Global Emission Control Catalyst Ecc Market

Market Size in USD Billion

CAGR :

%

USD

53.59 Billion

USD

97.01 Billion

2024

2032

USD

53.59 Billion

USD

97.01 Billion

2024

2032

| 2025 –2032 | |

| USD 53.59 Billion | |

| USD 97.01 Billion | |

|

|

|

|

Emission Control Catalyst (ECC) Market Size

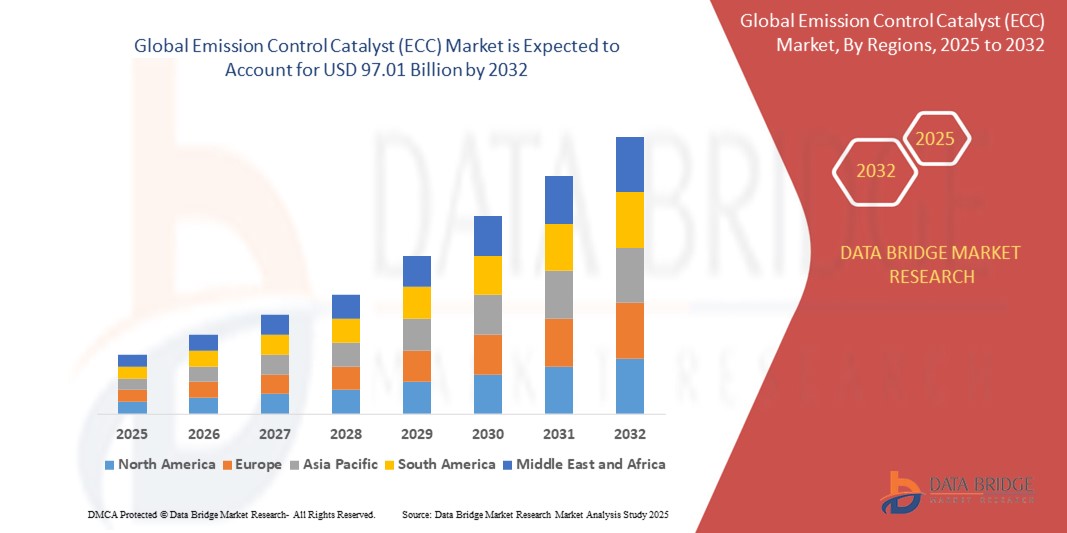

- The global Emission Control Catalyst (ECC) market size was valued at USD 53.59 billion in 2024 and is expected to reach USD 97.01 billion by 2032, at a CAGR of 7.70% during the forecast period

- The market growth is largely fueled by increasingly stringent emission regulations across the automotive and industrial sectors, driving the widespread adoption of emission control catalysts to reduce harmful pollutants such as NOx, CO, and hydrocarbons. Governments worldwide are enforcing tighter standards, such as Euro 6/7 and China 6, which are compelling manufacturers to incorporate advanced catalyst systems into vehicles and stationary equipment

- Furthermore, rising environmental awareness and global decarbonization efforts are encouraging investment in cleaner technologies. These converging factors are accelerating the integration of emission control catalysts across mobile and stationary sources, thereby significantly boosting the industry's growth

Emission Control Catalyst (ECC) Market Analysis

- Emission control catalysts are advanced materials that facilitate chemical reactions to convert toxic gases in exhaust emissions into less harmful substances. Widely used in automotive, power generation, and chemical manufacturing, ECCs play a critical role in compliance with environmental regulations and in minimizing the environmental impact of combustion-based processes

- The escalating demand for ECCs is primarily driven by growing industrialization, expansion of the global vehicle fleet, and technological advancements in catalyst formulations that enhance efficiency and durability under increasingly demanding emission standards

- North America dominated the Emission Control Catalyst (ECC) market in 2024, due to stringent EPA regulations, a mature automotive industry, and strong demand for catalytic converters in gasoline-powered vehicles

