Global Customer Data Platform Market

Market Size in USD Billion

CAGR :

%

USD

8.34 Billion

USD

85.18 Billion

2024

2032

USD

8.34 Billion

USD

85.18 Billion

2024

2032

| 2025 –2032 | |

| USD 8.34 Billion | |

| USD 85.18 Billion | |

|

|

|

|

Customer Data Platform Market Size

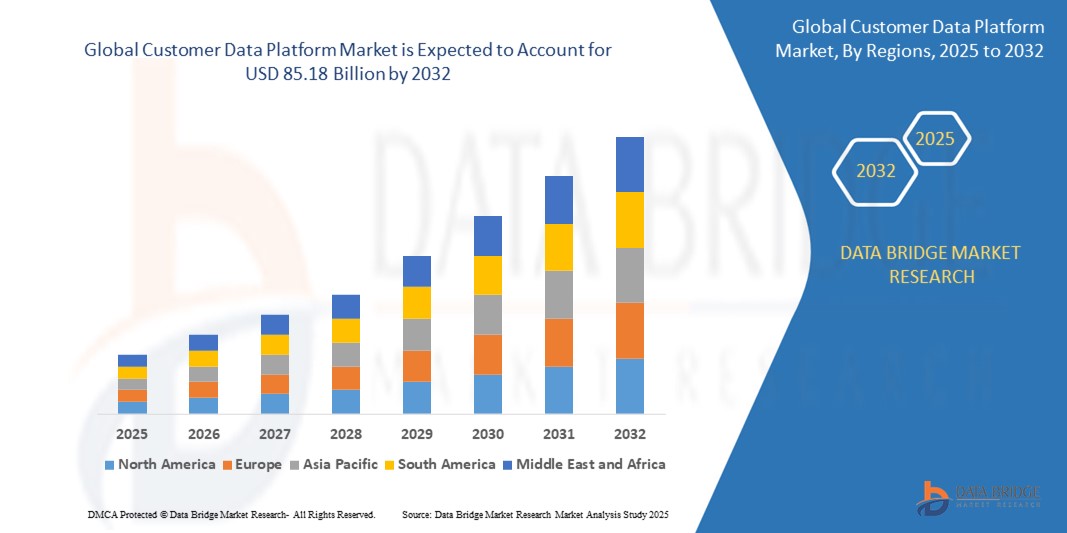

- The global customer data platform market was valued at USD 8.34 billion in 2024 and is expected to reach USD 85.18 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 33.70%, primarily driven by the increasing demand for personalized customer experiences and the integration of artificial intelligence and machine learning technologies

- This growth is further supported by factors such as the rising adoption of privacy-first solutions and the escalating need for real-time data processing

Customer Data Platform Market Analysis

- CDPs are essential tools that aggregate and organize customer data from various sources, creating unified, comprehensive customer profiles. These platforms are crucial for businesses aiming to enhance customer engagement and deliver personalized marketing strategies

- The demand for CDPs is significantly driven by the increasing need for data-driven marketing strategies and the rising volume of customer data. Businesses are leveraging CDPs to gain deeper insights into customer behaviors and preferences, enabling more targeted and effective marketing campaigns

- North America stands out as the dominant region in the CDP market, attributed to its advanced digital infrastructure and high adoption of innovative marketing technologies. The region's focus on enhancing customer experiences and the presence of major market players contribute to its leading position

- Globally, CDPs are recognized as pivotal components in modern marketing technology stacks, second only to customer relationship management (CRM) systems. They play a crucial role in ensuring data-driven decision-making and personalized customer interactions

- For instance, Starbucks: Utilizes its CDP to track customers' purchase history and preferences, enabling the company to send customized offers through their app. This focus on personalization strengthens client loyalty and drives higher engagement rates.

- Delta Air Lines: Employed AI technology to optimize ad performance and connect advertising with sales data, attributing USD 30 million in sales to its Olympic sponsorship.

- Levi Strauss & Co.: Leveraged data analytics to predict consumer trends, leading to a 15% increase in loose fit jeans sales.

