Global Cream Market

Market Size in USD Billion

CAGR :

%

USD

23.39 Billion

USD

36.72 Billion

2024

2032

USD

23.39 Billion

USD

36.72 Billion

2024

2032

| 2025 –2032 | |

| USD 23.39 Billion | |

| USD 36.72 Billion | |

|

|

|

|

Cream Market Size

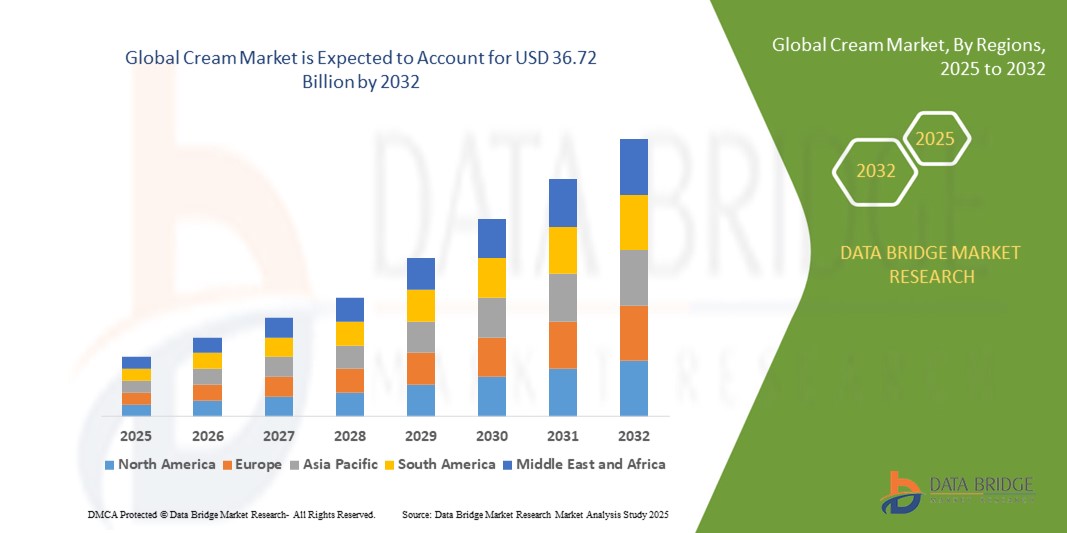

- The global cream market size was valued at USD 23.39 billion in 2024 and is projected to reach USD 36.72 billion by 2032, at a CAGR of 5.80% during the forecast period from 2025 to 2032.

- The market growth is primarily driven by increasing consumer preference for skincare and cosmetic products, along with rising awareness about health and wellness, which is fueling demand for specialized and natural cream formulations across various demographics.

- penetration of e-commerce platforms are enabling wider accessibility and adoption of creams in both developed and emerging markets. These factors collectively support steady growth in the global cream market.

Cream Market Analysis

- Creams, encompassing a wide range of skincare and cosmetic formulations, are essential products in daily personal care routines, offering moisturizing, anti-aging, and protective benefits across diverse consumer segments.

- The increasing demand for creams is largely driven by growing awareness of skincare health, rising disposable incomes, and the popularity of natural and organic ingredients, coupled with a surge in product innovations tailored to various skin types and concerns.

- Europe remained the largest regional market in 2024 with a revenue share of 38.5%, supported by high demand for sustainable and cruelty-free beauty products, a mature skincare market, and increasing male grooming trends across key economies including Germany, France, and the U.K.

- Asia-Pacific is anticipated to experience sustained growth, bolstered by rapid urbanization, higher disposable incomes, and strong consumer demand in countries like China, Japan, and South Korea, further driven by social media influence and thriving online retail platforms.

- Moisturizing creams segment led the market with a share of 45.7% in 2024, owing to their widespread use across all age groups and growing preference for formulations that provide hydration and skin barrier protection.

