Global Elevator Market

Market Size in USD Billion

CAGR :

%

USD

81.68 Billion

USD

147.85 Billion

2024

2032

USD

81.68 Billion

USD

147.85 Billion

2024

2032

| 2025 –2032 | |

| USD 81.68 Billion | |

| USD 147.85 Billion | |

|

|

|

|

Elevator Market Size

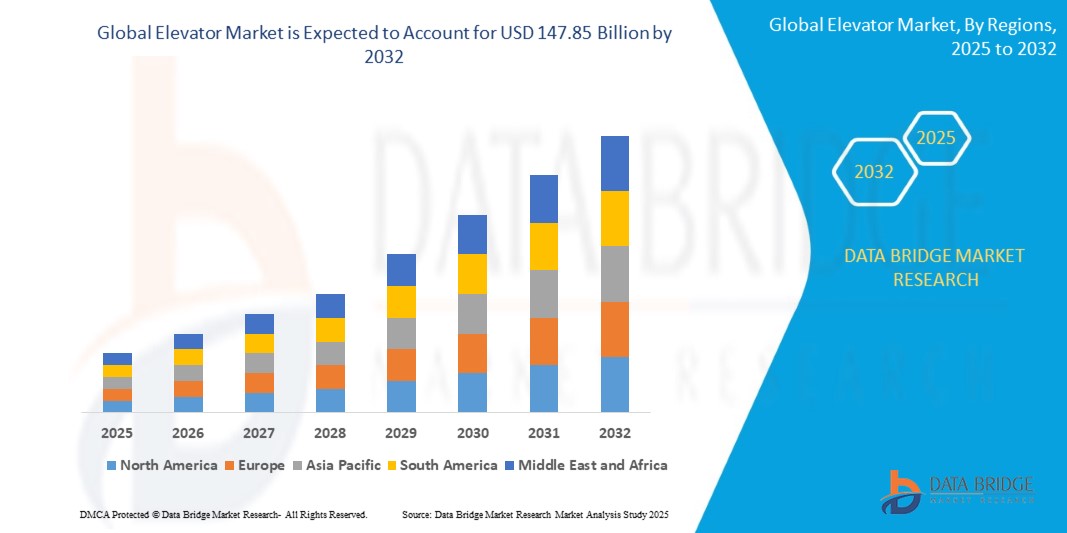

- The global elevator market size was valued at USD 81.68 billion in 2024 and is expected to reach USD 147.85 billion by 2032, at a CAGR of 7.8% during the forecast period

