Global Digital Camera Market

Market Size in USD Billion

CAGR :

%

USD

8.92 Billion

USD

12.40 Billion

2024

2032

USD

8.92 Billion

USD

12.40 Billion

2024

2032

| 2025 –2032 | |

| USD 8.92 Billion | |

| USD 12.40 Billion | |

|

|

|

|

Digital Camera Market Analysis

The digital camera market has witnessed substantial growth in recent years, driven by advancements in technology and increasing consumer demand for high-quality photography. The market is dominated by leading players such as Canon, Nikon, Sony, and Fujifilm, who continue to innovate with cutting-edge features such as enhanced image sensors, 4K/8K video recording, and improved autofocus systems. One of the key trends is the growing adoption of mirrorless cameras, which offer compact designs, faster performance, and superior image quality, making them increasingly popular among both professional and amateur photographers. The rise of smartphone cameras has also contributed to the market's growth, as consumers seek high-performance cameras with advanced functionalities. In addition, there is a rising demand for digital cameras in industries such as entertainment, media, and sports, where high-quality imaging is essential. The market is expected to continue expanding, driven by further technological advancements, such as artificial intelligence (AI) integration for smarter features, improved low-light performance, and expanded connectivity options. With these advancements, the digital camera market is poised for significant growth in the coming years.

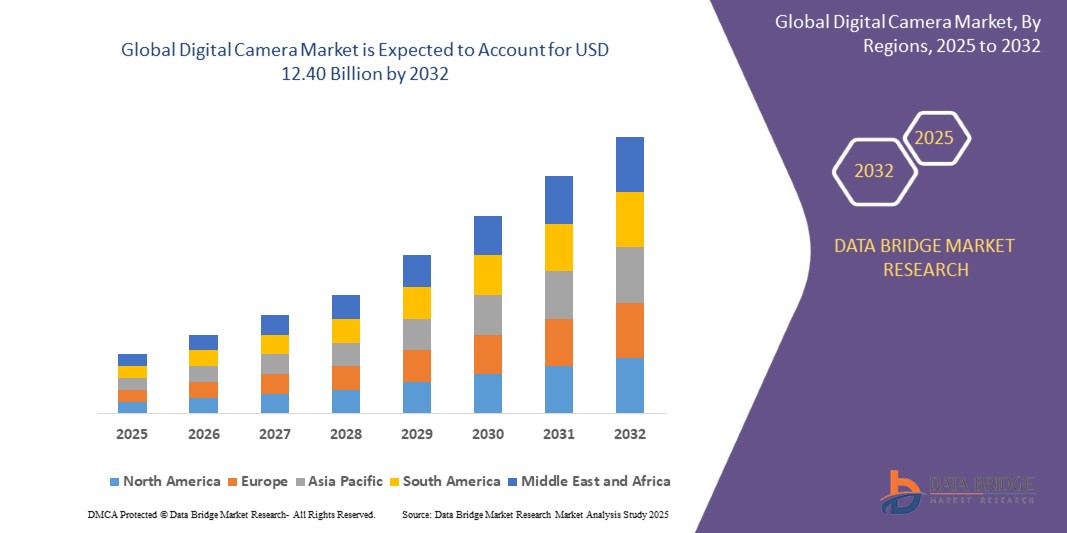

Digital Camera Market Size

The global digital camera market size was valued at USD 8.92 billion in 2024 and is projected to reach USD 12.40 billion by 2032, with a CAGR of 4.21% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Digital Camera Market Trends

“Increasing Demand for Mirrorless Cameras”

The digital camera market is experiencing significant growth, driven by technological advancements and evolving consumer preferences. A prominent digital camera trend is the increasing demand for mirrorless cameras, which combine high image quality with a compact design. Companies such as Canon and Sony have capitalized on this trend by introducing advanced mirrorless models, such as the Canon EOS R5 and Sony Alpha 7R IV, offering superior autofocus, faster shutter speeds, and 4K video recording capabilities. These cameras are becoming the preferred choice for both professional photographers and content creators, thanks to their versatility and performance. Moreover, the rise of social media platforms and video content creation has further fueled the need for high-performance digital cameras. As consumers seek devices that can deliver excellent image quality in various conditions, the market is witnessing a shift from traditional DSLR cameras to more lightweight, feature-rich mirrorless options, reshaping the landscape of digital photography.