Report Scope and Market Segmentation

|

Attributes |

Cream Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cream Market Trends

Rising Demand for Plant-Based and Functional Creams

- A prominent and rapidly growing trend in the global cream market is the increasing consumer shift towards plant-based cream alternatives and functional creams enriched with health-boosting ingredients such as probiotics, vitamins, and antioxidants. This shift reflects growing health consciousness and dietary preferences such as veganism and lactose intolerance awareness.

- For instance, brands such as Alpro and Silk offer plant-based creamers made from soy, almond, and oat, catering to consumers seeking dairy-free options without compromising taste or texture. Similarly, functional creams infused with collagen or CBD are gaining traction for their added skincare or wellness benefits.

- Innovation in formulation is enabling plant-based creams to mimic the texture and richness of traditional dairy creams, expanding their appeal in coffee, baking, and cooking applications. Additionally, clean-label and organic certifications are increasingly valued by consumers, driving product development in these segments.

- The expanding availability of these products through e-commerce and specialty health stores makes them more accessible, supporting wider adoption across urban and health-conscious populations globally.

- This trend towards healthier, sustainable, and multifunctional cream products is driving key players like Danone, Nestlé, and Fonterra to invest heavily in research and product diversification to meet evolving consumer demands.

- Growing consumer preference for natural, ethical, and nutrient-enhanced creams is expected to fuel market growth in both developed and emerging regions, especially in North America and Asia-Pacific, where awareness of dietary health and sustainability is rising rapidly.

Cream Market Dynamics

Driver

Increasing Demand Driven by Health Consciousness and Premiumization

- Growing consumer awareness about health and wellness, alongside a rising preference for premium, natural, and organic cream products, is a key driver fueling demand in the global cream market.

- For example, companies like Danone and Nestlé have expanded their product lines to include organic and functional creams with added health benefits such as probiotics and vitamins, catering to health-conscious consumers.

- The rising popularity of indulgent food and beverage items, including specialty coffee creamers, gourmet desserts, and premium bakery products, further supports market expansion.

- Additionally, the increasing penetration of e-commerce and modern retail channels facilitates easier access to diverse cream products, boosting adoption in both developed and emerging markets.

- Consumers are also shifting towards plant-based and lactose-free cream alternatives due to dietary restrictions and environmental concerns, driving innovation and product diversification in the market.

Restraint/Challenge

Price Sensitivity and Fluctuating Raw Material Costs

- The cream market faces challenges from price volatility in dairy raw materials, such as milk and creamfat, which can impact product pricing and profit margins for manufacturers.

- For instance, fluctuations in global dairy supply and demand, as well as geopolitical factors, can lead to unpredictable cost swings that affect the affordability of cream products.

- Moreover, health concerns regarding high fat and calorie content in traditional dairy creams limit demand growth among certain consumer segments prioritizing low-fat or diet-friendly options.

- Although plant-based alternatives are gaining traction, they often come at a higher price point, which may deter price-sensitive buyers, particularly in emerging markets.

- Addressing these challenges requires innovation in cost-efficient production processes, consumer education about product benefits, and the development of affordable, healthier cream options to sustain market growth.

Cream Market Scope

The market is segmented on the basis product, source, and application.

- By Product

On the basis of product, the cream market is segmented into Fresh, Table, Heavy, Whipping, and Others. The Fresh cream segment dominated the market with the largest market revenue share of 38.7% in 2024, primarily due to its wide usage in both home and commercial kitchens for cooking, baking, and dessert preparation. Fresh cream’s versatility and ease of incorporation into various cuisines make it a staple in the dairy segment. It is also widely used in ready-to-eat and convenience foods, contributing to its strong demand.

The Whipping cream segment is projected to witness the fastest growth rate of 18.9% from 2025 to 2032, driven by its increasing application in bakery products, confectionery, and beverages such as coffee and milkshakes. Growth in the foodservice industry, along with the rising popularity of premium desserts and home baking trends, is fueling demand for whipping cream globally.

