Global Dosage Cups Market

Market Size in USD Million

CAGR :

%

USD

885.30 Million

USD

1,555.56 Million

2024

2032

USD

885.30 Million

USD

1,555.56 Million

2024

2032

| 2025 –2032 | |

| USD 885.30 Million | |

| USD 1,555.56 Million | |

|

|

|

|

Dosage Cups Market Size

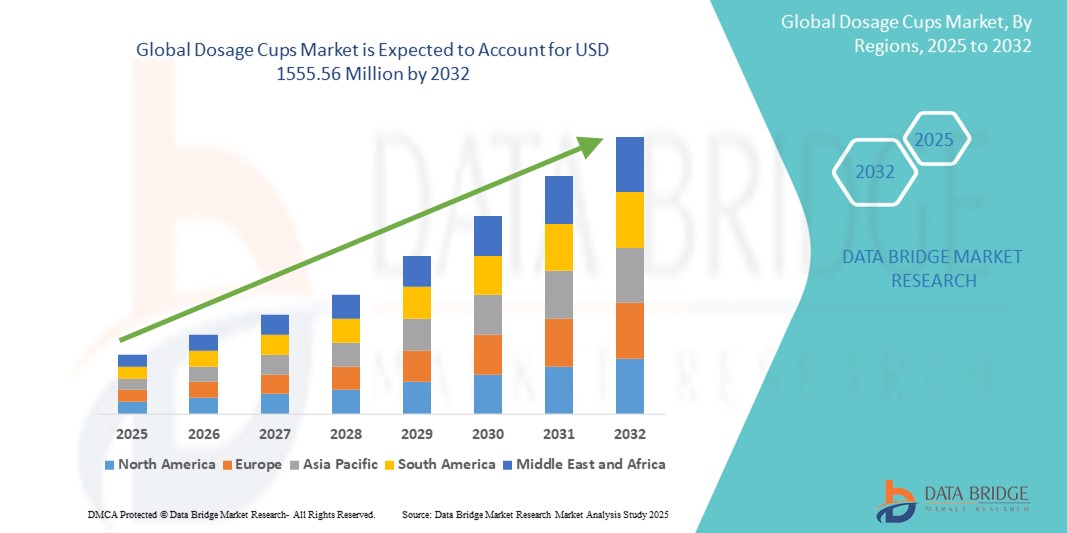

- The global dosage cups market size was valued at USD 885.30 million in 2024 and is expected to reach USD 1,555.56 million by 2032, at a CAGR of 7.30% during the forecast period

- This growth is driven by high demand for dosage cups due to increasing regulatory emphasis on patient safety

Dosage Cups Market Analysis

- There is a growing demand for reusable dosage cups due to their cost-effectiveness, environmental benefits, and the increasing emphasis on sustainability in healthcare packaging

- The expanding healthcare infrastructure and the rise in home healthcare solutions are driving the demand for easy-to-use, reliable dosage cups, especially for self-administered treatments and chronic disease management

- North America is expected to dominate the dosage cups market, supported by its advanced healthcare infrastructure, high pharmaceutical consumption, and regulatory standards ensuring precise drug delivery

- Asia-Pacific is projected to register the highest growth rate in the dosage cups market due to increasing healthcare investments, rapid urbanization, and growing awareness of medication safety in emerging markets

- The reusable segment is expected to dominate the material segment with the largest market share of 81.55%, due to the growing preference among end users for reusable dosage cups, driven by their cost-efficiency and environmentally friendly, recyclable properties

Report Scope and Dosage Cups Market Segmentation

|

Attributes |

Dosage Cups Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dosage Cups Market Trends

“Rising Demand for Eco-friendly and Reusable Dosage Cups”

- A growing trend in the dosage cups market is the shift towards eco-friendly and reusable dosage cups, driven by increasing environmental concerns and the need for sustainable healthcare practices. These reusable cups help reduce plastic waste and are gaining popularity in hospitals, pharmacies, and households

- Consumers and healthcare providers are increasingly opting for dosage cups made from biodegradable materials or recyclable plastics, aligning with the global push for sustainability in healthcare packaging

- This trend is in line with the rising awareness of reducing the environmental impact of medical products, as well as the demand for more cost-effective solutions in healthcare settings

- For instance, in 2024, Yasharyn Packaging Pvt. Ltd. introduced biodegradable dosage cups, providing a more sustainable alternative to conventional plastic cups in the healthcare market

- The growing preference for eco-friendly products is expected to expand the market for sustainable dosage cups, especially in environmentally-conscious regions

Dosage Cups Market Dynamics

Driver

“Rising Demand for Home Healthcare Solutions”

- The increasing adoption of home healthcare services is significantly driving the demand for dosage cups, as patients now require precise and convenient ways to administer medication at home

- With the aging population and the growing prevalence of chronic diseases, home healthcare solutions are becoming more mainstream, leading to higher usage of self-administered medication tools, including dosage cups

- The convenience and accessibility of dosage cups in home care settings further promote their use, as patients can easily measure and manage their medication dosages

- For instance, in 2023, Medline Industries, Inc. launched a range of specialized dosage cups designed for home healthcare patients, providing easy-to-use solutions for medication management at home

- The growing demand for home healthcare is expected to propel the market for dosage cups, offering long-term growth opportunities in this segment

Opportunity

“Technological Integration for Enhanced Dosage Precision”

- The integration of technologies such as digital measurement and smart features into dosage cups presents a significant opportunity to enhance the accuracy and precision of medication administration.

