Global Catalyst Carriers Market

Market Size in USD Million

CAGR :

%

USD

450.80 Million

USD

606.50 Million

2024

2032

USD

450.80 Million

USD

606.50 Million

2024

2032

| 2025 –2032 | |

| USD 450.80 Million | |

| USD 606.50 Million | |

|

|

|

|

Catalyst Carriers Market Size

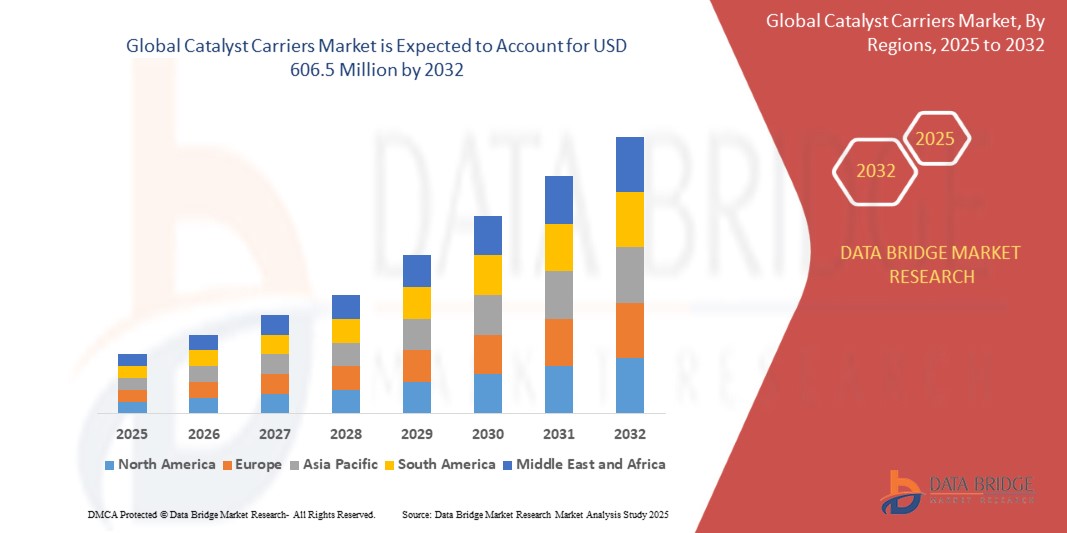

- The global catalyst carriers market size was valued at USD 450.8 million in 2024 and is expected to reach USD 606.5 million by 2032, at a CAGR of 9.1% during the forecast period

- The market growth is driven by rising demand from the petrochemical and refining industries, where catalyst carriers play a critical role in improving catalyst efficiency and durability.

- Advancements in nanomaterials, 3D printing, and optimized porosity designs are enhancing the performance and lifespan of catalyst carriers.

- Environmental regulations and increasing adoption of cleaner processing technologies promote the use of advanced catalyst carriers for emissions control and sustainable manufacturing.

Catalyst Carriers Market Analysis

- Catalyst carriers are materials that provide support for catalysts in chemical reactions, improving catalyst efficiency, mechanical strength, and thermal stability while facilitating optimal surface area and porosity.

- The market includes various carrier types such as ceramics, alumina, titania, magnesia, activated carbon, silica, zeolite, and others tailored for specific industrial applications.

- These carriers are formed in different shapes including spheres, extrudates, powders, and honeycombs to meet performance and reactor design needs.

- They are widely used in end-use industries like petrochemicals, chemicals manufacturing, oil & gas refining, automotive catalyst production, pharmaceuticals, and agrochemicals.

- Technological innovations focus on materials that provide better durability under harsh operating conditions and support catalyst recycling and environmental compliance.

Report Scope and Catalyst Carriers Market Segmentation

|

Attributes |

Catalyst Carriers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Catalyst Carriers Market Trends

Advancements in Material Science and Sustainable Catalyst Technologies

- Integration of nanomaterials and 3D printing is enabling precise control over porosity and surface area, enhancing catalyst effectiveness and durability.

- Growing emphasis on green chemistry and cleaner catalytic processes drives demand for eco-friendly catalyst carriers.

- Increased research into carbon-based and zeolitic carriers that improve selectivity and reduce environmental impact.

- Expansion of customized catalyst carriers optimized for emerging areas such as hydrogen production and bio-refining.

- This trend is particularly prominent in post-pandemic markets, where the need for hygienic, safe, and eco-responsible products has redefined consumer expectations and corporate sustainability commitments in the textile sector.

Catalyst Carriers Market Dynamics

Driver

Increasing Demand from Petrochemical and Refining Sectors

- The petrochemical and refining industries are experiencing growth driven by rising global energy demands and increasing production of fuels, chemicals, and plastics. Catalyst carriers play a critical role in these processes by enhancing catalyst activity, mechanical strength, and longevity, making their demand essential for efficient operations.

