Global Diabetic Assays Market

Market Size in USD Billion

CAGR :

%

USD

3.53 Billion

USD

5.02 Billion

2024

2032

USD

3.53 Billion

USD

5.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.53 Billion | |

| USD 5.02 Billion | |

|

|

|

|

Diabetic Assays Market Size

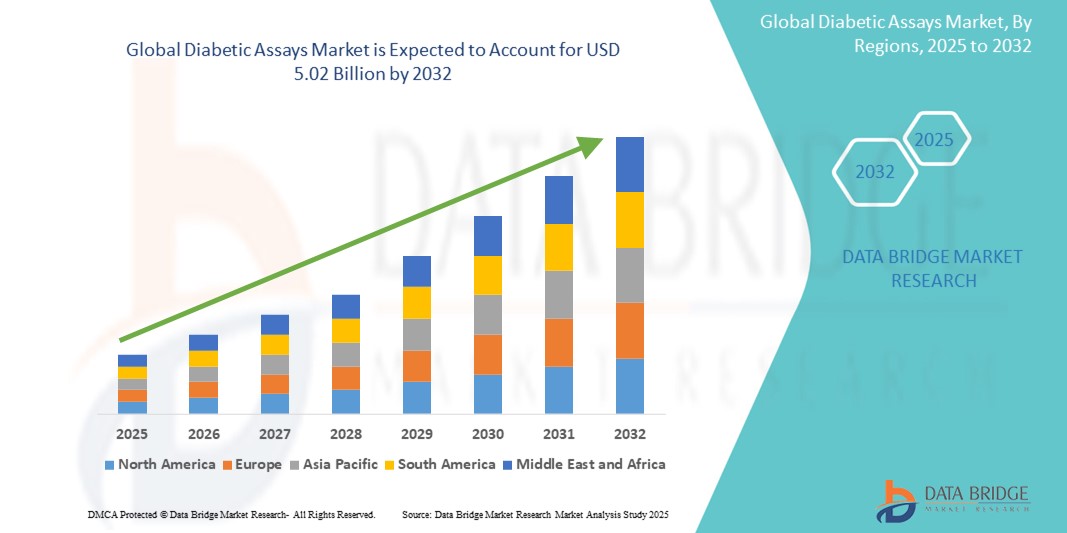

- The global diabetic assays market size was valued at USD 3.53 billion in 2024 and is expected to reach USD 5.02 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is primarily driven by the increasing prevalence of diabetes worldwide, coupled with advancements in assay technologies that enable faster, more accurate, and cost-effective diagnostic solutions. The expanding adoption of point-of-care testing and continuous glucose monitoring systems further contribute to market expansion

- Moreover, growing awareness among healthcare providers and patients about early diagnosis and continuous monitoring of diabetic conditions, along with government initiatives promoting diabetes screening programs, is driving demand for diabetic assay products globally. These factors are collectively fueling the rapid growth of the diabetic assays market

Diabetic Assays Market Analysis

- Diabetic assays, encompassing a range of diagnostic tools used to detect and monitor biomarkers such as glucose, insulin, and HbA1c, are increasingly essential components of modern diabetes management in both clinical and homecare settings due to their enhanced accuracy, rapid results, and compatibility with automated and point-of-care systems

- The escalating demand for diabetic assays is primarily fueled by the growing global burden of diabetes, increasing awareness of early diagnostic testing, and the proliferation of technologically advanced diagnostic platforms that facilitate efficient and frequent monitoring

- North America dominates the diabetic assays market with the largest revenue share of 38.5% in 2024, characterized by a high prevalence of diabetes, advanced healthcare infrastructure, and strong support from governmental and private organizations promoting early detection and disease management

- Asia-Pacific is expected to be the fastest growing region in the diabetic assays market during the forecast period due to increasing diabetic population, improving access to healthcare diagnostics, and rising awareness of the importance of routine blood glucose and HbA1c testing

- Enzymatic Assay segment dominates the diabetic assays market with a market share of 45.5% in 2024, driven by its high sensitivity, accuracy, and widespread adoption in clinical diagnostics for glucose and HbA1c testing

Report Scope and Diabetic Assays Market Segmentation

|

Attributes |

Diabetic Assays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diabetic Assays Market Trends

“Technological Advancements in Point-of-Care and Automated Testing”

- A significant and accelerating trend in the global diabetic assays market is the rapid technological advancement in point-of-care (POC) and automated testing solutions, enabling quicker, more accurate, and user-friendly diagnostic experiences in both clinical and homecare settings. These innovations are reshaping diabetes monitoring by improving accessibility, reducing turnaround times, and enhancing the reliability of test results

