Global E Series Glycol Ether Market

Market Size in USD Billion

CAGR :

%

USD

2.45 Billion

USD

3.57 Billion

2024

2032

USD

2.45 Billion

USD

3.57 Billion

2024

2032

| 2025 –2032 | |

| USD 2.45 Billion | |

| USD 3.57 Billion | |

|

|

|

E-Series Glycol Ether Market Analysis

The global growth of the cosmetics industry increased by 8.2 percent in 2021 after displaying a loss of 8.1 percent in 2020, according to the L'OREAL annual report for 2021. The demand for e-series glycol ether is increasing as a result of the growth of the cosmetics and personal care sector, which is driving the market for this substance and creating significant potential opportunities for the market over the forecast period.

E-Series Glycol Ether Market Size

Global E-series glycol ether market size was valued at USD 2.45 billion in 2024 and is projected to reach USD 3.57 billion by 2032, with a CAGR of 4.8% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

E-Series Glycol Ether Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Key Market Players |

Dow (U.S.), LyondellBasell Industries N.V. (Netherlands), BASF SE (Germany), A.D.M. (U.S.), Global Bio-chem Technology Group Company Limited. (China), DuPont (U.S.), S.K.C. (South Korea), Temix Oleo (Italy), INEOS Oxide (Switzerland), Huntsman International L.l..C (U.S.), ADEKA CORPORATION (Japan), Chaoyang Chemicals, Inc. (U.S.), Manali Petrochemicals Limited (India), Haike Chemical Group Co., Ltd. (China), Arch Chemicals Inc, (U.S.), Repsol (Spain), Midland Company (U.S.), Helm AG (Germany), Shell Plc (U.K.) |

|

Market Opportunities |

|

E-Series Glycol Ether Market Definition

Alkyl ethers of propylene or ethylene glycol serve as the foundation for the family of solvents known as glycol ethers. Ethylene oxide is the raw material for e-series glycol ether, therefore the name. Mono, di, and tri-ethylene glycol ethers are possible upon attachment of repeating units of the ethylene oxide group's e-series.

E-Series Glycol Ether Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High Usage across Cosmetic and Personal Care Industry

The demand for the e-series glycol ether is booming in the cosmetic and personal care business for various uses in skin care, hair care, body care, and other areas. The global need for colour cosmetics, rising hygiene and beauty trends, and changing lifestyles are all contributing to the success of the cosmetic and personal care industry. For instance, the International Trade Administration estimates that Thailand's beauty and personal care industry will generate US$4.2 billion in revenues in 2021 and will expand at a rate of 5.5 percent through 2025. The largest share of this industry is made up of 42 percent of skincare, 12 percent of dental care, 14 percent of soaps and hygiene products, and 15 percent of hair care. The demand for e-series glycol ether is increasing as a result of the growth of the cosmetics and personal care industry, which is driving the market for this substance and creating significant growth opportunities.

- Increased Applications across Pharmaceutical Sector

In the pharmaceutical business, the e-series glycol ethers, such as ethylene glycol propyl ether (EGPE), ethylene glycol butyl ether (EGBE), and others, are in high demand for use in medications, laxatives, ointments, eye drops, and other products. Due to new medical diseases, the creation of new medications, and improvements in the infrastructure of the medical system, the pharmaceutical sector is expanding quickly. For instance, the pharmaceuticals industry in India was valued at US$42 billion in 2021 and is expected to reach US$120-US130 billion by 2030, according to the India Brand Equity Federation (IBEF). Applications of e-series glycol ether in creams, medicines, and other treatments are expanding as pharmaceutical output and expansion increase. Therefore, the industry for e-series glycol ether is being driven by and promising significant growth due to the flourishing demand from medicines.

Furthermore, growing ether usage in various industries, adoption of ether for the production of medicine extraction in the pharma industry, and increasing product demand due to their solvent strength, low volatility, and other properties are some of the factors that will likely to boost the growth of the e-series glycol ether market in the forecast period.

Opportunities

- Advancements, Research and Development and Awareness

Furthermore, the advances by the manufacturers and significant investments in research and development activities which further enhance product applications, extend profitable opportunities to the market players in the forecast period of 2025 to 2032. Additionally, the rising awareness about the benefits of e-series glycol ether will further expand the future growth of the e-series glycol ether market.

Restraints/Challenges

- Lesser Adoption due to Toxic Effects

The ethylene glycol e-series ethers are poisonous and negatively affect human health and the environment. Toxic gases are released into the atmosphere by low molecular weight ethylene glycol ethers such ethylene glycol ethyl ether (EGEE) or ethyl cellosolve and ethylene glycol methyl ether (EGME). This will further create lesser adoption for the growth of the e-series glycol ether market.

- Stringent Regulations

There are various organizations that have enacted a number of limitations and laws to limit the use of such dangerous glycol ethers. In addition, the European Union and Canada have implemented laws prohibiting the use of e-series glycol ethers in consumer goods. For instance, REACH's Annex XVII places restrictions on the harmful materials that can be found in consumer goods, such as different glycol ethers. As a result of these limitations, the market is faced with a dilemma as the demand for and applications of e-series glycol ethers are significantly impacted and slowed down. Therefore, these restrictions pose a challenge for the e-series glycol ether market growth rate.

