Global Digital Recorder Market

Market Size in USD Billion

CAGR :

%

USD

1.88 Billion

USD

2.70 Billion

2024

2032

USD

1.88 Billion

USD

2.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.88 Billion | |

| USD 2.70 Billion | |

|

|

|

|

Digital Recorder Market Size

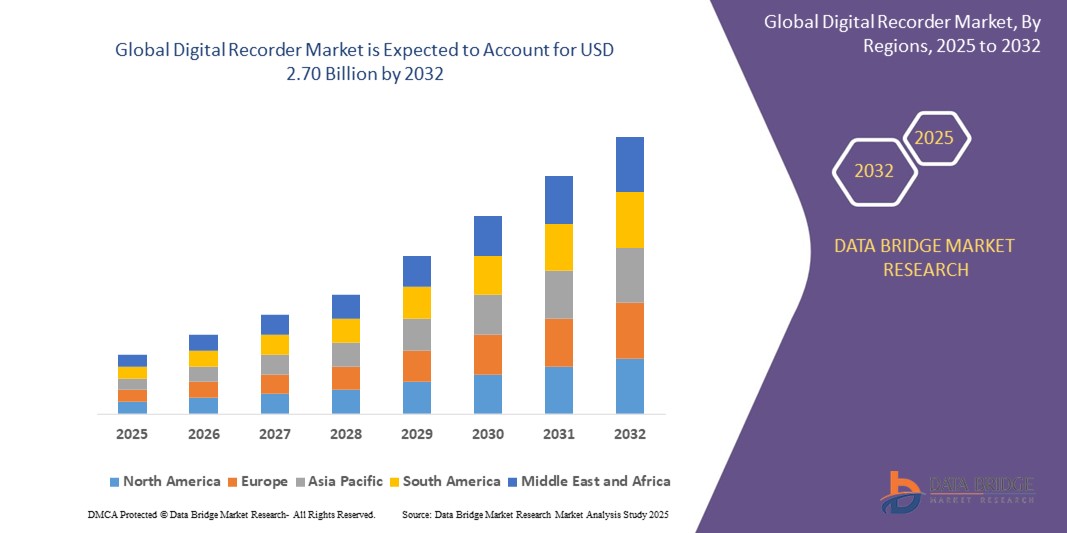

- The global digital recorder market size was valued at USD 1.88 billion in 2024 and is expected to reach USD 2.70 billion by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is primarily driven by the increasing demand for high-quality audio recording solutions, advancements in digital storage technologies, and the growing adoption of digital recorders in professional and personal applications

- Rising consumer preference for portable, user-friendly, and high-capacity recording devices, coupled with the integration of advanced connectivity options such as Bluetooth and Wireless, is further propelling market expansion

Digital Recorder Market Analysis

- Digital recorders, designed for capturing high-quality audio and data, are increasingly integral to various applications, including journalism, education, podcasting, and professional audio production, due to their portability, ease of use, and compatibility with modern digital ecosystems

- The surge in demand for digital recorders is fueled by the growing popularity of content creation, such as podcasts and interviews, increasing need for reliable voice recording solutions, and advancements in battery life and storage capacities

- North America dominated the digital recorder market with the largest revenue share of 38.5% in 2024, driven by early adoption of advanced recording technologies, high disposable incomes, and the presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing adoption of digital content creation, and rising disposable incomes in countries such as China, India, and Japan

- The USB segment dominated the largest market revenue share of 35% in 2024, driven by its widespread compatibility, ease of use, and hot-swapping capabilities, allowing seamless connectivity with devices such as computers, cameras, and media players for efficient data transfer

Report Scope and Digital Recorder Market Segmentation

|

Attributes |

Digital Recorder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Recorder Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global digital recorder market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing, providing deeper insights into audio quality, user behavior, and device performance optimization

- AI-powered digital recorders can proactively identify recording issues, such as background noise or low battery, enhancing user experience and device reliability

- For instances, companies are developing AI-driven platforms that analyze audio patterns to offer features such as automatic transcription, voice-to-text conversion, and noise cancellation for clearer recordings

- This trend enhances the value proposition of digital recorders, making them more appealing to professionals in journalism, education, and legal sectors, as well as individual consumers

- AI algorithms can analyze various recording metrics, such as audio clarity, speech patterns, and environmental noise, to optimize settings and improve output quality

Digital Recorder Market Dynamics

Driver

“Rising Demand for High-Quality Audio Recording and Connectivity Features”

- Increasing consumer demand for high-quality audio recording solutions, such as those used for podcasting, interviews, and educational purposes, is a major driver for the global digital recorder market

