Global Enterprise Key Management Market

Market Size in USD Billion

CAGR :

%

USD

2.97 Billion

USD

6.40 Billion

2024

2032

USD

2.97 Billion

USD

6.40 Billion

2024

2032

| 2025 –2032 | |

| USD 2.97 Billion | |

| USD 6.40 Billion | |

|

|

|

|

Enterprise Key Management Market Size

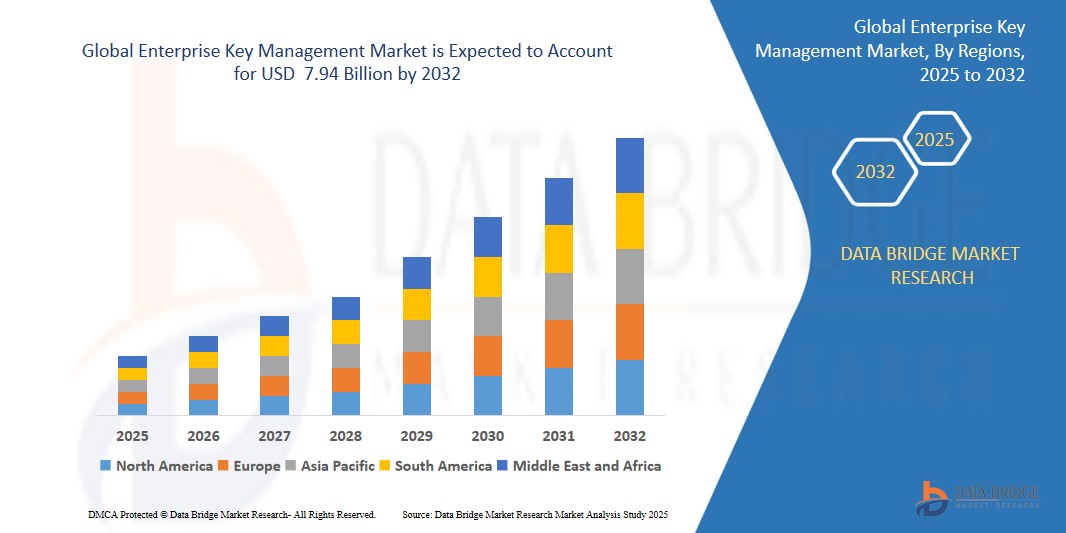

- The global Enterprise Key Management market size is estimated to be valued at USD 2.97 billion in 2025 and is projected to reach USD 7.949 billion by 2032, at a CAGR of 15.1% during the forecast period.

- This growth is driven by increasing cyber threats, widespread cloud adoption, and stringent regulatory requirements for data security across industries.

Enterprise Key Management Market Analysis

- The Enterprise Key Management market encompasses solutions and services for managing cryptographic keys, including creation, storage, access control, and destruction, to protect sensitive data across applications like disk, database, and cloud encryption, serving industries such as BFSI, healthcare, and IT.

- The demand for enterprise key management is significantly driven by rising data breaches, with global cybercrime costs projected to reach USD 10.5 trillion annually by 2025, and regulatory mandates like GDPR, HIPAA, and PCI DSS requiring robust encryption.

- North America is expected to dominate the Enterprise Key Management market, holding a 35.0% market share in 2024, due to stringent cybersecurity laws and high cloud adoption.

- Asia Pacific is expected to be the fastest-growing region due to rapid digital transformation and increasing cyberattacks in countries like China and India, projected to grow at a CAGR of 16.0%.

- The BFSI segment is expected to dominate the market with a market share of 30.0% in 2025 due to its high volume of sensitive financial data and compliance needs.

Report Scope and Enterprise Key Management Market Segmentation

|

Attributes |

Enterprise Key Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Enterprise Key Management Market Trends

“Integration of Key Management with Cloud-Native Security Platforms”

- A major trend in enterprise key management is its growing integration with cloud-native security tools to ensure secure data encryption and seamless key lifecycle management across hybrid and multi-cloud environments.

- As organizations adopt SaaS, IaaS, and PaaS platforms, the need for centrally managed, cloud-compatible key management systems has intensified.

- For instance, in January 2024, Thales introduced enhancements to its CipherTrust Cloud Key Manager, enabling advanced integrations with AWS KMS, Azure Key Vault, Google Cloud EKM, and Salesforce Shield Platform Encryption, helping enterprises manage encryption keys more efficiently across diverse cloud services.

- This trend reflects the growing need for interoperability and compliance with data protection regulations like GDPR, HIPAA, and CCPA in cloud ecosystems.

Enterprise Key Management Market Dynamics

Driver

“Rising Data Breach Incidents and Stringent Compliance Regulations”

- The increasing volume of data breaches and cyber threats is driving demand for robust encryption and centralized key management solutions.

- Organizations are prioritizing the implementation of enterprise key management systems to ensure data integrity, privacy, and regulatory compliance.

- According to IBM's Cost of a Data Breach Report 2024, the global average cost of a data breach reached $4.45 million, with encryption and key management cited among the top mitigating factors in reducing breach costs.

- Additionally, regulations such as ISO/IEC 27001, NIST SP 800-57, and FIPS 140-3 are propelling the adoption of standards-based key management practices.

