Market Analysis and Insights of Corrosion Inhibitors Market

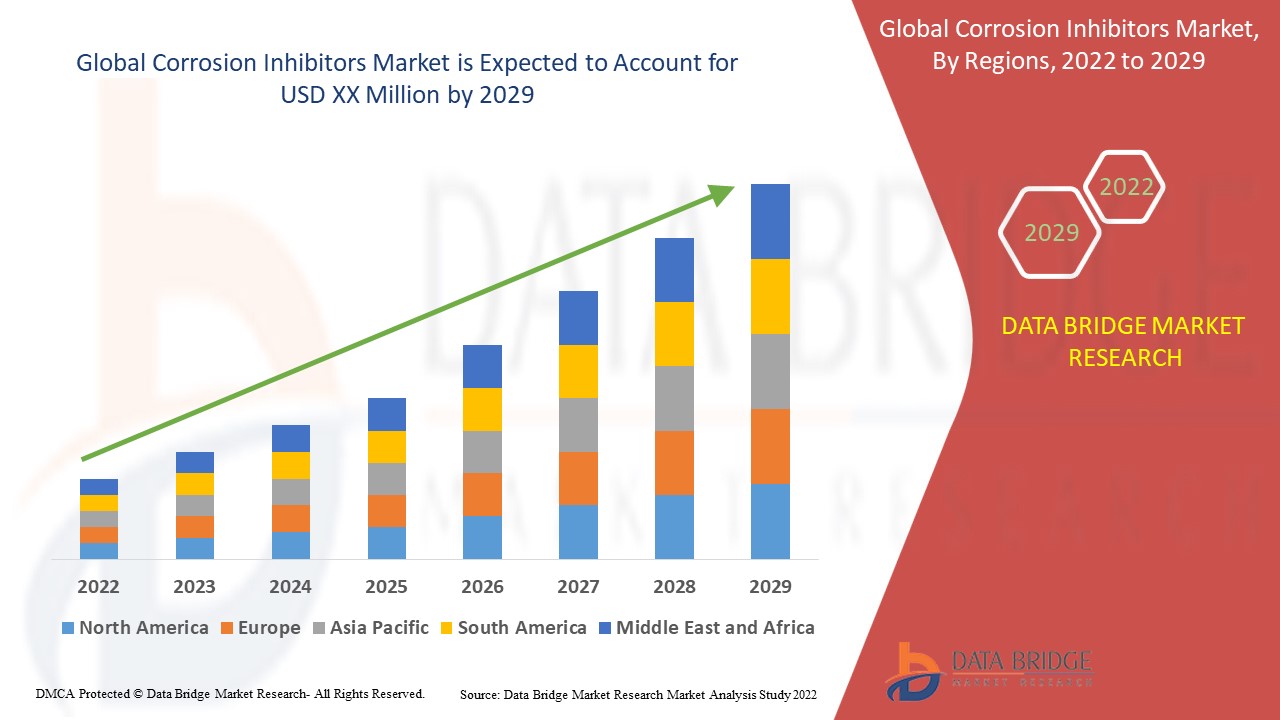

Data Bridge Market Research analyses that the corrosion inhibitors market will witness a CAGR of 4.50% for the forecast period of 2022-2029. Growth in the demand for corrosion inhibitors especially in the developing economies like India and China, growing use of corrosion inhibitors for a wide range of end user applications such as power generation, chemical processing and other end user applications, increasing investment by the government for research and development activities and surge in industrialization especially in the developing countries are the major factors attributable to the growth of the corrosion inhibitors market.

From the name itself, it is clear that corrosion inhibitors are the chemicals that are applied to the surfaces of metals to prevent them from getting corroded or rusted. Corrosion inhibitors are available in all kinds of forms, namely, gaseous, liquid, powdered and solid.

Rise in demand for corrosion inhibitors by the oil and gas industry in developed and developing economies is the root cause fuelling up the market growth rate. Rising application areas for corrosion inhibitors such as in the metal and metal processing and growth and expansion of various end user industries especially in the developing economies will also directly and positively impact the growth rate of the market. Rising number of power plants, increasing crude oil production, increasing buildings and construction projects in the developing economies, rising expenditure for research and development proficiencies by the major companies, upsurge in the rate of industrialization and growing focus on the technological advancements and modernization in the production techniques will further carve the way for the growth of the market.

However, insufficiency in raw material demand and supply owing to the lockdown and volatility in their prices will pose a major challenge to the growth of the market. High costs associated with research and development proficiencies, strict environmental regulations imposed by the government coupled with geopolitical issues, disposal of harmful materials such as zinc, chromium, and phosphorus and strict global trade restrictions will dampen the market growth rate.

This corrosion inhibitors market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographical expansions, technological innovations in the market. To gain more info on corrosion inhibitors market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Corrosion Inhibitors Market Scope and Market Size

The corrosion inhibitors market is segmented on the basis of product, application, end-use industry, corrosive agent, corrosion type and inhibitor type. The growth amongst the different segments helps you in attaining the knowledge related to the different growth factors expected to be prevalent throughout the market and formulate different strategies to help identify core application areas and the difference in your target market.

- On the basis of product, the corrosion inhibitors market is segmented into organic and inorganic. Organic segment is sub-segmented into benzotriazole, tolyltriazole, mercaptobenzothiazole, amines and phosphonates. Inorganic segment is sub-segmented into nitrites and nitrates, chromates, DI chromates and borates, molybdates, zinc sulfate and other salts, silicates and polyphosphates.

- The application segment for corrosion inhibitors market includes water-based and solvent/oil-based.

