Global Crystal Oscillator Market

Market Size in USD Billion

CAGR :

%

USD

2.89 Billion

USD

4.21 Billion

2024

2032

USD

2.89 Billion

USD

4.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.89 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Crystal Oscillator Market Size

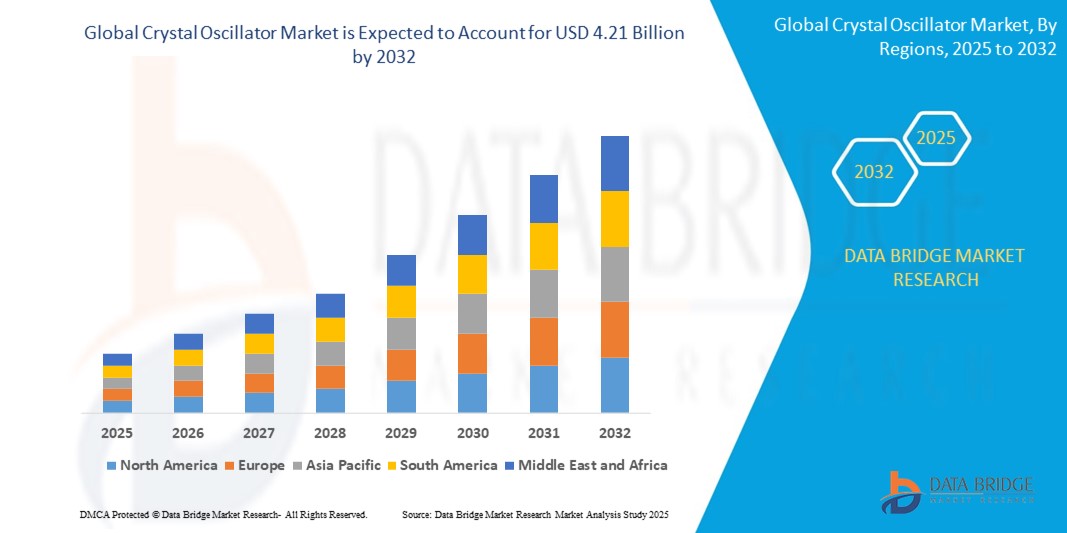

- The global crystal oscillator market size was valued at USD 2.89 billion in 2024 and is expected to reach USD 4.21 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by the increasing demand for consumer electronics, growing adoption of advanced communication technologies, and expanding use of crystal oscillators in automotive and industrial applications

- Rising integration of crystal oscillators in emerging technologies such as 5G infrastructure, Internet of Things devices, and smart wearables is also contributing to the sustained growth of the market

Crystal Oscillator Market Analysis

- The crystal oscillator market is experiencing steady growth due to increasing demand for precise frequency control in telecommunications, consumer electronics, and automotive applications

- Innovations in miniaturization and enhanced performance are driving adoption across diverse industries, enabling more reliable and energy-efficient devices

- North America dominates the crystal oscillator market with the largest revenue share of over 30.5% in 2024, driven by significant research and development expenditures, robust government efforts to foster technological innovation, and the strong presence of key players in the aerospace and defence industries in the region. The increasing adoption of 5G technology and IoT applications also contributes to the high demand for precise frequency control components.

- Asia-Pacific is expected to be the fastest growing region in the crystal oscillator market during the forecast period due to rapid industrialization and urbanization, increasing production of electronic devices owing to lower manufacturing costs, and surging demand for smartphones, digital televisions, and automotive electronics. In addition, the expanding cellular infrastructure and growing number of telecom equipment shipments in countries such as China and India are major contributors to this growth

- The surface mount segment dominates the largest market revenue share, primarily due to its compact size, suitability for automated assembly processes, and higher integration capabilities with modern electronic circuits. This mounting scheme enables smaller and more efficient device designs, catering to the miniaturization trend in electronics

Report Scope and Crystal Oscillator Market Segmentation

|

Attributes |

Crystal Oscillator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Seiko Epson Corporation (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Crystal Oscillator Market Trends