- By Source

On the basis of source, the cream market is segmented into Dairy and Non-Dairy. The Dairy segment held the largest market revenue share of 72.4% in 2024, owing to its traditional usage, established supply chains, and consumer preference for natural and authentic taste profiles. Dairy creams are heavily used in both foodservice and packaged food industries for their rich flavor, texture, and functional properties. Additionally, innovations such as low-fat and lactose-free dairy creams are attracting health-conscious consumers without compromising on taste.

The Non-Dairy segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, driven by rising veganism, lactose intolerance, and growing environmental concerns. Made from ingredients like soy, almond, coconut, and oats, non-dairy creams are gaining popularity in both household and commercial kitchens. Their expanding presence in cafés and bakeries as alternatives for traditional cream-based products is contributing to rapid market expansion.

- By Application

On the basis of application, the cream market is segmented into Commercial and Household. The Commercial segment accounted for the largest market revenue share of 58.9% in 2024, led by high consumption of cream in hotels, restaurants, bakeries, cafés, and food processing industries. The demand is further supported by the growing foodservice sector, increasing penetration of international cuisines, and the rising trend of artisanal desserts and beverages that use cream-based ingredients. Food manufacturers also rely on cream for product formulations in soups, sauces, ice creams, and confectionery.

The Household segment is projected to register the fastest CAGR of 17.5% from 2025 to 2032, driven by increased home cooking, baking trends, and growing availability of cream in retail stores. The rise of digital food content, cooking shows, and online recipe platforms has significantly boosted household experimentation with cream-based dishes, contributing to rising demand in this segment.

Cream Market Regional Analysis

- Europe dominated the cream market with the largest revenue share of 36.5% in 2024, driven by strong demand across bakery, confectionery, and culinary sectors. The region’s deep-rooted dairy culture, combined with premiumization trends and growing consumer preference for clean-label, high-quality cream products, supports market leadership.

- European consumers favor both traditional dairy and emerging plant-based cream alternatives, driven by health consciousness and sustainability concerns. Rising demand from foodservice, retail, and industrial segments across countries like France, Germany, and the UK continues to boost overall cream consumption.

- The market also benefits from increasing investments in innovation and R&D, particularly in producing long-shelf-life and fortified cream varieties that cater to evolving dietary needs and convenience trends.

Germany Cream Market Insight

Germany held the largest revenue share in Europe in 2024, owing to the country's well-established dairy processing industry and rising consumer demand for organic and lactose-free cream options. German consumers show a strong preference for high-quality fresh and sour cream in cooking and baking, while the growth of private-label cream brands and clean-label trends are reshaping product offerings. Additionally, growing demand in the HoReCa (Hotel/Restaurant/Café) segment contributes to robust market expansion.

France Cream Market Insight

The France cream market is projected to grow steadily throughout the forecast period, supported by the country's traditional culinary practices and high per capita dairy consumption. The rising appeal of gourmet cooking and artisanal foods continues to boost demand for premium cream varieties, including whipping and heavy cream. Moreover, French producers are increasingly innovating in non-dairy cream products to align with emerging vegan and health-oriented consumer segments.

North America Cream Market Insight

The North America cream market is expected to register substantial growth, fueled by increasing consumption of cream-based food and beverages, ready-to-eat products, and dessert toppings. A high demand for clean-label, organic, and functional dairy products is reshaping the U.S. and Canadian markets. Consumers increasingly seek out healthier alternatives, including plant-based creams made from oats, almonds, and coconuts, driving rapid expansion in this segment.

U.S. Cream Market Insight

The U.S. accounted for over 78% of the North America cream market revenue in 2024, with strong demand across both traditional dairy and plant-based cream categories. Growth is supported by the rising popularity of home baking, the boom in coffee and dessert culture, and innovation in lactose-free and fortified creams. Foodservice channels, including cafés and quick-service restaurants, continue to adopt cream-based ingredients for premium menu offerings.