Report Scope and Customer Data Platform Market Segmentation

|

Attributes |

Customer Data Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Customer Data Platform Market Trends

“Growing Adoption of AI-Driven Analytics and Real-Time Data Processing”

- One prominent trend in the global customer data platform (CDP) market is the increasing adoption of artificial intelligence (AI)-driven analytics and real-time data processing

- These advanced capabilities enhance the efficiency and effectiveness of customer data management by enabling businesses to analyze vast amounts of customer data in real-time, providing actionable insights for personalized marketing and engagement strategies

- For instance, AI-powered CDPs enable businesses to segment customers dynamically based on real-time behaviors, allowing for hyper-personalized product recommendations and targeted campaigns that improve conversion rates

- Real-time data processing also facilitates instant customer engagement, enabling businesses to respond to customer interactions immediately with relevant offers, messages, or services

- This trend is revolutionizing how companies manage and utilize customer data, leading to more personalized experiences, improved customer satisfaction, and a growing demand for AI-integrated CDPs in the market

Customer Data Platform Market Dynamics

Driver

“Growing Demand for Personalized Customer Experiences”

- The increasing need for personalized customer experiences is a significant driver for the growth of the global Customer Data Platform (CDP) market

- Businesses across various industries are leveraging customer data to deliver tailored interactions, customized marketing campaigns, and real-time engagement strategies to enhance customer satisfaction

- Consumers today expect brands to understand their preferences and behaviors, making data-driven personalization a critical component of modern customer engagement

- The growing adoption of digital channels, such as e-commerce platforms, social media, and mobile applications, has further fueled the demand for CDPs that unify customer data and provide actionable insights for businesses to optimize their marketing efforts

- As companies strive to improve customer loyalty and retention, the need for CDPs that can aggregate, analyze, and activate customer data in real time continues to grow

For instance,

- In February 2023, according to a report published by the CDP Institute, businesses that implemented CDPs saw a 25% increase in customer engagement rates, driven by more precise targeting and personalized experiences. This highlights the growing importance of customer data platforms in enhancing marketing efficiency and customer satisfaction

- In August 2022, a survey conducted by Gartner revealed that 63% of marketing leaders prioritized investing in CDPs to improve customer insights and drive personalization efforts, further reinforcing the increasing adoption of these platforms across industries

- As customer expectations continue to evolve, businesses are actively seeking advanced data-driven solutions to enhance personalization, making CDPs a crucial tool in modern customer engagement strategies

Opportunity

“Enhancing Customer Insights with AI and Predictive Analytics”

- AI-powered Customer Data Platforms (CDPs) can enhance customer insights, automate data processing, and improve predictive analytics, enabling businesses to make more informed decisions in marketing and customer engagement

- AI algorithms can analyze real-time customer interactions, identify behavior patterns, and predict future preferences, helping businesses optimize marketing campaigns and customer experiences

- Additionally, AI-driven CDPs can assist in segmenting audiences more accurately, enabling personalized messaging, targeted promotions, and improved conversion rates

For instance,

- In March 2024, according to a report published by Gartner, companies that implemented AI-powered CDPs saw a 30% improvement in customer retention rates, demonstrating the potential of AI-driven insights in enhancing customer engagement

- In September 2023, a study by Forrester Research revealed that businesses utilizing predictive analytics within their CDPs experienced a 40% increase in marketing ROI, highlighting the impact of AI-driven data strategies in optimizing business performance

- The integration of AI in CDPs can also lead to improved marketing efficiency, higher customer satisfaction, and increased revenue. By leveraging AI-powered data analysis, businesses can anticipate customer needs and proactively engage with them, driving stronger brand loyalty and business growth

Restraint/Challenge

“High Implementation Costs”

- The high cost of implementing customer data platforms (CDPs) poses a significant challenge for the market, particularly affecting the adoption rates among small and mid-sized enterprises (SMEs)

- CDPs, which are essential for unifying customer data and enabling personalized marketing, often require substantial investments in software, integration, and maintenance, which can range from tens of thousands to several hundred thousand dollars annually

- This significant financial barrier can deter smaller businesses with limited budgets from adopting CDP solutions, leading them to rely on fragmented or outdated customer data management methods

For instance,

- In October 2024, according to a report published by Forrester Research, 40% of SMEs cited cost as the primary reason for not adopting a CDP, despite recognizing its benefits, highlighting the affordability challenge in the market

- In June 2023, a survey conducted by the CDP Institute found that many businesses struggle with the ongoing costs of maintaining and integrating CDPs with their existing tech stacks, leading to underutilization of platform capabilities

