Global Energy Drinks Market

Market Size in USD Billion

CAGR :

%

USD

133.90 Billion

USD

350.96 Billion

2024

2032

USD

133.90 Billion

USD

350.96 Billion

2024

2032

| 2025 –2032 | |

| USD 133.90 Billion | |

| USD 350.96 Billion | |

|

|

|

|

Energy Drinks Market Size

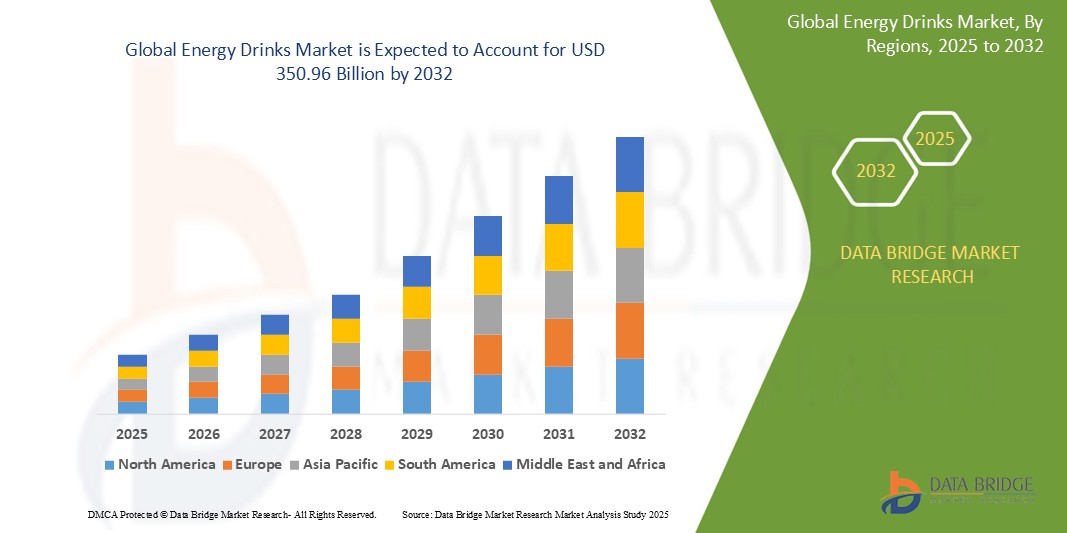

- The global energy drinks market size was valued at USD 133.90 billion in 2024 and is expected to reach USD 350.96 billion by 2032, at a CAGR of 12.80% during the forecast period

- The market growth is largely fueled by increasing consumer demand for functional beverages that provide instant energy, enhanced alertness, and physical endurance, especially among millennials, fitness enthusiasts, and working professionals

- Furthermore, the surge in product innovations—such as the introduction of sugar-free, organic, and natural ingredient-based energy drinks—is attracting a broader health-conscious consumer base. These converging factors are accelerating the adoption of energy drinks globally, thereby significantly boosting the industry's growth

Energy Drinks Market Analysis

- Energy drinks, offering quick energy boosts through stimulants such as caffeine, taurine, and B vitamins, are increasingly popular among athletes, students, and working professionals seeking enhanced physical and mental performance, with rising consumption in both developed and emerging markets due to urbanization and busy lifestyles

- The escalating demand for energy drinks is primarily fueled by growing health and fitness awareness, increasing participation in sports and physical activities, and the expanding millennial and Gen Z consumer base looking for convenient, functional beverages

- North America dominates the energy drinks market with the largest revenue share of 38.6% in 2024, characterized by high brand visibility, strong marketing campaigns by leading players, and a growing shift towards zero-sugar and natural ingredient-based formulations, particularly in the U.S., where energy drinks are mainstream in gyms, convenience stores, and supermarkets

- Europe is expected to be the fastest growing region in the energy drinks market during the forecast period due to increasing health-consciousness, expanding fitness and sports culture, and the rapid proliferation of premium and organic energy drink brands tailored to diverse taste preferences and regulatory standards

- The non-alcoholic energy drinks segment is expected to dominate the energy drinks market with a market share of 76.4% in 2024, driven by its wide acceptance as a functional beverage for daily use, increasing availability in retail and online channels, and regulatory support for caffeine-limited formulations

Report Scope and Energy Drinks Market Segmentation

|

Attributes |

Energy Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Energy Drinks Market Trends

“Health-Conscious Innovation and Functional Formulation”

- A significant and accelerating trend in the global energy drinks market is the shift toward health-conscious innovation, with brands reformulating products to appeal to consumers seeking functional benefits beyond energy boosts. This includes low or zero sugar content, natural caffeine sources, added vitamins, adaptogens, and electrolytes tailored for fitness, hydration, or cognitive focus.