Report Scope and Digital Camera Market Segmentation

|

Attributes |

Digital Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Canon U.S.A. Inc. (U.S.), Nikon Corporation (Japan), Sony Group Corporation (Japan), Olympus America. (U.S.), FUJIFILM Corporation (Japan), SAMSUNG (South Korea), Seiko Epson Corp. (Japan), Panasonic Holdings Corporation (Japan), CASIO COMPUTER CO., LTD. (Japan), RICOH IMAGING COMPANY, LTD (Japan), HP Development Company, L.P. (U.S.), ZEISS International (Germany), Leica Camera AG (Germany), SIGMA CORPORATION (U.S.), and Toshiba Teli Corporation (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Digital Camera Market Definition

A digital camera is an electronic device that captures and stores photographs or videos in a digital format, rather than using traditional film. It uses an image sensor, such as a CCD (Charge-Coupled Device) or CMOS (Complementary Metal-Oxide-Semiconductor) sensor, to convert light into digital data, which is then processed and saved onto a memory card or internal storage. Digital cameras typically offer features such as adjustable settings for exposure, focus, and white balance, as well as advanced functions such as video recording, image stabilization, and Wi-Fi connectivity for sharing content.

Digital Camera Market Dynamics

Drivers

- Rising Demand for High-Quality Imaging

The rising demand for high-quality imaging is a major driver in the digital camera market, particularly as social media users, influencers, and content creators seek superior photography and videography equipment. Platforms such as Instagram, YouTube, and TikTok have amplified the need for cameras that can deliver professional-grade images and videos. For instance, cameras with advanced image sensors and features such as 4K video recording, enhanced autofocus, and high-resolution capabilities are becoming increasingly popular. The Canon EOS R5, a mirrorless camera with 8K video recording capabilities, is a prime instance of how high-quality imaging is meeting the demands of both amateur and professional photographers. This demand is further boosted by consumers seeking to elevate their visual content and stand out in the crowded digital space. As a result, camera manufacturers are focusing on developing more sophisticated imaging technologies to cater to these evolving demands, propelling the growth of the digital camera market.

- Increasing Use of Digital Cameras in Professional and Creative Industries

The increasing use of digital cameras in professional and creative industries is significantly driving the market growth, as photographers, videographers, and content creators seek advanced imaging solutions for high-resolution images and videos. Digital cameras offer unmatched versatility, allowing professionals to capture detailed and dynamic content across various settings. For instance, the Canon EOS-1D X Mark III, favored by sports and wildlife photographers, delivers exceptional image quality, fast autofocus, and high-speed continuous shooting, making it ideal for capturing fast-moving action in sports. Similarly, in the film industry, cameras such as the RED Komodo 6K are widely used for their superior video quality and flexibility, driving the demand for high-end digital cameras. The growing reliance on digital cameras in sectors such as entertainment, media, and sports has further fueled this demand, as high-quality visual content becomes increasingly essential for engaging audiences across multiple platforms. This trend showcases the expanding role of digital cameras in professional and creative industries, making them a key market driver.

Opportunities

- Increasing Technological Advancements in Digital Camera Systems

Technological advancements in digital camera systems are playing a crucial role in driving market growth, offering consumers enhanced user experiences and opening up new opportunities for manufacturers. Improvements in features such as image stabilization, autofocus systems, and wireless connectivity are making cameras more efficient and easier to use, even in challenging shooting environments. For instance, the Sony Alpha 7R IV mirrorless camera integrates cutting-edge autofocus technology with real-time Eye Autofocus, making it perfect for capturing fast-moving subjects or portraits with precise detail. In addition, the rise of mirrorless cameras, which combine high performance with compact designs, has transformed the market, as seen with the Canon EOS R5. This camera offers a robust combination of 8K video recording, 45-megapixel stills, and faster performance in a lightweight body, appealing to both professional photographers and content creators. These technological innovations are improving the overall performance of digital cameras and driving the shift towards more versatile and portable options, creating significant opportunities in the market.