- In June 2023, Entrust launched new FIPS 140-3 validated nShield HSMs, supporting secure key generation and lifecycle management, enabling enterprises to meet compliance requirements across critical industries like finance and healthcare

Opportunity

“AI and Quantum-Resistant Cryptography Integration in Key Management Systems”

- The integration of artificial intelligence and quantum-resistant encryption methods within key management solutions is emerging as a key opportunity area.

- AI can enhance anomaly detection, key usage pattern analysis, and real-time policy enforcement, making key management more proactive and resilient.

- In October 2024, IBM introduced quantum-safe cryptography capabilities into its IBM Key Protect for IBM Cloud, offering tools to prepare enterprises for the post-quantum computing era.

- These next-gen systems can future-proof organizations from quantum decryption threats and support regulatory transitions toward PQC standards outlined by NIST.

Restraint/Challenge

“Complex Integration and High Implementation Costs”

- Integrating enterprise key management systems with existing IT infrastructures, especially in legacy environments, poses a significant challenge.

- Additionally, the upfront costs associated with deploying HSMs (Hardware Security Modules), staff training, and policy framework development can be prohibitively high for small and mid-sized enterprises.

- According to a 2023 report by Ponemon Institute, 58% of organizations cited integration complexity and cost as the top barriers to adopting enterprise key management solutions.

- The need for consistent updates, skilled security personnel, and interoperability with various endpoints and platforms further complicates adoption in budget-constrained environments.

Enterprise Key Management Market Scope

The market is segmented on the basis component, deployment mode, application, organization size, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Mode |

|

|

By Application |

|

|

By Organization Size |

|

|

By End User |

|

In 2025, the Disk Encryption Segment is Projected to Dominate the Market with the Largest Share in the Application Segment

The Disk Encryption segment is expected to dominate the Enterprise Key Management market with the largest share of 56.22% in 2025 due to the increasing need to secure sensitive data at rest across enterprises. With data breaches and insider threats on the rise, organizations are prioritizing encryption of entire storage devices, including hard drives and SSDs, to prevent unauthorized access..

The BFSI Segment is Expected to Account for the Largest Share During the Forecast Period in the End User Market

In 2025, the BFSI (Banking, Financial Services, and Insurance) segment is projected to dominate the Enterprise Key Management market with the largest market share of 51.31%. This is primarily due to the industry's stringent regulatory compliance requirements such as PCI DSS, GLBA, and Basel III, which mandate robust encryption and key lifecycle management.

Enterprise Key Management Market Regional Analysis

"North America Holds the Largest Share in the Enterprise Key Management Market”

- North America dominates the Enterprise Key Management market, driven by a strong cybersecurity infrastructure, widespread digital transformation, and stringent data privacy regulations such as HIPAA, CCPA, and SOX.

- The U.S. holds a significant share due to the high adoption of cloud computing, increasing data breach incidents, and the presence of major key management solution providers such as IBM, Thales, and Entrust.

- The region’s early adoption of Bring Your Own Key (BYOK) and Hold Your Own Key (HYOK) models for cloud security has further accelerated the demand for enterprise key management systems.

- Additionally, increased investment in AI-powered threat detection and post-quantum cryptography readiness among North American enterprises continues to drive demand for advanced key management systems.

“Asia-Pacific is Projected to Register the Highest CAGR in the Enterprise Key Management Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Enterprise Key Management market, fueled by the rapid digitization of businesses, growing e-commerce activity, and increasing cyber threats.

- Countries like India, China, Singapore, and Japan are experiencing rising demand for encryption solutions due to expanding cloud adoption and data localization regulations.

- Japan, known for its focus on data protection and corporate governance, is investing in quantum-safe encryption and secure key storage solutions, making it a strategic market for enterprise key management vendors.

- Furthermore, rising incidents of ransomware and financial fraud across APAC economies are prompting BFSI, telecom, and IT sectors to implement centralized key management for secure operations and compliance.

Enterprise Key Management Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amazon Web Services, Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Thales Group (France)

- Oracle Corporation (U.S.)

- Hewlett Packard Enterprise Company (U.S.)

- Google LLC (U.S.)

- Broadcom Inc. (U.S.)

- Dell Technologies Inc. (U.S.)

- WinMagic Inc. (Canada)

Latest Developments in Global Enterprise Key Management Market

- In April 2025, Thales, a global leader in data protection and cybersecurity, launched a new version of its CipherTrust Data Security Platform, which includes enhanced key lifecycle management, support for hybrid and multi-cloud environments, and improved integrations with public cloud providers like AWS, Azure, and Google Cloud. The update aims to help enterprises strengthen data sovereignty and simplify centralized encryption key governance.

- In March 2025, IBM announced advancements to its IBM Cloud Hyper Protect Crypto Services, enabling customers to manage their own encryption keys using FIPS 140-2 Level 4 certified hardware. This development provides enterprises, especially in regulated industries, with a higher degree of trust and compliance in cloud-based data protection.

- In February 2025, Amazon Web Services (AWS) expanded the capabilities of its AWS Key Management Service (KMS) by introducing support for external key stores (XKS). This allows organizations to use their on-premises key management infrastructure with AWS services, addressing regulatory and residency concerns for sensitive data.

- In November 2024, Google Cloud enhanced its Cloud External Key Manager (EKM) by enabling integration with third-party hardware security modules (HSMs), allowing customers in finance and government sectors to maintain full control over encryption keys outside Google infrastructure, thus increasing trust in cloud migrations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.