- For instance, Celsius Holdings has surged in popularity due to its fitness-forward formulations that include green tea extract, guarana, and ginger, marketed as a healthier energy alternative. Similarly, Red Bull Sugarfree and Monster Energy Zero Ultra address growing demand for reduced-calorie options without sacrificing performance.

- Brands are also emphasizing natural and organic ingredients. Products such as Guayaki Yerba Mate offer naturally caffeinated beverages positioned as clean-label energy sources. These formulations resonate strongly with Gen Z and millennial consumers, who increasingly scrutinize ingredient labels and prefer beverages aligned with wellness trends.

- Functional diversification is further evident in energy drinks designed for specific outcomes—such as focus-enhancing drinks with nootropics, hydration-based variants with electrolytes, and pre-workout energy drinks targeting gym-goers. For example, Bang Energy includes CoQ10 and BCAAs to cater to athletes and fitness enthusiasts.

- The trend toward sustainability and eco-conscious branding is gaining traction as well. Companies such as PepsiCo and Coca-Cola are launching energy drinks in recyclable aluminum cans, reducing plastic use, and highlighting their environmental commitments in marketing campaigns.

- This evolution toward cleaner, functional, and purpose-driven formulations is fundamentally reshaping the energy drinks market. Brands investing in R&D and transparent labeling are gaining a competitive edge as consumers prioritize health, performance, and responsible consumption

Energy Drinks Market Dynamics

Driver

“Rising Health Awareness and Increasing Demand for Functional Energy Beverages”

- The growing global consumer awareness regarding health and wellness, combined with the rising demand for functional beverages that provide both energy and added nutritional benefits, is a major driver propelling the growth of the global energy drinks market.

- For instance, in March 2024, Red Bull GmbH launched a new line of sugar-free, plant-based energy drinks enriched with vitamins and antioxidants, targeting health-conscious consumers seeking natural energy sources. Such product innovations by leading companies are expected to boost market expansion during the forecast period.

- Consumers are increasingly seeking energy drinks that not only offer an energy boost but also support cognitive function, hydration, and overall vitality, driving demand for formulations with added ingredients such as B-vitamins, electrolytes, and herbal extracts.

- In addition, the rising participation in sports and fitness activities worldwide is fueling the need for performance-enhancing energy beverages that aid endurance and recovery, further supporting market growth.

- The convenience of ready-to-drink formats and the expansion of distribution channels through e-commerce platforms and convenience stores enable easy access to energy drinks, contributing to increased consumption in both developed and emerging economies. The trend towards natural and organic ingredients and transparent labeling is also encouraging consumers to choose energy drinks as a healthier alternative to traditional soft drinks

Restraint/Challenge

“Health Concerns and Regulatory Scrutiny Over Ingredients and Marketing”

- Growing consumer awareness regarding the potential adverse health effects of excessive caffeine and sugar intake in energy drinks presents a significant challenge to market growth. Concerns over issues such as heart palpitations, high blood pressure, and other health risks have led some consumers and health advocates to exercise caution in energy drink consumption

- For instance, in late 2023, the U.S. Food and Drug Administration (FDA) issued warnings and called for stricter regulations on caffeine levels and labeling transparency for energy drinks, which has increased scrutiny on manufacturers and affected consumer confidence

- Regulatory frameworks in various countries are becoming more stringent, with some markets imposing age restrictions, limits on caffeine content, and stricter marketing guidelines to protect vulnerable populations such as adolescents. This increases compliance costs and operational complexities for energy drink producers

- In addition, negative media coverage and reports linking energy drink consumption to health incidents have prompted some retailers and institutions to restrict sales, which constrains market penetration, particularly among younger consumers

- Addressing these challenges requires manufacturers to innovate with healthier formulations, including reduced sugar, natural ingredients, and clear labeling, while actively engaging in consumer education and responsible marketing practices. Balancing product appeal with regulatory compliance will be critical to sustaining growth in the global energy drinks market

Energy Drinks Market Scope

The market is segmented on the basis of product type, type, application, consumption time, ingredients, distribution channel, packaging type, and packaging size.

