Global Cyber Insurance Market

Market Size in USD Billion

CAGR :

%

USD

18.87 Billion

USD

115.40 Billion

2024

2032

USD

18.87 Billion

USD

115.40 Billion

2024

2032

| 2025 –2032 | |

| USD 18.87 Billion | |

| USD 115.40 Billion | |

|

|

|

|

Cyber Insurance Market Size

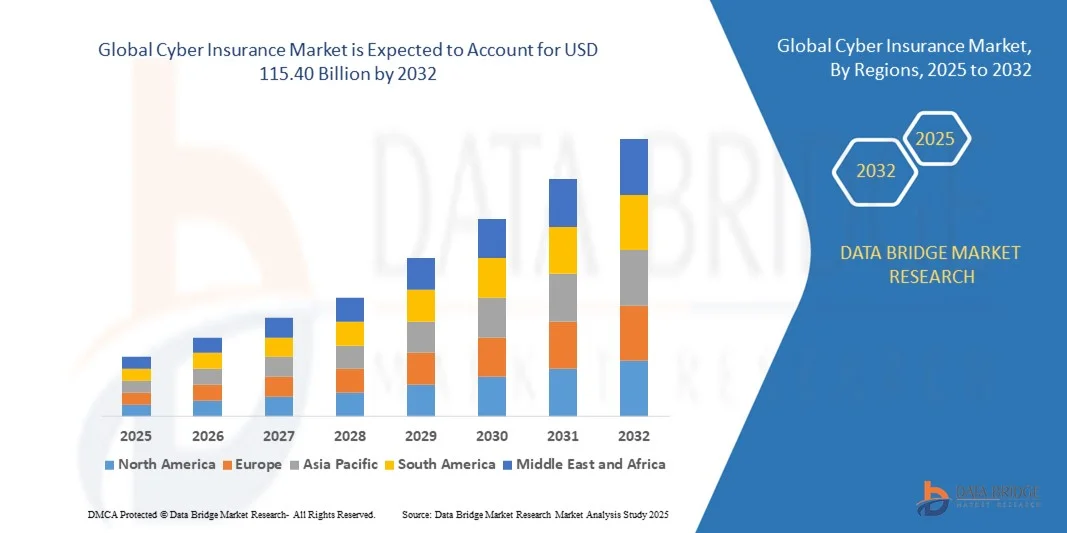

- The global cyber insurance market size was valued at USD 18.87 billion in 2024 and is expected to reach USD 115.40 billion by 2032, at a CAGR of 25.40% during the forecast period

- The market growth is largely fuelled by the rising frequency and sophistication of cyberattacks, increasing digital transformation initiatives across industries, and growing regulatory compliance requirements related to data protection and cybersecurity

- Organizations are increasingly recognizing the financial and reputational risks associated with cyber incidents, driving demand for tailored insurance coverage to mitigate potential losses

Cyber Insurance Market Analysis

- Increasing Frequency And Sophistication Of Cyber Attacks Driving Demand For Coverage Across Enterprises Of All Sizes, Including SMEs And Large Corporations, To Mitigate Financial Losses And Regulatory Penalties

- Rising Adoption Of Digital Technologies, Cloud Computing, And IoT Devices Across Industries Fuelling The Need For Cyber Insurance Solutions That Ensure Business Continuity, Data Protection, And Risk Management

- North America dominated the cyber insurance market with the largest revenue share of 38.5% in 2024, driven by the rising frequency of cyberattacks, stringent regulatory mandates, and increasing adoption of digital technologies across enterprises

- Asia-Pacific region is expected to witness the highest growth rate in the global cyber insurance market, driven by rapid technology adoption, expanding SMEs, increased cloud service usage, and growing recognition of the importance of risk transfer solutions across industries

- The Solutions segment held the largest market revenue share in 2024, driven by the increasing adoption of cybersecurity platforms, threat monitoring tools, and risk assessment frameworks integrated with insurance offerings. Solutions enable organizations to proactively identify vulnerabilities, manage cyber risks, and reduce the potential financial impact of breaches, making them highly attractive for enterprises of all sizes

Report Scope and Cyber Insurance Market Segmentation

|

Attributes |

Cyber Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cyber Insurance Market Trends

Rise of Cyber Risk Management and Insurance Adoption

- The growing frequency and sophistication of cyberattacks are transforming the cyber insurance landscape by prompting organizations to proactively secure coverage. Policies provide financial protection against data breaches, ransomware, and operational disruptions, helping businesses mitigate losses and ensure continuity. In addition, insurers are increasingly offering proactive risk management services, including vulnerability assessments and employee training programs, to help clients reduce exposure to cyber threats. The increasing reliance on digital transformation initiatives amplifies the importance of comprehensive coverage for business resilience