Asia-Pacific Cream Market Insight

The Asia-Pacific cream market is poised to witness the fastest CAGR of 22.6% from 2025 to 2032, driven by changing dietary habits, increasing urbanization, and rising disposable incomes across developing economies. A surge in western-style bakery and café culture in countries like China, India, South Korea, and Indonesia is fueling demand for cream products. The market also benefits from a growing shift toward value-added and packaged dairy, supported by government initiatives and rising cold chain infrastructure.

China Cream Market Insight

China led the Asia-Pacific region in terms of market share in 2024, propelled by the rising middle-class population and a strong push toward westernized food consumption. Demand for whipping cream and non-dairy cream alternatives is expanding across both retail and foodservice sectors. Local and international players are investing in localized production and product diversification to meet the tastes and dietary preferences of Chinese consumers.

India Cream Market Insight

India’s cream market is expected to grow at a notable CAGR during the forecast period, driven by rapid urbanization, rising demand for bakery and dessert products, and increasing interest in western cuisine. The market is also witnessing growth in both dairy-based and plant-based creams, with health-conscious consumers seeking low-fat and lactose-free options. Improved cold chain logistics and the expansion of modern trade channels are supporting cream availability in urban and semi-urban regions.

Cream Market Share

Cream Market Leaders Operating in the Market are:

- Nestlé S.A. (Switzerland)

- Danone (France)

- Cabot Creamery Cooperative, Inc. (U.S.)

- Fonterra Co-operative Group (New Zealand)

- Uelzana Group (Germany)

- Meggle AG (Germany)

- Starbucks Corporation (U.S.)

- Arby's (U.S.)

- Applebee's (U.S.)

- Auntie Anne's LLC (U.S.)

- A&W Restaurants, Inc. (U.S.)

- McDonald's Corporation (U.S.)

Recent Developments in Global Cream Market

- In June 2024, Danone announced the launch of a new line of plant-based culinary creams under its Alpro brand, targeting flexitarian and vegan consumers across Europe. These oat- and almond-based creams are designed for cooking and baking, offering a sustainable, dairy-free alternative without compromising on texture or taste. This move aligns with Danone's strategy to expand its plant-based portfolio and cater to the growing demand for healthier and environmentally friendly food products.

- In May 2024, Nestlé unveiled a new UHT whipping cream under its Nestlé Professional division, optimized for use in bakery and foodservice applications in Asia-Pacific markets. The new product boasts improved aeration, stability, and shelf life, tailored to the needs of high-temperature and high-humidity environments. This innovation supports Nestlé’s focus on strengthening its presence in the out-of-home segment and meeting rising demand for convenience and performance in commercial kitchens.

- In March 2024, Amul, India’s largest dairy cooperative, launched a range of premium flavored creams for the domestic retail market, including chocolate, vanilla, and saffron variants. The product targets the growing home baking trend and urban consumer preferences for value-added dairy offerings. With this launch, Amul aims to increase its footprint in the packaged dessert and value-added dairy segment, supporting the shift toward indulgent and convenient dairy products.

- In February 2024, Arla Foods introduced climate-labeled cream products in select European markets as part of its sustainability and transparency initiatives. These labels provide consumers with information about the carbon footprint of each product, promoting informed purchasing decisions. Arla’s move highlights the dairy industry’s increasing focus on environmental impact and positions the company as a leader in responsible food production.

- In January 2024, Oatly, the global oat-based dairy alternative brand, launched its first oat-based whipping cream in North America. This product caters to the rapidly expanding demand for non-dairy alternatives, particularly among lactose-intolerant and vegan consumers. The launch marks Oatly’s strategic expansion into culinary applications beyond beverages, reinforcing its position in the premium plant-based segment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cream Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cream Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cream Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.