By Product Type

On the basis of product type, the energy drinks market is segmented into energy drinks, energy shots, non-alcoholic, and alcoholic energy beverages. The energy drinks segment holds the largest market revenue share in 2025 due to its widespread popularity across diverse consumer groups. These products are available in a variety of flavors and formulations that cater to different preferences, including sugar-free and enhanced vitamin variants. This extensive variety helps maintain strong demand in both mature and emerging markets

Energy shots are gaining rapid acceptance, particularly among busy professionals and athletes who prefer quick and concentrated energy boosts. Their compact size and ease of portability make them ideal for on-the-go consumption. Although they hold a smaller share compared to regular energy drinks, their higher caffeine concentration drives significant interest. The convenience factor and immediate effectiveness contribute to the steady growth of this segment

• By Type

On the basis of type, the market is segmented into inorganic and organic energy drinks. The inorganic segment accounts for the largest revenue share in 2025, primarily due to its affordability and wide availability through established manufacturers. Most mass-market energy drinks fall under this category, appealing to a broad audience with familiar formulations. Large-scale production and extensive distribution networks also support this segment’s dominance

The organic energy drinks segment is anticipated to witness the fastest growth during the forecast period, driven by rising consumer awareness of health and wellness. Consumers are increasingly seeking products made with natural ingredients, free from artificial additives and preservatives. Organic energy drinks appeal to a niche but growing market segment focused on clean-label and sustainable consumption. This trend is particularly strong among younger, health-conscious demographics

• By Application

On the basis of application, the market is segmented into before exercise, during exercise, and recovery. The before exercise segment holds the largest share, as many consumers use energy drinks to boost stamina and focus prior to physical activity. This segment benefits from marketing campaigns targeting athletes, fitness enthusiasts, and individuals seeking enhanced mental alertness. Energy drinks in this category often contain caffeine and taurine to improve performance and endurance

The recovery segment is becoming increasingly important as formulations with electrolytes, vitamins, and antioxidants gain popularity. These products aim to replenish nutrients and aid muscle recovery after workouts or strenuous physical activity. Recovery-focused energy drinks cater to the growing fitness and sports nutrition market. The segment's growth is supported by rising awareness of post-exercise nutrition

• By Consumption Time

On the basis of consumption time, the market is segmented into before 11 am, 11 am to 2 pm, 2 pm to 5 pm, 5 pm to 9 pm, and post 9 pm. The before 11 am segment dominates as many consumers start their day with energy drinks to enhance alertness and productivity. Morning consumption is associated with combating sleep inertia and preparing for busy schedules. This habit is especially prevalent among working professionals and students

The 2 pm to 5 pm segment is experiencing rapid growth as consumers look for solutions to combat the afternoon energy slump. Energy drinks consumed during this period help maintain focus and mental clarity through the latter half of the workday. Increasing workplace demands and extended work hours contribute to this rising trend. Brands are targeting this segment with marketing focused on sustained energy and concentration

• By Ingredients

On the basis of ingredients, the market is segmented into taurine, caffeine, guarana, vitamin B complex, L-carnitine, antioxidants, and others. Caffeine remains the key ingredient, serving as the primary stimulant responsible for the energy-boosting effects in most products. Its proven efficacy and fast-acting nature keep it central to energy drink formulations globally

Taurine and guarana are widely incorporated for their synergistic effects, enhancing endurance and mental performance. Meanwhile, the inclusion of antioxidants and vitamin B complex reflects growing consumer demand for health-promoting benefits beyond energy. These ingredients are marketed to appeal to health-conscious buyers seeking functional beverages

• By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based retailers and non-store retailing. Store-based retailing, including supermarkets, convenience stores, and specialty outlets, commands the largest revenue share due to easy accessibility and consumer preference for in-person shopping. These channels benefit from high foot traffic and impulse purchases

Non-store retailing, which encompasses e-commerce, vending machines, and direct-to-consumer sales, is growing rapidly due to convenience and expanding internet penetration. Online platforms offer extensive product variety, competitive pricing, and doorstep delivery, making them attractive to younger consumers. The COVID-19 pandemic accelerated the adoption of online shopping, further boosting this channel’s growth potential