This e-series glycol ether market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the e-series glycol ether market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

E- Series Glycol Ether Market Scope

The e-series glycol ether market is segmented on the basis of type, application and molecular weight. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Ethylene Glycol Propyl Ether (EGPE)

- Ethylene Glycol Butyl Ether (EGBE)

- Ethylene Glycol Butyl Ether Acetate (EGBEA)

- Others

Application

- Paints and Coatings

- Printing Ink

- Cleaners

- Cosmetics and Personal Care

- Pharmaceuticals

- Automotive

- Chemical Intermediates

- Others

Molecular Weight

- Low Molecular Weight E-Series Glycol Ether

- High Molecular Weight E-Series Glycol Ether

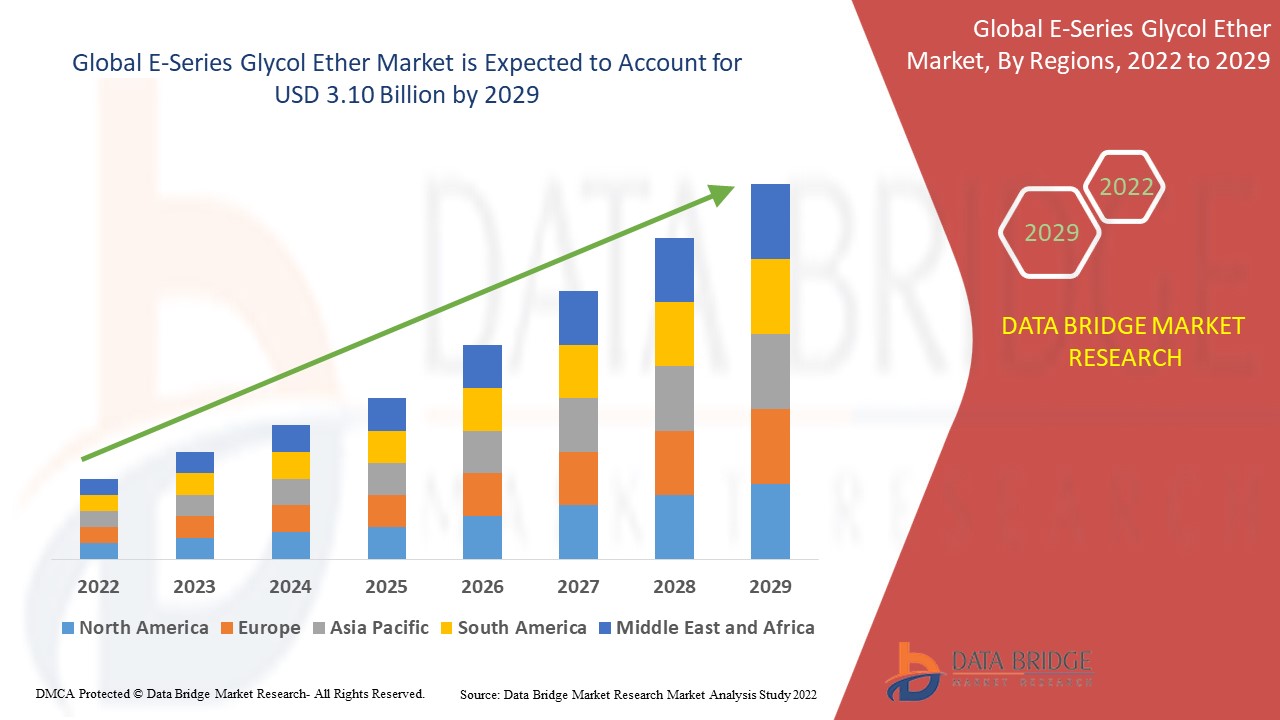

E- Series Glycol Ether Market Regional Analysis

The e-series glycol ether market is analyzed and market size insights and trends are provided by country, type, application and molecular weight as referenced above.

The countries covered in the e-series glycol ether market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2025-2032. The market growth over this region is attributed to the rising investment from various companies for the development of product within the region.

Asia-Pacific on the other hand, is estimated to show lucrative growth over the forecast period of 2025-2032, due to the increasing applications of cleaners, paints and coatings and the pharmaceuticals in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

E- Series Glycol Ether Market Share

The e-series glycol ether market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to e-series glycol ether market.

E- Series Glycol Ether Market Leaders Operating in the Market Are:

- Dow (U.S.)

- LyondellBasell Industries N.V. (Netherlands)

- BASF SE (Germany)

- A.D.M. (U.S.)

- Global Bio-chem Technology Group Company Limited. (China)

- DuPont (U.S.)

- S.K.C. (South Korea)

- Temix Oleo (Italy)

- INEOS Oxide (Switzerland)

- Huntsman International L.L.C (U.S.)

- ADEKA CORPORATION (Japan)

- Chaoyang Chemicals, Inc. (U.S.)

- Manali Petrochemicals Limited (India)

- Haike Chemical Group Co., Ltd. (China)

- Arch Chemicals Inc, (U.S.)

- Repsol (Spain)

- Helm AG (Germany)

- Shell Plc (U.K.)

Latest Developments in E- Series Glycol Ether Market

- In July 2021, India Glycols and Clariant established a new joint venture, with I.G.L. owning a 49 percent ownership and Clariant holding a 51 percent stake. The project aimed to increase production of green and other ethylene oxide derivatives, opening up new market opportunities.

- In November 2021, The Jubail United Petrochemical Company's ethylene glycol plant-3 has begun production, according to a SABIC announcement. The new facility employs cutting-edge technology, lowers emissions, and provides market sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global E Series Glycol Ether Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global E Series Glycol Ether Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global E Series Glycol Ether Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.