Global Distributed Antenna System Das Market

Market Size in USD Billion

CAGR :

%

USD

14.56 Billion

USD

35.82 Billion

2024

2032

USD

14.56 Billion

USD

35.82 Billion

2024

2032

| 2025 –2032 | |

| USD 14.56 Billion | |

| USD 35.82 Billion | |

|

|

|

|

Distributed Antenna System (DAS) Market Size

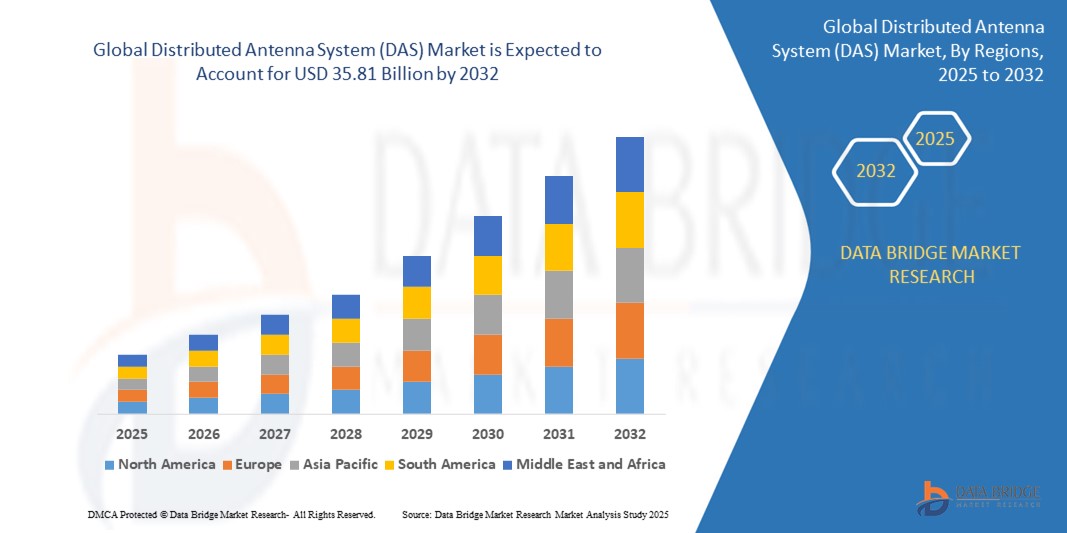

- The global distributed antenna system (DAS) market size was valued at USD 14.56 billion in 2024 and is expected to reach USD 35.81 billion by 2032, at a CAGR of 11.90% during the forecast period

- Market expansion is significantly driven by the increasing adoption of cloud-based applications across various industries. This growing trend necessitates the development of scalable and agile IT infrastructure to support digital transformation initiatives

- Furthermore, the rising demand for application components that are modular, resilient, and can be deployed independently is positioning distributed antenna system (DAS) as the preferred modern architectural style. This preference is further accelerating the adoption of DAS and contributing to the overall robust growth of the market

Distributed Antenna System (DAS) Market Analysis

- Distributed Antenna System (DAS) solutions, which offer a modular approach to both application development and deployment, are rapidly gaining prominence as essential components in modern software architectures across a diverse range of industries. This increasing importance is primarily due to their inherent advantages in terms of scalability, flexibility, and overall system resilience

- The market's current strong upward momentum can be largely attributed to the growing adoption of cloud computing technologies, the increasing demand for faster application development cycles to meet dynamic business needs, and the expanding preference among organizations for robust and efficient distributed systems

- North America is expected to dominate the distributed antenna system (DAS) market, commanding the largest revenue share of 30.02%. This dominance is fueled by a robust emphasis on technological advancement, widespread early adoption of innovative cloud-native architectures across diverse sectors, and a significant understanding of the advantages offered by agility and scalability

- Asia-Pacific is expected to be the fastest-growing market throughout the forecast period, driven by rapid digitalization, increasing cloud adoption, and a large developer base

