Global Dynamic Positioning Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.91 Billion

USD

2.54 Billion

2024

2032

USD

1.91 Billion

USD

2.54 Billion

2024

2032

| 2025 –2032 | |

| USD 1.91 Billion | |

| USD 2.54 Billion | |

|

|

|

|

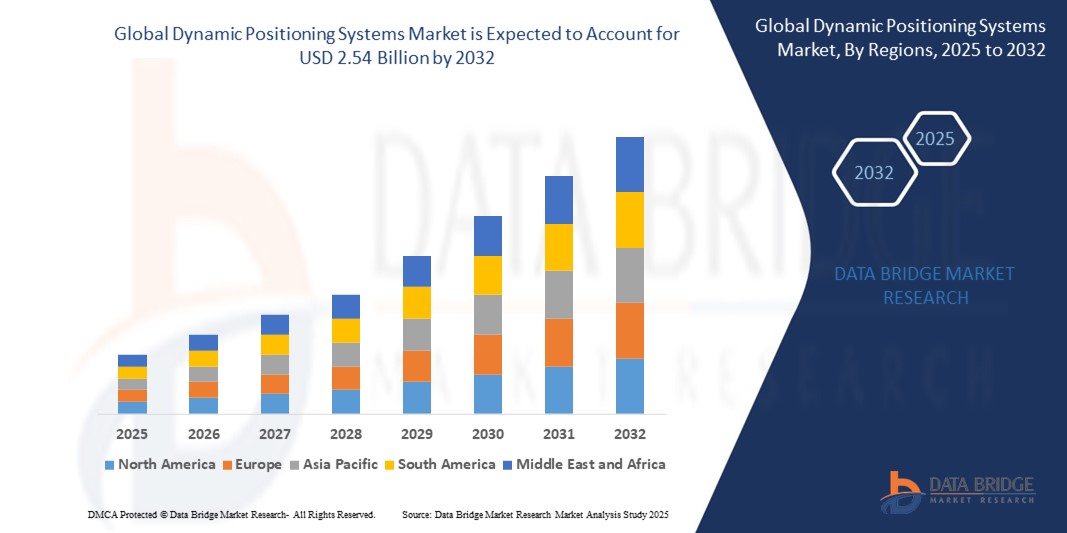

What is the Global Dynamic Positioning Systems Market Size and Growth Rate?

- The global dynamic positioning systems market size was valued at USD 1.91 billion in 2024 and is expected to reach USD 2.54 billion by 2032, at a CAGR of 3.60% during the forecast period

- The dynamic positioning systems (DPS) market is experiencing significant growth due to the increasing demand for offshore exploration, drilling, and construction activities in the oil and gas, renewable energy, and maritime sectors. With the rise in deep-water and ultra-deep-water exploration, the need for precise vessel positioning systems has become critical, driving the adoption of DPS technology

- The market is further fueled by advancements in automation and sensor technologies, enabling more accurate and reliable positioning control. In addition, the growth of offshore wind farms and subsea construction projects contributes to the increasing demand for dynamic positioning systems, as they provide the stability required for these complex operations

What are the Major Takeaways of Dynamic Positioning Systems Market?

- The maritime industry is placing an increasingly strong emphasis on safety, particularly in offshore operations and challenging environments where risks are heightened. This focus on safety stems from the need to mitigate accidents and operational hazards that can arise from unpredictable weather conditions, strong currents, and other environmental factors. As a result, there is a notable increase in the adoption of dynamic positioning systems (DPS) across the sector

- These systems are designed to enhance the stability and precision of vessel positioning, reducing the such aslihood of accidents and ensuring safe operations. The growing awareness of safety regulations and the potential for severe consequences from operational failures have driven maritime operators to invest in advanced DPS technology

- North America dominated the dynamic positioning systems market with the largest revenue share of 37.5% in 2024, driven by the region's robust offshore oil & gas industry, advanced maritime technologies, and presence of key industry players

- Asia-Pacific dynamic positioning systems market is projected to grow at the fastest CAGR of 11.47% during 2025–2032, fueled by growing investments in port infrastructure, rising seaborne trade, and the development of offshore energy projects in emerging economies

- The Conventional segment dominated the dynamic positioning systems market with the largest revenue share of 58.4% in 2024, owing to its wide-scale adoption across offshore drilling, marine research, and commercial shipping operations

Report Scope and Dynamic Positioning Systems Market Segmentation

|

Attributes |

Dynamic Positioning Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Dynamic Positioning Systems Market?

