Global Corrugated Bulk Bins Market

Market Size in USD Billion

CAGR :

%

USD

13.83 Billion

USD

19.67 Billion

2024

2032

USD

13.83 Billion

USD

19.67 Billion

2024

2032

| 2025 –2032 | |

| USD 13.83 Billion | |

| USD 19.67 Billion | |

|

|

|

|

Corrugated Bulk Bins Market Size

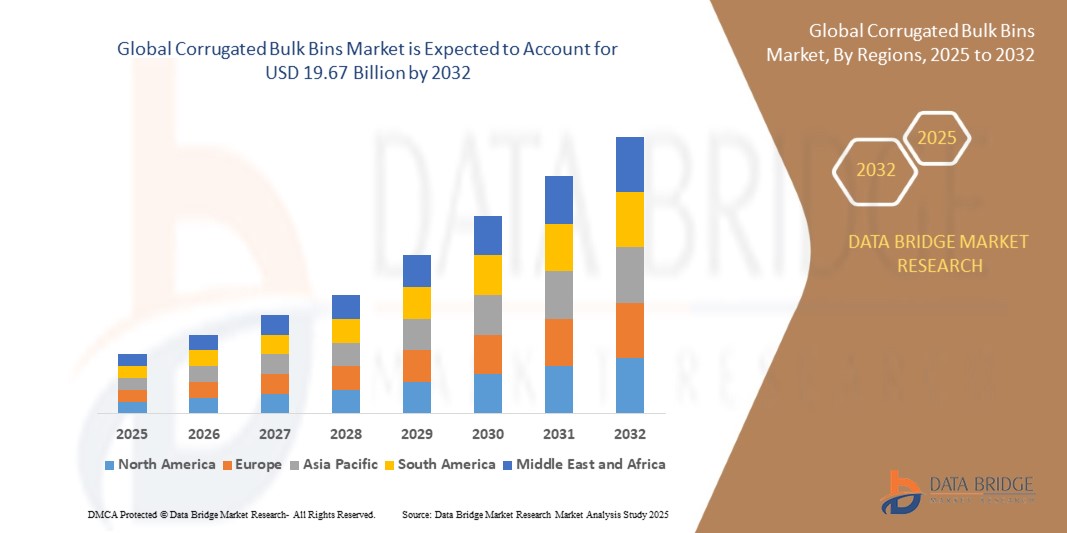

- The global corrugated bulk bins market size was valued at USD 13.83 billion in 2024 and is expected to reach USD 19.67 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the rising demand for cost-effective, lightweight, and recyclable packaging solutions across key sectors such as agriculture, food and beverage, and industrial manufacturing

- The increased emphasis on sustainable logistics and the expansion of global trade and e-commerce networks are further driving the adoption of corrugated bulk bins for efficient bulk storage and transportation

Corrugated Bulk Bins Market Analysis

- Growing environmental concerns and regulatory shifts toward sustainable packaging are significantly boosting the adoption of corrugated bulk bins as a preferred alternative to plastic and wood-based bulk containers

- Corrugated bulk bins are gaining traction for their ease of customization, stackability, and strength, making them ideal for transporting agricultural produce, automotive parts, and consumer goods

- Asia-Pacific dominated the corrugated bulk bins market with the largest revenue share in 2024, driven by the region’s expanding industrial base, rising demand for lightweight, cost-efficient packaging, and strong presence of manufacturing and export-oriented sectors

- North America region is expected to witness the highest growth rate in the global corrugated bulk bins market, driven by increasing adoption of circular economy practices, strong retail and logistics infrastructure, and rising preference for recyclable and reusable packaging materials across multiple industries

- The pallet packs segment accounted for the largest market revenue share in 2024, driven by their wide usage in warehousing, transportation, and storage of bulk goods. Their durability, stacking strength, and compatibility with forklifts make them an ideal choice across industries such as food, agriculture, and chemicals. In addition, the cost-efficiency and recyclability of pallet packs further boost their adoption among eco-conscious manufacturers

Report Scope and Corrugated Bulk Bins Market Segmentation

|

Attributes |

Corrugated Bulk Bins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Corrugated Bulk Bins Market Trends

“Rising Demand for Sustainable and Recyclable Bulk Packaging Solutions”

- Manufacturers are increasingly shifting from plastic and wooden containers to corrugated bulk bins due to their eco-friendly and recyclable nature

- Growing environmental regulations and sustainability goals are encouraging companies to adopt corrugated solutions across supply chains

- Corrugated bins offer lower carbon footprints and biodegradability, aligning with circular economy and green logistics practices

- Consumer brands are also under pressure to reduce packaging waste, prompting a switch to paper-based and fiberboard containers