- Europe is expected to be the fastest growing region in the Emission Control Catalyst (ECC) market during the forecast period due to the region’s progressive environmental policies and upcoming Euro 7 regulations targeting stricter emission thresholds

- Mobile sources segment dominated the market with a market share of 68.8% in 2024, due to high volume of catalytic converters installed in passenger cars, commercial vehicles, and motorcycles. Regulatory mandates such as Euro 6, China 6, and Tier 3 in the U.S. have compelled automakers to integrate advanced ECCs to reduce vehicular emissions, driving segment growth. The push for cleaner transportation and the shift to hybrid powertrains also enhance demand for effective emission control solutions

Report Scope and Emission Control Catalyst (ECC) Market Segmentation

|

Attributes |

Emission Control Catalyst (ECC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Emission Control Catalyst (ECC) Market Trends

“Rising Development of Hybrid and Electric Vehicles”

- A significant and accelerating trend in the emission control catalyst (ECC) market is the rapid development and adoption of hybrid and electric vehicles (EVs), which is reshaping the landscape for emission control technologies and materials

- For instance, companies such as Johnson Matthey, BASF, and Umicore are investing heavily in R&D to develop advanced emission control catalysts tailored for hybrid powertrains, focusing on enhanced efficiency and durability to meet evolving emission regulations

- The shift toward hybrid and electric mobility is prompting innovation in catalyst formulations, such as nanoparticle technology and highly efficient metal oxides, to ensure compliance with stricter emission norms and extend catalyst lifespan in vehicles with variable engine use

- Governments worldwide are enforcing stringent air quality and carbon reduction targets, driving demand for selective catalytic reduction (SCR), three-way catalysts, and onboard diagnostics (OBD) systems in both new vehicles and retrofitting projects

- Collaboration between automotive OEMs such as Toyota, Ford, and Volkswagen and catalyst producers is increasing to develop solutions that balance performance, durability, and cost-effectiveness amid the transition toward electrification

Emission Control Catalyst (ECC) Market Dynamics

Driver

“Growing Automotive Industry”

- The ongoing expansion of the global automotive industry is a major driver for the ECC market, as rising vehicle production and ownership directly increase the need for emission control solutions in both developed and emerging markets

- For instance, China’s FAW Group, India’s Tata Motors, and Mexico’s Nemak are scaling up vehicle manufacturing, which in turn drives demand for advanced emission control catalysts to comply with local and international emission standards

- The proliferation of vehicles across applications—including trucks, buses, motorcycles, and off-road equipment—fuels the need for sophisticated catalyst systems subject to increasingly stringent environmental regulations

- Automotive manufacturers are integrating advanced catalyst technologies to meet regulatory requirements, improve air quality, and enhance sustainability, making ECC technology critical in modern vehicle design

- The sector’s focus on innovation, efficiency, and compliance is expected to sustain robust demand for emission control catalysts in the coming years

Restraint/Challenge

“High Cost of Catalyst Materials”

- The high cost of catalyst materials, particularly precious metals such as platinum, palladium, and rhodium, presents a significant challenge for the ECC market, affecting production costs and pricing for end users

- For instance, Johnson Matthey and BASF SE face fluctuations in precious metal prices that increase manufacturing expenses, compelling automotive OEMs to balance cost management with stringent emission compliance

- Reliance on scarce and expensive raw materials creates supply chain vulnerabilities, especially during market volatility or geopolitical tensions

- Manufacturers are investing in research to develop cost-effective catalyst formulations and recycling technologies, but maintaining high performance while reducing material costs remains a key industry concern

- Addressing this challenge will require ongoing innovation, strategic sourcing, and collaboration between suppliers and automakers such as Toyota and Ford to ensure long-term sustainability and affordability of emission control catalyst technologies

Emission Control Catalyst (ECC) Market Scope

The market is segmented on the basis of metal type, application, and type.