- For instance, Abbott’s FreeStyle Libre system exemplifies how continuous glucose monitoring (CGM) technologies are integrating with mobile applications to provide real-time glucose readings without the need for traditional finger-prick testing. Roche’s Cobas systems are another instance, automating HbA1c and glucose testing for centralized laboratories with high throughput and precision

- The evolution of diabetic assays is also marked by the use of miniaturized biosensors and microfluidic platforms that support compact and portable diagnostic devices. These advancements facilitate convenient self-monitoring and frequent testing, particularly beneficial for managing Type 2 diabetes, which often requires continuous lifestyle and treatment adjustments

- The integration of diabetic testing devices with smartphone apps and cloud-based platforms is enabling remote monitoring and data sharing with healthcare providers, supporting telemedicine and personalized treatment plans. For instance, Bio-Rad’s D-10 system and PTS Diagnostics’ CardioChek analyzers enable consistent tracking of HbA1c and lipid levels, with digital connectivity enhancing patient engagement and clinical decision-making

- This trend toward faster, more connected, and user-centric diagnostic technologies is fundamentally transforming how patients and clinicians manage diabetes. As a result, companies such as Siemens Healthineers and Dexcom are focusing on AI-supported diagnostics, compact multi-analyte devices, and POC solutions that combine clinical-grade accuracy with real-time data integration

- The growing demand for diabetic assays that offer speed, precision, and digital connectivity is accelerating across both high-income and emerging economies, driven by the increasing burden of diabetes, healthcare digitalization, and the shift toward value-based care

Diabetic Assays Market Dynamics

Driver

“Increasing Diabetes Prevalence and Demand for Early, Accurate Diagnosis”

- The global rise in diabetes prevalence, driven by sedentary lifestyles, unhealthy diets, and aging populations, is a major driver of demand for diabetic assays, which are essential for timely diagnosis and effective disease management across all age groups

- For instance, in 2024, the International Diabetes Federation (IDF) estimated that over 537 million adults globally are living with diabetes, with projections reaching 643 million by 2030. This alarming increase is pushing healthcare systems and diagnostic companies to prioritize early and accessible testing solutions, boosting the adoption of diabetic assay technologies

- Accurate and early detection of blood glucose levels, HbA1c, insulin, and other biomarkers is critical for initiating treatment plans and preventing long-term complications such as neuropathy, retinopathy, and cardiovascular diseases. Diabetic assays offer this clinical value, positioning them as indispensable tools in chronic disease monitoring

- In addition, growing public and private healthcare investments in diabetes screening and awareness programs are supporting the increased deployment of diagnostic kits and point-of-care testing devices in both urban and rural areas, particularly in developing regions.

- Technological advancements such as lab-on-a-chip platforms, biosensors, and integration with mobile health apps are making diabetic assays more accessible, faster, and easier to use. These innovations enhance patient compliance and enable decentralized testing outside of traditional clinical settings

- The demand for precise, reliable, and patient-friendly diagnostic tools continues to grow as healthcare providers and governments focus on reducing the global burden of diabetes. As a result, diabetic assays are becoming central to routine screenings, personalized therapy plans, and value-based healthcare strategies

Restraint/Challenge

“Regulatory Complexities and High Cost of Advanced Diagnostic Solutions”

- Regulatory hurdles and the high cost associated with advanced diagnostic technologies present significant challenges to the widespread adoption of diabetic assays, especially in low- and middle-income countries. Stringent regulatory approval processes for new diagnostic assays often delay product launches and market availability, thereby slowing innovation diffusion and limiting access in key regions

- For instance, companies developing novel HbA1c or biosensor-based glucose assays must undergo rigorous clinical validation and approval from authorities such as the FDA, EMA, or regional equivalents, which can be time-consuming and resource-intensive

- In addition, the cost of high-performance diabetic diagnostic systems—particularly automated platforms and continuous glucose monitoring (CGM) devices—can be prohibitive for smaller clinics and patients without sufficient insurance coverage. This is particularly evident in developing countries, where healthcare budgets are constrained and access to reliable diagnostic tools remains inconsistent

- Despite the introduction of lower-cost point-of-care kits and test strips, advanced diagnostics such as integrated analyzers or mobile-connected devices remain out of reach for many healthcare providers and individuals. Moreover, recurrent expenses related to consumables, calibration, and maintenance can further increase the economic burden

- The complexity of diagnostic reimbursement policies across regions, coupled with the lack of standardized diagnostic practices, also contributes to uneven adoption. This variability makes it difficult for global manufacturers to scale efficiently and ensure affordability

- Overcoming these challenges will require strategic investments in cost-effective innovations, regulatory harmonization, and international collaborations aimed at improving access and affordability. Enhancing awareness and support for preventive diabetes screening programs can also play a key role in mitigating these barriers and fostering long-term market growth

Diabetic Assays Market Scope

The market is segmented on the basis of method, product type, disease type, end-users, and distribution channel.

