Global Dog Food Market

Market Size in USD Billion

CAGR :

%

USD

71.24 Billion

USD

100.16 Billion

2024

2032

USD

71.24 Billion

USD

100.16 Billion

2024

2032

| 2025 –2032 | |

| USD 71.24 Billion | |

| USD 100.16 Billion | |

|

|

|

|

Dog Food Market Analysis

According to the American pet products association's (APPA) 2019-2020 national pet owners survey, most US homes (about 84.9 million families) have a pet, with dogs accounting for most of pet ownership. In recent years, the nation has spent more money on dogs. The rising demand for healthy and nourishing pet foods across the nation is a result of pet owners' growing health concerns. For instance, Wild Earth Inc., a startup in the United States, introduced the first line of high-protein, meat-free dog food in the industry. The demand for dog food has also increased as more dog shelters are in the area to help stray dogs.

Dog Food Market Size

Global dog food market size was valued at USD 71.24 billion in 2024 and is projected to reach USD 100.16 billion by 2032, with a CAGR of 4.35% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Dog Food Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Hill's Pet Nutrition, Inc (U.S.), The J.M. Smucker Company (U.S.), Diamond Pet Foods, Inc. (Part of Schell & Kampeter, Inc.) (U.S.), Heristo Aktiengesellschaft (Germany), Simmon Pet Food, Inc. (U.S.), WellPet, LLC (U.S.), The Farmers Dog, Inc. (U.S.), Jinx, Inc. (U.S.), JustFoodForDogs, LLC (U.S.), Ollie Pets Inc. (U.S.), Farmina Pet Foods Holding B.V. (Netherlands), and NomNomNow, Inc. (Philippines) |

|

Market Opportunities |

|

Dog Food Market Definition

Dog food is food that has been prepared especially for dogs and other canines. Dogs are regarded as omnivores with a preference for carnivorous foods. They are obligate carnivores like cats, lacking the ten genes responsible for starch and glucose digestion and the ability to produce amylase, an enzyme that works to break down carbohydrates into simple sugars. However, they have the sharp, pointed teeth and shorter gastrointestinal tracts of carnivores, better suited for meat consumption than vegetable substances. Dogs developed the ability to coexist with humans in agricultural communities because they survived on human waste and dung. The capacity of dogs to digest carbohydrates readily may be a crucial distinction between dogs and wolves. Dogs have evolved over thousands of years to exist on the meat and non-meat scraps and leftovers of human life and flourish on a variety of diets. By 2022, the dog food business in the United States is anticipated to be worth USD 23.3 billion.

Dog Food Market Dynamics

Drivers

- Increasing dog adoption

Demand for the product is anticipated to rise as the practise of adopting dogs as household pets becomes more widespread. The idea of "humanising" pets is gaining popularity, and dogs in particular are seeing this trend. Dog ownership has increased as a result, and more individuals are feeding their pets healthy food. Increasing urbanisation is also one of the market's main drivers.

- Increasing trend of Pet Humanization

Over the past ten years, pet ownership has grown globally, and this trend is expected to continue. The american pet products association reports that the United States has the world's greatest dog population with 69.9 million dogs being kept as family pets in 2019–2020. The most popular breeds among pet owners in Europe in recent years were labrador retrievers, german shepherds, golden retrievers, french bulldogs, and bulldogs. These breeds are more popular than other dog varieties, it is projected that the various dog diets and treats created especially for them would improve pet food sales.

- Increased consumer knowledge

Dog weight maintenance and improvement have received more attention as a result of increased consumer knowledge of pet health. Customers select from a selection of foods and give product brands a high priority. The goal of producers is to expand into the market for upscale dog food and raise their overall profit margin.

Opportunities

The dog food market's growth is fuelled by rising pet dog population all over the world, along with increasing concerns of owners regarding pet health. This will provide beneficial opportunities for the dog food market growth.

Restraints/Challenges

- High price of products

Dog food products are available at a higher cost in retail and online stores. As a result, the lower class income group cannot afford these products.

This dog food market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the dog food market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Dog Food Market Scope

The dog food market is segmented on the basis of product, pricing, ingredient, application and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Dry Dog Food