- Increasing reliance on digital platforms, cloud services, and IoT devices is accelerating the adoption of cyber insurance, particularly in sectors handling sensitive data. Organizations benefit from risk assessment, breach response support, and regulatory compliance guidance provided by insurers. Cyber insurance also supports business continuity planning and disaster recovery strategies, ensuring that operations can resume quickly after incidents. Companies implementing hybrid IT environments increasingly view cyber insurance as a critical tool for safeguarding data across multiple systems and networks

- The scalability and customization of modern cyber insurance policies make them suitable for businesses of all sizes, from SMEs to large enterprises. Policies often bundle coverage with risk management tools and advisory services, improving organizational resilience against cyber threats. Insurers are also leveraging AI-driven analytics to tailor premiums and coverage based on real-time risk profiles, allowing businesses to obtain more accurate and cost-effective protection. Flexible policy structures facilitate rapid adaptation to evolving threat landscapes, enhancing overall market appeal

- For instance, in 2023, several multinational firms in North America reported minimized operational losses and faster recovery times after leveraging cyber insurance solutions during ransomware incidents, highlighting the protective impact on business continuity and stakeholder trust. Companies also gained access to expert forensic teams and crisis communication support, which reduced reputational damage. These real-world cases have prompted more businesses to evaluate comprehensive cyber insurance as a strategic risk management solution, increasing overall market penetration

- While cyber insurance adoption is increasing, its effectiveness depends on policy coverage, ongoing risk assessments, and cybersecurity best practices. Insurers must continually innovate and tailor solutions to address emerging threats and regulatory requirements. Firms are also encouraged to implement layered security measures, including endpoint protection, identity management, and intrusion detection systems, to complement their insurance coverage and fully mitigate risks. Enhanced reporting and monitoring features in modern policies further support risk reduction and compliance

Cyber Insurance Market Dynamics

Driver

Increasing Cyber Threats And Regulatory Compliance Mandates

- The rise in cyberattacks, including phishing, ransomware, and insider threats, is driving both private and public organizations to adopt cyber insurance as a frontline risk management strategy. Coverage helps mitigate financial losses and reputational damage. Insurers are increasingly collaborating with cybersecurity vendors to offer integrated solutions, combining coverage with preventive technologies. The growing regulatory landscape globally is also creating a mandatory need for organizations to maintain robust cyber risk strategies

- Companies are becoming more aware of potential legal and regulatory liabilities associated with data breaches, which fuels demand for insurance policies that ensure compliance with GDPR, CCPA, and other frameworks. Compliance requirements are increasingly complex, and cyber insurance provides a structured approach to meeting obligations while reducing exposure to penalties. Firms also benefit from access to legal and consulting support included in many cyber insurance policies, assisting with breach notification and regulatory reporting

- Cyber insurance also provides access to expert breach response teams, forensic investigations, and crisis management services, improving overall organizational readiness against cyber incidents. Many insurers now include post-incident recovery services, such as PR support and operational continuity planning. This holistic support reduces downtime, financial losses, and reputational damage, making coverage more attractive to high-risk industries such as finance, healthcare, and retail

- For instance, in 2022, several U.S.-based financial institutions increased policy uptake after experiencing attempted cyber intrusions, boosting market demand for comprehensive cyber coverage and risk mitigation services. These organizations cited faster incident resolution, reduced liability, and improved stakeholder confidence as key benefits. The lessons learned from these breaches have prompted a wider set of companies to reassess their cyber insurance needs

- While awareness and regulatory pressures drive adoption, companies must continuously update cybersecurity practices and align coverage with evolving threat landscapes to maximize the benefits of cyber insurance. Organizations are increasingly integrating insurance requirements into broader risk management and IT governance frameworks. Continuous monitoring, vulnerability testing, and employee awareness programs enhance the value of policies and ensure alignment with insurer expectations

Restraint/Challenge

High Premium Costs And Complex Policy Structures

- The cost of comprehensive cyber insurance policies can be prohibitive for small and medium-sized enterprises, limiting market penetration despite growing risk awareness. Premiums are often determined by company size, sector, and historical claims. Rising claims from increasingly sophisticated attacks are also driving annual premium increases, making policies less affordable for smaller firms

- Policy complexity and varying coverage terms can make it difficult for organizations to understand exclusions, limits, and claim procedures, potentially leading to underinsurance or gaps in protection. Businesses often require specialized consultancy to evaluate policy terms accurately, adding to the overall cost. Misalignment between actual risk exposure and policy coverage can create a false sense of security, leaving firms vulnerable

- Many organizations also lack sufficient internal cybersecurity maturity, which can result in higher premiums or denial of coverage, creating additional adoption barriers. Insufficient IT infrastructure, outdated software, or lack of employee training can lead insurers to impose stringent requirements or increased costs. This disparity is particularly challenging for SMEs and startups with limited resources to meet insurer criteria

- For instance, in 2023, several SMEs in Europe delayed policy procurement due to high costs and unclear policy conditions, leaving them exposed to cyber risks while slowing market expansion. The lack of standardized policies and inconsistent global regulations exacerbates this problem, making it difficult to compare offerings across providers

- While insurers continue to develop innovative coverage options, addressing affordability, clarity, and risk-based pricing remains critical to unlocking the full growth potential of the cyber insurance market. New modular and usage-based policies, combined with digital underwriting tools, are emerging to lower barriers and encourage wider adoption, fostering long-term market growth

Cyber Insurance Market Scope

The market is segmented on the basis of component, insurance type, insurance coverage, organization size, application, and coverage type.

