Global Dental Splints Market

Market Size in USD Million

CAGR :

%

USD

440.01 Million

USD

696.04 Million

2022

2030

USD

440.01 Million

USD

696.04 Million

2022

2030

| 2023 –2030 | |

| USD 440.01 Million | |

| USD 696.04 Million | |

|

|

|

|

Dental Splints Market Analysis and Size

Dental splints, also known as occlusal splints or occlusal guards, are oral appliances used in dentistry to address various conditions related to the occlusion (bite) and temporomandibular joint (TMJ). These splints are typically custom made by a dentist or a dental laboratory to fit a patient's specific needs. Dental splints are devices which are used to solve a various different dental problem, such as bruxism and loose teeth. In addition, they are used to treat problems related to snoring and apnoea. Dental splints are fitted by a dentist at the clinic who confirms that the splints adapt to the patient’s teeth or not. Dental splinting procedure is used to cure loose teeth by joining them together. Dental splint balances teeth. Therefore, they are less likely to move.

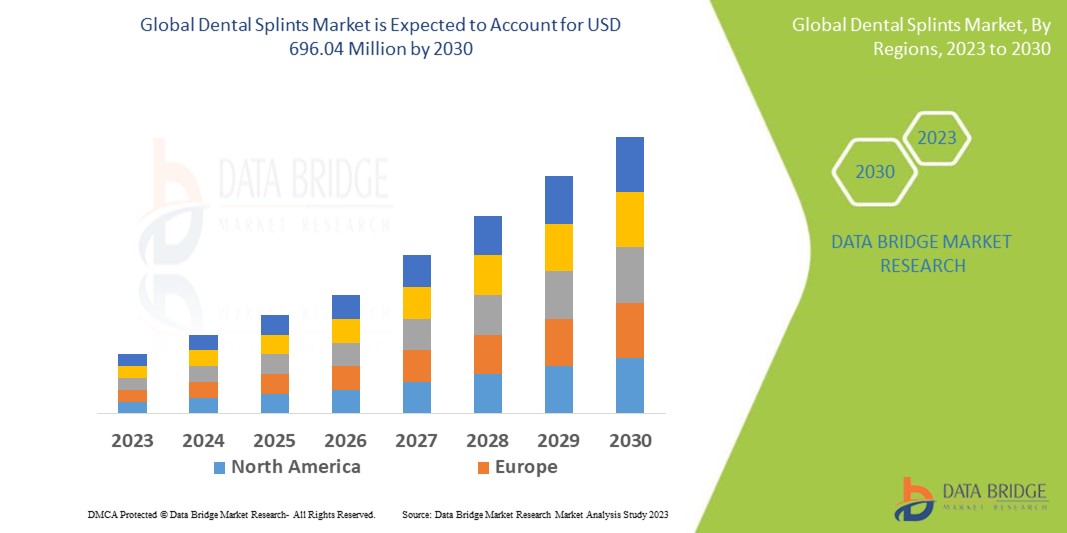

Data Bridge Market Research analyses that the global dental splints market which was USD 440.01 million in 2022, is expected to reach USD 696.04 million by 2030, and is expected to undergo a CAGR of 5.9% during the forecast period of 2023 to 2030. “Implants” dominates the product segment of the global dental splints market owing to the increasing prevalence of dental disorders. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Dental Splints Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Implants, Prosthetics, Orthodontics, Endodontics, Infection Control, Periodontics, Whitening Products, Prophylaxis, Fluorides, Sealants, Splints), and End User (Hospital & Clinic, Laboratory) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), South Africa, Saudi Arabia, UA..E., Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Danaher (U.S.), Dentsply Sirona (U.S.), Ultradent Products Inc. (U.S.), Septodont Holding (France), Henry Schein, Inc. (U.S.), Benco Dental Supply Company (U.S.), Brasseler USA (U.S.), Ivoclar Vivadent (Liechtenstein), COLTENE Group (Switzerland), FKG Dentaire Sàrl (Switzerland), Orofacial Therapeutics, LP (Switzerland), GC Corporation (Japan), Keystone Dental Inc (U.S.), Vertex Holdings (Singapore), 3D Systems, Inc. (U.S.), Institut Straumann AG (Switzerland) and BEGO GmbH & Co. KG (Germany) |

|

Market Opportunities |

|

Market Definition

An occlusal splint or orthotic device is a specially designed mouth guard for people who grind their teeth, have a history of pain and dysfunction associated with their bite or temporomandibular joints (TMJ), or have completed a full mouth reconstruction. An occlusal splint is custom made using detailed study models on an instrument called an articulator that simulates the movement of the jaws.