- Increasing Demand for Affordable Cameras

As digital cameras become more affordable, they are increasingly appealing to everyday consumers who seek better image quality than what smartphones offer, presenting a significant market opportunity. Entry-level point-and-shoot cameras, such as the Canon PowerShot G7 X Mark III, provide a simple yet effective upgrade for individuals looking to step up their photography game. With features such as 4K video recording, improved optical zoom, and better image stabilization, these cameras offer a much higher-quality experience compared to smartphones at a similar price point. As a result, more consumers are recognizing the value of standalone cameras for capturing high-resolution photos and videos, especially for events, travel, or vlogging. This growing shift from smartphones to dedicated digital cameras is creating demand in the consumer electronics market, and brands are capitalizing on this trend by offering affordable, user-friendly models, driving further market growth. This trend reflects the growing recognition of digital cameras as accessible tools for better image quality and creative control.

Restraints/Challenges

- Competition from Smartphones

Smartphone competition is one of the most significant challenges facing the digital camera market, as smartphones have become increasingly capable of replacing traditional digital cameras for many consumers. With continuous advancements in smartphone camera technology, such as higher resolution sensors, multi-lens setups, and AI-driven features such as scene detection and automatic enhancements, smartphones now offer impressive image quality and versatility. For instance, flagship smartphones such as the iPhone 15 and Samsung Galaxy S24 come equipped with advanced camera systems that rival many entry-level and mid-range digital cameras, offering features such as optical zoom, night mode, and portrait photography. As a result, consumers no longer feel the need to invest in standalone digital cameras, especially for everyday photography, which leads to a decline in demand for digital cameras in these segments. This shift has affected companies such as Canon and Nikon, whose entry-level models are increasingly bypassed in favor of smartphone cameras, which are more convenient, compact, and multifunctional. The growing dominance of smartphones has thus become a significant barrier for the traditional digital camera market, contributing to stagnant growth and declining sales.

- Technological Obsolescence

Technological obsolescence is a significant challenge in the digital camera market, as rapid advancements in technology necessitate frequent product upgrades. Consumers and professionals alike face the constant pressure to stay updated with the latest features, such as improved sensors, faster processing speeds, and enhanced image quality. For instance, the introduction of mirrorless cameras such as the Sony Alpha series has created a demand for more compact, high-performance models, while newer versions of image stabilization and autofocus technology require consumers to upgrade their existing cameras. This cycle of continuous innovation means that manufacturers must regularly release new models to remain competitive, and consumers often feel compelled to replace their older models to access the latest features. While this creates opportunities for manufacturers, it also places financial pressure on consumers, particularly those who are not ready for constant upgrades. As a result, technological obsolescence is driving the need for frequent product replacements, posing a challenge for both buyers and brands in the digital camera market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Digital Camera Market Scope

The market is segmented on the basis of product type, distribution channel, digital sensor type, component, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Digital Single-Lens Reflex (DSLR) Cameras

- Compact Digital Cameras

- Bridge Compact Digital Cameras

- Mirrorless Interchangeable Lens Cameras

Distribution Channel

- Online

- Offline

Digital Sensor Type

- CCD Sensor

- CMOS Sensor

- FOVEON X3 Sensor

- Live MOS Sensor

Component

- Lenses

- Sensors

- LCD Screen

- Memory Card

- Others

End User

- Personal

- Professional

Digital Camera Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, distribution channel, digital sensor type, component, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is dominating the digital camera market, driven by its rapid adoption of cutting-edge technologies and innovations. The demand for lightweight and high-performance digital cameras is escalating, further contributing to market growth. In addition, the increasing utilization of digital cameras across industries such as entertainment, media, and sports is fueling this growth. As consumers and professionals alike seek advanced imaging solutions, the region is poised to remain a key player in the global digital camera market.