- The hardware segment is segment is expected to dominate the distributed antenna system (DAS) Market in 2025, primarily due to the essential components such as antennas, repeaters, baseband units, and cables required for establishing robust DAS networks

Report Scope and Distributed Antenna System (DAS) Market Segmentation

|

Attributes |

Distributed Antenna System (DAS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Distributed Antenna System (DAS) Market Trends

“Growing Adoption of AI and ML Integration"

- The distributed antenna system (DAS) market is witnessing a significant shift towards incorporating Artificial Intelligence (AI) and Machine Learning (ML) capabilities within cloud platforms. This integration is primarily aimed at enhancing the automation, predictive analytics, and intelligent monitoring functionalities available for microservices-based architectures

- For instance, major cloud providers such as Google Cloud, with its introduction of AI-driven workload optimization for Anthos in May 2025, and AWS, through its enhancements to SageMaker in April 2025 to facilitate the deployment of ML models as microservices, are at the forefront of this trend

- Businesses are increasingly leveraging AI/ML technologies to automate deployment processes, proactively predict potential operational issues before they escalate, and optimize the allocation of valuable resources. This adoption ultimately enables the development of more intelligent, responsive, and efficient cloud-native applications that can better adapt to changing demands and conditions

- The inherent ability of AI and ML to automate and optimize various aspects of microservices management provides a robust foundation for significantly enhancing overall application efficiency, leading to a substantial reduction in operational costs, and contributing to improved system performance

- Consequently, major cloud service providers and a growing number of enterprises across different sectors are actively exploring and strategically implementing AI/ML-powered tools and platforms to streamline their microservices workflows and further enhance the agility and scalability of their underlying cloud infrastructures

Distributed Antenna System (DAS) Market Dynamics

Driver

“Rising Demand for Seamless Connectivity in High-Density Areas"

- A significant factor propelling the growth of the distributed antenna system (DAS) market is the consistently rising demand for seamless and reliable wireless connectivity in environments characterized by high user density

- These areas typically include large public venues such as sports stadiums that host tens of thousands of spectators, busy international airports where numerous travellers rely on constant connectivity, sprawling shopping malls with a high concentration of shoppers and retailers, and expansive enterprise buildings housing a large workforce and numerous connected devices

- In such high-traffic locations, traditional cellular network infrastructure often faces significant challenges in providing adequate signal coverage and sufficient network capacity to simultaneously support a large number of users, frequently resulting in a degraded and often frustrating user experience characterized by slow data speeds, dropped calls, and intermittent connectivity

- DAS solutions effectively address these limitations by strategically distributing the cellular signal throughout the entire venue using a network of smaller, interconnected antennas. This distributed approach ensures consistent and strong signal coverage across all areas and provides the necessary network capacity to handle the high volume of users accessing wireless services concurrently

- As the expectation for uninterrupted and high-speed wireless connectivity continues to grow in these heavily populated locations, the deployment of robust and efficient DAS infrastructure becomes increasingly crucial for venue operators and businesses to meet the demands of their users and maintain a competitive edge in today's digitally connected world

Restraint/Challenge

"Complexity in Managing Distributed Systems"

- A notable restraint that can hinder the broader and faster adoption of distributed antenna system (DAS) is the inherent complexity associated with effectively managing systems comprised of numerous distributed components

- Deploying and maintaining a large number of independent services, which is a hallmark of microservices architectures within a DAS framework, introduces a variety of operational challenges. These challenges include ensuring reliable and efficient inter-service communication, implementing comprehensive and unified monitoring across all the distributed components, and effectively diagnosing and resolving issues that may arise in such a complex environment

- For instance, integrating modern monitoring and observability tools with existing legacy systems can be a significant undertaking, often requiring specialized expertise and custom configurations. While companies such as Datadog and New Relic offer sophisticated platforms specifically designed to monitor distributed systems, their effective implementation and integration into an organization's existing IT landscape demand skilled personnel and a well-defined strategy

- Furthermore, ensuring data consistency across multiple geographically or logically distributed data stores and effectively handling the inevitable challenges posed by network latency between different services are significant hurdles that development and operations teams must address

- Successfully overcoming these inherent complexities necessitates a substantial investment in advanced monitoring tools, sophisticated orchestration frameworks for managing the deployment and scaling of services, and robust distributed transaction management mechanisms to ensure the overall reliability, consistency, and operational efficiency of microservices deployments within a DAS environment

Distributed Antenna System (DAS) Market Scope

The market is segmented on the basis of offering, DAS type, coverage, ownership, technology, user facility and vertical.