- Consequently, such cost limitations can result in disparities in customer data management efficiency and hinder the widespread adoption of CDPs, ultimately slowing down market growth

Customer Data Platform Market Scope

The market is segmented on the basis of component, deployment mode, organization size, application, industry, and capability

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Mode |

|

|

By Organization Size |

|

|

By Application |

|

|

By Industry |

|

|

By Capability |

|

Customer Data Platform Market Regional Analysis

“North America is the Dominant Region in the Customer Data Platform Market”

- North America leads the global Customer Data Platform (CDP) market, holding approximately 44% of the market share in2024

- This dominance is driven by the presence of major technology providers, a robust technological infrastructure, and a high level of CDP adoption across various sectors

- The accelerated digital transformation and substantial data generation from diverse industries have created a fertile ground for CDP implementation in the region

- Organizations in North America are increasingly leveraging CDPs to unify customer data, enhance personalized marketing efforts, and maintain competitive advantages in their respective markets

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to experience the highest growth rate in the CDP market, with a projected growth rate of approximately 30% from 2025 to 2032

- This rapid expansion is fueled by the region's swift digital transformation, increasing internet penetration, and the rising focus on customer experience among businesses in emerging markets

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, growing middle class, and escalating adoption of advanced analytics solutions

- Organizations in these countries are investing in CDPs to harness the power of customer data, deliver personalized experiences, and drive business growth in a competitive digital landscape

Customer Data Platform Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- Adobe Inc. (U.S.)

- Salesforce.com Inc. (U.S.)

- Microsoft Corporation (U.S.)

- SAS Institute (U.S.)

- Twilio Inc. (U.S.)

- Cloudera Inc. (U.S.)

- Tealium Inc. (U.S.)

- Nice Systems Ltd. (Israel)

Latest Developments in Global Customer Data Platform Market

- In November 2023, the latest version of SAS Viya introduced advanced analytics, machine learning (ML), and data management enhancements. The update includes SAS Visual Statistics and Visual Text Analytics for deeper insights, improved ML capabilities for better automation, and SAS Information Catalog & Governance for enhanced data security and compliance. Additionally, SAS Model Manager optimizes AI/ML model deployment, while SAS Studio offers a user-friendly interface. These updates empower organizations to analyze data more efficiently, drive automation, and enhance decision-making, leading to greater accuracy, productivity, and strategic growth across industries

- In October 2023, the latest version of SAP S/4HANA Cloud (Private Edition) introduced innovative enhancements to optimize enterprise resource planning (ERP). This update integrates embedded artificial intelligence (AI), new predictive scenarios, and expansions to the predefined event and ML feature catalogs within FI-CA (Financial Contract Accounting) processes and data. These advancements enhance automation, streamline financial workflows, and improve data-driven decision-making. The benefits include better predictive insights, enhanced operational efficiency, and more accurate financial forecasting, allowing businesses to optimize financial operations with greater precision. The impact of these updates is expected to drive higher productivity, improved financial management, and more intelligent automation across industries, reinforcing SAP S/4HANA Cloud as a leading intelligent ERP solution

- In September 2023, Oracle and Microsoft announced Oracle Database Azure, a collaboration that enables customers to access Oracle database services directly on Oracle Cloud Infrastructure (OCI) while being deployed within Microsoft Azure data centers. This initiative enhances multi-cloud capabilities, allowing businesses to leverage Oracle’s high-performance databases with the scalability and security of Azure’s cloud infrastructure. The key benefits include seamless database integration, reduced data latency, and greater flexibility for enterprises running workloads across both platforms. By combining Oracle’s database expertise with Azure’s cloud services, organizations can improve operational efficiency, enhance data accessibility, and optimize hybrid cloud strategies. The impact of this partnership is expected to drive cost savings, better performance, and increased cloud adoption for enterprises worldwide, reinforcing the growing trend of multi-cloud interoperability in enterprise IT solutions

- In June 2023, Microsoft and Moody’s Corporation announced a strategic partnership to enhance data, analytics, research, collaboration, and risk solutions for financial services and global knowledge professionals. This collaboration aims to integrate advanced AI-driven analytics and cloud capabilities, enabling organizations to make more data-driven decisions with improved accuracy and efficiency. The key benefits include enhanced financial risk assessment, better market insights, and streamlined workflows for businesses relying on complex data analysis. By leveraging Microsoft’s cloud infrastructure and AI technologies alongside Moody’s expertise in financial intelligence, this partnership is set to transform how companies assess risk, manage financial data, and drive business growth. The impact of this initiative is expected to accelerate innovation in financial services, empower businesses with deeper insights, and foster a more resilient and informed global economy