- Digital recorders enhance functionality with features such as cloud integration, automatic transcription, and compatibility with smartphones and other devices

- Government and industry mandates, particularly in legal and healthcare sectors, are driving the adoption of digital recorders for accurate documentation and transcription

- The proliferation of IoT and advancements in 5G technology are enabling faster data transmission and lower latency, supporting sophisticated recording applications such as real-time sharing and cloud storage

- Manufacturers are increasingly offering digital recorders with built-in connectivity options, such as Bluetooth and Wi-Fi, as standard or optional features to meet consumer expectations and enhance device value

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The significant initial investment required for advanced hardware, software, and integration of digital recorder systems can be a barrier to adoption, particularly in cost-sensitive emerging markets

- Retrofitting digital recorders with existing devices or systems can be complex and costly, limiting accessibility for some users

- Data security and privacy concerns are a major challenge, as digital recorders collect and store sensitive audio data, raising risks of breaches or misuse, particularly in legal and healthcare applications

- The fragmented regulatory landscape across countries regarding data collection, storage, and usage complicates compliance for manufacturers and service providers operating internationally

- These factors can deter potential buyers and slow market growth, especially in regions with high awareness of data privacy or significant cost sensitivity

Digital Recorder market Scope

The market is segmented on the basis of recorder interface, memory size, battery type, and consumer.

- By Recorder Interface

On the basis of recorder interface, the global digital recorder market is segmented into bluetooth, infrared, USB, SD card, and wireless. The USB segment dominated the largest market revenue share of 35% in 2024, driven by its widespread compatibility, ease of use, and hot-swapping capabilities, allowing seamless connectivity with devices such as computers, cameras, and media players for efficient data transfer.

The wireless segment is expected to witness the fastest growth rate of 12.5% from 2025 to 2032, propelled by rising demand for enhanced connectivity features such as Wi-Fi and Bluetooth, enabling remote access and easy file sharing. Advancements in IoT integration and cloud-based solutions further accelerate adoption, enhancing user convenience and functionality.

- By Memory Size

On the basis of memory size, the global digital recorder market is segmented into 1 GB, 2 GB, 4 GB, 8 GB, and 16 GB. The 8 GB segment dominated the market with a revenue share of 31.3% in 2024, offering a balanced combination of ample storage and affordability, catering to both professional and consumer needs for extended recordings.

The 16 GB segment is anticipated to experience the fastest growth rate of 11.8% from 2025 to 2032, driven by increasing demand from professional users, such as journalists and content creators, for high-capacity storage to support longer, high-quality audio and video recordings without frequent data transfers.

- By Battery Type

On the basis of battery type, the global digital recorder market is segmented into rechargeable, AA, AAA, lithium ion, and others. The lithium ion segment held the largest market revenue share of 40.2% in 2024, owing to its high energy density, compact size, and ability to support multiple recharge cycles, making it ideal for portable digital recorders used in demanding applications.

The rechargeable segment is expected to witness significant growth from 2025 to 2032, with a CAGR of 10.9%, driven by consumer preference for eco-friendly and cost-effective solutions. Advancements in fast-charging technology and the integration of rechargeable batteries in compact devices further enhance their adoption.

- By Consumer

On the basis of consumer, the global digital recorder market is segmented into voice recording, commercial, interview recording, and others. The voice recording segment dominated the market with a revenue share of 38.7% in 2024, driven by its widespread use in education, journalism, and personal applications for capturing lectures, interviews, and notes with high audio quality.

The interview recording segment is expected to witness the fastest growth rate of 13.2% from 2025 to 2032, fueled by increasing demand in media, legal, and healthcare sectors for high-quality, reliable recording solutions. The integration of AI-powered transcription and noise reduction technologies further boosts adoption for professional interview purposes.

Digital Recorder Market Regional Analysis

- North America dominated the digital recorder market with the largest revenue share of 38.5% in 2024, driven by early adoption of advanced recording technologies, high disposable incomes, and the presence of key industry players

- Consumers prioritize digital recorders for high-quality voice recording, enhanced connectivity, and portability, particularly in regions with strong media, education, and corporate sectors

- Growth is supported by advancements in recorder technology, including AI-powered transcription, cloud storage integration, and improved battery life, alongside rising adoption in both professional and consumer segments

U.S. Digital Recorder Market Insight

The U.S. digital recorder market captured the largest revenue share of 77.5% in 2024 within North America, fueled by strong demand in journalism, education, and corporate sectors, as well as growing consumer awareness of high-quality audio and transcription benefits. The trend toward remote work and online learning further boosts market expansion. Manufacturers’ integration of advanced features such as Bluetooth and voice-to-text capabilities complements professional and personal use, creating a robust product ecosystem.