- By Method

On the basis of method, the diabetic assays market is segmented into ELISA, point of care testing, enzymatic assay, colorimetric assay, and others. The enzymatic assay segment dominates the largest market revenue share of 45.5% in 2024, driven by its high specificity, sensitivity, and suitability for glucose and HbA1c quantification. These assays are widely adopted in both clinical laboratories and automated platforms due to their reliability in detecting metabolic changes associated with diabetes.

The point of care testing segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for rapid, on-site diabetes diagnosis and monitoring in home and outpatient settings. Their ability to deliver immediate results supports early intervention and improved disease management, especially in resource-limited environments.

- By Product Type

On the basis of product type, the diabetic assays market is segmented into instruments, testing kits, and reagents. The testing kits segment held the largest market revenue share in 2024, owing to their widespread use in both professional healthcare settings and personal monitoring. These kits offer a combination of affordability, portability, and ease of use, making them essential tools in routine blood glucose and HbA1c testing.

The reagents segment is expected to witness the highest CAGR from 2025 to 2032, driven by the continuous innovation in assay chemistry and the growing demand for high-throughput reagents compatible with advanced analyzers and automated platforms. Reagents form the core of diagnostic performance and are critical for accurate biochemical measurements

- By Disease Type

On the basis of disease type, the diabetic assays market is segmented into Type 1 diabetes, Type 2 diabetes, and gestational diabetes. The type 2 diabetes segment dominates the market in 2024, accounting for the majority of diabetic assay applications due to the high global prevalence and rising incidence among aging and obese populations. The increasing focus on routine monitoring and early detection further accelerates assay usage in this segment.

The gestational diabetes segment is projected to grow at the fastest rate, driven by increasing awareness about maternal and neonatal complications and the growing implementation of prenatal screening protocols across healthcare systems.

- By End User

On the basis of end-users, the diabetic assays market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment captured the largest market share in 2024, supported by their centralized diagnostic infrastructure, higher patient inflow, and the availability of sophisticated laboratory instruments for diabetes screening and management.

The homecare segment is expected to expand at the fastest pace over the forecast period, fueled by the rising prevalence of diabetes, increasing elderly population, and the trend toward personalized, at-home diagnostic solutions. Growing adoption of portable kits and digital glucometers has significantly enhanced the feasibility of home-based testing.

- By Distribution Channel

On the basis of distribution channel, the diabetic assays market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment leads the diabetic assays market in 2024, driven by strong integration with healthcare providers and the immediate availability of diagnostic consumables and kits for inpatient and outpatient use.

The online pharmacy segment is projected to grow at the highest CAGR from 2025 to 2032, supported by increasing e-commerce penetration, greater convenience, and the rise of telemedicine platforms. Consumers are increasingly turning to online platforms for recurring diagnostic needs, especially in urban and tech-savvy populations.

Diabetic Assays Market Regional Analysis

- North America dominates the diabetic assays market with the largest revenue share of 38.5% in 2024, driven by high prevalence of diabetes, advanced healthcare infrastructure, and strong support from governmental and private organizations promoting early detection and disease management

- The region’s widespread implementation of routine diabetes screening programs, along with favorable reimbursement policies and well-established clinical laboratories, significantly boosts the demand for diabetic assay products across hospitals and diagnostic centers

- Furthermore, the presence of key players, ongoing R&D activities, and the growing emphasis on early disease detection and personalized treatment are fostering the consistent expansion of the diabetic assays market across North America

U.S. Diabetic Assays Market Insight

The U.S. diabetic assays market captured the largest revenue share of 83.5% in 2024 within North America, driven by the country’s high diabetes prevalence, proactive healthcare policies, and advanced diagnostic capabilities. Increased emphasis on early disease detection and personalized diabetes management has led to widespread adoption of enzymatic and ELISA-based assay technologies. Moreover, strong research funding, coupled with the presence of leading diagnostic companies and a high rate of screening awareness among the population, significantly supports market growth across both public and private healthcare settings

Europe Diabetic Assays Market Insight

The Europe diabetic assays market is projected to expand at a substantial CAGR throughout the forecast period, primarily due to rising healthcare spending and the increasing burden of diabetes across major economies. With strong governmental focus on preventative health measures, diabetic screening programs are gaining momentum, especially in countries such as Germany, France, and Italy. In addition, the region’s shift toward decentralized diagnostics and point-of-care testing is fostering demand for rapid and reliable diabetic assay kits across both primary care facilities and homecare environments.

U.K. Diabetic Assays Market Insight

The U.K. diabetic assays market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by national efforts to combat rising diabetes rates through early detection and public awareness initiatives. The NHS and affiliated bodies continue to invest in diagnostics to reduce long-term healthcare costs, thereby creating favorable conditions for diabetic assay manufacturers. In addition, technological innovation and partnerships between healthcare providers and diagnostic companies are accelerating the adoption of automated and home-based assay solutions.