Global Dental Splints Market Dynamics

Drivers

- Increasing Prevalence of Dental disorders

Dental conditions such as bruxism (teeth grinding), temporomandibular joint disorders (TMD), malocclusion, and tooth wear are becoming increasingly prevalent. These conditions often require the use of dental splints as part of the treatment or management plan, driving the demand for splints.

- Dental Aesthetics and Cosmetic Dentistry

The increasing focus on dental aesthetics and cosmetic dentistry has driven the demand for dental splints. Splints can be used to correct malocclusion, align teeth, and improve the overall appearance of the smile. This trend has led to an expanded market for aesthetic splints and orthodontic splints used in cosmetic dental procedures.

- Growing Awareness and Diagnosis

There is a growing awareness among individuals about the importance of oral health and the need for timely diagnosis and treatment of dental disorders. As a result, more people are seeking dental care, leading to an increased diagnosis of conditions that require dental splints.

- Aging Population

The aging population is a significant driver for the dental splints market. As people age, they may experience a higher incidence of dental conditions such as TMD and tooth wear. Dental splints can provide relief and improve oral function in these cases, making them an essential treatment option for the elderly population.

Opportunities

- Integration of Digital Dentistry

The integration of digital workflows in dentistry provides opportunities for improved treatment planning and splint fabrication. Digital tools such as intraoral scanners, digital impressions, and virtual articulators enable more precise measurements and better customization of dental splints.

- Expansion of Applications

Dental splints have traditionally been used for conditions like bruxism and temporomandibular joint disorders. However, there is potential for expanding the applications of dental splints to other areas, such as sleep apnea, orthodontics, and cosmetic dentistry. Developing splints for these applications can open new market segments and increase the overall demand for dental splints.

Restraints/Challenges

- Variability in Effectiveness

The effectiveness of dental splints can vary among individuals due to factors such as different underlying conditions, patient compliance, and individual anatomical variations. The variability in outcomes may lead to skepticism or hesitation among some patients or practitioners.

- Complex Treatment Planning

The proper use of dental splints requires careful treatment planning, including accurate diagnosis, evaluation of occlusion, and customization of the splint. This process can be complex and time-consuming, requiring specialized knowledge and expertise, which may limit their widespread use.

This global dental splints market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Dental Splints market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In March 2023, Asiga launches UltraGLOSS 3D-printed polished splints that require no post-processing

- In October 2020, Glidewell introduces the Comfort3D Bite Splint. With the launch of the Comfort3D Bite Splint, Glidewell now offers custom occlusal guards made with digital design and 3D-printing technology, ensuring maximum comfort and retention. This launch represents another exciting step in Glidewell's legacy of applying cutting-edge science to the dental laboratory

Global Dental Splints Market Scope

The global dental splints market is segmented on the basis of product, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Implants

- Prosthetics

- Orthodontics

- Endodontics

- Infection Control

- Periodontics

- Whitening Products

- Prophylaxis

- Fluorides

- Sealants

- Splints

End User

- Hospital and Clinic

- Laboratory

Global Dental Splints Market Regional Analysis/Insights

The global dental splints market is analysed and market size insights and trends are provided by country, product, and end user as referenced above.

The countries covered in the global dental splints market report are U.S., Canada and Mexico in North America, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America dominates the global dental splints market because of the rising prevalence of dental diseases in region, growing investment in healthcare infrastructure is also boosting the growth of the market.

Asia-Pacific is expected to witness significant growth in the global dental splints market during the forecast period of 2023 to 2030, due to the increase in government initiatives to promote awareness, rise in medical tourism, growing research activities in the region, availability of massive untapped markets, large population pool, and the growing demand for quality healthcare in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The global dental splints market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for dental splints market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the dental splints market. The data is available for historic period 2015-2020.

Competitive Landscape and Global Dental Splints Market Share Analysis

The global dental splints market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global dental splints market.

Some of the major players operating in the global dental splints market are:

- Danaher (U.S.)

- Dentsply Sirona (U.S.)

- Ultradent Products Inc. (U.S.)

- Septodont Holding (France)

- Henry Schein, Inc. (U.S.)

- Benco Dental Supply Company (U.S.)

- Brasseler USA (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- COLTENE Group (Switzerland)

- FKG Dentaire Sàrl (Switzerland)

- Orofacial Therapeutics (Switzerland)

- GC Corporation (Japan)

- Keystone Dental Inc (U.S.)

- Vertex Holdings (Singapore)

- 3D Systems, Inc. (U.S.)

- Institut Straumann AG (Switzerland)

- BEGO GmbH & Co. KG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.