Global Demand Response Market

Market Size in USD Billion

CAGR :

%

USD

10.27 Billion

USD

17.59 Billion

2024

2032

USD

10.27 Billion

USD

17.59 Billion

2024

2032

| 2025 –2032 | |

| USD 10.27 Billion | |

| USD 17.59 Billion | |

|

|

|

|

Demand Response Market Size

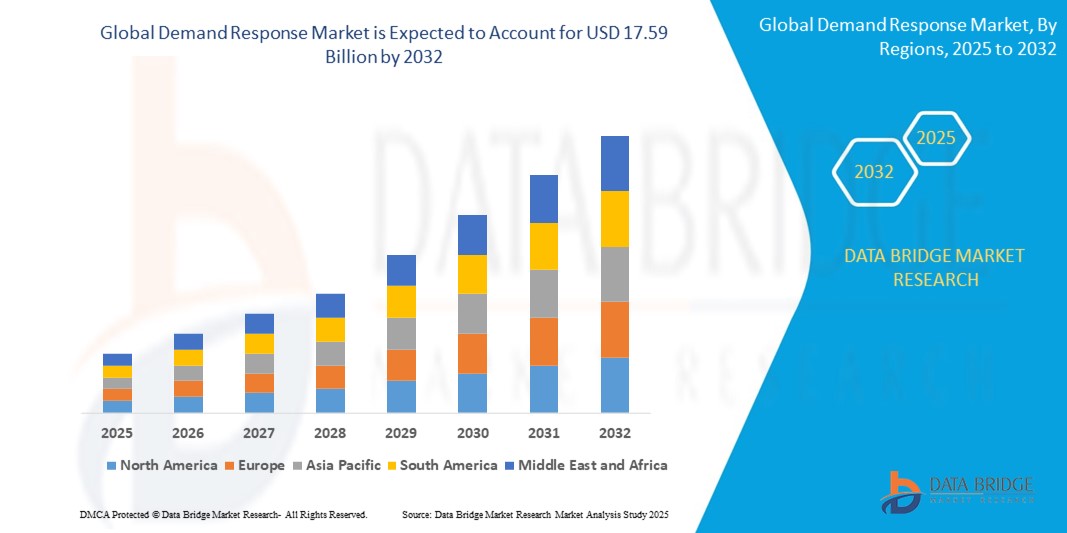

- The global demand response market size was valued at USD 10.27 billion in 2024 and is expected to reach USD 17.59 billion by 2032, at a CAGR of 6.95% during the forecast period

- The market growth is largely fuelled by the increasing integration of smart grid technologies, rising electricity prices, and growing awareness of energy efficiency programs among consumers

- In addition, rising investments in advanced metering infrastructure and real-time energy monitoring solutions are enabling better load management, encouraging wider adoption of demand response programs across industrial, commercial, and residential sectors

Demand Response Market Analysis

- The demand response market is witnessing a steady rise due to the growing need for grid stability, especially during peak load periods. Governments and utility providers across the globe are implementing demand-side management strategies to ensure a balanced energy supply-demand structure

- Technological advancements such as automated metering infrastructure (AMI), Internet of Things (IoT), and artificial intelligence (AI) are making demand response systems more effective and user-friendly. These tools enable real-time communication between consumers and utility providers, allowing for better control and flexibility

- North America led the demand response market with the largest revenue share of 38.7% in 2024, driven by the presence of a mature energy infrastructure, supportive regulatory frameworks, and increasing integration of smart grid technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global demand response market, driven by rapid urbanization, growing electricity consumption, deployment of smart meters, and regional efforts to integrate renewable energy sources while enhancing grid reliability and energy cost savings

- The commercial DRMS segment dominated the market with the largest revenue share of 44.6% in 2024, driven by increased energy consumption in commercial buildings and the rising need for peak load management. Businesses are increasingly adopting automated demand response platforms to reduce operational costs and enhance energy efficiency. The ability of commercial DRMS to integrate seamlessly with building management systems is also contributing to its widespread implementation across malls, offices, and data centers.

Report Scope and Demand Response Market Segmentation

|

Attributes |

Demand Response Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration of Artificial Intelligence and Machine Learning in Demand Response Programs • Expansion of Demand Response Solutions in Emerging Smart City Projects |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Demand Response Market Trends

“Increased Integration of Renewable Energy Sources Is Transforming Demand Response Programs”

- The rising integration of renewable energy sources such as solar and wind into national grids is driving the evolution of demand response programs toward more dynamic, real-time load balancing capabilities that address the variability and intermittency of clean energy generation, which conventional grids were not built to manage efficiently

- Advanced analytics and predictive algorithms are increasingly being integrated into demand response systems to forecast load patterns and energy supply variability, enabling automated adjustments based on grid conditions and consumer behavior, which enhances system reliability and reduces reliance on peaker plants

- The rise of distributed energy resources (DERs), including rooftop solar panels, electric vehicles, and battery storage, is accelerating the need for bi-directional energy flows and demand response mechanisms that allow users to shift from consumers to active participants in grid stabilization efforts