- By Component

On the basis of component, the global cyber insurance market is segmented into Solutions and Services. The Solutions segment held the largest market revenue share in 2024, driven by the increasing adoption of cybersecurity platforms, threat monitoring tools, and risk assessment frameworks integrated with insurance offerings. Solutions enable organizations to proactively identify vulnerabilities, manage cyber risks, and reduce the potential financial impact of breaches, making them highly attractive for enterprises of all sizes.

The Services segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for managed risk advisory, breach response support, and policy consulting. Cyber insurance services provide organizations with expert guidance during incidents, helping minimize operational disruptions and regulatory penalties. These services also include continuous monitoring, training, and compliance assistance, making them a critical component of comprehensive cyber risk management.

- By Insurance Type

On the basis of insurance type, the market is segmented into Packaged and Standalone policies. The Packaged segment dominated in 2024 due to its combined coverage options, which often include risk assessment, breach response, and legal support, providing a holistic approach to cyber risk management. Packaged policies offer convenience and reduced administrative burden, which is appealing to organizations seeking all-in-one protection.

The Standalone segment is expected to witness the fastest growth rate from 2025 to 2032, driven by companies looking for customizable policies targeting specific risks such as ransomware or cloud vulnerabilities. Standalone coverage allows organizations to tailor protection based on unique threat landscapes, making it particularly relevant for highly regulated or technology-driven sectors.

- By Insurance Coverage

Based on insurance coverage, the market is divided into Data Breach, Cyber Liability, and Source/Target coverage. The Data Breach segment held the largest share in 2024, fueled by the increasing frequency of personal and corporate data leaks and the associated regulatory fines. Policies covering data breaches ensure financial compensation, legal guidance, and incident management for affected organizations.

The Cyber Liability segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising complexity of cyber threats and the need to protect organizations against third-party claims, reputational damage, and business interruption. Cyber liability coverage is particularly significant for SMEs and enterprises heavily reliant on digital operations.

- By Organization Size

On the basis of organization size, the market is segmented into Large Enterprises and Small and Medium-Sized Enterprises (SMEs). Large enterprises accounted for the highest revenue share in 2024 due to their extensive digital infrastructure, higher risk exposure, and regulatory requirements, prompting a greater need for comprehensive cyber insurance solutions.

SMEs is expected to witness the fastest growth rate from 2025 to 2032, driven by increased awareness of cyber threats, the digitalization of business operations, and the availability of cost-effective policies. Insurers are increasingly offering SME-focused packages with flexible coverage options to support business continuity.

- By Application

On the basis of application, the market is categorized into Information and Communication Technology, Financial Services, Manufacturing, Retail, Healthcare, and Others. The Financial Services segment dominated the market in 2024, fueled by high cyber risk exposure, stringent compliance mandates, and the critical need to protect sensitive customer data.

The Healthcare segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing adoption of connected devices, electronic health records, and telemedicine solutions, which expose organizations to higher cyber risks. Cyber insurance in this sector ensures regulatory compliance, patient data protection, and rapid breach response.

- By Coverage Type

Based on coverage type, the market is segmented into First-Party Coverage and Third-Party Coverage. The First-Party Coverage segment held the largest share in 2024, driven by the need to safeguard organizational assets, business interruption losses, and internal systems from cyber threats.

The Third-Party Coverage segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising legal liabilities, contractual obligations, and claims from clients or partners affected by cyber incidents. Organizations are increasingly seeking third-party coverage to mitigate potential lawsuits and reputational damage.

Cyber Insurance Market Regional Analysis

- North America dominated the cyber insurance market with the largest revenue share of 38.5% in 2024, driven by the rising frequency of cyberattacks, stringent regulatory mandates, and increasing adoption of digital technologies across enterprises

- Organizations in the region are increasingly prioritizing cyber risk management, leveraging insurance policies to safeguard against data breaches, ransomware, and operational disruptions, while ensuring business continuity and stakeholder trust

- This widespread adoption is further supported by high IT spending, advanced cybersecurity infrastructure, and a strong regulatory environment, establishing cyber insurance as a critical risk mitigation tool across industries

U.S. Cyber Insurance Market Insight

The U.S. cyber insurance market captured the largest revenue share in 2024 within North America, fueled by growing cyber threats, regulatory compliance requirements, and heightened awareness of financial and reputational risks. Businesses are increasingly opting for comprehensive coverage that includes first-party and third-party protection, breach response services, and risk advisory support. In addition, the surge in cloud adoption, remote work, and IoT deployments is driving demand for tailored cyber insurance solutions across large enterprises and SMEs.