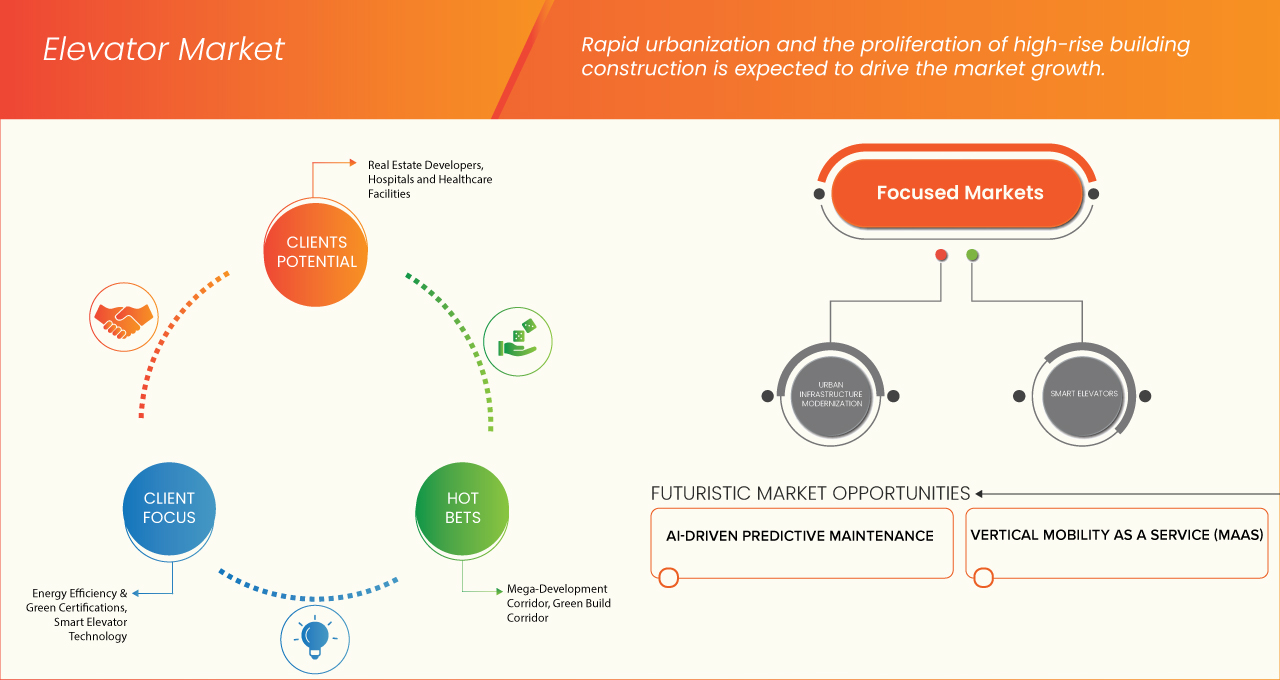

- The growth is driven by rapid urbanization and increasing construction of high-rise buildings, fueled by population growth, economic development, and government initiatives in smart city and infrastructure projects

- The integration of innovative technologies such as IoT-enabled predictive maintenance, energy-efficient systems (e.g., regenerative drives), and smart/touchless controls, along with advancements in design for enhanced safety and aesthetic appeal, is further propelling market expansion, particularly in the smart and sustainable building segments

Elevator Market Analysis

- Elevators are commercially manufactured vertical transportation systems designed for convenient movement of people and goods within multi-story buildings, offering essential accessibility and efficiency. These systems are a staple in sectors such as commercial real estate, residential complexes, hospitality, and public infrastructure, satisfying user demand for convenient, safe, and often high-tech vertical mobility solutions

- The growing demand for elevators is driven by rapid urbanization and the increasing construction of high-rise buildings and smart cities globally, providing critical infrastructure for modern living and working. This demand is further supported by innovations in elevator technology, such as IoT-enabled predictive maintenance, energy-efficient systems (e.g., regenerative drives), and smart/touchless controls, which enhance safety, efficiency, and user experience. The global push for sustainable and smart building solutions, driven by increasing awareness of energy consumption and operational efficiency, coupled with rising investments in infrastructure development in emerging economies, is significantly boosting the adoption of advanced elevator systems worldwide

- Asia-Pacific dominated the global elevator market with a commanding revenue share of 44.72% in 2024, driven by rapid urbanization, increasing construction of high-rise buildings, and significant infrastructure development. China and India, in particular, have emerged as leaders due to their massive construction activities and ongoing smart city initiatives, coupled with the presence of major industry players and their extensive manufacturing and distribution networks

- The Asia-Pacific region is expected to be the fastest growing region in the global elevator market, with a projected CAGR of 8.6% from 2025 to 2032, propelled by continued rapid urbanization, rising disposable incomes, and increasing government investments in infrastructure and smart building projects in countries such as China, India, Japan, and South Korea. The region's focus on sustainable and energy-efficient building solutions, coupled with the growing demand for modernization of existing elevator systems, is further driving demand for a diverse range of advanced elevator technologies

- Passenger Elevator segment dominated the Global elevator market with a market share of 52.36% in 2024, due to its widespread installation in high-rise residential and commercial buildings driven by rapid urbanization and infrastructure growth across developing regions

Report Scope and Elevator Market Segmentation

|

Attributes |

Elevator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Elevator Market Trends

Increasing Need for Freight and Automated Vertical Transport Systems in Warehousing and Logistics Facilities

- The rapid growth of e-commerce, third-party logistics (3PL), and automated warehouses is driving strong demand for freight elevators and vertical transport systems tailored to industrial environments

- Modern logistics centers and fulfillment hubs require robust, high-capacity elevator solutions that can handle heavy loads, operate efficiently, and integrate seamlessly with automated storage and retrieval systems (ASRS)