- In May 2023, SAP and Google Cloud expanded their strategic partnership by launching a comprehensive open data solution aimed at optimizing data landscapes and enhancing business intelligence. This initiative focuses on seamlessly integrating SAP’s enterprise applications with Google Cloud’s scalable infrastructure, allowing organizations to access, analyze, and utilize data more efficiently. The key benefits include improved data accessibility, enhanced decision-making capabilities, and greater operational efficiency by enabling real-time insights across various business functions. By leveraging advanced AI, machine learning, and cloud technologies, companies can drive innovation, reduce complexities, and accelerate digital transformation. The broader impact of this collaboration is expected to empower businesses with more actionable insights, foster a data-driven culture, and support enterprises in adapting to evolving market demands with increased agility and precision

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CUSTOMER DATA PLATFORM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CUSTOMER DATA PLATFORM MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 MULTIVARIATE MODELLING

2.2.5 STANDARDS OF MEASUREMENT

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 VENDOR SHARE ANALYSIS

2.2.8 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.9 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CUSTOMER DATA PLATFORM MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 CASE STUDIES

5.2 REGULATORY FRAMEWORK

5.3 TECHNOLOGICAL TRENDS

5.4 PRICING ANALYSIS

5.5 PORTERS FIVE FORCE

6. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1. CONSULTING

6.3.1.2. SUPPORT AND MAINTENANCE

6.3.1.3. SYSTEM INTEGRATION & DEPLOYMENT

6.3.2 MANAGED SERVICES

7. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY DATA CHANNEL

7.1 OVERVIEW

7.2 WEB

7.3 SOCIAL MEDIA

7.4 SMS

7.5 EMAIL

7.6 PUSH MESSAGING

7.7 OTHERS

8. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY TYPE

8.1 OVERVIEW

8.2 CAMPAIGN CDP

8.3 DATA CDP

8.4 ANALYTICS CDP

8.5 DELIVERY CDP

9. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PREDICTIVE ANALYTICS

9.3 CUSTOMER RETENTION & ENGAGEMENT

9.4 SECURITY MANAGEMENT

9.5 MARKETING DATA SEGMENTATION

9.6 PERSONALIZED RECOMMENDATIONS

9.7 RISK & COMPLIANCE MANAGEMENT

9.8 OTHERS

10. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY CAPABILITY

10.1 OVERVIEW

10.2 REAL-TIME ANALYTICS

10.3 OPEN ACCESS

10.4 AUDIENCE MANAGEMENT

10.5 IDENTITY MANAGMENT

11. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY DEPLOYMENT MODE

11.1 OVERVIEW

11.2 ON-PREMISES

11.3 CLOUD

12. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY ENTERPRISE SIZE

12.1 OVERVIEW

12.2 SMALL ENTERPRISES

12.2.1 BY DEPLOYMENT MODE

12.2.1.1. ON-PREMISES

12.2.1.2. CLOUD

12.3 MEDIUM SCALE ENTERPRISES

12.3.1 BY DEPLOYMENT MODE

12.3.1.1. ON-PREMISES

12.3.1.2. CLOUD

12.4 LARGE SCALE ENTERPRISES

12.4.1 BY DEPLOYMENT MODE

12.4.1.1. ON-PREMISES

12.4.1.2. CLOUD

13. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY DATA TYPE

13.1 OVERVIEW

13.2 IDENTITY DATA

13.3 INTERACTION DATA

13.4 BEHAVIORAL DATA

13.5 ATTITUDINAL DATA

14. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY VERTICAL

14.1 OVERVIEW

14.2 BFSI

14.2.1 BY OFFERING

14.2.1.1. SOLUTION

14.2.1.2. SERVICES

14.3 IT & TELECOMMUNICATION

14.3.1 BY OFFERING

14.3.1.1. SOLUTION

14.3.1.2. SERVICES

14.4 RETAIL & E-COMMERCE

14.4.1 BY OFFERING

14.4.1.1. SOLUTION

14.4.1.2. SERVICES

14.5 HEALTHCARE

14.5.1 BY OFFERING

14.5.1.1. SOLUTION

14.5.1.2. SERVICES

14.6 TRAVEL & HOSPITALITY

14.6.1 BY OFFERING

14.6.1.1. SOLUTION

14.6.1.2. SERVICES

14.7 MEDIA & ENTERTAINMENT

14.7.1 BY OFFERING

14.7.1.1. SOLUTION

14.7.1.2. SERVICES

14.8 OTHERS

15. GLOBAL CUSTOMER DATA PLATFORM MARKET, BY REGION

Global CUSTOMER DATA PLATFORM Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 FRANCE

