Global Distributed Fiber Optic Sensor Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

3.58 Billion

2024

2032

USD

1.35 Billion

USD

3.58 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 3.58 Billion | |

|

|

|

|

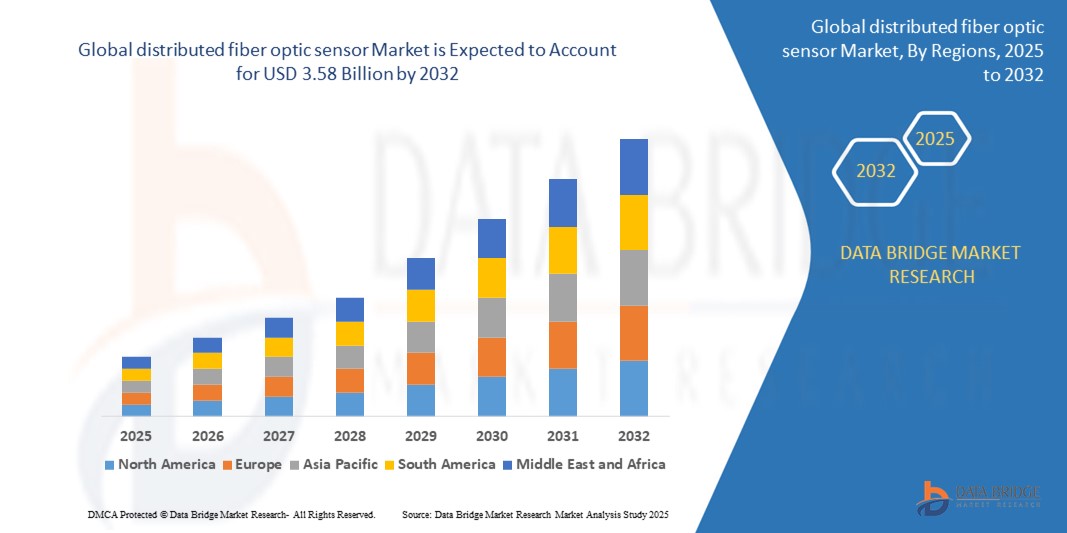

What is the Global distributed fiber optic sensor Market Size and Growth Rate?

- The global distributed fiber optic sensor market size was valued at USD 1.35 billion in 2024 and is expected to reach USD 3.58 billion by 2032, at a CAGR of 12.94% during the forecast period

- The distributed fiber optic sensor market is experiencing remarkable growth fueled by advancements in technology. Innovations such as Rayleigh scattering-based systems and Brillouin scattering techniques are enhancing sensing capabilities

- Industries are increasingly utilizing these sensors for structural health monitoring, oil and gas exploration, and environmental monitoring. This market's trajectory showcases a promising future driven by the latest methods and technologies

What are the Major Takeaways of Distributed Fiber Optic Sensor Market?

- The escalating need for infrastructure safety fuels the adoption of distributed fiber optic sensors, ensuring continuous monitoring of critical assets such as pipelines, bridges, and tunnels

- For instance, in pipeline monitoring, these sensors detect abnormalities such as leaks or structural weaknesses in real-time, enabling prompt interventions to prevent accidents and environmental hazards. This demand surge underscores the pivotal role of distributed fiber optic sensors in safeguarding vital infrastructure worldwide

- North America dominated the distributed fiber optic sensor market with the largest revenue share of 36.12% in 2024, attributed to growing industrial automation, enhanced oilfield monitoring, and security surveillance needs

- Asia-Pacific is projected to grow at the fastest CAGR of 7.58% from 2025 to 2032, driven by rapid industrialization, infrastructure development, and growing use of smart sensing in energy and construction sectors

- The Single-Mode Fiber segment dominated the distributed fiber optic sensor market with the largest market revenue share of 62.8% in 2024, driven by its high sensitivity, long-range capabilities, and preference in large-scale industrial and infrastructure monitoring

Report Scope and Distributed Fiber Optic Sensor Market Segmentation

|

Attributes |

Distributed Fiber Optic Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Distributed Fiber Optic Sensor Market?