- In addition, the adoption of robotic and conveyor-based systems in smart warehouses is creating opportunities for elevators designed to work in tandem with AGVs (Automated Guided Vehicles) and IoT-enabled inventory systems, enabling faster and more efficient vertical movement of goods

- For instance, In April 2025, according to OTIS, as part of its automation push, Otis New Zealand integrated a service robot with its elevator systems at the Sudima Hotel in Auckland. This setup uses Otis Integrated Dispatch API to enable robots to autonomously call elevators and handle deliveries—demonstrating seamless vertical coordination between robots and elevator hardware in real-world environments

- In conclusion, the rising demand for automation and efficiency in logistics and warehousing is reshaping the global elevator market. With the integration of AGVs, service robots, and IoT-driven systems, freight elevators are evolving into smart, interconnected components of the supply chain

Elevator Market Dynamics

Driver

Rapid Urbanization and The Proliferation of High-Rise Building Construction

- Rapid urbanization and the relentless proliferation of high-rise building construction stand as the preeminent drivers of the global elevator market. This symbiotic relationship stems from the fundamental shift in how cities accommodate growing populations: by building upwards

- As urban land becomes increasingly scarce and expensive, vertical expansion becomes the most viable and efficient strategy for residential, commercial, and mixed-use development. Every new multi-story structure, from apartment complexes to towering corporate headquarters, inherently creates a demand for sophisticated vertical transportation systems

- This high-rise boom directly translates into a surging need for new elevator installations worldwide, especially in rapidly developing regions such as Asia-Pacific, where smart city initiatives and massive infrastructure projects are underway. Beyond sheer volume, the height and density of these new buildings compel innovation

- For Instance, In July 2025, According to Towards Elavator, Emerging markets—particularly in Asia, Africa, and Latin America—are experiencing a surge in elevator demand as urban populations grow and cities scale vertically. Governments and developers are investing heavily in smart city projects, transit hubs, and multi-story infrastructure, making elevators a necessity rather than a luxury

- In January 2025, According to Dezeen, Numerous high-rise buildings are slated for completion in 2025 and beyond across the globe. Projects like "The Henderson" in Hong Kong, "270 Park Avenue" in the USA, and the "China Merchants Bank Headquarters" in China (all by renowned architects) exemplify the continued Asia-Pacific push for vertical development. Many more, including Jeddah Tower (Saudi Arabia), Burj Azizi (Dubai), and various towers in China and India, are currently under construction and set to complete by 2030, each requiring extensive elevator systems

- In conclusion, rapid urbanization and the rise of high-rise buildings are key drivers of the global elevator market. As cities grow vertically, especially in emerging markets, demand for efficient, space-saving, and sustainable elevator systems continues to surge. This trend fuels constant innovation, making elevators essential to modern urban development.

Restraint/Challenge

Stringent And Evolving Safety Regulations Across Regions

- Stringent and constantly evolving safety regulations represent a significant restraint for the global elevator market. As governments and regulatory bodies around the world prioritize occupant safety, environmental compliance, and technological standards, elevator manufacturers and developers face increasing pressure to meet a wide array of complex requirements—often varying from country to country or even region to region.

- Compliance with frameworks such as EN 81 (Europe), ASME A17.1 (North America), and IS 17900 (India) demands continual updates in design, engineering, and testing practices. These standards often require advanced safety features like dual-channel controllers, redundancy systems, fire-rated components, emergency evacuation systems, seismic resistance, and accessibility compliance (such as Braille buttons and audio announcements). For smaller manufacturers and new entrants, adapting to these regulations can be cost-prohibitive due to the high R&D and certification expenses.

- Moreover, frequent regulatory changes—especially in fast-developing markets—necessitate ongoing technical adaptations and extended approval timelines. This slows down new product rollouts and increases operational costs.