Europe Digital Recorder Market Insight

The Europe digital recorder market is expected to witness significant growth, supported by regulatory emphasis on data privacy and secure recording solutions. Consumers seek recorders that offer superior audio quality and connectivity features such as Wi-Fi and Bluetooth. The growth is prominent in both professional applications and personal use, with countries such as Germany and France showing significant uptake due to increasing adoption in legal and educational sectors.

U.K. Digital Recorder Market Insight

The U.K. market for digital recorders is expected to witness rapid growth, driven by demand for high-quality audio solutions in media and corporate environments. Increased interest in portable, user-friendly devices and rising awareness of transcription and noise reduction benefits encourage adoption. Evolving regulations on data security and recording standards influence consumer choices, balancing functionality with compliance.

Germany Digital Recorder Market Insight

Germany is expected to witness rapid growth in the digital recorder market, attributed to its advanced technology sector and high consumer focus on audio quality and data privacy. German consumers prefer technologically advanced recorders that offer noise reduction and multi-device compatibility. The integration of these devices in professional settings and aftermarket options supports sustained market growth.

Asia-Pacific Digital Recorder Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding consumer electronics markets and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of high-quality audio recording, transcription capabilities, and device portability is boosting demand. Government initiatives promoting digitalization and smart technology further encourage the use of advanced digital recorders.

Japan Digital Recorder Market Insight

Japan’s digital recorder market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced recorders that enhance audio clarity and connectivity. The presence of major electronics manufacturers and integration of recorders in professional applications accelerate market penetration. Rising interest in personal recording devices also contributes to growth.

China Digital Recorder Market Insight

China holds the largest share of the Asia-Pacific digital recorder market, propelled by rapid urbanization, rising electronics consumption, and increasing demand for high-quality audio solutions. The country’s growing middle class and focus on digital innovation support the adoption of advanced recorders. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Digital Recorder Market Share

The digital recorder industry is primarily led by well-established companies, including:

- Sony Corporation (Japan)

- Nikon Corporation (Japan)

- RICOH Imaging Company Ltd (Japan)

- Olympus Corporation (Japan)

- Fujifilm Corporation (Japan)

- SAMSUNG ELECTRONICS CO., LTD. (South Korea)

- Panasonic Corporation (Japan)

- JVCKENWOOD Corporation (Japan)

- ARRI AG (Germany)

- Blackmagic Design Pty. Ltd. (Australia)

- Kinefinity Inc. (China)

- BMG (U.S.)

- PLR Ecommerce, LLC (U.S.)

- Ricoh India Ltd (India)

- Zoom Corporation (Japan)

- Hyundai Digital Technology Shenzhen Co Ltd (China)

- LEAP INVESTMENTS LTD (U.K.)

- Koninklijke Philips N.V. (Netherlands)

What are the Recent Developments in Global Digital Recorder Market?

- In May 2025, Zowietek, a China-based provider of professional video solutions, launched ZowieREC, a multi-purpose, compact 4K HDMI video recorder. This device is designed for top-tier video recording, streaming, and analog-to-digital conversion, offering standalone 4K/1080p recording, zero-latency pass-through, H.265 encoding, and PC-free streaming to platforms such as YouTube and Twitch

- In June 2024, OneSpan Inc. launched the OneSpan Integration Platform, designed to streamline the integration of eSignatures into popular applications. While focused on digital transaction management, this platform indirectly supports digital recording workflows by simplifying the process of sending, signing, and storing transactions, enhancing overall efficiency for businesses that utilize digital records

- In April 2024, iFlytek, a China-based manufacturer, unveiled the iFLYTEK Smart Recorder. This is noted as the first offline AI voice recorder capable of converting spoken words to written text entirely without needing an internet connection. It targets professional and academic use with features such as long-distance recording, intelligent noise reduction, and comprehensive language support

- In November 2023, DocuSign Inc., a key player in digital transaction management, launched WhatsApp Delivery for its eSignature platform. This collaboration allows users to send and receive real-time notifications and agreements directly through WhatsApp, facilitating faster and more secure digital record-keeping and transaction completion

- In May 2023, Nextbase unveiled the Nextbase iQ, representing the next generation of in-car security and driver assistance. Nextbase partnered with Vodafone and T-Mobile to provide connectivity for the device in the U.K. and North America, respectively, enabling features such as real-time video, notifications, and over-the-air updates for in-car digital video recording

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.