- Smart dosage cups equipped with sensors can offer real-time feedback on medication volume, ensuring better adherence to prescribed dosages, especially for patients with complex medication regimens

- This technological advancement is ideal for the growing trend of personalized medicine and patient-centered care, where accurate drug dosage is critical

- For instance, in 2024, Origin Pharma Packaging introduced smart dosage cups that integrate digital sensors to measure and track the volume of liquid medication administered, ensuring accurate dosing for patients

- The convergence of technology and dosage cup design is expected to drive market growth by offering more reliable and efficient solutions for medication management

Restraint/Challenge

“High Cost of Advanced Materials and Manufacturing”

- One of the key challenges facing the dosage cups market is the high cost associated with the development of specialized dosage cups using advanced materials and manufacturing techniques

- Materials such as biodegradable plastics or high-quality polymers can be expensive, and the manufacturing processes often require specialized equipment and expertise, which can increase production costs

- This can create a barrier for smaller manufacturers and companies in emerging markets that are looking to enter the dosage cups market but face challenges in producing cost-effective solutions

- For instance, in 2023, The Adelphi Group of Companies faced delays in scaling production of its eco-friendly dosage cups due to the high cost of sustainable materials and challenges in optimizing manufacturing processes

- Overcoming these cost-related challenges will be critical for achieving widespread adoption of innovative and sustainable dosage cups, especially in price-sensitive markets

Dosage Cups Market Scope

The market is segmented on the basis of type, product type, capacity, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product Type |

|

|

By Capacity |

|

|

By End User |

|

In 2025, the reusable is projected to dominate the market with a largest share in type segment

The reusable segment is expected to dominate the dosage cups market with the largest market share of 81.55% in 2025, due to the growing preference among end users for reusable dosage cups, driven by their cost-efficiency and environmentally friendly, recyclable properties.

The hospital is expected to account for the largest share during the forecast period in end user segment

In 2025, the hospital segment is expected to dominate the market with the largest market share of 41.25% due to high volume of medication administration, necessitating accurate and reliable dosing tools like dosage cups. The increasing number of hospital admissions and the expansion of healthcare infrastructure, especially in developing regions, further bolster this demand.

Dosage Cups Market Regional Analysis

“North America Holds the Largest Share in the Dosage Cups Market”

- North America is expected to dominate the global dosage cups market, driven by the widespread use of unit-dose packaging, increasing demand for patient-centric drug delivery, and the presence of major pharmaceutical and healthcare packaging companies

- The U.S. dominates the region due to advanced healthcare infrastructure, stringent dosage accuracy regulations, and a strong focus on reducing medication errors

- Continuous innovation in drug packaging technologies, rising chronic disease prevalence, and investments in sustainable medical packaging are expected to reinforce North America's dominance throughout the forecast period

“Asia-Pacific is Projected to Register the Highest CAGR in the Dosage Cups Market”

- Asia-Pacific is expected to experience the highest compound annual growth rate (CAGR) in the Dosage Cups market, driven by increasing access to healthcare services, growing pharmaceutical manufacturing capabilities, and rising public health awareness

- Countries such as China, India, and Japan are key growth engines, with government-led programs such as “Ayushman Bharat” and “Made in China 2025” encouraging local production of affordable and precise drug delivery solutions, including dosage cups

- Rapid urbanization, growing middle-class populations, and increasing preference for home-based healthcare are accelerating demand for disposable and reusable dosage cups across the region

Dosage Cups Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Comar (U.S.)

- Qosina (U.S.)

- Lyne Laboratories (U.S.)

- O.BERK (U.S.)

- Healthmark (U.S.)

- Origin Pharma Packaging (U.K.)

- Eastman Chemical Company (U.S.)

- Medline Industries, Inc. (U.S.)

- Yasharyn Packaging Pvt. Ltd (India)

- THE ADELPHI GROUP OF COMPANIES (U.K.)

- gpcmedical (India)

- Rutvik Pharma (India)

- PRABHOTI PLASTIC INDUSTRIES (India)

- ALPLA (Austria)

- Mikart LLC (U.S.)

- GA2 (Malaysia)

- Farmmash (Ukraine)

- SGH Medical Pharma (India)

- Gramß GmbH Kunststoffverarbeitung (Germany)

Latest Developments in Global Dosage Cups Market

- In February 2022, Automatic Plastics Ltd. was acquired by Comar LLC, enhancing Comar’s manufacturing strength in medical device and pharmaceutical packaging. This acquisition is expected to significantly expand Comar’s production capabilities and market presence across the healthcare packaging sector

- In December 2021, H&T Presspart Manufacturing Ltd. partnered with BIOCORP, a France-based medical device company, to develop TM digital technology—a smart sensor that transforms traditional inhalers into connected devices to support asthma treatment. This collaboration aims to improve medication adherence and digital integration in respiratory care

- In January 2020, LLC Farmmash began manufacturing the SD-15 dosing cup, which features the option of a child-resistant cap for enhanced safety. This innovation supports secure dosing solutions in pediatric and family healthcare settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.