Asia-Pacific is anticipated to witness highest growth in the digital camera market, driven by the growing popularity of photography across the region. The increasing use of digital cameras for personal and professional purposes, such as content creation and social media, is a key factor fueling this trend. In addition, rapid technological advancements and the rise in disposable income among consumers are contributing to higher demand for advanced imaging devices. As photography continues to gain cultural and commercial significance in Asia-Pacific, the market is set to expand rapidly in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Digital Camera Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Digital Camera Market Leaders Operating in the Market Are:

- Canon U.S.A. Inc. (U.S.)

- Nikon Corporation (Japan)

- Sony Group Corporation (Japan)

- Olympus America (U.S.)

- FUJIFILM Corporation (Japan)

- SAMSUNG (South Korea)

- Seiko Epson Corp. (Japan)

- Panasonic Holdings Corporation (Japan)

- CASIO COMPUTER CO., LTD. (Japan)

- RICOH IMAGING COMPANY, LTD (Japan)

- HP Development Company, L.P. (U.S.)

- ZEISS International (Germany)

- Leica Camera AG (Germany)

- SIGMA CORPORATION (U.S.)

- Toshiba Teli Corporation (Japan)

Latest Developments in Digital Camera Market

- In October 2024, Fujifilm Corporation unveiled the latest model in its X Series, the "Fujifilm X-M5". Weighing just 355g, it is the lightest camera in the series. Packed with advanced features such as AI-powered subject detection autofocus for moving subjects and 6.2K/30P movie recording, the X-M5 is designed for everyone from beginners to professional photographers, enhancing the overall photography experience

- In September 2024, Canon Inc. launched the RF28-70mm f/2.8 Image Stabilization (IS) Stepping Motor (STM) lens, compatible with the EOS R mirrorless camera system. This f/2.8 constant aperture zoom lens, Canon's first non-professional-grade model, is aimed at a broader audience. Alongside, Canon also introduced the EOS C80 digital cinema camera, part of its Cinema EOS lineup, featuring a lightweight build, 6K full-frame sensor, and user-friendly design for high-quality video production

- In July 2024, Leica Camera AG introduced the Leica D-Lux 8, a compact camera combining the brand’s design excellence with improved user experience. The model boasts intuitive controls, an optimized button layout, and ergonomically arranged features, providing enhanced convenience for users

- In June 2024, Nikon Corporation expanded its camera lineup with the NIKKOR Z 35mm f/1.4 wide-angle lens, specially developed for full-frame/FX-format cameras and featuring the Nikon Z mount

- In October 2022, Fujifilm announced a partnership with Adobe to develop the "FUJIFILM X-H2S" mirrorless digital camera firmware, scheduled for release in spring 2023. This firmware will introduce the world’s first native Camera to Cloud (C2C) connectivity for mirrorless digital cameras, powered by Frame.io. In addition, the firmware for the "FT-XH" file transmitters will also be launched

- In September 2022, Canon U.S.A., Inc. revealed a new suite of products for its cinema and broadcast line, responding to growing user demand. New offerings include the 8K CINE-SERVO 15-120mm T2.95-3.95 EF/PL lens for various productions, the EU-V3 modular expansion unit for EOS C500 Mark II and EOS C300 Mark III cameras, a Cinema EOS firmware update, and the DP-V2730i, a 27-inch 4K professional reference display designed for seamless integration into broadcaster and filmmaker workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DIGITAL CAMERA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DIGITAL CAMERA MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL DIGITAL CAMERA MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 KOREAN MARKET OVERVIEW