- Environmental regulations worldwide are becoming more stringent, pushing companies to adopt advanced catalyst carriers that help reduce emissions and improve process efficiency. This regulatory pressure boosts the requirement for state-of-the-art carriers with enhanced thermal stability and resistance to deactivation.

- Ongoing technological advances, such as the integration of nanomaterials and the use of 3D printing for precise control over porosity and shape, improve catalyst performance and durability. These innovations reduce operational costs through longer catalyst life spans and fewer shutdowns, encouraging higher adoption.

- Emerging economies are industrializing rapidly, expanding their refining and chemical production capacities, thereby increasing the consumption of catalyst carriers. Governments in these regions are also promoting cleaner and more efficient production methods, further supporting market growth.

Restraint/Challenge

Raw Material Price Volatility and High Capital Investment

- The production of catalyst carriers depends on critical raw materials like alumina, rare earth elements, and specialty ceramics whose prices are subject to volatility due to supply constraints, geopolitical factors, and mining challenges. This introduces cost uncertainty and affects pricing stability for manufacturers and end-users.

- Developing and manufacturing advanced catalyst carriers require significant capital investment in R&D, sophisticated production facilities, and quality control systems. These high costs can be a barrier for new entrants and limit capacity expansion, especially for smaller companies.

- Compliance with strict environmental, health, and safety regulations increases operational complexities and costs. For example, the processing of certain rare materials or the handling of nano-scale additives can involve stringent safety protocols, limiting flexibility in production scaling.

- Competition from alternative catalyst technologies, such as catalyst supports made from new composite materials or non-porous carriers, presents challenges to traditional catalyst carrier manufacturers. Some of these alternatives may offer advantages in specific niche applications, eroding market share.

Catalyst Carriers Market Scope

The market is segmented on the basis of type, form, surface area, pore volume, and end-use industry.

- By Type

On the basis of type, the catalyst carriers market is segmented into ceramic, alumina, titania, magnesia, silicon carbide, silica, activated carbon, zeolite, and others. The ceramic segment dominates the largest market revenue share in 2024, owing to its excellent thermal stability, mechanical strength, and broad applicability across petrochemical and refining processes. Alumina and activated carbon carriers are also significant, valued for their surface properties and catalytic support efficiency. Emerging eco-friendly and carbon-based carriers are anticipated to witness the fastest growth from 2025 to 2032, driven by environmental regulations and demand for sustainable catalyst solutions.

- By Form

On the basis of form, the catalyst carriers market is segmented into sphere, extrudate, powder, honeycomb, and others. The sphere form holds the largest market share in 2024 due to its optimal surface area and fluidization properties that enhance catalyst performance in various reactor types. Honeycomb carriers are growing in adoption for automotive and emission control catalysts due to their high surface area and structural efficiency. Powder carriers are favored in specialty chemical processes requiring fine particle dispersion.

- By Surface Area

On the basis of surface area, the market is divided into low, intermediate, and high categories. The intermediate surface area segment holds the largest share, balancing effective catalytic activity with mechanical stability. High surface area carriers are expected to exhibit the fastest CAGR due to their superior catalytic support in advanced and emerging applications like hydrogen production and bio-refining.

- By Pore Volume

On the basis of application, the Catalyst Carrierss market is segmented into medical textiles, commercial textile, apparels, home textiles, industrial textile, and others.Medical textiles dominated the market in 2024, driven by heightened infection prevention measures in hospitals, clinics, and eldercare facilities. The demand for antimicrobial scrubs, surgical drapes, patient bedding, and masks surged post-COVID-19, and the trend continues amid concerns over healthcare-associated infections (HAIs).

- By End-Use Industry

On the basis of end-use industry, the catalyst carriers market is segmented into chemicals, petrochemicals, oil & gas, automotive, pharmaceuticals, agrochemicals, and others. The petrochemical segment commands the largest market share due to its extensive use of catalysts in hydroprocessing, cracking, and reforming units. The automotive segment is rapidly growing, driven by stringent emission standards requiring advanced catalyst supports in exhaust treatment systems. Pharmaceuticals and agrochemical sectors are increasingly adopting customized catalyst carriers to enhance process efficiency and product purity.

Catalyst Carriers Market Regional Analysis

- Asia-Pacific dominates the global catalyst carriers market with the 51.75% revenue share in 2024, driven by rapid industrialization, expanding petrochemical and refining industries, and growing automotive manufacturing across key countries including China, India, Japan, and South Korea. The region benefits from large-scale investments in chemical processing plants, oil refining complexes, and emission control projects supported by government initiatives promoting cleaner technologies and energy-efficient manufacturing.