- For Instance, In May 2025, According to Fox 59 News, North Carolina enacted new elevator inspection fees under House Bill 559, including annual charges of USD 200–300, a USD 1,000 reinspection fee, and revised permit structures tied to building height. These changes, along with state adoption of the ASME A17.1‑2022 code, raise operational costs and administrative burden for commercial properties and elevator service providers

- In October 2023, according to ANSI, The 2022 edition of ASME A17.1/CSA B44 introduces major changes such as cybersecurity protocols, remote monitoring capabilities, flood detection systems, hoistway lighting, and enhanced emergency radio coverage. These additions impose higher compliance and modernization costs, particularly for existing installations

- In conclusion, while evolving safety regulations are essential for ensuring user protection and system reliability, they present substantial operational and financial challenges for the global elevator industry. The constant need for technical upgrades, region-specific compliance, and investment in certifications not only increases the cost of manufacturing and maintenance but also delays product deployment. These regulatory complexities particularly impact smaller players and existing infrastructure, acting as a key restraint on market growth despite the broader industry’s push toward modernization and innovation

Elevator Market Scope

The market is segmented on the basis of type, mechanism, speed, component, deck, capacity, elevation, destination control, door type, and end-use.

- By Type

On the basis of type, the global elevator market is segmented into passenger elevators, freight elevators, hospital elevators, observation elevators, residential elevators, and others. In 2025, the passenger elevator segment is expected to dominate the global elevator market due to its widespread installation in high-rise residential and commercial buildings driven by rapid urbanization and infrastructure growth across developing regions.

The freight elevators segment is projected to be the fastest-growing segment during the forecast period, due to its due to its widespread installation in high-rise residential and commercial buildings driven by rapid urbanization and infrastructure growth across developing regions.

- By Mechanism

On the basis of mechanism, the global elevator market is segmented into machine room reduced (MRL) ELEVATORSTRACTION / cable driven elevators, hydraulic elevators, A.C. elevators, D.C. elevators and others. The traction elevator segment is expected to lead in 2025 due to its energy efficiency, superior speed range, and increasing installation in high-rise buildings, particularly in commercial and office complexes.

The traction elevator segment, is expected to witness the fastest CAGR from 2025 to 2032. This growth is attributed to its space-saving advantages, enhanced energy efficiency, and suitability for a wide range of building heights, from mid-rise to high-rise structures. These factors appeal to developers and building owners seeking sustainable and efficient vertical transportation solutions that align with modern architectural designs and operational cost savings.

- By Speed

On the basis of speed, the global elevator market is segmented into ~1.0 mps (or less), 1.5 - 2.0 mps, 2.5 - 3.0 mps, 3.5 - 4.0 mps and 5.0 mps (or more). In 2025, ~1.0 mps (or less) are projected to dominate due to their suitability in mid-rise residential and commercial buildings which represent the majority of global urban development.

The ~1.0 mps (or less) speed segment is expected to witness the fastest CAGR from 2025 to 2032, primarily driven by the continuous construction of low- and mid-rise buildings Asia-Pacificly, where these speeds are perfectly adequate and cost-effective. This segment also benefits significantly from the increasing demand for home elevators, aimed at enhancing accessibility and convenience in multi-story residences, and the ongoing modernization efforts in existing low-rise commercial and residential structures, all of which prioritize safety, comfort, and often simpler, more affordable solutions.

- By Component

On the basis of component, the global elevator market is segmented into hardware and services. The hardware segment is expected to experience the highest growth due to the increasing adoption of advanced digital control systems, IoT-based monitoring, and predictive maintenance technologies.

The hardware segment is expected to witness the fastest CAGR from 2025 to 2032 within the elevator market. This is mainly attributed to the continuous demand for new elevator installations in rapidly urbanizing areas and high-rise building construction. Furthermore, ongoing technological advancements in components like motors, control systems, and safety mechanisms are crucial, as they enhance energy efficiency, introduce smart features like IoT connectivity and AI-driven predictive maintenance, and meet evolving safety standards, all of which are essential for modern vertical transportation solutions.

- By Deck

On the basis of deck, the global elevator market is segmented into single deck and double deck. Single deck elevators are expected to hold the largest share in 2025 due to their simplicity, lower installation cost, and prevalence in most residential and mid-rise commercial buildings.