- For instance, IKEA has adopted fully recyclable corrugated packaging for its internal logistics system, showcasing its commitment to sustainable transport packaging

Corrugated Bulk Bins Market Dynamics

Driver

“Growth in E-Commerce and Global Logistics Infrastructure”

- The expansion of e-commerce has increased demand for bulk packaging that is lightweight, stackable, and cost-effective

- Corrugated bulk bins reduce overall shipment weight, leading to lower transportation and fuel costs for online retailers and logistics firms

- These bins offer collapsibility, allowing for return shipment savings and efficient warehouse storage when not in use

- Their ability to safely hold large or fragile items has made them a preferred solution for high-volume, long-distance shipping

- For instance, Amazon uses corrugated bulk bins for seasonal inventory surges and warehouse overflow, enabling cost-effective bulk movement across its fulfillment centers

Restraint/Challenge

“Limited Durability in Moisture-Prone or Heavy-Duty Applications”

- Corrugated materials tend to weaken when exposed to water or high humidity, reducing their reliability for wet or cold chain logistics

- Industries that ship heavy goods or liquids often opt for plastic or metal bins that offer better resistance to moisture and structural wear

- While wax coatings and laminations can add water resistance to corrugated bins, they also increase production costs and reduce recyclability

- In outdoor or marine environments, untreated corrugated bins may collapse or fail, leading to product damage and logistical setbacks

- For instance, Seafood distribution companies avoid using corrugated bins for transporting fresh catch, instead favoring durable plastic totes for moisture resistance and hygiene compliance

Corrugated Bulk Bins Market Scope

The market is segmented on the basis of type, load capacity, format, and application.

• By Type

On the basis of type, the corrugated bulk bins market is segmented into pallet packs, hinged, totes, and others. The pallet packs segment accounted for the largest market revenue share in 2024, driven by their wide usage in warehousing, transportation, and storage of bulk goods. Their durability, stacking strength, and compatibility with forklifts make them an ideal choice across industries such as food, agriculture, and chemicals. In addition, the cost-efficiency and recyclability of pallet packs further boost their adoption among eco-conscious manufacturers.

The totes segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to rising demand for compact and efficient bulk storage solutions in e-commerce and retail sectors. Totes provide space-saving options for distribution centers and offer ease of handling, especially for smaller volume shipments, enhancing operational efficiency across supply chains.

• By Load Capacity

On the basis of load capacity, the market is segmented into below 1000 kg, 1000–1500 kg, and more than 1500 kg. The below 1000 kg segment led the market in 2024, supported by its extensive use in handling lightweight and perishable products such as fresh produce and pharmaceuticals. These bins are preferred for their ease of transport, minimal structural requirements, and flexibility in various applications.

The more than 1500 kg segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing usage in heavy-duty industrial sectors such as automotive and construction. These bins offer robust structural integrity and are suitable for storing and transporting metal parts, machinery, and bulk chemicals.

• By Format

On the basis of format, the corrugated bulk bins market is segmented into single wall, double wall, triple wall, and others. The double wall segment dominated the market in 2024 due to its balance of strength and cost-effectiveness, making it a preferred option for medium-duty applications in food and beverage, electronics, and general packaging.

The triple wall segment is expected to witness the fastest growth rate from 2025 to 2032, as industries handling heavy or high-value goods increasingly demand maximum protection and stacking strength. The enhanced durability of triple wall bins ensures safer long-distance transport and reduces product damage, driving demand in global trade and export sectors.

• By Application

On the basis of application, the market is segmented into food and beverage, automotive, pharmaceutical, chemical, oil and lubricant, building and construction, and others. The food and beverage segment held the largest revenue share in 2024, fueled by increased demand for hygienic, lightweight, and cost-efficient packaging solutions for bulk produce, beverages, and packaged goods.

The pharmaceutical segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising global healthcare demand and the need for contamination-resistant, easily disposable, and space-efficient storage and transport options. The sector’s strict regulatory compliance also boosts the appeal of corrugated bulk bins for safe and traceable packaging.

Corrugated Bulk Bins Market Regional Analysis

- Asia-Pacific dominated the corrugated bulk bins market with the largest revenue share in 2024, driven by the region’s expanding industrial base, rising demand for lightweight, cost-efficient packaging, and strong presence of manufacturing and export-oriented sectors

- Countries such as China, India, and Japan are increasingly adopting corrugated bulk bins across automotive, chemical, agriculture, and construction industries to improve handling, reduce transportation costs, and support sustainability goals

- Government regulations promoting recyclable materials and growing focus on reducing plastic waste are further accelerating the adoption of corrugated bulk bins across the region

China Corrugated Bulk Bins Market Insight

The China corrugated bulk bins market accounted for the largest revenue share within Asia-Pacific in 2024, propelled by the country’s robust manufacturing output and growing export activity. The rapid expansion of the automotive and e-commerce sectors has fueled demand for strong, stackable, and reusable packaging solutions. In addition, China's domestic packaging manufacturers are increasingly offering customized bin formats to meet the diverse requirements of logistics, agriculture, and heavy-duty sectors.