4.1 DRIVERS

4.2 RESTRAINTS

4.3 OPPORTUNITIES

4.4 CHALLENGES

5 EXECUTIVE SUMMARY

6 PREMIUM INSIGHTS

6.1 CONSUMER BUYING BEHAVIOUR

6.2 FACTORS AFFECTING BUYING DECISION

6.3 PRODUCT ADOPTION SCENARIO

6.4 PORTER’S FIVE FORCES

6.5 REGULATION COVERAGE

6.6 RAW MATERIAL SOURCING ANALYSIS

6.7 IMPORT EXPORT SCENARIO

7 PRODUCTION CAPACITY OUTLOOK

8 BRAND OUTLOOK

9 BRAND COMPARATIVE ANALYSIS

10 PRODUCT VS BRAND OVERVIEW

11 PRICING ANALYSIS

12 IMPACT OF ECONOMIC SLOWDOWN

12.1 IMPACT ON PRICES

12.2 IMPACT ON SUPPLY CHAIN

12.3 IMPACT ON SHIPMENT

12.4 IMPACT ON DEMAND

12.5 IMPACT ON STRATEGIC DECISIONS

13 SUPPLY CHAIN ANALYSIS

13.1 OVERVIEW

13.2 LOGISTIC COST SCENARIO

13.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

14 GLOBAL DIGITAL CAMERA MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) (MILLION UNITS)

14.1 OVERVIEW

14.2 DIGITAL SLR (OR DSLR)

14.2.1 FULL-FRAME

14.2.2 APS-C

14.3 MIRRORLESS

14.4 COMPACT (POINT-AND-SHOOT)

14.5 BRIDGE CAMERAS

14.6 ACTION CAMERA

14.7 ELECTRONIC VIEWFINDER (EVF)

14.8 LINE-SCAN CAMERA

15 GLOBAL DIGITAL CAMERA MARKET, BY MEMORY STORAGE, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 SECURE DIGITAL

15.3 SDHC

15.4 MICROSD OR COMPACTFLASH CARD

16 GLOBAL DIGITAL CAMERA MARKET, BY BATTERIES, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 LITHIUM-ION BATTERIES

16.3 NICKEL-METAL-HYDRIDE BATTERIES

16.4 DISPOSABLE AA AND AAA BATTERIES

17 GLOBAL DIGITAL CAMERA MARKET, BY TYPE OF CAMERA SENSOR, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 CHARGE-COUPLED DEVICE (CCD)