- Manufacturers and end-users in the region are increasingly adopting advanced catalyst carriers such as nanomaterial-enhanced ceramics and honeycomb structures to improve catalyst efficiency, durability, and sustainability. The availability of abundant raw materials, cost-effective production capabilities, and a skilled workforce further strengthen Asia-Pacific’s leading position.

- The region’s growth is also fueled by stringent environmental regulations and an increasing shift towards cleaner fuel production methods, driving demand for high-performance, eco-friendly catalyst carriers. Asia-Pacific’s robust export landscape and continuous technological innovations ensure its sustained dominance in the global catalyst carriers market.

U.S. Catalyst Carriers Market Insight

The U.S. is a key player in the global catalyst carriers market, driven by a mature refining sector and continuous investments in emission control technologies. Leading chemical manufacturers and catalyst producers prioritize innovation and strict regulatory compliance, fostering steady market growth. Demand is strong in petrochemical, oil & gas, and automotive catalyst production, supported by stringent environmental standards requiring advanced and durable catalyst carriers.

Europe Catalyst Carriers Market Insight

Europe’s catalyst carriers market is experiencing robust growth, led by countries such as Germany, France, and the U.K. The region emphasizes sustainable manufacturing and energy-efficient catalytic processes to comply with rigorous environmental regulations, including REACH and the European Green Deal. Advanced catalyst carriers designed for cleaner production and emission reduction are seeing widespread adoption in chemical manufacturing, refining, and automotive sectors.

U.K. Catalyst Carriers Market Insight

The U.K. market is poised for steady expansion due to investments in infrastructure, automotive manufacturing, and pharmaceutical industries. Increasing demand for high-performance catalyst carriers that meet stringent emission control and sustainability standards is driving innovation. Public and private initiatives promoting green chemistry also contribute to the market’s growth, especially in catalytic converters and industrial catalytic processes.

Germany Catalyst Carriers Market Insight

Germany maintains a leading position through a strong industrial base and leadership in engineering and chemical manufacturing. The country’s emphasis on R&D fosters development of advanced catalyst carriers with superior mechanical strength and thermal stability. Demand is driven by automotive catalyst production, refining, and chemicals manufacturing, aligned with national and EU environmental policies.

Asia-Pacific Catalyst Carriers Market Insight

Asia-Pacific dominates the global catalyst carriers market with the largest revenue share in 2024 and is the fastest growing region. Rapid industrialization, expansion of petrochemical complexes, refining facilities, and automotive manufacturing in China, India, Japan, and South Korea fuel market growth. Government initiatives supporting cleaner energy, emission reduction, and green manufacturing practices further bolster demand. The region benefits from cost-effective production, abundant raw materials, and technological adoption including nanomaterials and 3D printing for catalyst carrier optimization.

India Catalyst Carriers Market Insight

India is projected to witness a substantial CAGR, supported by rapid industrialization, infrastructure development, and expanding petrochemical and refining sectors. Government programs fostering sustainable industrial practices and "Make in India" initiatives accelerate investments in catalyst carrier manufacturing. Increased focus on environmental compliance and technological upgrades in chemical production will continue to drive market expansion.

China Catalyst Carriers Market Insight

China leads Asia-Pacific and the global catalyst carriers market in terms of revenue share, enabled by its extensive refining and chemical manufacturing infrastructure. Regulatory emphasis on cleaner fuel standards and environmental protection encourages widespread adoption of high-performance catalyst carriers, including eco-friendly and customized materials. Growing domestic demand combined with export capabilities sustains China’s dominant market position.

Catalyst Carriers Market Share

The Catalyst Carriers industry is primarily led by well-established companies, including:

- BASF (Germany)

- Evonik Industries AG (Germany)

- Almatis (Germany)

- Cabot Corporation (U.S.)

- CeramTec GmbH (Germany)

- CoorsTek, Inc. (U.S.)

- Magma Catalysts (U.S.)

- Noritake Co., Ltd. (Japan)

- Sasol Ltd. (South Africa)

- W.R. Grace & Co. (U.S.)

- Clariant AG (Switzerland)

- Johnson Matthey (U.K.)

- Sasol Solvents (South Africa)

- Saint-Gobain (France)

- Haldor Topsoe (Denmark)

Latest Developments in Global Catalyst Carriers Market

- In February 2024 BASF SE launched a high-performance alumina catalyst carrier optimized for hydrogen production with enhanced thermal stability.

- In April 2024 Clariant released CATOFIN 312, a next-generation catalyst for propane dehydrogenation with extended life and selectivity improvements.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Catalyst Carriers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Catalyst Carriers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Catalyst Carriers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.