By Offering

On the basis of offering, the distributed antenna system (DAS) market is segmented into hardware and services. The hardware segment is anticipated to witness a significant market revenue share in 2025, primarily due to the essential components such as antennas, repeaters, baseband units, and cables required for establishing robust DAS networks. The increasing demand for higher-performing hardware to manage growing mobile data traffic, especially in commercial and enterprise sectors, will continue to drive this segment.

The services segment is projected to witness a fast CAGR from 2025 to 2032. This rapid growth is fueled by the increasing need for expertise in the design, deployment, and management of complex DAS architectures. This includes strategic consulting, development, integration, and ongoing management, with providers playing a crucial role in guiding enterprises through DAS implementations.

By DAS Type

On the basis of DAS type, the distributed antenna system (DAS) market is segmented into passive, active, and hybrid. The passive segment is expected to hold the largest market share in 2025 due to its simplicity, cost-effectiveness, and reliability, making it a preferred choice for various organizations, particularly in commercial buildings and venues, requiring less infrastructure investment for adequate coverage.

The hybrid segment is estimated to grow at a robust pace from 2025 to 2032, offering the advantages of both passive and active systems by incorporating passive components such as antennas and coaxial cables with active elements such as remote radio units, thus providing flexibility and scalability.

By Coverage

On the basis of coverage, the distributed antenna system (DAS) market is segmented into indoor and outdoor. The indoor DAS segment is anticipated to account for the largest market revenue share of 61.11% in 2025 and is also projected to witness the fastest CAGR from 2025 to 2032. This growth is driven by the increasing need for enhanced wireless connectivity within buildings where signals are often impeded.

By Ownership

On the basis of ownership, the distributed antenna system (DAS) market is segmented into neutral host, carrier, and enterprise. The neutral-host ownership model is likely to command the largest market revenue share in 2025. This model's popularity stems from its ability to allow multiple carriers and service providers to utilize a common infrastructure, thereby reducing expenses and improving coverage in high-density areas without requiring individual setups.

By Technology

The distributed antenna system (DAS) market includes various technologies such as carrier Wi-Fi and small cells, which are crucial for addressing the continued growth of mobile data traffic and evolving coverage requirements. These technologies work in conjunction with DAS to enhance network capacity and user experience.

By User Facility

On the basis of user facility size, the distributed antenna system (DAS) market is segmented into areas greater than 500K sq. ft., between 200K–500K sq. ft., and less than 200K sq. ft. Large facilities are likely to represent a significant market share in 2025 due to the necessity of robust wireless infrastructure in extensive commercial and public venues.

By Vertical

On the basis of vertical, the distributed antenna system (DAS) market is segmented into commercial and public safety. The commercial sector is anticipated to hold the largest market revenue share in 2025, encompassing various industries requiring enhanced connectivity.

The public safety segment is projected to witness a fast CAGR from 2025 to 2032, driven by the increasing need for reliable emergency communication systems within buildings for first responders and safety personnel, especially in commercial buildings, healthcare facilities, and government facilities.

Distributed Antenna System (DAS) Market Regional Analysis

- North America is expected to dominate the distributed antenna system (DAS) market, commanding the largest revenue share of 30.02%. This dominance is fueled by a robust emphasis on technological advancement, widespread early adoption of innovative cloud-native architectures across diverse sectors, and a significant understanding of the advantages offered by agility and scalability

- Both consumers and enterprises in the region highly value the enhanced flexibility, resilience, and accelerated development cycles enabled by distributed antenna system (DAS) solutions.