17.3 ELECTRON-MULTIPLYING CHARGE-COUPLED DEVICE (EMCCD)

17.4 COMPLEMENTARY METAL-OXIDE-SEMICONDUCTOR (CMOS)

17.5 BACK-ILLUMINATED CMOS

18 GLOBAL DIGITAL CAMERA MARKET, BY LENS SIZE, 2018-2032 (USD MILLION)

18.1 OVERVIEW

18.2 4MM - 14MM

18.3 14MM - 35MM

18.4 35MM - 85MM

18.5 85MM - 135MM

18.6 135MM - 300MM

18.7 300MM+

19 GLOBAL DIGITAL CAMERA MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

19.1 OVERVIEW

19.2 1280×720

19.3 1280×960

19.4 1920×1080

19.5 2560×1440

19.6 2560×1920

19.7 3840×2160

20 GLOBAL DIGITAL CAMERA MARKET, BY LENS TYPE, 2018-2032 (USD MILLION)

20.1 OVERVIEW

20.2 ULTRA WIDE ANGLE LENSES

20.2.1 ULTRA WIDE ANGLE LENSES, BY TYPE

20.2.1.1. BUILT-IN

20.2.1.2. INERCHANGEABLE

20.3 WIDE ANGLE LENSES

20.3.1 WIDE ANGLE LENSES, BY TYPE

20.3.1.1. BUILT-IN

20.3.1.2. INERCHANGEABLE

20.4 STANDARD LENSES

20.4.1 STANDARD LENSES, BY TYPE

20.4.1.1. BUILT-IN

20.4.1.2. INERCHANGEABLE

20.5 TELEPHOTO LENSES

20.5.1 TELEPHOTO LENSES, BY TYPE

20.5.1.1. SHORT TELEPHOTO LENSES

20.5.1.2. MEDIUM TELEPHOTO LENSES

20.5.1.3. SUPER TELEPHOTO LENSES

20.5.2 TELEPHOTO LENSES, BY TYPE

20.5.2.1. BUILT-IN

20.5.2.2. INERCHANGEABLE

20.6 OTHERS

21 GLOBAL DIGITAL CAMERA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

21.1 OVERVIEW

21.2 STORE BASED RETAILERS

21.2.1 HYPERMARKET AND SUPERMARKET

21.2.2 CONVENIENCE STORES

21.2.3 DISCOUNT STORES

21.2.4 BRAND OUTLETS

21.2.4.1. SINGLE BRAND STORES

21.2.4.2. MULTI-BRAND STORES

21.2.5 TRAVEL RETAIL SHOPS

21.2.6 OTHERS

21.3 NON-STORE RETAILERS

21.3.1 COMPANY OWNED WEBSITES

21.3.2 E-COMMERCE WEBSITES

22 GLOBAL DIGITAL CAMERA MARKET, BY PRICE, 2018-2032 (USD MILLION)

22.1 OVERVIEW

22.2 LOW- RANGE ( UPTO 500 USD)

22.3 MID-RANGE ( 501-1000 USD)

22.4 HIGH- RANGE ( MORE THAN 1000 USD)

23 GLOBAL DIGITAL CAMERA MARKET, BY COLOR, 2018-2032 (USD MILLION)

23.1 OVERVIEW

23.2 BLACK

23.3 WHITE

23.4 SILVER

23.5 RED

23.6 BLUE

23.7 PINK

23.8 GOLD

23.9 OTHERS

24 GLOBAL DIGITAL CAMERA MARKET, BY END USER, 2018-2032 (USD MILLION)

24.1 OVERVIEW

24.2 PERSONAL

24.2.1 PERSONAL, BY END USER

24.2.1.1. STUDENTS

24.2.1.2. SOCIAL MEDIA ENTHUSIASTS

24.2.1.3. HOBBYISTS AND CASUAL PHOTOGRAPHERS

24.2.2 PERSONAL, BY PRODUCT TYPE

24.2.2.1. DIGITAL SLR (OR DSLR)

24.2.2.2. MIRRORLESS

24.2.2.3. COMPACT (POINT-AND-SHOOT)

24.2.2.4. BRIDGE CAMERAS

24.2.2.5. ACTION CAMERA

24.2.2.6. ELECTRONIC VIEWFINDER (EVF)

24.2.2.7. LINE-SCAN CAMERA

24.3 PROFESSIONAL

24.3.1 PROFESSIONAL, BY END USER

24.3.1.1. PROFESSIONAL PHOTOGRAPHERS

24.3.1.2. CORPORATE AND BUSINESS USE

24.3.1.3. SCIENTIFIC AND TECHNICAL FIELDS

24.3.1.4. MEDIA INDUSTRY

24.3.1.5. ENTERTAINMENT INDUSTRY

24.3.1.6. SPORTS INDUSTRY

24.3.1.7. OTHERS

24.3.2 PROFESSIONAL, BY PRODUCT TYPE

24.3.2.1. DIGITAL SLR (OR DSLR)

24.3.2.2. MIRRORLESS

24.3.2.3. COMPACT (POINT-AND-SHOOT)

24.3.2.4. BRIDGE CAMERAS

24.3.2.5. ACTION CAMERA

24.3.2.6. ELECTRONIC VIEWFINDER (EVF)

24.3.2.7. LINE-SCAN CAMERA

25 GLOBAL DIGITAL CAMERA MARKET, BY GEOGRAPHY , 2018-2032 (USD MILLION) (MILLION UNITS)

GLOBAL DIGITAL CAMERA MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 NORTH AMERICA