“Rise of Miniaturized and High-Precision Crystal Oscillators”

- The crystal oscillator market is focusing on miniaturized and high-precision oscillators to fit compact and complex electronic devices such as smartphones and wearables

- There is rising demand for oscillators with enhanced frequency stability and low phase noise to support sophisticated consumer electronics and IoT devices

- The automotive sector increasingly uses precise timing oscillators for advanced driver-assistance systems and autonomous vehicle technologies

- For instance, surface-mount device oscillators with smaller footprints help integrate oscillators into tight circuit boards without losing performance

- Another instance is the deployment of high-precision oscillators in 5G infrastructure to enable ultra-reliable, low-latency communication

Crystal Oscillator Market Dynamics

Driver

“Rapid Growth of Consumer Electronics and Telecommunications Sectors”

- Rapid growth in consumer electronics such as smartphones, tablets, and wearable devices is driving demand for reliable and accurate timing components such as crystal oscillators

- The rollout of 5G networks increases the need for oscillators with superior stability and low phase noise to support faster data rates and reduced latency, as seen in advanced telecom infrastructure

- Connected automotive technologies, including advanced driver-assistance systems and autonomous vehicles, require high-precision and durable crystal oscillators to function effectively in varying environments

- Manufacturers are focusing on producing smaller and more energy-efficient oscillators, suitable for portable and battery-powered devices such as IoT gadgets

- For instance, crystal oscillators are integral in ensuring data synchronization in smart home devices, while their robust performance supports critical timing in automotive safety systems

Restraint/Challenge

“Intense Competition from Alternative Timing Technologies”

- The crystal oscillator market faces strong competition from alternative timing technologies such as microelectromechanical systems oscillators and silicon-based resonators, which offer smaller size and lower power consumption

- MEMS technology’s growth especially challenges crystal oscillators in consumer electronics where miniaturization and efficiency are crucial

- For instance, MEMS oscillators have been increasingly adopted in wearable devices such as fitness trackers and smartwatches, where their smaller size and lower power consumption provide a clear advantage over traditional crystal oscillators

- Price volatility and supply chain issues related to quartz crystal raw materials can increase production costs and affect availability

- Environmental regulations and the demand for sustainable manufacturing add complexity and expenses for producers of crystal oscillators

- High precision requirements in industries lead to extensive testing and quality control, raising production time and costs, which can limit adoption in cost-sensitive markets and emerging regions

Crystal Oscillator Market Scope

The market is segmented on the basis of mounting scheme, general circuitry, and crystal cut.

- By Mounting Scheme

On the basis of mounting scheme, the market is segmented into surface mount and through hole. The surface mount segment dominates the largest market revenue share, primarily due to its compact size, suitability for automated assembly processes, and higher integration capabilities with modern electronic circuits. This mounting scheme enables smaller and more efficient device designs, catering to the miniaturization trend in electronics.

The through hole segment is anticipated to witness the fastest growth, fuelled by its robustness, ease of manual assembly and repair, and suitability for applications requiring higher power or mechanical stability. Despite the rise of surface mount technology, through-hole components remain crucial for certain industrial and high-reliability applications, leading to sustained demand and growth.

- By General Circuitry

On the basis of general circuitry, the market is segmented into SPXO, VCXO, TCXO, OCXO, and FCXO. The SPXO (Simple Packaged Crystal Oscillators) segment holds the largest market revenue share, driven by their widespread use in various electronic devices due to their cost-effectiveness, simplicity, and reliable frequency output. SPXOs serve as fundamental timing devices in consumer electronics, telecommunications, and industrial applications.

The TCXO (Temperature Compensated Crystal Oscillators) segment is expected to witness the fastest CAGR, propelled by the increasing demand for high-precision timing in applications sensitive to temperature fluctuations, such as telecommunications infrastructure, GPS systems, and advanced medical devices. Their ability to maintain frequency stability over a wide temperature range makes them critical for high-performance systems.