- This extensive adoption is further bolstered by a well-established technological infrastructure, substantial investments in digital transformation initiatives, and the strong presence of key market players and prominent cloud service providers.

- Consequently, distributed antenna system (DAS) is rapidly becoming the preferred solution for modernizing existing applications and architecting new, highly scalable services

U.S. Distributed Antenna System (DAS) Market Insight

The U.S. distributed antenna system (DAS) market holds a significant portion of the revenue within North America, primarily driven by the rapid expansion of digital services and a strong focus on cloud-native development practices. Enterprises are increasingly prioritizing the integration of microservices to achieve greater agility and enhanced scalability for their application portfolios. The growing preference for containerization technologies, such as Docker, and orchestration platforms, such as Kubernetes, coupled with a strong demand for efficient application development and deployment processes, further propels the distributed antenna system (DAS) industry. Moreover, the increasing trend of migrating legacy applications to the cloud utilizing a microservices architecture is significantly contributing to the market's overall expansion.

Europe Distributed Antenna System (DAS) Market Insight

Europe is anticipated to experience substantial expansion at a considerable CAGR throughout the forecast period. This growth is primarily attributed to stringent data sovereignty regulations and a growing need for comprehensive digital transformation across various industries. The increasing pace of digitalization, combined with a strong focus on application modernization initiatives and the recognized benefits of loosely coupled architectures, is fostering the widespread adoption of distributed antenna system (DAS) solutions. European consumers and businesses are also increasingly drawn to the enhanced resilience and scalability that these technologies provide. The region is witnessing significant growth in applications across e-commerce, financial services, and manufacturing sectors, with distributed antenna system (DAS) being strategically incorporated into both newly developed cloud-native applications and the ongoing refactoring of existing monolithic systems.

U.K. Distributed Antenna System (DAS) Market Insight

The U.K. distributed antenna system (DAS) market is projected to grow at a notable CAGR during the forecast period. This growth is driven by the escalating trend of cloud adoption across various sectors and a strong desire among organizations for increased agility and faster time-to-market for their applications. Furthermore, the pressing need for highly scalable and resilient IT infrastructure is encouraging both organizations and individual developers to increasingly favor cloud-native architectures. The U.K.'s proactive embrace of cloud technologies, coupled with its well-established and dynamic technology sector, is expected to continue to be a significant catalyst for sustained market growth in the years to come.

Germany Distributed Antenna System (DAS) Market Insight

The German distributed antenna system (DAS) market is expected to expand at a considerable CAGR throughout the forecast period. This growth is fueled by a rising awareness of the significant benefits associated with modern application architectures and a strong demand for highly scalable and resilient IT solutions. Germany’s well-developed digital infrastructure, combined with its traditional emphasis on engineering excellence and technological innovation, strongly promotes the adoption of distributed antenna system (DAS), particularly within key sectors such as manufacturing, automotive, and financial services. The adoption of sophisticated containerization and orchestration technologies is also becoming increasingly prevalent across German enterprises, reflecting a strong preference for robust and scalable cloud-native solutions that align with the specific needs of local businesses.

Asia-Pacific Distributed Antenna System (DAS) Market Insight

Asia-Pacific is poised to witness the fastest CAGR in the distributed antenna system (DAS) market. This rapid growth is primarily driven by increasing digitalization across various sectors, rising internet penetration rates in many countries, and proactive government initiatives promoting cloud adoption, particularly in major economies such as China, Japan, and India. The region's growing inclination towards digital economies, strongly supported by substantial government investments in advanced technology and a large and expanding base of software developers, is a key factor driving the widespread adoption of distributed antenna system (DAS). Furthermore, as the Asia-Pacific region increasingly emerges as a significant global hub for software development and overall cloud adoption, the development and accessibility of innovative distributed antenna system (DAS) solutions are expanding to cater to an ever-wider base of users and organizations.