“AI-Driven Autonomy and Predictive Navigation”

- A major evolving trend in the dynamic positioning systems (DPS) market is the integration of artificial intelligence (AI) and machine learning (ML) to enable predictive navigation and autonomous station-keeping in dynamic maritime conditions

- AI-enhanced DPS enables vessels to anticipate environmental shifts, optimize thruster use, and enhance fuel efficiency. For instance, ABB’s Ability™ Marine Pilot Control utilizes AI algorithms to improve vessel maneuverability and reduce operator workload during complex operations

- Predictive positioning algorithms also enhance safety by forecasting potential drift or collisions based on sensor fusion, allowing preemptive corrective action. Companies such as Kongsberg Maritime are leveraging AI to develop systems that adapt in real-time to changing wind, wave, and current conditions

- Integration with digital twins and real-time simulation is also gaining traction, enabling proactive fault detection and performance optimization. Wärtsilä, for instance, is deploying AI-backed DPS platforms integrated with its Smart Marine Ecosystem strategy

- As maritime industries face stricter efficiency and safety requirements, the convergence of AI with DPS is becoming critical for autonomous shipping, particularly for offshore drilling, research vessels, and defense applications

- This shift is accelerating the demand for intelligent DPS solutions, transforming them from reactive control systems to predictive navigational intelligence platforms that redefine how vessels operate in challenging sea environments

What are the Key Drivers of Dynamic Positioning Systems Market?

- Rising offshore exploration and production activities, coupled with the global push for autonomous marine operations, are major demand drivers for dynamic positioning systems

- For instance, in January 2024, Kongsberg Maritime secured a contract to deliver advanced DPS solutions for a new class of autonomous offshore wind service vessels in Europe, supporting the shift toward unmanned and sustainable maritime operations

- Increasing investments in offshore renewable energy projects, such as wind farms and subsea construction, require precision station-keeping, bolstering the need for advanced DPS technologies

- The commercial shipping industry is also embracing DPS for safety, fuel optimization, and regulatory compliance, especially in high-risk waters where manual positioning is insufficient

- In addition, evolving IMO (International Maritime Organization) regulations and growing preference for hybrid propulsion systems are encouraging integration of energy-efficient DPS that reduce fuel consumption and emissions

Which Factor is challenging the Growth of the Dynamic Positioning Systems Market?

- The high capital and maintenance costs associated with dynamic positioning systems present a notable barrier, particularly for small and medium-sized operators in developing economies

- For instance, a full-fledged Class 3 DPS installation can significantly increase vessel costs, limiting its adoption in non-critical applications such as regional cargo or fishing fleets

- In addition, system complexity and crew training requirements act as bottlenecks. Operators must be certified and trained to manage DPS software and respond to failures, increasing the dependency on skilled personnel

- The potential for software failure, signal interference, or sensor drift also raises concerns about system reliability, especially in harsh or congested environments where GPS and motion references may be unstable

- Overcoming these challenges through modular DPS designs, affordable retrofit solutions, and AI-based fault-tolerant systems will be essential for broader market adoption and long-term success

How is the Dynamic Positioning Systems Market Segmented?

The market is segmented on the basis of type, equipment type, sub-systems, application, and end user.

- By Type

On the basis of type, the dynamic positioning systems market is segmented into Conventional and Next-Generation. The Conventional segment dominated the dynamic positioning systems market with the largest revenue share of 58.4% in 2024, owing to its wide-scale adoption across offshore drilling, marine research, and commercial shipping operations. These systems are well-established, cost-effective, and proven in high-demand maritime conditions, especially for station-keeping and low-autonomy tasks.