25.1.1 U.S.

25.1.2 CANADA

25.1.3 MEXICO

25.2 EUROPE

25.2.1 GERMANY

25.2.2 U.K.

25.2.3 ITALY

25.2.4 FRANCE

25.2.5 SPAIN

25.2.6 SWITZERLAND

25.2.7 RUSSIA

25.2.8 TURKEY

25.2.9 BELGIUM

25.2.10 NETHERLANDS

25.2.11 SWITZERLAND

25.2.12 DENMARK

25.2.13 NORWAY

25.2.14 FINLAND

25.2.15 SWEDEN

25.2.16 REST OF EUROPE

25.3 ASIA-PACIFIC

25.3.1 JAPAN

25.3.2 CHINA

25.3.3 SOUTH KOREA

25.3.4 INDIA

25.3.5 SINGAPORE

25.3.6 THAILAND

25.3.7 INDONESIA

25.3.8 MALAYSIA

25.3.9 PHILIPPINES

25.3.10 AUSTRALIA

25.3.11 NEW ZEALAND

25.3.12 HONG KONG

25.3.13 TAIWAN

25.3.14 REST OF ASIA-PACIFIC

25.4 SOUTH AMERICA

25.4.1 BRAZIL

25.4.2 ARGENTINA

25.4.3 REST OF SOUTH AMERICA

25.5 MIDDLE EAST AND AFRICA

25.5.1 SOUTH AFRICA

25.5.2 EGYPT

25.5.3 SAUDI ARABIA

25.5.4 UNITED ARAB EMIRATES

25.5.5 ISRAEL

25.5.6 BAHRAIN

25.5.7 KUWAIT

25.5.8 OMAN

25.5.9 QATAR

25.5.10 REST OF MIDDLE EAST AND AFRICA

26 GLOBAL DIGITAL CAMERA MARKET, COMPANY LANDSCAPE

26.1 COMPANY SHARE ANALYSIS: GLOBAL

26.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

26.3 COMPANY SHARE ANALYSIS: EUROPE

26.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

26.4.1 COMPANY SHARE ANALYSIS: SOUTH KOREA

26.5 MERGERS AND ACQUISITIONS

26.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

26.7 EXPANSIONS

26.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

27 GLOBAL DIGITAL CAMERA MARKET- COMPANY PROFILES

27.1 SONY ELECTRONICS INC. (SEL)

27.1.1 COMPANY SNAPSHOT

27.1.2 REVENUE ANALYSIS

27.1.3 PRODUCT PORTFOLIO

27.1.4 RECENT UPDATES

27.2 FUJIFILM HOLDINGS AMERICA CORPORATION

27.2.1 COMPANY SNAPSHOT

27.2.2 REVENUE ANALYSIS

27.2.3 PRODUCT PORTFOLIO

27.2.4 RECENT UPDATES

27.3 CANON INDIA PVT LTD.

27.3.1 COMPANY SNAPSHOT

27.3.2 REVENUE ANALYSIS

27.3.3 PRODUCT PORTFOLIO

27.3.4 RECENT UPDATES

27.4 NIKON INC.

27.4.1 COMPANY SNAPSHOT

27.4.2 REVENUE ANALYSIS

27.4.3 PRODUCT PORTFOLIO

27.4.4 RECENT UPDATES

27.5 PANASONIC LIFE SOLUTIONS INDIA PVT. LTD.

27.5.1 COMPANY SNAPSHOT

27.5.2 REVENUE ANALYSIS

27.5.3 PRODUCT PORTFOLIO

27.5.4 RECENT UPDATES

27.6 KONINKLIJKE PHILIPS N.V.

27.6.1 COMPANY SNAPSHOT

27.6.2 REVENUE ANALYSIS

27.6.3 PRODUCT PORTFOLIO

27.6.4 RECENT UPDATES

27.7 EASTMAN KODAK COMPANY

27.7.1 COMPANY SNAPSHOT

27.7.2 REVENUE ANALYSIS