Japan Distributed Antenna System (DAS) Market Insight

The Japan distributed antenna system (DAS) market is gaining significant momentum, largely due to the country’s advanced high-tech culture, the rapid pace of digitalization across its industries, and a strong demand for efficient and scalable application development methodologies. The Japanese market places a particularly significant emphasis on system reliability and overall performance, and the increasing adoption of distributed antenna system (DAS) is primarily driven by a growing need for agile and highly resilient IT systems across various sectors, including the critical finance and manufacturing industries. The seamless integration of distributed antenna system (DAS) with modern software development practices and leading cloud platforms is a key factor fueling market growth. Moreover, Japan's strong and consistent focus on technological advancement is highly likely to continue to spur demand for innovative and scalable cloud-native solutions in the foreseeable future.

China Distributed Antenna System (DAS) Market Insight

China’s distributed antenna system (DAS) market accounts for a substantial market revenue share within the broader Asia Pacific region. This significant share is primarily attributed to the country's expansive digital economy, the rapid rate of technological adoption across its industries, and strong government support for cloud computing initiatives and overall software development. China stands out as one of the largest and most dynamic markets for digital transformation globally, and distributed antenna system (DAS) is becoming increasingly critical in key areas such as thriving e-commerce platforms, rapidly expanding fintech sectors, and the development of advanced smart city infrastructure. The strong push towards adopting cloud-native architectures and the availability of robust domestic technological capabilities are identified as key factors that are significantly propelling the growth of the distributed antenna system (DAS) market within China.

Distributed Antenna System (DAS) Market Share

The Distributed Antenna System (DAS) industry is primarily led by well-established companies, including:

- AT&T Intellectual Property (U.S.)

- ATC TRS V LLC (U.S.)

- Corning Incorporated (U.S.)

- COMMSCOPE (U.S.)

- Wesco (U.S.)

- Comba Telecom Systems Holdings Ltd. (Hong Kong)

- DigitalBridge Group, Inc. (U.S.)

- JMA Wireless (U.S.)

- Hughes Network Systems, LLC (U.S.)

- Radio Frequency Systems (Germany)

- VIAVI Solutions Inc. (U.S.)

- TM Galtronics (Taiwan)

- Zinwave (U.K.)

- Betacom Inc. (U.S.)

- Boldyn Networks (U.K.)

Latest Developments in Global Distributed Antenna System (DAS) Market

- In February 2024, AT&T initiated a 5G pilot project in collaboration with the U.S. Department of Veterans Affairs, focusing on healthcare innovation through distributed antenna systems and edge computing. With strategic plans to integrate millimeter wave spectrum and multi-access edge computing (MEC), this initiative signifies the transformative role of 5G in modern medical services. This bold move underscores AT&T’s ambition to lead in healthcare connectivity amidst growing competition from Verizon

- In July 2023, ATC TRS V LLC, in partnership with the Minnesota Wild, upgraded the Xcel Energy Center with a high-performance Distributed Antenna System (DAS), bringing robust 5G capabilities to the venue. Designed to support over 1.7 million visitors and 150+ events annually, including NHL games, this deployment enhances connectivity and fan engagement. This installation strengthens American Tower’s position as a top-tier provider of venue connectivity solutions in the sports and entertainment sectors

- In September 2022, Advanced RF Technologies, Inc. introduced C-band wireless solutions, including ADXV DAS modules and the SDRX repeater, offering full-spectrum 5G coverage for indoor spaces. Utilizing the 3.7 GHz to 3.98 GHz C-band range, these products allow seamless upgrades from existing 4G/LTE systems. This product launch marked a significant step forward in providing future-ready wireless infrastructure for commercial venues

- In October 2020, Advanced RF Technologies, Inc. became the first DAS and ERCES provider to join the National Systems Contractors Association (NSCA), a leading non-profit organization for commercial integrators. This membership bolstered the company’s industry standing and brand credibility. This move contributed significantly to enhancing the company's goodwill and professional recognition

- In March 2020, Advanced RF Technologies, Inc. formed a distribution partnership with Windy City Wire (WCW) to expand access to its in-building wireless systems tailored for commercial and public safety applications. This collaboration enabled wider market penetration and customer base expansion. This strategic alliance helped the company scale its operations and improve service accessibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.