The Next-Generation segment is anticipated to witness the fastest growth rate of 23.6% from 2025 to 2032, driven by the increasing integration of AI, IoT, and predictive navigation technologies. These smart systems offer enhanced redundancy, better fuel efficiency, and support autonomous and remote operations—ideal for modern offshore energy platforms and defense vessels.

- By Equipment Type

On the basis of equipment type, the market is segmented into Class 1, Class 2, and Class 3. The Class 2 segment held the largest market share of 46.2% in 2024, due to its robust fault-tolerant features, making it suitable for offshore supply vessels and dynamic environments where redundancy is critical. Class 2 systems are often mandated for operations involving human presence in hazardous zones.

The Class 3 segment is expected to register the fastest CAGR over the forecast period, supported by increased demand for ultra-reliable systems in deep-water drilling, FPSO units, and defense operations where loss of position could result in catastrophic consequences.

- By Sub-Systems

On the basis of sub-systems, the dynamic positioning systems market is segmented into Position Reference and Tracking Systems, Power Systems, Motors and Drives, and DP Control Systems. The DP Control Systems segment dominated with the highest revenue share of 34.9% in 2024, driven by the increasing need for advanced control algorithms that can respond to real-time environmental inputs and vessel movements. These systems act as the brain of the entire DP setup, ensuring coordinated thruster responses.

The Position Reference and Tracking Systems segment is projected to witness the fastest growth rate, owing to advancements in GNSS, radar, laser-based systems, and underwater acoustic technologies that provide precise location data for enhanced DP performance.

- By Application

On the basis of application, the market is segmented into Commercial and Military. The Commercial segment accounted for the largest market revenue share of 64.1% in 2024, led by the growing number of offshore wind farms, oil exploration platforms, survey vessels, and subsea construction vessels requiring precise station-keeping capabilities.

The Military segment is expected to grow at a notable CAGR from 2025 to 2032, with rising investment in naval modernization, unmanned surface vessels, and submarine support requiring autonomous dynamic positioning capabilities.

- By End User

On the basis of end user, the market is segmented into OEM and Retrofit. The OEM segment dominated with the largest market share of 57.5% in 2024, as newbuild vessels are increasingly equipped with integrated DP systems to meet evolving regulatory and safety standards from the outset.

The Retrofit segment is expected to grow rapidly during the forecast period, driven by the demand for upgrading legacy vessels to meet IMO compliance, efficiency targets, and remote operation capabilities. Retrofit solutions also cater to budget-sensitive operators looking for partial system enhancement instead of full system replacements.

Which Region Holds the Largest Share of the Dynamic Positioning Systems Market?

- North America dominated the dynamic positioning systems market with the largest revenue share of 37.5% in 2024, driven by the region's robust offshore oil & gas industry, advanced maritime technologies, and presence of key industry players

- The U.S., in particular, leads due to increased investment in offshore exploration and naval defense modernization programs that require high-precision vessel control systems

- In addition, North America's focus on maritime safety regulations and technological integration across commercial vessels contributes significantly to the adoption of Dynamic Positioning (DP) solutions

U.S. Dynamic Positioning Systems Market Insight

The U.S. market dominaited North America's revenue share in 2024, propelled by its expansive offshore energy activities in the Gulf of Mexico and a strong naval fleet modernization strategy. The adoption of autonomous and semi-autonomous ships by both defense and commercial sectors further strengthens market demand. Government funding for marine robotics and increased integration of DP systems in offshore wind farm installations also boost the market's momentum.

Europe Dynamic Positioning Systems Market Insight

Europe is witnessing strong growth driven by a growing emphasis on sustainable marine operations and offshore wind energy projects, particularly in the North Sea region. Countries such as Norway, the U.K., and the Netherlands are heavily investing in next-gen DP-enabled vessels to support renewable energy exploration. In addition, stringent IMO regulations and the focus on reducing emissions enhance the demand for efficient vessel positioning systems.