27.7.3 PRODUCT PORTFOLIO

27.7.4 RECENT UPDATES

27.8 SIGMA CORPORATION

27.8.1 COMPANY SNAPSHOT

27.8.2 REVENUE ANALYSIS

27.8.3 PRODUCT PORTFOLIO

27.8.4 RECENT UPDATES

27.9 LEICA CAMERA AG

27.9.1 COMPANY SNAPSHOT

27.9.2 REVENUE ANALYSIS

27.9.3 PRODUCT PORTFOLIO

27.9.4 RECENT UPDATES

27.1 HASSELBLAD

27.10.1 COMPANY SNAPSHOT

27.10.2 REVENUE ANALYSIS

27.10.3 PRODUCT PORTFOLIO

27.10.4 RECENT UPDATES

27.11 OLYMPUS CORPORATION

27.11.1 COMPANY SNAPSHOT

27.11.2 REVENUE ANALYSIS

27.11.3 PRODUCT PORTFOLIO

27.11.4 RECENT UPDATES

27.12 SAMSUNG

27.12.1 COMPANY SNAPSHOT

27.12.2 REVENUE ANALYSIS

27.12.3 PRODUCT PORTFOLIO

27.12.4 RECENT UPDATES

27.13 RICOH IMAGING COMPANY, LTD.

27.13.1 COMPANY SNAPSHOT

27.13.2 REVENUE ANALYSIS

27.13.3 PRODUCT PORTFOLIO

27.13.4 RECENT UPDATES

27.14 TOSHIBA TELI CORPORATION

27.14.1 COMPANY SNAPSHOT

27.14.2 REVENUE ANALYSIS

27.14.3 PRODUCT PORTFOLIO

27.14.4 RECENT UPDATES

27.15 RICOHPENTAX INDIA.

27.15.1 COMPANY SNAPSHOT

27.15.2 REVENUE ANALYSIS

27.15.3 PRODUCT PORTFOLIO

27.15.4 RECENT UPDATES

27.16 SJCAM

27.16.1 COMPANY SNAPSHOT

27.16.2 REVENUE ANALYSIS

27.16.3 PRODUCT PORTFOLIO

27.16.4 RECENT UPDATES

27.17 GOPRO INC

27.17.1 COMPANY SNAPSHOT

27.17.2 REVENUE ANALYSIS

27.17.3 PRODUCT PORTFOLIO

27.17.4 RECENT UPDATES

28 KOREA DIGITAL CAMERA MARKET- COMPANY PROFILES

28.1 SAMSUNG

28.1.1 COMPANY SNAPSHOT

28.1.2 REVENUE ANALYSIS

28.1.3 PRODUCT PORTFOLIO

28.1.4 RECENT UPDATES

28.2 LEICA CAMERA AG

28.2.1 COMPANY SNAPSHOT

28.2.2 REVENUE ANALYSIS

28.2.3 PRODUCT PORTFOLIO

28.2.4 RECENT UPDATES

28.3 SONY

28.3.1 COMPANY SNAPSHOT

28.3.2 REVENUE ANALYSIS

28.3.3 PRODUCT PORTFOLIO

28.3.4 RECENT UPDATES

28.4 NIKON

28.4.1 COMPANY SNAPSHOT

28.4.2 REVENUE ANALYSIS

28.4.3 PRODUCT PORTFOLIO

28.4.4 RECENT UPDATES

28.5 CANON

28.5.1 COMPANY SNAPSHOT

28.5.2 REVENUE ANALYSIS

28.5.3 PRODUCT PORTFOLIO

28.5.4 RECENT UPDATES

28.6 PANASONIC

28.6.1 COMPANY SNAPSHOT

28.6.2 REVENUE ANALYSIS

28.6.3 PRODUCT PORTFOLIO

28.6.4 RECENT UPDATES

28.7 FUJIFILM HOLDINGS

28.7.1 COMPANY SNAPSHOT

28.7.2 REVENUE ANALYSIS

28.7.3 PRODUCT PORTFOLIO

28.7.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

29 RELATED REPORTS

30 QUESTIONNAIRE

31 CONCLUSION

32 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.