- By Crystal Cut

On the basis of crystal cut, the market is segmented into AT-cut, BT-cut, and SC-cut. The AT-cut segment holds the largest market revenue share, primarily due to its superior frequency stability over a broad temperature range and excellent aging characteristics. AT-cut crystals are widely used in high-precision oscillators for telecommunications, computing, and industrial control systems where stable timing is crucial.

The SC-cut (Stress Compensated-cut) segment is anticipated to witness the fastest growth, driven by its exceptional frequency stability, lower aging rates, and superior resistance to vibration and acceleration compared to other cuts. These properties make SC-cut crystals ideal for demanding applications such as aerospace, defence, and high-precision instrumentation, where environmental robustness and ultra-stable timing are paramount.

Crystal Oscillator Market Regional Analysis

- North America dominates the crystal oscillator market with the largest revenue share of over 30.5% in 2024

- This is primarily driven by significant research and development expenditures, robust government efforts to foster technological innovation, and the strong presence of key players in the aerospace and defence industries in the region

- The increasing adoption of 5G technology and IoT applications also contributes to the high demand for precise frequency control components

U.S. Crystal Oscillator Market Insight

The U.S. crystal oscillator market holds a substantial revenue share within North America, fuelled by a high demand for precision timing components in advanced communication, automotive, and industrial electronics sectors. The widespread deployment of 5G and IoT infrastructure, alongside ongoing advancements in consumer electronics, further propels the market.

Europe Crystal Oscillator Market Insight

The Europe crystal oscillator market is expected to grow at a substantial growth rate throughout the forecast period, primarily driven by technological advancements, increasing adoption of 5G networks, and rising consumption of electronics. The focus on high-reliability applications in industrial and automotive sectors also contributes to market expansion in the region.

U.K. Crystal Oscillator Market Insight

The U.K. crystal oscillator market is expected to grow at a substantial growth rate during the forecast period, driven by the increasing demand for advanced electronic devices, particularly in telecommunications and consumer electronics. The country's ongoing investments in 5G infrastructure and the need for stable timing sources for modern applications are key growth drivers.

Germany Crystal Oscillator Market Insight

The German crystal oscillator market is expected to grow at a substantial growth rate during the forecast period, fuelled by its strong industrial base, significant automotive manufacturing sector, and increasing demand for high-performance electronic components. The emphasis on precision engineering and integration into complex systems further drives the market.

Asia-Pacific Crystal Oscillator Market Insight

The Asia-Pacific crystal oscillator market is expected to grow at a substantial growth rate during the forecast period, driven by rapid industrialization and urbanization, increasing production of electronic devices due to lower manufacturing costs, and surging demand for smartphones, digital televisions, and automotive electronics. The expanding cellular infrastructure and growing number of telecom equipment shipments in countries such as China and India are major contributors.

Japan Crystal Oscillator Market Insight

The Japan crystal oscillator market is expected to grow at a substantial growth rate due to its high-tech culture, rapid urbanization, and increasing demand for precision timing in advanced consumer electronics and automotive industries. The country's leading position in motor vehicle manufacturing and the continuous integration of electronic equipment in vehicles significantly contribute to market growth.

China Crystal Oscillator Market Insight

The China crystal oscillator market is expected to grow at a substantial growth rate in Asia Pacific, attributed to its vast manufacturing capabilities, rapid deployment of 5G technology, and the highest production and consumption levels of crystal oscillators globally. The country's strong focus on advanced industrial development and the booming consumer electronics sector are key factors propelling the market.

Crystal Oscillator Market Share

The crystal oscillator industry is primarily led by well-established companies, including:

• Seiko Epson Corporation (Japan)

• NIHON DEMPA KOGYO CO., LTD. (Japan)

• TXC Corporation (Taiwan)

• KYOCERA Corporation (Japan)

• Daishinku Corp. (Japan)

• Microchip Technology Inc. (U.S.)

• Murata Manufacturing Co., Ltd. (Japan)

• SiTime Corp. (U.S.)