• By Packaging Type

On the basis of packaging type, the market is segmented into bottled energy drinks and canned energy drinks. Canned energy drinks dominate the market, favored for their convenience, portability, and extended shelf life. The standard size and recyclable nature of cans appeal to environmentally conscious consumers. Cans are also popular for on-the-go consumption at sports events, workplaces, and social gatherings

Bottled energy drinks are growing in popularity, especially in premium and functional product categories. Bottles allow for larger serving sizes and creative packaging designs, attracting consumers seeking variety and novelty. These products often emphasize natural ingredients and wellness benefits. The packaging flexibility supports brand differentiation in a crowded market

• By Packaging Size

On the basis of packaging size, the market is segmented into 250 ml, 1 liter, and other sizes. The 250 ml segment commands the largest share as it aligns with the standard serving size preferred by most consumers for single-use energy boosts. This size balances portability with sufficient volume to deliver the desired energy effect. It is widely available across all retail channels

The 1-liter packaging size is growing steadily, favored by regular energy drink consumers and athletes who require larger quantities. Bulk packaging offers better value for money and reduces the frequency of purchase. This segment also supports family or group consumption occasions. The growth is supported by rising health and fitness awareness prompting increased intake

Energy Drinks Market Regional Analysis

- North America dominates the energy drinks market with the largest revenue share of 38.5% in 2024, driven by high consumer awareness, strong brand presence, and growing demand for performance-enhancing beverages

- Consumers in the region highly value product variety, convenience, and innovative formulations such as sugar-free and organic options

- This widespread adoption is further supported by rising fitness trends, increasing disposable incomes, and a fast-paced lifestyle that encourages consumption during work and recreational activities

U.S. Energy Drinks Market Insight

The U.S. energy drinks market captured the largest revenue share of 42% within North America in 2024, driven by rising consumer demand for functional beverages and growing fitness culture. Consumers are increasingly seeking energy-boosting products that enhance physical performance and mental alertness throughout the day. The expanding trend of convenient, on-the-go consumption, along with strong marketing campaigns by leading brands, further fuels market growth. Moreover, the rising popularity of sugar-free and organic energy drinks, coupled with collaborations with fitness and lifestyle influencers, is significantly contributing to the market’s expansion.

Europe Energy Drinks Market Insight

The European energy drinks market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising health awareness and growing demand for functional beverages. Increasing urbanization and a younger population embracing active lifestyles are fueling energy drink consumption across the region. Consumers are also attracted to sugar-free and organic options, reflecting a shift toward healthier formulations. The market is witnessing significant growth across retail, fitness, and hospitality sectors, with energy drinks becoming a popular choice for both pre- and post-exercise consumption.

U.K. Energy Drinks Market Insight

The U.K. energy drinks market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising consumer demand for convenient energy-boosting beverages. Increasing health awareness has led to the development and popularity of low-sugar and organic energy drink options. The growing fitness culture, combined with a strong retail and e-commerce infrastructure, is expected to continue stimulating market growth. Additionally, busy lifestyles and the desire for quick energy solutions are encouraging consumers to choose energy drinks for pre- and post-exercise consumption.

Germany Energy Drinks Market Insight

The German energy drinks market is expected to expand at a considerable CAGR during the forecast period, fueled by growing consumer interest in health-conscious and performance-enhancing beverages. Increasing awareness of sugar content and demand for natural, organic ingredients are driving innovation in product offerings. Germany’s strong focus on sustainability and wellness is encouraging manufacturers to develop eco-friendly packaging and formulations. The market is also benefiting from a well-established retail network and rising participation in fitness and sports activities across all age groups.

Asia-Pacific Energy Drinks Market Insight

The Asia-Pacific energy drinks market is poised to grow at the fastest CAGR of over 15% during the forecast period, driven by increasing urbanization, rising disposable incomes, and changing consumer lifestyles in countries such as China, India, and Japan. The growing awareness of fitness and health, along with expanding sports and gym culture, is boosting demand for energy-boosting beverages. In addition, government initiatives supporting the food and beverage industry and increasing availability of energy drinks through modern retail and e-commerce platforms are enhancing market accessibility. Affordability and localized product offerings tailored to regional tastes are further expanding the consumer base in this region.