- By Metal Type

On the basis of metal type, the ECC market is segmented into palladium, platinum, rhodium, and others. The palladium segment held the largest market revenue share in 2024 due to its high activity in oxidation reactions, particularly in gasoline engines. Its strong catalytic efficiency in converting harmful pollutants such as hydrocarbons (HC) and carbon monoxide (CO) into less harmful substances drives its dominance. Automakers increasingly prefer palladium due to its performance balance and relatively lower cost compared to platinum, especially in light-duty vehicle applications.

The rhodium segment is projected to witness the fastest growth rate from 2025 to 2032, driven by its unmatched effectiveness in reducing nitrogen oxides (NOx) emissions. As global emission regulations become more stringent, especially in the U.S., Europe, and China, rhodium's critical role in three-way catalytic converters is elevating its demand. Despite being the most expensive among the group metals, its low dosage requirement and critical importance in meeting regulatory standards are key factors boosting its adoption.

- By Application

On the basis of application, the market is segmented into mobile sources and stationary sources. The mobile sources segment dominated the market revenue share of 68.8% in 2024, largely due to the high volume of catalytic converters installed in passenger cars, commercial vehicles, and motorcycles. Regulatory mandates such as Euro 6, China 6, and Tier 3 in the U.S. have compelled automakers to integrate advanced ECCs to reduce vehicular emissions, driving segment growth. The push for cleaner transportation and the shift to hybrid powertrains also enhance demand for effective emission control solutions.

The stationary sources segment is anticipated to register the fastest CAGR from 2025 to 2032, supported by the expansion of industrial operations and power plants, especially in emerging economies. The increasing enforcement of emission norms for industrial boilers, generators, and turbines is creating robust demand for ECCs. Technologies such as selective catalytic reduction (SCR) and oxidation catalysts for flue gas treatment are gaining traction in oil & gas, cement, and chemical industries, further boosting the market.

- By Type

On the basis of type, the ECC market is segmented into DDR4, DDR3, DDR2, DDR, and Others. The DDR4 segment accounted for the largest market share in 2024, as it represents the most widely used generation in modern vehicles and equipment requiring enhanced computational capability to optimize emissions performance. With ECC technologies often embedded in electronic control units (ECUs) for monitoring and adjusting engine outputs, the DDR4’s higher bandwidth and efficiency help meet complex regulatory requirements.

The DDR5 segment (within 'Others') is expected to witness the fastest growth from 2025 to 2032 due to the ongoing digital transformation of emission systems and the integration of AI-based analytics for real-time emission data processing. This advanced memory type supports faster data transfer and increased energy efficiency, making it ideal for next-gen automotive and industrial emission systems. The evolution toward smarter, more responsive emission control platforms is set to drive DDR5’s demand across various ECC applications.

Emission Control Catalyst (ECC) Market Regional Analysis

- North America dominated the Emission Control Catalyst (ECC) market with the largest revenue share in 2024, driven by stringent EPA regulations, a mature automotive industry, and strong demand for catalytic converters in gasoline-powered vehicles

- The region’s high vehicle ownership rate, established emission norms such as Tier 3 standards, and emphasis on reducing industrial emissions contribute to widespread ECC adoption across mobile and stationary sources

- Advancements in emission reduction technologies and the presence of leading ECC manufacturers further support North America’s dominant position in the global market

U.S. ECC Market Insight

The U.S. ECC market captured the largest revenue share in North America in 2024, fueled by aggressive emissions mandates and high demand for aftermarket catalytic converters. The country’s focus on reducing air pollution from both transportation and industrial sources, alongside increasing adoption of hybrid vehicles, is driving ECC integration. The U.S. is also witnessing steady growth in ECC applications across power generation and manufacturing facilities.