“AI-Powered Predictive Analytics for Real-Time Monitoring”

- A major trend shaping the global distributed fiber optic sensor (DFOS) market is the integration of artificial intelligence (AI) and machine learning (ML) to enable predictive analytics, fault detection, and real-time data interpretation

- This innovation transforms raw fiber optic sensor data into actionable insights, helping industries anticipate failures, optimize maintenance, and enhance operational efficiency

- For instance, Halliburton’s FiberWatch system incorporates AI-driven analytics to monitor well integrity, detect temperature/strain anomalies, and improve oilfield decision-making in real-time

- AI integration also enhances environmental monitoring, with sensors in pipelines or tunnels detecting changes in acoustics, pressure, or vibrations—then triggering alerts autonomously

- Companies like QinetiQ and Luna Innovations are leading this shift by offering DFOS platforms embedded with AI engines for anomaly detection and asset integrity management

- As industries demand smarter, autonomous monitoring systems, AI-driven DFOS solutions are expected to dominate future infrastructure and security applications globally

What are the Key Drivers of Distributed Fiber Optic Sensor Market?

- The rising need for structural health monitoring, perimeter security, and asset protection across oil & gas, power grids, and civil infrastructure is driving DFOS demand globally

- In March 2023, Bandweaver launched its Horizon platform offering real-time temperature and acoustic sensing for tunnels, power lines, and critical infrastructure, enhancing risk mitigation

- DFOS systems deliver continuous, real-time sensing across long distances with high spatial resolution, making them ideal for harsh and hazardous environments

- Additionally, increasing investments in smart grid modernization, pipeline safety, and border surveillance are pushing utilities and governments toward DFOS-based monitoring

- The growing emphasis on predictive maintenance and early fault detection is accelerating DFOS adoption, especially in high-risk sectors like oil refineries and chemical plants

Which Factor is challenging the Growth of the Distributed Fiber Optic Sensor Market?

- A primary challenge is the high installation and integration costs of DFOS systems, which can limit adoption, particularly for small enterprises or low-margin infrastructure projects

- For example, deploying fiber cables across long industrial pipelines or power lines requires substantial capital investment, specialized equipment, and trained personnel

- Additionally, technical complexity and lack of skilled operators for data interpretation remain barriers, especially in emerging markets where awareness is limited

- Companies like Ziebel and OFS Fitel are working to counter this by introducing modular, plug-and-play sensor systems with simplified software interfaces and reduced installation costs

- Widespread adoption will require a focus on cost-efficient product development, standardization, and expanding training programs to address the current skills gap and technical limitations

How is the Distributed Fiber Optic Sensor Market Segmented?

The market is segmented on the basis of fiber type, operating principle, scattering process, application, and vertical.

- By Fiber Type

On the basis of fiber type, the distributed fiber optic sensor market is segmented into Single-Mode Fiber and Multimode Fiber. The Single-Mode Fiber segment dominated the distributed fiber optic sensor market with the largest market revenue share of 62.8% in 2024, driven by its high sensitivity, long-range capabilities, and preference in large-scale industrial and infrastructure monitoring. Its ability to operate over long distances with minimal signal loss makes it ideal for oil & gas pipelines, power grid monitoring, and perimeter security applications.

The Multimode Fiber segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to its cost-effectiveness and growing use in short-range sensing applications in civil engineering and commercial settings. As urban infrastructure projects increase, multimode fiber sensors are gaining popularity for structural health monitoring and temperature detection.

- By Operating Principle

On the basis of operating principle, the market is segmented into Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR). The OTDR segment held the largest market share in 2024, owing to its mature technology, robust design, and ability to detect and localize faults in long optical fibers. It remains a preferred choice for applications in energy and oil & gas sectors where real-time fault location is critical.

The OFDR segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its superior spatial resolution, faster data acquisition, and its emerging use in dynamic strain and temperature profiling, especially in aerospace and industrial automation applications.