- For instance, in Germany, demand response is being used in tandem with decentralized solar production to modulate grid load, particularly during mid-day solar peaks, allowing utilities to delay infrastructure investments and maintain grid efficiency through smarter energy management

- In conclusion, as renewable energy becomes a central pillar of modern energy policy, demand response programs are evolving into essential grid tools that complement clean energy integration, enable flexibility, and reduce strain on existing infrastructure across regional and national grids

Demand Response Market Dynamics

Driver

“Adoption of Smart Meters and Grid Modernization Is Fueling Demand Response Participation”

- The widespread installation of smart meters is enabling two-way communication between utilities and consumers, offering real-time data that allows for automated demand response, load adjustments, and participation in time-of-use pricing programs that benefit both grid operators and end users

- Grid modernization efforts across developed and developing countries are supporting the deployment of intelligent distribution management systems, allowing utilities to better detect, predict, and respond to demand fluctuations while enhancing grid visibility and responsiveness

- Consumer empowerment through mobile applications and smart home devices is increasing engagement with demand response programs by providing real-time control, consumption insights, and financial incentives, making participation accessible and attractive to residential users

- For instance, the U.K. National Grid ESO implemented an opt-in demand flexibility service during winter 2022–2023 that allowed households with smart meters to reduce consumption during peak times, saving energy costs and contributing to grid stability, illustrating how modern infrastructure facilitates scalable DR initiatives

- The expansion of smart infrastructure and digital engagement tools is a foundational driver of the demand response market, enabling a smarter, more interactive grid that benefits utilities, consumers, and regulators in pursuit of energy reliability and efficiency

Restraint/Challenge

“Lack of Consumer Awareness and Engagement in Demand Response Programs”

- Many consumers, especially in residential sectors, remain unaware of demand response programs or do not fully understand their benefits, which creates a significant barrier to widespread adoption and limits the potential impact of consumer-driven grid support mechanisms

- Technical complexity and lack of standardized protocols across regions and utility providers make integration with home energy systems and appliances difficult, particularly for older infrastructure, which discourages participation and delays program scalability

- Concerns over data privacy, control loss, and insufficient financial incentives continue to hinder consumer trust in automated demand response technologies, especially where regulatory clarity or transparency from utility companies is lacking

- For instance, a survey by the U.S. Department of Energy found that nearly 40% of households were unfamiliar with demand response programs and expressed concerns about external control of their energy usage, highlighting the need for better outreach and user-friendly program design

- In conclusion, without targeted awareness campaigns, user-centric technologies, and stronger incentive structures, demand response programs may face limited consumer uptake, thus restricting their full potential to enhance grid flexibility and energy conservation outcomes

Demand Response Market Scope

The market is segmented on the basis of solution, services, and verticals.

- By Solution

On the basis of solution, the demand response market is segmented into residential DRMS, commercial DRMS, and industrial DRMS. The commercial DRMS segment dominated the market with the largest revenue share of 44.6% in 2024, driven by increased energy consumption in commercial buildings and the rising need for peak load management. Businesses are increasingly adopting automated demand response platforms to reduce operational costs and enhance energy efficiency. The ability of commercial DRMS to integrate seamlessly with building management systems is also contributing to its widespread implementation across malls, offices, and data centers.

The residential DRMS segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption of smart meters and time-based pricing programs among households. Consumers are becoming more aware of energy savings and incentive-based programs, encouraging participation in load control initiatives. The increasing penetration of home automation and connected devices is further supporting the growth of residential DRMS platforms.

- By Services

On the basis of services, the market is segmented into system integration and consulting services, support and maintenance, curtailment services, and managed services. The curtailment services segment held the largest market share in 2024, supported by strong demand from utility providers to implement short-notice energy reduction programs during peak demand hours. These services offer flexible participation models and financial incentives, making them attractive to commercial and industrial energy users. Curtailment service providers are also leveraging predictive analytics to optimize response strategies and improve participation rates.

The managed services segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increased outsourcing by utilities seeking end-to-end management of demand response programs. Managed services enable utilities to focus on core operations while benefiting from expert handling of monitoring, analytics, and customer engagement. The scalability and cost-effectiveness of managed models are also contributing to their growing preference across regions.

- By Verticals

On the basis of verticals, the demand response market is segmented into office and commercial buildings, energy and power, manufacturing, municipal, university, school, hospital systems (MUSH), and agriculture. The energy and power segment led the market with the highest revenue contribution in 2024, due to the critical role demand response plays in maintaining grid reliability during peak loads and renewable integration. Utilities and power producers are increasingly investing in DR platforms to avoid blackouts, defer infrastructure upgrades, and reduce carbon emissions. Government policies supporting grid flexibility are also reinforcing this trend.

The MUSH segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising energy efficiency mandates and sustainability goals in public infrastructure. Universities, hospitals, and municipal bodies are adopting demand response to cut energy bills and comply with regulatory frameworks. The focus on building resiliency and budget optimization in public sectors is expected to further boost the adoption of DR programs.

