 24 EUROPE ESPORTS MARKET: COMPANY SHARE 2023 (%)

FIGURE 25 ASIA-PACIFC ESPORTS MARKET: COMPANY SHARE 2023 (%)

FIGURE 26 NORTH AMERICA ESPORTS MARKET: COMPANY SHARE 2023 (%)

Global Esports Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Esports Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Esports Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.