- By Scattering Process

On the basis of scattering process, the distributed fiber optic sensor market is segmented into Rayleigh Scattering Effect, Raman Scattering Effect, Brillouin Scattering Effect, and Fiber Bragg Grating. The Rayleigh Scattering Effect dominated the market with a revenue share of 34.5% in 2024, supported by its widespread adoption in distributed acoustic sensing (DAS), particularly for perimeter intrusion detection, oil well monitoring, and railway track surveillance.

The Brillouin Scattering Effect is projected to witness the fastest growth rate during the forecast period due to its capability to measure both static and dynamic strain and temperature over long distances. Its rising implementation in structural health monitoring and geotechnical applications is expected to drive segment growth.

- By Application

On the basis of application, the distributed fiber optic sensor market is segmented into Temperature Sensing, Acoustic Sensing, and Other Sensing Applications. The Temperature Sensing segment held the largest market revenue share of 47.1% in 2024, driven by its extensive use in pipeline monitoring, power cables, and fire detection systems, where real-time thermal data is crucial for safety and maintenance.

The Acoustic Sensing segment is projected to register the highest growth from 2025 to 2032, driven by the demand for real-time acoustic monitoring in security, oil wells, and border surveillance. The proliferation of distributed acoustic sensing (DAS) in multiple verticals contributes to its strong growth outlook.

- By Vertical

On the basis of vertical, the distributed fiber optic sensor market is segmented into Oil and Gas, Power and Utility, Safety and Security, Industrial, and Civil Engineering. The Oil and Gas segment dominated the market with the largest revenue share of 39.3% in 2024, owing to the need for long-range monitoring of pipelines, wells, and reservoir management, where distributed sensors offer real-time data and early warning of anomalies.

The Safety and Security segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increased demand for intrusion detection systems, border monitoring, and smart fencing. Governments and private sectors are increasingly investing in fiber-based security systems for real-time threat assessment.

Which Region Holds the Largest Share of the Distributed Fiber Optic Sensor Market?

- North America led the distributed fiber optic sensor market with the largest revenue share of 36.12% in 2024, attributed to growing industrial automation, enhanced oilfield monitoring, and security surveillance needs

- The increasing deployment of fiber optic sensing technologies in the energy and utilities sectors, along with the region’s robust investment in smart infrastructure, supports continued adoption

- High R&D spending, presence of major sensor manufacturers, and increasing focus on structural health monitoring in civil infrastructure further propel growth across the U.S. and Canada

U.S. Distributed Fiber Optic Sensor Market Insight

The U.S. dominated North America's distributed fiber optic sensor market share in 2024, supported by advanced deployment in oil & gas and defense sectors. Rapid adoption of distributed temperature and strain sensing in pipeline monitoring and structural applications is fueling market expansion. Growing demand from data centers, smart buildings, and aerospace industries, along with presence of key players such as Halliburton and OFS, is further driving the market forward.

Europe Distributed Fiber Optic Sensor Market Insight

The Europe market is projected to expand at a strong CAGR during the forecast period due to increasing adoption in border security, smart grid monitoring, and transportation infrastructure. The region’s focus on sustainability and safety regulations is enhancing the need for real-time monitoring solutions using fiber optic sensors. Countries such as Germany, France, and the U.K. are actively investing in smart city initiatives and renewables, supporting broader adoption across sectors.

U.K. Distributed Fiber Optic Sensor Market Insight

The U.K. market is expected to grow significantly, driven by high adoption of smart infrastructure technologies and increased spending on public safety and defense. The demand for vibration and intrusion detection sensors across military bases, utilities, and railways is a major driver. The growing presence of regional tech startups and partnerships with academic institutions further supports innovation and deployment.

Germany Distributed Fiber Optic Sensor Market Insight

The Germany market is poised for robust growth owing to increasing digitization of industrial operations and government-backed infrastructure modernization. High integration of distributed sensing in railways, bridges, and manufacturing is promoting long-term demand. Germany’s leadership in precision engineering and Industry 4.0 is pushing for advanced sensing technologies for predictive maintenance and energy efficiency.