Japan Corrugated Bulk Bins Market Insight

The Japan corrugated bulk bins market is expected to witness the fastest growth rate from 2025 to 2032 due to the country's focus on efficiency, sustainability, and space-saving logistics. Japanese industries are adopting high-strength, recyclable bulk bins to streamline storage and transportation processes. The demand is particularly high in electronics, food, and pharmaceutical sectors, where compact, durable packaging formats are essential. The push for automation and smart warehousing solutions is also increasing the integration of foldable and customized bin options.

North America Corrugated Bulk Bins Market Insight

The North America corrugated bulk bins market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising preference for lightweight and sustainable bulk packaging across industries such as food and beverage, chemicals, and automotive. The region's strong focus on circular economy practices and reducing environmental impact is fueling the adoption of recyclable corrugated solutions. Manufacturers in the U.S. and Canada are increasingly offering advanced designs, including triple-wall bins and modular formats, to cater to evolving supply chain demands.

U.S. Corrugated Bulk Bins Market Insight

The U.S. corrugated bulk bins market is expected to witness the fastest growth rate from 2025 to 2032, supported by widespread usage in logistics, warehousing, and industrial packaging. Key sectors such as agriculture, manufacturing, and construction rely on corrugated bulk bins for their durability and cost-effectiveness. Innovations in moisture-resistant coatings and easy-assembly structures are helping drive adoption across both regional and international distribution networks.

Europe Corrugated Bulk Bins Market Insight

The Europe corrugated bulk bins market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent environmental regulations and a rising shift toward sustainable packaging solutions. Countries such as Germany, France, and the United Kingdom are adopting corrugated bins to replace plastic containers in supply chain operations. The demand is particularly strong in the food and pharmaceutical sectors, where hygiene and recyclability are key priorities. Moreover, manufacturers are investing in lightweight, high-load capacity designs to improve logistics efficiency.

Germany Corrugated Bulk Bins Market Insight

The Germany corrugated bulk bins market is expected to witness the fastest growth rate from 2025 to 2032, backed by the country’s strong automotive, chemical, and engineering sectors. Corrugated bins are increasingly used for safe handling of components, raw materials, and semi-finished goods. German companies are also emphasizing circular packaging systems, promoting the use of triple-wall, heavy-duty corrugated bins for repeated use in industrial settings. The trend toward smart logistics and automation is encouraging demand for stackable and RFID-compatible bins.

U.K. Corrugated Bulk Bins Market Insight

The U.K. corrugated bulk bins market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rise in e-commerce, industrial packaging needs, and sustainability initiatives. With increasing demand for recyclable, space-saving packaging in warehouse and transport operations, businesses are investing in foldable corrugated bins with reinforced formats. Government policies promoting the reduction of plastic use and the adoption of recyclable materials are also accelerating market adoption across multiple end-use sectors.

Corrugated Bulk Bins Market Share

The Corrugated Bulk Bins industry is primarily led by well-established companies, including:

- Mondi (U.K.)

- Sonoco Products Company (U.S.)

- WestRock Company (U.S.)

- International Paper (U.S.)

- Georgia-Pacific (U.S.)

- Greif (U.S.)

- Smurfit Kappa (Ireland)

- Orora Packaging Australia Pty Ltd (Australia)

- Packaging Corporation of America (U.S.)

- Larson Packaging Company Ltd. (U.K.)

- Supack Industries Pvt. Ltd (India)

- JAYARAJ FORTUNE PACKAGING PVT. LTD. (India)

- B&B Triplewall Containers Ltd (India)

- Saica (Spain)

- DS Smith (U.K.)

Latest Developments in Global Corrugated Bulk Bins Market

- In February 2021, DS Smith Plc announced the launch of a new line of circular corrugated bulk bins as part of its sustainable packaging development strategy. These bins are manufactured entirely from recycled materials and are fully recyclable after use, aligning with circular economy principles. The initiative is aimed at reducing packaging waste and offering environmentally friendly alternatives to plastic and other non-recyclable materials. This development strengthens DS Smith’s commitment to sustainability and is expected to positively influence the corrugated bulk bins market by meeting rising demand for eco-conscious packaging solutions across industries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Corrugated Bulk Bins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Corrugated Bulk Bins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Corrugated Bulk Bins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.