The single deck segment is projected to maintain highest CAGR in the elevator market during the forecast period. This is primarily because single-deck elevators are widely used across all building types – residential, commercial, and industrial – especially in low and mid-rise structures that constitute a significant portion of global construction. Their simpler design, lower installation costs, and flexibility in adapting to various building layouts make them a cost-effective and practical solution for a broad range of vertical transportation needs.

- By Capacity

On the basis of capacity, the global elevator market is segmented into up to 630kg (or less), 630–1050kg, 1050–1600kg, 1600–2000kg, 2000–2500kg and Over 2500kg. The 630kg (or less) segment is expected to dominate the market due to the wide installation of standard passenger elevators in mid-sized buildings. However, demand for elevators with higher capacities is rising in hospitals, malls, and airports.

The 630kg (or less) capacity segment is expected to be a rapidly growing area within the elevator market during the forecast period. This growth is predominantly driven by the surging demand for home elevators, as aging populations seek enhanced accessibility and convenience in multi-story residences.

- By Elevation

On the basis of elevation, the global elevator market is segmented into low rise elevators, mid-rise elevators and high-rise elevators. Low Rise Elevators are expected to contribute the highest market share in 2025 due to rapid urban development and the rising trend of multi-storey residential apartments and commercial offices globally.

The low-rise elevators segment is anticipated to be a highest CAGR within the elevator market during the forecast period. This is primarily fueled by increasing urbanization and robust construction activities in both residential and commercial sectors globally, particularly in developing economies, where low-rise and mid-rise buildings are prevalent. These elevators offer cost-effective and practical vertical transportation solutions for a large consumer base, aligning with the widespread demand for accessible and efficient mobility in urban and suburban developments.

- By Destination Control

On the basis of destination control, the global elevator market is segmented into conventional control and smart control. In 2025 Conventional is projected to grow at a significant pace due to its ability to optimize elevator allocation and reduce waiting times, particularly in buildings with multiple elevators and high passenger volumes.

The conventional control segment is anticipated to be the highest CAGR during the forecast period from 2025 to 2032 in the elevator market. Instead, the elevator market is seeing a strong shift towards smart elevator control systems.

- By Door Type

On the basis of door type, the global elevator market is segmented into automatic door, sliding door, manual door, swinging door and others. In 2025, The automatic door segment is expected to dominate due to safety, ease of access, and growing installation in both residential and commercial sectors. Manual doors remain prominent in low-budget or rural infrastructure projects

The automatic door segment is projected to be the fast-growing segment in the elevator market during the forecast period. This is driven by several key factors: the ongoing demand for enhanced convenience and accessibility in all types of buildings, from residential to commercial. Automatic doors offer smooth and hands-free operation, which is highly valued for user comfort and safety, particularly in high-traffic environments. Furthermore, the increasing focus on hygiene and touchless solutions, accelerated by recent global health concerns, is significantly boosting the adoption of automatic doors, as they minimize physical contact points within the elevator system.

- By End-Use

On the basis of end-use, the global elevator market is segmented into commercial, residential and industrial. The Commercial segment is anticipated to dominate the market in 2025 due to the increase in high-rise residential complexes, especially in densely populated urban regions across Asia-Pacific and the Middle East.

The commercial segment is projected to be a highest CAGR during the forecast period from 2025 to 2032 in the elevator market. This is primarily due to continued global urbanization and the rising demand for modern high-rise commercial buildings, including office spaces, shopping malls, hotels, and transportation hubs. The need for efficient vertical transportation in these high-traffic environments, coupled with the increasing adoption of smart and energy-efficient elevator systems that enhance safety and user experience, is propelling this segment's expansion.