15.2.3 U.K.

15.2.4 ITALY

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 TURKEY

15.2.8 BELGIUM

15.2.9 NETHERLANDS

15.2.10 NORWAY

15.2.11 FINLAND

15.2.12 SWITZERLAND

15.2.13 DENMARK

15.2.14 SWEDEN

15.2.15 POLAND

15.2.16 REST OF EUROPE

15.3 ASIA PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 AUSTRALIA

15.3.6 NEW ZEALAND

15.3.7 SINGAPORE

15.3.8 THAILAND

15.3.9 MALAYSIA

15.3.10 INDONESIA

15.3.11 PHILIPPINES

15.3.12 TAIWAN

15.3.13 VIETNAM

15.3.14 REST OF ASIA PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 EGYPT

15.5.3 SAUDI ARABIA

15.5.4 U.A.E

15.5.5 ISRAEL

15.5.6 OMAN

15.5.7 BAHRAIN

15.5.8 KUWAIT

15.5.9 QATAR

15.5.10 REST OF MIDDLE EAST AND AFRICA

16. GLOBAL CUSTOMER DATA PLATFORM MARKET,COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17. GLOBAL CUSTOMER DATA PLATFORM MARKET, SWOT AND DBMR ANALYSIS

18. GLOBAL CUSTOMER DATA PLATFORM MARKET, COMPANY PROFILE

18.1 ORACLE CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 SAP SE

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 MICROSOFT CORPORATION

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 SAS INSTITUTE, INC

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 NICE CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ADOBE SYSTEMS

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 SALESFORCE.COM

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 TERADATA CORPORATION

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 ZYLOTECH CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.10 UPLAND SOFTWARE

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 CALIBERMIND

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 BLUECONIC, INC

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 BLUEVENN

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 AMPERITY, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 ZETA GLOBAL CORP.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 TOTANGO

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 ACQUIA

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 TEALIUM CORPORATION

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 LYTICS INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.20 CELEBRUS

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 TREASURE DATA

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 SIMON DATA

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 TWILIO INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 CLOUDERA, INC.

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 DUN & BRADSTREET

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 LEADSPACE, INC.

18.26.1 COMPANY SNAPSHOT

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHIC PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

18.27 OPTIMOVE INC.

18.27.1 COMPANY SNAPSHOT

18.27.2 REVENUE ANALYSIS

18.27.3 GEOGRAPHIC PRESENCE

18.27.4 PRODUCT PORTFOLIO

18.27.5 RECENT DEVELOPMENTS

18.28 INSIDER

18.28.1 COMPANY SNAPSHOT

18.28.2 REVENUE ANALYSIS

18.28.3 GEOGRAPHIC PRESENCE

18.28.4 PRODUCT PORTFOLIO

18.28.5 RECENT DEVELOPMENTS

18.29 LISTRAK INC.

18.29.1 COMPANY SNAPSHOT

18.29.2 REVENUE ANALYSIS

18.29.3 GEOGRAPHIC PRESENCE

18.29.4 PRODUCT PORTFOLIO

18.29.5 RECENT DEVELOPMENTS

18.30 OMETRIA

18.30.1 COMPANY SNAPSHOT

18.30.2 REVENUE ANALYSIS

18.30.3 GEOGRAPHIC PRESENCE

18.30.4 PRODUCT PORTFOLIO

18.30.5 RECENT DEVELOPMENTS

18.31 LEARNA

18.31.1 COMPANY SNAPSHOT

18.31.2 REVENUE ANALYSIS

18.31.3 GEOGRAPHIC PRESENCE

18.31.4 PRODUCT PORTFOLIO

18.31.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

19. CONCLUSION

20. QUESTIONNAIRE

21. RELATED REPORTS

22. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.