Japan Energy Drinks Market Insight

The Japan energy drinks market is gaining momentum due to the country’s health-conscious consumers and busy urban lifestyles. Increasing participation in sports and fitness activities is driving demand for energy-boosting beverages that provide convenience and sustained energy. The market benefits from the availability of a wide range of innovative products, including low-calorie and functional energy drinks tailored to Japanese preferences. In addition, Japan’s advanced retail infrastructure and high acceptance of international brands are contributing to steady market growth.

China Energy Drinks Market Insight

The China energy drinks market accounted for the largest market revenue share in Asia Pacific in 2025, driven by rapid urbanization, a growing middle class, and rising health awareness. Increasing participation in fitness and sports activities, coupled with a fast-paced lifestyle, is boosting demand for convenient energy-boosting beverages. The expansion of modern retail chains and e-commerce platforms is improving product accessibility across urban and semi-urban areas. In addition, local manufacturers are innovating with unique flavors and functional ingredients tailored to Chinese consumers, further strengthening market growth.

Energy Drinks Market Share

The energy drinks industry is primarily led by well-established companies, including:

- Red Bull (Austria)

- Monster Energy Company Monster Energy (U.S.)

- Rockstar Energy Drink (U.S.)

- Coca-Cola HBC. Burn (Coca-Cola) (U.S.)

- PepsiCo, Inc. Mountain Dew Game Fuel (PepsiCo) (U.S.)

- SUNTORY HOLDINGS LIMITED. Suntory (Japan)

- Otsuka Pharmaceutical (Japan)

- Vital Pharmaceuticals, Inc. (U.S.)

- Fraser and Neave, Limited. Fraser and Neave Beverages (Singapore)

- Osotspa Co., Ltd. (Thailand)

- Oishi Group (Thailand)

- Yakult Honsha Co., Ltd. (Japan)

- Pacific Refreshments Pty Ltd. (New Zealand)

- Tiger Foods Limited Tiger Brands (South Africa)

- THP GROUP. Tan Hiep Phat Group (Vietnam)

Latest Developments in Global Energy Drinks Market

- In April 2024, PepsiCo India introduced Sting Blue Current, a limited-edition flavor of its Sting Energy drink, designed to electrify consumers with a refreshing new taste. The launch was accompanied by a quirky brand campaign, reinforcing Sting’s mantra of "Kamaal ka Current"—inviting consumers to experience its exhilarating energy firsthand. Available in 200 ml single-serve packs across India, Sting Blue Current continues the brand’s commitment to delivering bold flavors and high-energy experiences

- In April 2024, GURU Organic Energy Corp., Canada's leading organic energy drink brand, introduced Peach Mango Punch to the Canadian market, backed by a national marketing campaign. This refreshing drink is low in calories and packed with natural ingredients designed to boost focus and brain performance. It contains 140 mg of natural caffeine and is certified organic, free from sucralose and aspartame. The drink features L-theanine, monk fruit, and stevia, offering both health benefits and natural sweetness

- In February 2024, Red Bull GmbH unveiled its Summer Edition Curuba Elderflower, a refreshing energy drink blending curuba and elderflower flavors. Available in 250ml cans, this limited-time edition was launched in multiple formats, including sugar-free options, catering to diverse preferences. Red Bull's 'Editions' range played a key role in expanding its customer base by 50%, reflecting the growing demand for flavored energy drinks. To further meet consumer needs, the brand introduced an 8x250ml mixed sugar-free multipack, ensuring more variety for energy drink enthusiasts

- In January 2024, Celsius Holdings, Inc. expanded its presence into Canada, the UK, and Ireland, strengthening its global footprint. PepsiCo became the exclusive distributor in Canada, extending its 2022 U.S. agreement. Meanwhile, Suntory Beverage & Food Great Britain and Ireland was chosen as the exclusive sales and distribution partner for the UK, the Isle of Man, the Channel Islands, and the Republic of Ireland. This strategic move aims to bring Celsius energy drinks to a broader audience

- In July 2023, Monster Beverage Corporation completed its acquisition of Bang Energy, strengthening its foothold in the Asia-Pacific energy drink market. The deal, valued at approximately USD 362 million, included Bang Energy's beverage production facility in Phoenix, Arizona. This strategic move aims to expand Monster's consumer base in the region while integrating Bang Energy's distinct market positioning into its broader portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Energy Drinks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Energy Drinks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Energy Drinks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.