Elevator Market Regional Analysis

- Asia-Pacific leads in growth, driven by rapid urbanization, extensive high-rise building construction, and significant government investments in smart city and infrastructure development. Countries like China and India are at the forefront of this expansion

- North America and Europe are mature markets, sustaining sales through a strong focus on modernization of existing elevator systems, integration of advanced technologies like IoT and AI for smart elevators, and adherence to stringent safety and energy efficiency regulations, despite slower overall new installation growth

- Latin America, Middle East, and Africa offer emerging growth potential, as increasing infrastructure development, particularly in commercial and residential sectors, rapid urbanization in key cities, and a rising focus on smart building technologies boost the adoption of new and technologically advanced elevator solutions

North America Elevator Market Insight

The North America elevator market held a significant share of the global market, with a value of USD 18.75 billion in 2024, and is projected to reach USD 33.14 billion by 2032, growing at a CAGR of 7.5%. This growth is primarily driven by ongoing urbanization, increasing construction of high-rise buildings in both commercial and residential sectors, and a strong emphasis on modernizing existing infrastructure. The region benefits from robust government investments in infrastructure development, pushing the demand for efficient and safe vertical transportation solutions. The adoption of advanced technologies, such as IoT-enabled predictive maintenance, energy-efficient systems, and touchless controls, is a key trend.

U.S. Elevator Market Insight

The U.S. elevator market commands a significant share, reflecting its mature real estate market and substantial investment in smart building solutions. Growth is propelled by consistent urban development, a surge in multifamily housing construction, and an aging population that necessitates improved accessibility in residential and healthcare facilities. Leading elevator manufacturers have a strong presence, actively integrating artificial intelligence and the Internet of Things for enhanced efficiency and safety. The modernization of older elevator systems, along with the increased adoption of touchless technologies, further stimulates market expansion.

Europe Elevator Market Insight

The Europe elevator market was valued at approximately USD 15.43 billion in 2024 and is estimated to grow at a CAGR of over 7.2% from 2025 to 2032. It is driven by a strong emphasis on high-rise building development, particularly in major European cities, and a growing need for energy-efficient and technologically advanced elevator systems. Countries like Germany, the United Kingdom, and France are key contributors. The market benefits from ongoing urbanization, a focus on reducing energy consumption in buildings, and increasing migration within the continent. The integration of AI for predictive maintenance and enhanced user experience is a significant trend, alongside the modernization of existing elevator and escalator systems. Housing initiatives and public transport investments, such as those by the European Investment Bank for railway projects, further boost demand.

U.K. Elevator Market Insight

The U.K. elevator market is experiencing notable growth, driven by its robust construction sector, increasing urban density, and rising demand for modernized and efficient vertical transportation solutions. The commitment to upgrading urban infrastructure, including the integration of AI for real-time data monitoring and predictive maintenance, is a key driver. Machine room-less traction elevators are particularly popular due to their space-saving and energy-efficient design, aligning with sustainable building initiatives. Large-scale infrastructure projects also contribute to the demand for advanced vertical transportation.

Germany Elevator Market Insight

The Germany elevator market is expanding due to the country's strong economy, high consumer standards for quality and sustainability in construction, and a significant aging population requiring enhanced mobility solutions. Rapid urbanization and increasing construction activities, especially in residential and commercial sectors, are driving demand. Government plans to modernize infrastructure and support new housing construction are expected to significantly boost the market. Technological advancements, such as smart elevators with IoT capabilities, energy-efficient systems, and AI-driven predictive maintenance, are transforming the industry. The trend towards sustainable and energy-efficient solutions is also highly prevalent.

Asia-Pacific Elevator Market Insight

The Asia-Pacific elevator market was valued at USD 36.52 billion in 2024 and is projected to reach USD 69.91 billion by 2030, rising at a CAGR of 8.6%. It is poised to grow at the fastest rate globally, driven by unprecedented urbanization, rising disposable incomes, and massive investments in infrastructure development across countries like China, India, and Japan. The region's market expansion is propelled by the increasing demand for high-rise buildings in both residential and commercial sectors, as well as the need for efficient vertical transportation in public infrastructure projects. Government initiatives promoting smart cities and advanced building solutions further fuel this growth.

Japan Elevator Market Insight

The Japan elevator market is gaining momentum due to the country’s advanced urban development, coupled with a strong focus on premium, high-quality, and technologically integrated products. Ongoing urbanization and an aging population requiring enhanced accessibility are key drivers. The demand for elevators and escalators is also fueled by investments in non-residential and infrastructure development. The adoption of advanced technologies for modernization, such as energy-efficient systems and smart elevators with IoT connectivity, is a significant trend. The growing tourism industry also contributes to the demand for vertical transportation in hotels and public spaces.