Europe ECC Market Insight

Europe is projected to register the fastest CAGR in the ECC market during the forecast period from 2025 to 2032, attributed to the region’s progressive environmental policies and upcoming Euro 7 regulations targeting stricter emission thresholds. Growing emphasis on climate neutrality, rising adoption of low-emission vehicles, and strong enforcement of emission norms across automotive and industrial sectors are major factors boosting ECC deployment. Countries such as Germany, France, and the U.K. are witnessing rapid adoption of advanced catalyst technologies in both new vehicles and retrofitted systems

Germany ECC Market Insight

The Germany ECC market is poised for rapid growth due to the country’s leadership in automotive innovation and commitment to sustainability. Germany's support for cleaner transport, investments in hydrogen and electric mobility, and tightening industrial emission controls are accelerating the use of ECCs across various sectors.

Asia-Pacific ECC Market Insight

Asia-Pacific held a significant market share in 2024, led by massive vehicle production, increasing industrial output, and the enforcement of emissions standards such as China 6 and Bharat Stage VI. The region’s expansive manufacturing base and the transition to greener technologies are supporting ECC demand in both transportation and energy sectors. China continues to be a key market, with substantial investment in emission control systems across both public and private sectors

China ECC Market Insight

The China ECC market accounted for the largest share in Asia-Pacific in 2024, driven by large-scale vehicle ownership, strict emissions laws, and growing industrial activity. Government-backed programs to improve air quality, including catalytic converter retrofits and factory upgrades, are further boosting the market.

Emission Control Catalyst (ECC) Market Share

The Emission Control Catalyst (ECC) industry is primarily led by well-established companies, including:

- BASF (Germany)

- Johnson Matthey (U.K.)

- Sinocat Environmental Technology Co., Ltd (China)

- Cormetech (U.S.)

- Solvay (Belgium)

- Micron Technology, Inc. (U.S.)

- Faurecia (France)

- SMPE (India)

- Hitachi Zosen Corporation (Japan)

- Haldor Topsoe (Denmark)

- Lenovo (China)

- I'M Intelligent Memory (China)

- Clean Diesel Technologies (U.S.)

- NGK Insulators (Japan)

- Magneti Marelli (Italy)

- Tenneco (U.S.)

- Umicore SA (Belgium)

- Bosal (Belgium)

- Corning Incorporated (U.S.)

- DCL International Inc. (Canada)

- Aerinox Inc. (U.S.)

Latest Developments in Global Emission Control Catalyst (ECC) Market

- In December 2024, Clariant announced the successful startup of its EnviCat N2O-S catalyst at Sichuan Lutianhua’s nitric acid plant, expected to cut emissions by 275 kilotons of CO₂ equivalent annually. This deployment reinforces Clariant's leadership in industrial emission reduction and is likely to accelerate the adoption of high-efficiency catalysts in global nitric acid production, boosting ECC market demand

- In November 2024, Solvay launched climate and water initiatives at its Paulínia site in Brazil, targeting a 40% reduction in greenhouse gas emissions and a 10% cut in water intake by 2025. These efforts underscore Solvay’s commitment to sustainability and are expected to strengthen its position in the ECC market by aligning product development with environmental performance goals

- In November 2024, Honeywell UOP and Johnson Matthey formed a strategic partnership to enable the production of sustainable fuels from various feedstocks. The collaboration integrates advanced technologies to lower costs and improve project execution, potentially driving demand for emission control catalysts used in biofuel and clean energy applications

- In August 2024, DCL International Inc. transferred sponsorship of the Mining Vehicle Powertrain Conference to Roadwarrior Inc., signaling a strategic shift toward expanding clean energy and environmental technology solutions. This move is likely to sharpen DCL’s focus on innovative ECC systems tailored for heavy-duty and off-road applications, enhancing its competitive edge in specialized segments

- In April 2023, Solvay entered a strategic partnership with Ginkgo Bioworks to accelerate the development of sustainable solutions. By leveraging Ginkgo’s bioengineering capabilities, this alliance is set to fuel innovation in environmentally friendly catalyst technologies, positioning Solvay for long-term growth in the ECC market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Emission Control Catalyst Ecc Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Emission Control Catalyst Ecc Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Emission Control Catalyst Ecc Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.