Europe Cyber Insurance Market Insight

The Europe cyber insurance market is expected to witness the fastest growth rate from 2025 to 2032, driven by strict data protection regulations such as GDPR, increasing cyberattack incidents, and growing digital transformation initiatives. Organizations across financial services, healthcare, and manufacturing sectors are adopting cyber insurance to mitigate potential losses and ensure compliance. The region is witnessing notable growth in both standalone and packaged insurance policies that cater to diverse risk management requirements.

U.K. Cyber Insurance Market Insight

The U.K. cyber insurance market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising cybercrime, stringent regulatory oversight, and growing awareness among businesses regarding financial and operational risks. Organizations are increasingly investing in policies that provide coverage for data breaches, cyber liability, and regulatory penalties, along with access to forensic and breach response support. The U.K.’s emphasis on cybersecurity and its mature financial services ecosystem are key factors stimulating market growth.

Germany Cyber Insurance Market Insight

The Germany cyber insurance market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing cybersecurity awareness, regulatory compliance requirements, and widespread digitalization of business operations. German companies are adopting cyber insurance policies to protect against data breaches, ransomware, and network disruptions. In addition, the integration of cyber insurance with risk management frameworks and advanced IT infrastructure is driving demand across commercial and industrial sectors.

Asia-Pacific Cyber Insurance Market Insight

The Asia-Pacific cyber insurance market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid digitalization, increasing cybercrime incidents, and growing IT infrastructure investments in countries such as China, Japan, and India. Businesses are increasingly adopting cyber insurance to manage first-party and third-party risks associated with data breaches, network attacks, and operational disruptions. Furthermore, government initiatives promoting cybersecurity awareness and regulatory compliance are fueling market expansion in the region.

Japan Cyber Insurance Market Insight

The Japan cyber insurance market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced technological ecosystem, increasing digitization of enterprises, and rising cyber threats. Japanese organizations are adopting cyber insurance solutions to protect against financial losses, reputational damage, and regulatory penalties. The growing adoption of IoT, cloud computing, and connected devices in commercial and industrial sectors is further boosting demand for comprehensive cyber risk coverage.

China Cyber Insurance Market Insight

The China cyber insurance market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid digital transformation, expanding cloud adoption, and rising cyberattack incidents. Organizations across manufacturing, financial services, and e-commerce sectors are increasingly leveraging cyber insurance to mitigate risks associated with data breaches, ransomware, and third-party liabilities. The expansion of domestic insurers offering tailored solutions, combined with government initiatives promoting cybersecurity, is propelling market growth in China.

Cyber Insurance Market Share

The Cyber Insurance industry is primarily led by well-established companies, including:

- American International Group, Inc. (U.S.)

- Cisco Systems, Inc.(U.S.)

- Aon Plc (U.K.)

- IBM (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- CyberArk Software Ltd. (U.S.)

- F5, Inc. (U.S.)

- FireEye, Inc. (U.S.)

- Forcepoint (U.S.)

- Fortinet, Inc (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Oracle (U.S.)

- Palo Alto Networks (U.S.)

- Imperva (U.S.)

- Qualys, Inc (U.S.)

- Accenture (Ireland)

- HCL Technologies Limited (India)

- Capgemini (France)

- Cognizant (U.S.)

- Broadcom (U.S.)

- Wipro (India)

Latest Developments in Global Cyber Insurance Market

- In December 2022, Grover launched Grover Connect in the U.S., partnering with Gigs to operate as a mobile virtual network operator (MVNO). This development expanded Grover’s technology rental ecosystem by providing enhanced connectivity solutions for users, improving customer experience and broadening the company’s service offerings in the tech rental market

- In October 2022, Upcover introduced Cyber and Privacy Liability Insurance for Australian SMEs, in response to the Optus cyberattacks and aligned with Cyber Security Awareness Month. The initiative aimed to safeguard small businesses against financial losses from cyber incidents, boosting awareness and adoption of cyber insurance solutions in the SME segment

- In August 2022, Coalition completed the acquisition of Digital Affect Insurance Company from Munich Re Digital Partners U.S. Holding Corporation, following regulatory approval across all 50 states. This strategic move strengthened Coalition’s capabilities in proactive digital risk mitigation, positioning the company as an active player in the property and casualty cyber insurance market while enhancing service offerings for clients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.