Which Region is the Fastest Growing in the Distributed Fiber Optic Sensor Market?

Asia-Pacific is projected to grow at the fastest CAGR of 7.58% from 2025 to 2032, driven by rapid industrialization, infrastructure development, and growing use of smart sensing in energy and construction sectors. Government-backed initiatives in smart cities, defense modernization, and renewable energy adoption are driving sensor integration in nations such as China, India, and Japan. Increased production capacity of fiber optics and lower sensor costs across APAC enhances accessibility for both domestic and export markets.

Japan Distributed Fiber Optic Sensor Market Insight

The Japan market is accelerating due to strong emphasis on disaster resilience, infrastructure safety, and energy efficiency. Deployment in seismic monitoring, tunnel surveillance, and utilities reflects Japan’s focus on long-term reliability and automation. The country’s innovation-driven ecosystem and integration of IoT across public infrastructure is boosting sensor demand.

China Distributed Fiber Optic Sensor Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, backed by rapid infrastructure expansion and large-scale deployment in utilities and railways. Strong domestic production capabilities and favorable policy support for smart energy and transportation infrastructure is fueling growth. Leading Chinese tech firms and fiber optic manufacturers are contributing to a robust and scalable sensor ecosystem.

Which are the Top Companies in Distributed Fiber Optic Sensor Market?

The distributed fiber optic sensor industry is primarily led by well-established companies, including:

- Halliburton Energy Services, Inc. (U.S.)

- Yokogawa India Ltd. (India)

- Weatherford International Ltd. (U.S.)

- QinetiQ (U.K.)

- Luna Innovations Incorporated (U.S.)

- OFS Fitel, LLC. (U.S.)

- Bandweaver (U.K.)

- Omnisens (Switzerland)

- Brugg Kabel AG (Switzerland)

- AP Sensing GmbH (Germany)

- AFL (U.S.)

- Ziebel (Norway)

- FISO (Canada)

- OSENSA Innovations Corp. (Canada)

- Lockheed Martin Corporation (U.S.)

- NEC Corporation (Japan)

- Verizon (U.S.)

- Solifos AG (Switzerland)

What are the Recent Developments in Global Distributed Fiber Optic Sensor Market?

- In March 2023, Yokogawa Electric and Otsuka Chemical forged a partnership to establish Syncrest Inc., aiming to innovate the middle-molecule pharmaceuticals sector. By pooling resources for research, development, and production, they seek to revolutionize drug development processes and enhance therapeutic outcomes

- In May 2022, Fiber Bragg Grating pressure sensors, combined with AP Sensing’s Distributed Temperature Sensing, were integrated by the China National Petroleum Corporation. Deployed in three horizontal wells across two oilfield sites, this technology monitors downhole conditions, evaluates casing integrity, and detects potential leaks, bolstering operational safety and efficiency

- In April 2022, Schlumberger and Sintela collaborated to pioneer advanced fiber-optic solutions across industries. Leveraging Sintela's DFOS technology and Schlumberger's expertise in energy, CCS, and geothermal markets, the partnership aims to develop cutting-edge solutions to meet evolving industry needs, enhancing performance, reliability, and cost-effectiveness

- In July 2020, Halliburton and TechnipFMC introduced Odassea, a distributed acoustic sensing solution for subsea wells. Enabling intervention-free reservoir diagnostics and seismic imaging, Odassea enhances reservoir understanding and reduces total cost of ownership, empowering operators with actionable insights for optimized performance and maintenance strategies

- In February 2020, OFS Fitel, LLC unveiled the AcoustiSens wideband single-mode vibration sensor fiber, augmenting distributed acoustic sensing systems. Designed to enhance system sensitivity and accuracy, this innovation elevates the performance capabilities of acoustic sensing technologies, enabling more precise monitoring and analysis across various applications and industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.