• Crystal Technology Co., Ltd. (Taiwan)

• Rakon Limited (New Zealand)

• Vishay Intertechnology, Inc. (U.S.)

• Hosonic Technology (Group) Co., Ltd. (Taiwan)

• RIVER ELETEC CORPORATION (Japan)

• Mercury Inc (Taiwan)

• Abracon (U.S.)

• Greenray Industries, Inc. (U.S.)

• MTI-Milliren Technologies, Inc. (U.S.)

• QVS Tech, Inc. (U.S.)

• SHENZHEN YANGXING TECHNOLOGY CO., LTD. (China)

• Bliley (U.S.)

• Fuji Crystal (Hong Kong) Electronics Co., Ltd. (Hong Kong)

• Shenzhen Crystal Technology Industrial Co., Ltd. (China)

• AXTAL GmbH (Germany)

• TAITIEN ELECTRONICS CO., LTD (Taiwan)

• Crystek Corporation (U.S.)

Latest Developments in Global Crystal Oscillator Market

- In November 2024, Nihon Dempa Kogyo Co., Ltd. (NDK) introduced a groundbreaking differential-output crystal oscillator, the NP2016SBE/NP2520SBE series, designed for next-generation data centers and optical transceivers. These oscillators, measuring just 2.0×1.6×0.66 mm and 2.5×2.0×0.74 mm, operate at fundamental frequencies ranging from 156 MHz to 625 MHz, with a maximum frequency tolerance of ±20 × 10⁻⁶ and an ultra-low phase jitter of 28 femtoseconds. Engineered to withstand high temperatures up to 105°C, they are ideal for high-speed optical communication modules transitioning from 800 Gbps to 1.6 Tbps. The compact size and exceptional performance make them suitable for automotive applications as well, particularly as in-vehicle networks evolve toward higher speeds. NDK plans to commence mass production in April 2025 for the 156.25 MHz variant, followed by the 312.5 MHz version in April 2026, marking a significant advancement in crystal oscillator technology for high-performance applications

- In April 2024, TXC Corporation (Taiwan) introduced the Xterniti Platform, a precision timing solution designed to enhance synchronization in telecommunications networks. This platform incorporates TXC's proprietary Extended Holdover OCXO technology, which allows for over 24 hours of phase holdover under constant temperature conditions and 8 to 24 hours under dynamic real-world temperature variations. The compact design of the Xterniti Platform makes it suitable for integration into various synchronization applications, offering a cost-effective and miniature solution compared to traditional OCXOs. The platform's capabilities are particularly beneficial for customers with stringent Precision Time Protocol (PTP) requirements, ensuring accurate timing even during network disruptions or GPS signal loss. TXC plans to showcase the Xterniti Platform at ITSF 2024, OCP 2024, and UFFC-JS 2024, providing live demonstrations to potential client’s

- In October 2024, Seiko Epson Corporation developed the OG7050CAN, an oven-controlled crystal oscillator (OCXO) that consumes 56% less power and is 85% smaller than its predecessor, the OG1409 series. This compact and energy-efficient OCXO is tailored for next-generation communication infrastructures, such as base stations and data centers, where precise timing is crucial. The reduction in power consumption and size addresses the growing demand for low-power components in the face of increasing data traffic driven by 5G, IoT, and AI applications. Epson's innovation supports the development of sustainable and high-performance communication systems

- In November 2023, SiTime Corporation, a leading precision timing company, announced the completion of its acquisition of clock products from Aura Semiconductor, including licensing all associated clock intellectual property. This strategic move enhances SiTime’s capabilities in providing comprehensive and differentiated precision timing solutions. The acquisition adds 20 high-performance clock products to SiTime’s portfolio, with an additional 20 expected by the end of 2024. By integrating these clock products with its existing MEMS-based oscillators, SiTime aims to offer optimized timing solutions tailored for core markets such as communications, data centers, and artificial intelligence. Furthermore, SiTime is establishing an engineering and support office in Bengaluru, India, to bolster its global presence and support infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Crystal Oscillator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Crystal Oscillator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Crystal Oscillator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.