Germany Diabetic Assays Market Insight

The Germany diabetic assays market is expected to expand at a considerable CAGR, driven by robust diagnostic infrastructure and a growing emphasis on preventive care. Germany’s universal healthcare coverage, coupled with increased funding for chronic disease management, supports routine diabetes testing across hospitals, clinics, and specialized diagnostic labs. With a strong focus on accuracy and efficiency, the country is witnessing growing demand for high-sensitivity assay kits, particularly enzymatic and ELISA formats, in both outpatient and institutional settings.

Asia-Pacific Diabetic Assays Market Insight

The Asia-Pacific diabetic assays market is poised to grow at the fastest CAGR of 25.3% during the forecast period of 2025 to 2032, fueled by the region’s increasing diabetes burden, expanding healthcare access, and rising awareness of regular glucose monitoring. Countries such as China, India, and Japan are driving regional growth through large-scale public health campaigns and government-backed chronic disease screening programs. Moreover, the growing presence of local diagnostic manufacturers and technological innovations in point-of-care testing are making diabetic assays more accessible and affordable across diverse populations.

Japan Diabetic Assays Market Insight

The Japan diabetic assays market is gaining momentum due to the country’s aging population, high diabetes prevalence, and emphasis on preventive diagnostics. Japan’s advanced medical infrastructure and integration of AI in diagnostics are enhancing the reliability and speed of assay-based diabetes testing. In addition, collaborations between government bodies and private companies are enabling widespread deployment of point-of-care kits in community clinics, elderly care centers, and home settings, promoting early intervention and sustained disease management

India Diabetic Assays Market Insight

The India diabetic assays market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the nation’s expanding healthcare infrastructure, growing diabetic population, and government-led screening initiatives. Rapid urbanization and a shift towards sedentary lifestyles are contributing to the diabetes surge, prompting increased demand for diagnostic assays. Domestic manufacturers and startups are also playing a pivotal role by offering cost-effective and accessible assay solutions tailored for rural and underserved areas, thereby significantly broadening market reach

Diabetic Assays Market Share

The diabetic assays industry is primarily led by well-established companies, including:

- Abbvie, Inc (U.S.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd (Israel)

- Pfizer Inc. (U.S.)

- Merck KGaA, (U.S.)

- Abbott (U.S.)

- Siemens (Germany)

- Dynatronics Corporation (U.S.)

- BIOMÉRIEUX (France)

- Bio-Rad Laboratories, Inc. (U.S.)

- BAG Diagnostics GmbH (Germany)

- DiaSorin S.p.A. (Italy)

- DRG INSTRUMENTS GMBH (Germany)

- PTS Diagnostics (U.S.)

- QuidelOrtho Corporation (U.S.)

- Diazyme Laboratories (U.S.)

- ETHOS BIOSCIENCES (U.S.)

- Abnova Corporation (Taiwan)

- Monobind Inc. (U.S.)

Latest Developments in Global Diabetic Assays Market

- In March 2024, Abbott Laboratories launched the next-generation FreeStyle Libre 3 continuous glucose monitoring system with enhanced accuracy and real-time glucose data transmission. This upgrade provides diabetic patients with improved monitoring capabilities, supporting better glycemic control and proactive management. Abbott’s advancement highlights its commitment to integrating innovative sensor technology with user-friendly mobile applications

- In February 2024, Roche Diagnostics introduced a new enzymatic assay for rapid HbA1c testing designed for point-of-care settings. This test delivers accurate results within minutes, facilitating timely diagnosis and monitoring of diabetes in clinical environments. Roche’s development addresses the increasing demand for convenient, reliable, and rapid diabetic assays in primary care and specialty clinics

- In January 2024, Siemens Healthineers expanded its portfolio by launching an advanced reagent kit optimized for Type 2 diabetes biomarkers. The new kit enhances sensitivity and specificity, improving early detection and personalized treatment strategies. Siemens' innovation underscores the growing trend toward precision diagnostics in diabetes care

- In December 2023, Bio-Rad Laboratories announced the commercial availability of a colorimetric assay kit targeting gestational diabetes. This assay facilitates non-invasive, rapid screening during pregnancy, enabling early intervention to reduce complications. Bio-Rad’s product expansion supports the rising prevalence of gestational diabetes worldwide

- In November 2023, Dexcom, Inc. launched enhanced software integration for its continuous glucose monitoring (CGM) devices that enables seamless data sharing with healthcare providers and integration with electronic health records (EHR). This advancement fosters improved remote patient monitoring and personalized diabetes management. Dexcom's commitment to digital health innovation positions it strongly in the diabetic assays market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.