U.K. Dynamic Positioning Systems Market Insight

The U.K. market is set to grow at a steady CAGR as the nation continues to develop offshore wind infrastructure and strengthen naval capabilities. Investments in shipbuilding for the defense sector, coupled with the integration of AI-powered DP systems in maritime operations, are key contributors. The U.K.’s maritime innovation hubs and ship retrofit programs further support the adoption of DP systems.

Germany Dynamic Positioning Systems Market Insight

Germany's DP systems market is driven by its leadership in maritime engineering and automation. As a manufacturing and logistics hub, Germany sees rising demand from the commercial shipping sector. Smart vessel integration and government initiatives promoting digital shipping operations are key growth drivers. German ports and shipbuilders increasingly utilize DP-enabled systems for efficient harbor maneuvering and cargo handling.

Which Region is the Fastest Growing Region in the Dynamic Positioning Systems Market?

Asia-Pacific dynamic positioning systems market is projected to grow at the fastest CAGR of 11.47% during 2025–2032, fueled by growing investments in port infrastructure, rising seaborne trade, and the development of offshore energy projects in emerging economies. Countries such as China, Japan, South Korea, and India are leading this growth due to increasing demand for efficient maritime logistics and naval capabilities.

Japan Dynamic Positioning Systems Market Insight

Japan’s market is advancing rapidly due to its strong maritime sector, cutting-edge automation, and growing emphasis on marine safety. With government-led digital transformation initiatives in shipping and a rise in offshore LNG terminal developments, the demand for DP systems continues to surge. Japanese shipbuilders are also integrating DP technology in modern vessels to enhance operational precision and reduce crew dependency.

China Dynamic Positioning Systems Market Insight

China led the Asia-Pacific market revenue share in 2024, driven by the nation’s dominant shipbuilding industry, offshore oil & gas projects in the Bohai Bay and South China Sea, and strategic military naval expansion. In addition, government initiatives under the "Belt and Road Maritime Silk Road" and investment in autonomous shipping technologies propel the demand for DP systems across multiple sectors.

Which are the Top Companies in Dynamic Positioning Systems Market?

The dynamic positioning systems industry is primarily led by well-established companies, including:

- Kongsberg Maritime (Norway)

- ABB (Switzerland)

- General Electric (U.S.)

- Wärtsilä (Finland)

- Rolls-Royce plc (U.K.)

- L3Harris Technologies, Inc. (U.S.)

- Marine Technologies, LLC (U.S.)

- Praxis Automation Technology B.V. (Netherlands)

- Raytheon Anschütz (Germany)

- VERIPOS (U.K.)

What are the Recent Developments in Global Dynamic Positioning Systems Market?

- In May 2024, Seadrill confirmed its commitment to expand its fleet with the addition of two next-generation drillships, incorporating advanced dynamic positioning systems and other modern technologies aimed at optimizing offshore drilling operations. This move aligns with the company’s strategy to meet rising global demand for deepwater exploration, reinforcing its competitive position in the offshore oil and gas sector

- In April 2024, Royal IHC announced a contract agreement with Eastern Shipbuilding Group (ESG) to build a state-of-the-art medium-class hopper dredge for the United States Army Corps of Engineers (USACE), featuring integrated dynamic positioning, tracking, sonar, and dredging assist systems. This partnership highlights both firms' commitment to enhancing maritime automation and U.S. dredging capabilities

- In January 2024, MarineTech Solutions introduced a dynamic positioning system powered by IoT and big data analytics on its latest fleet, enabling real-time data monitoring, predictive maintenance, and enhanced navigational accuracy. This implementation marks a significant leap in maritime digital transformation and operational excellence

- In August 2023, Elcome International acquired a majority stake in Fabio Fiorucci, an Italian navigation systems firm, aiming to expand its solutions portfolio and strengthen its presence in the Mediterranean region. This strategic move enhances Elcome’s service reach across key maritime hubs including Spain, Portugal, and the Suez

- In August 2023, Navis Engineering OY successfully completed sea trials for its new NavDP4000 dynamic positioning control system on Orange Marine’s advanced cable laying vessel, showcasing improved capabilities in maritime positioning and operational sustainability. This trial signifies the company’s leadership in eco-efficient marine technology development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.