- Dog Treats

- Wet Dog Food

Pricing

- Premium Products

- Mass Products

Ingredient

- Animal Derived

- Plant Derived

Application

- Adult Dog

- Puppy

Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

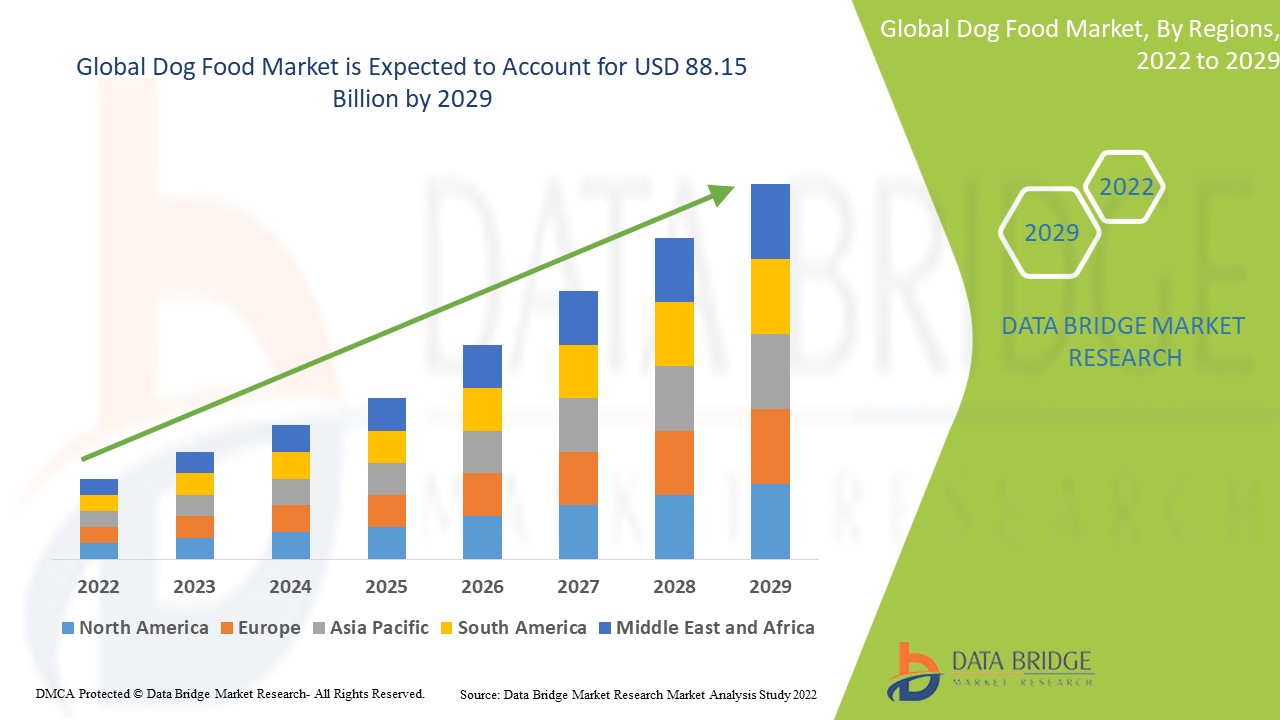

Dog Food Market Regional Analysis

The dog food market is analyzed and market size insights and trends are provided by country, product, pricing, ingredient, application and distribution channel as referenced above.

The countries covered in the dog food market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the dog food market due to the rising consumer awareness about the positive impact on pet health, as well as the growing trend of humanization of pets, is driving regional demand for dog food.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2025 to 2032 due to the owing to rising disposable income among middle class population groups coupled with rapid urbanization.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Dog Food Market Share

The dog food market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to dog food market.

Dog Food Market Leaders Operating in the Market Are:

- Canidae (U.S.)

- Natural Dog food company (U.K.)

- Colgate-Palmolive Company (U.S.)

- Del Monte Foods Inc. (U.S.)

- Royal Canin (France)

- Hill's Pet Nutrition, Inc.(U.S.)

- The J.M. Smucker Company (U.S.)

- Diamond Pet Foods, Inc. (U.S.)

- Heristo Aktiengesellschaft (Germany)

- Simmon Pet Food, Inc. (U.S.)

- WellPet, LLC (U.S.)

- The Farmers Dog, Inc. (U.S.)

- Jinx, Inc. (U.S.)

- JustFoodForDogs, LLC (U.S.)

- Ollie Pets Inc. (U.S.)

- Farmina Pet Foods Holding B.V. (Netherlands)

- NomNomNow, Inc. (Philippines)

Latest Developments in Dog Food Market

- In June 2021, The KARMA plant-first recipes were the newest additions to Mars Inc.'s line of dog foods when they were introduced. Flaxseed, chickpeas, dried coconut, chia seeds, dried pumpkin, kale, and other plant-based superfoods are used in the KARMA meals, which are also complemented with real chicken or white fish.

- In July 2021, the production facility for Nestlé Purina PetCare Co.'s pet care products in King William County, Virginia, US, received a USD 182 million investment. A 138,000 square foot buildout will be part of the plant expansion, which is expected to be finished by the end of 2023 and will boost the company's ability to produce Tidy Cat litter products.

- In June 2021, Mars Inc. expanded its product line in India by introducing wet cat food under the Whiskas brand. Pet shops, grocery stores, and online shopping sites all carry the new product line.

- In June 2021, A 25,000 square foot nutrition innovation centre for pets was inaugurated by Hill's Pet Nutrition in the US. This facility would give the business the ability to create cutting-edge goods specifically for little and miniature canines.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.