China Elevator Market Insight

The China elevator market commands the largest share in Asia-Pacific, driven by its immense urban population, rapid economic growth, and a significant shift towards high-rise living. The market is propelled by aggressive urbanization, large-scale infrastructure development, and increasing high-rise construction. A substantial portion of existing elevators are also aging, driving demand for modernization. The integration of smart building solutions, including AI scheduling algorithms, app-based interfaces, and cloud-based monitoring, is a major trend. Both domestic and international brands are investing heavily to capture this expanding market.

Elevator Market Share

The Elevator industry is primarily led by well-established companies, including:

- TK Elevators (Germany)

- Hitachi, Ltd. (Japan)

- Schindler (Switzerland)

- Otis Worldwide Corporation (U.S.)

- TOSHIBA CORPORATION (Japan)

- KONE Corporation (Finland)

- HYUNDAIELEVATOR CO.,LTD (South Korea)

- CANNY ELEVATOR CO.,LTD (China)

- KLEEMANN (Greece)

- Wittur (Germany)

- Fujitec Co. Ltd. (Japan)

- Cibes Lift (Sweden)

- Stannah (U.K.)

- Gulf Elevators (Saudi Arabia)

- Sodimas (France)

- American Crescent Elevator Manufacturing (U.S.)

- Mitsubishi Elevator India Pvt Ltd (India)

- Zhejiang Meilun Elevator Co., Ltd. (China)

- GEDA Original (Germany)

- Garaventa Lift (Canada)

- Schmitt + Sohn (Germany)

- Bunse-Aufzüge GmbH (Germany)

- Nationwide Lifts (U.S.)

- Stag Home Elevators LLP. (India)

- EKA (India)

- Johnsonlifts (India)

- Custom Elevator (U.S.)

- SUZHOU LG ELEVATOR CO., LTD. (China)

- Vintec Elevators (India)

- AVT Beckett (U.K.)

Latest Developments in Global Elevator Market

- In June 2025, TK Elevator has secured a major contract to supply, install, and maintain 55 Passenger Boarding Bridges (PBBs) for Kuwait International Airport’s Terminal 2 expansion (Package No. 3). The custom-designed bridges will accommodate all aircraft types and enhance passenger flow and operational efficiency. This win strengthens TKE’s presence in the Middle East and reinforces its role as a leading airport solutions provider

- In July 2025, Hitachi and QST successfully completed the prototype of the divertor outer vertical target for the ITER fusion reactor. The component passed the ITER Organization’s certification test, marking a key step toward realizing fusion energy—a promising solution to global energy and environmental challenges. This achievement highlights Japan’s innovation in high-precision thermal and structural technologies. The official approval demonstrates global confidence in Hitachi and QST’s advanced engineering capabilities

- In April 2025, Schindler awarded Surrey Langley SkyTrain elevators and escalators contract in Canada (April 4, 2024) – As part of a strategic infrastructure collaboration, Schindler will supply 29 elevators and 31 escalators for the Surrey Langley SkyTrain extension in British Columbia. This development strengthens Schindler’s presence in the North American public infrastructure sector, enhances its role in urban mobility, and reinforces its reputation as a reliable provider of vertical transportation solutions in high-demand transit systems

- In August 2024, Schindler wins The Avenues – Riyadh project, Saudi Arabia (August 13, 2024) – As part of a major infrastructure and real estate development, Schindler Olayan will supply 293 elevators, escalators, and moving walks for Phase One of The Avenues – Riyadh, a vast multi-purpose project spanning 1.8 million square meters. This development strengthens Schindler’s footprint in the Middle East, showcasing its capacity to deliver large-scale, high-performance mobility solutions for complex urban environments

- In July 2024, Otis partnered with Tatweer Misr to deliver smart vertical mobility solutions for major urban developments like Il Monte Galala, Fouka Bay, and Bloomfields in Egypt. This strategic collaboration enhances Otis’ presence in the MENA region and demonstrates its leadership in smart, sustainable elevator technologies, supporting large-scale, modern infrastructure projects.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Elevator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Elevator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Elevator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.