Demand Response Market Regional Analysis

• North America led the demand response market with the largest revenue share of 38.7% in 2024, driven by the presence of a mature energy infrastructure, supportive regulatory frameworks, and increasing integration of smart grid technologies

• Utilities across the region are actively promoting demand-side energy management programs, with substantial investments in automated demand response platforms and energy efficiency initiatives

• The growing emphasis on grid reliability, sustainability goals, and peak load management continues to strengthen the adoption of demand response solutions across residential, commercial, and industrial sectors

U.S. Demand Response Market Insight

The U.S. demand response market held the dominant share in 2024 within North America, supported by federal energy efficiency mandates and state-level initiatives encouraging consumer participation in grid stability. The market benefits from robust smart meter penetration and the active participation of independent system operators (ISOs) in demand response programs. In addition, major utilities are deploying advanced analytics and real-time control systems to optimize load management and reduce strain on aging infrastructure.

Europe Demand Response Market Insight

The Europe demand response market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent emissions regulations, growing renewable energy adoption, and an increased focus on energy efficiency. Countries such as Germany, France, and the U.K. are leading in implementing real-time pricing models and incentivized load balancing schemes. The region’s shift toward decentralized energy systems and cross-border energy trading is further accelerating demand response deployment across industrial and commercial sectors.

U.K. Demand Response Market Insight

The U.K. demand response market is expected to witness the fastest growth rate from 2025 to 2032, encouraged by government-backed smart grid initiatives and rising energy price volatility. The National Grid’s Capacity Market and Demand Side Response programs are creating lucrative opportunities for businesses to monetize flexible energy usage. The increasing adoption of distributed energy resources and energy storage systems is also enhancing the responsiveness and value proposition of demand-side strategies.

Germany Demand Response Market Insight

The Germany demand response market is expected to witness the fastest growth rate from 2025 to 2032 as a result of the country’s aggressive energy transition policies and efforts to stabilize its grid amid high renewable penetration. German utilities are investing in digital platforms to manage real-time demand and integrate variable energy sources efficiently. The market is seeing strong traction in the manufacturing sector, where industrial players are optimizing operations through flexible load scheduling and incentive-based participation in balancing markets.

Asia-Pacific Demand Response Market Insight

The Asia-Pacific demand response market is expected to witness the fastest growth rate from 2025 to 2032, supported by urbanization, expanding electricity demand, and increasing smart grid deployments in countries such as China, India, South Korea, and Japan. Governments across the region are emphasizing energy efficiency and grid modernization through regulatory reforms and pilot programs. Rapid advancements in communication infrastructure and growing investment in automated demand response technologies are expected to further fuel market growth.

China Demand Response Market Insight

China accounted for the largest revenue share in the Asia-Pacific demand response market in 2024, driven by the government’s push for energy conservation, demand-side management, and integration of renewable sources. China’s large-scale smart meter rollout and pilot demand response programs across industrial hubs are reshaping electricity usage behavior. The focus on peak load reduction, particularly in energy-intensive sectors, and the emergence of digital energy platforms are key contributors to the market’s expansion.

Japan Demand Response Market Insight

Japan’s demand response market is expected to witness the fastest growth rate from 2025 to 2032, with support from the government’s energy resilience strategies and efforts to diversify power sources following the Fukushima disaster. Programs such as Negawatt trading and virtual power plants (VPPs) are creating a robust ecosystem for demand flexibility. The country’s highly digitized grid infrastructure and strong emphasis on energy independence are driving broader adoption among residential and commercial end users.

Demand Response Market Share

The Demand Response industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Eaton (Ireland)

- General Electric (U.S.)

- Honeywell International Inc (U.S.)

- Schneider Electric (France)

- Siemens AG (Germany)

- Energate Inc. (Canada)

- Tantalus Systems Corp (Canada)

- Open Access Technology International, Inc (U.S.)

- Verdigris Technologies, Inc (U.S.)

Latest Developments in Global Demand Response Market

• In March 2024, DemandQ launched its Real-time Demand (RTD) Hub, an advanced AI-powered solution aimed at automating electricity demand management across utilities, suppliers, ISOs, and aggregators. This innovation enhances the scale and responsiveness of demand response and economic dispatch programs while maintaining user-defined comfort standards. The development is expected to significantly improve grid efficiency and enable smarter energy usage across markets

• In January 2024, Catalyst Power Holdings LLC introduced new demand response programs for commercial and industrial clients in New York, focusing on optimizing energy consumption and promoting renewable integration. These offerings empower businesses with greater control over their energy use while supporting sustainability goals. The initiative strengthens Catalyst Power’s role in driving cleaner, more efficient energy practices in regional markets

• In November 2023, Exaum, a Finnish startup, launched a 1MW AI-optimized grid balancing pilot project at Karhulan Industrial Park. Designed to stabilize fluctuating renewable sources such as wind and solar, the solution delivers near-instantaneous grid balancing. This development contributes to grid reliability and supports broader adoption of renewable energy by mitigating supply variability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Demand Response Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Demand Response Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Demand Response Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.