- Based on end-use industry, the corrosion inhibitors market is segmented into power generation, oil and gas, chemical processing, metal processing and others.

- On the basis of corrosive agent, the corrosion inhibitors market is segmented into oxygen, hydrogen sulfide and carbon dioxide.

- On the basis of corrosion type, the corrosion inhibitors market is segmented into uniform or general corrosion, galvanic corrosion, localized corrosion, stress corrosion cracking (SCC) and erosion corrosion. Uniform or general corrosion segment is sub-segmented into atmospheric corrosion, high-temperature corrosion, liquid-metal corrosion, molten-salt corrosion, biological corrosion and stray-current corrosion. Localized corrosion segment is sub-segmented into crevice corrosion, filiform corrosion, pitting corrosion and intergranular corrosion.

- On the basis of inhibitor type, the corrosion inhibitors market is segmented into passivating inhibitors, volatile inhibitors, cathodic inhibitors, anodic inhibitors, mixed Inhibitors, synergistic inhibitors, precipitation inhibitors, green corrosion inhibitors and adsorption action inhibitors. Adsorption Action inhibitors segment is sub-segmented into chemisorption and physical adsorption.

Global Corrosion Inhibitors Market Country Level Analysis

The corrosion inhibitors market is analysed and market size, volume information is provided by country, product, application, end-use industry, corrosive agent, corrosion type and inhibitor type as referenced above.

The countries covered in the corrosion inhibitors market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the corrosion inhibitors market owing to the increase in the research and development activities and presence of significant oil and gas reserves in the region. Asia-Pacific will continue to undergo substantial gains during the forecast period owing to the high economic growth in the emerging countries, surging urbanization and industrialization, growing spending on construction from the public and private sector in the countries such as India, China, and Indonesia and abundant availability of raw materials.

The country section of the corrosion inhibitors market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Corrosion Inhibitors Market Share Analysis

The corrosion inhibitors market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to corrosion inhibitors market.

Some of the major players operating in the corrosion inhibitors market report are Advance Products & Systems, LLC., Akzo Nobel N.V., Air Products and Chemicals, Inc., Champion Technology Services, Inc., ICL, SUEZ, Daubert Cromwell, Inc., Dai-ichi India Pvt Ltd, Solvay, ChemTreat, Inc., Aegion Corporation, Kurita Water Industries Ltd., Kemira, The Lubrizol Corporation, Milacron, Ecolab, QED Chemicals Ltd, Eastman Chemical Company, SHAWCOR, Ashland., Corrosion Technologies., and BASF SE among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CORROSION INHIBITORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CORROSION INHIBITORS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL CORROSION INHIBITORS MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 RAW MATERIAL PRODUCTION COVERAGE

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL CORROSION INHIBITORS MARKET, BY INHIBITOR TYPE, 2022-2031, (USD MILLION) (KILO TONS)

(ASP, VOLUME AND VALUE WILL BE PROVIDED FOR ALL THE SEGMENTS)

8.1 OVERVIEW

8.2 ORGANIC CORROSION INHIBITORS

8.2.1 ORGANIC CORROSION INHIBITORS, BY TYPE

8.2.1.1. AMINES ORGANIC CORROSION INHIBITORS

8.2.1.2. PHOSPHONATES ORGANIC CORROSION INHIBITORS

8.2.1.3. BENZOTRIAZOLE ORGANIC CORROSION INHIBITORS

8.2.1.4. OTHERS

8.3 INORGANIC CORROSION INHIBITORS

8.3.1 INORGANIC CORROSION INHIBITORS, BY TYPE

8.3.1.1. CATHODIC INHIBITORS

8.3.1.1.1. NITRITES AND NITRATES

8.3.1.1.2. ZINC SULPHATE

8.3.1.1.3. OTHERS

8.3.1.2. ANODIC INHIBITORS

8.3.1.2.1. CHROMATES, DI CHROMATES AND BORATES

8.3.1.2.2. SILICATES

8.3.1.2.3. OTHERS

8.3.1.3. OTHERS

9 GLOBAL CORROSION INHIBITORS MARKET, BY TYPE, 2022-2031, (USD MILLION)

9.1 OVERVIEW

9.2 WATER-BASED CORROSION INHIBITORS

9.3 OIL / SOLVENT BASED CORROSION INHIBITORS

9.4 VOLATILE CORROSION INHIBITORS

10 GLOBAL CORROSION INHIBITORS MARKET, BY TARGET CORROSIVE AGENT, 2022-2031, (USD MILLION)

10.1 OVERVIEW

10.2 OXYGEN

10.3 HYDROGEN SULFIDE

10.4 CARBON DIOXIDE

11 GLOBAL CORROSION INHIBITORS MARKET, BY FORM, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 SPRAY

11.3 COATING

12 GLOBAL CORROSION INHIBITORS MARKET, BY CORROSION TYPE, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 UNIFORM OR GENERAL CORROSION

12.3 GALVANIC CORROSION

12.4 LOCALIZED CORROSION

12.5 STRESS CORROSION CRACKING (SCC)

12.6 EROSION CORROSION

12.7 OTHERS

13 GLOBAL CORROSION INHIBITORS MARKET, BY FUNCTION, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 SOLUBILITY

13.3 ADSORPTION

13.4 FILM FORMATION

13.5 OTHERS

14 GLOBAL CORROSION INHIBITORS MARKET, BY END USE, 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 OIL AND GAS

14.2.1 OIL AND GAS, BY INHIBITOR TYPE

14.2.1.1. ORGANIC CORROSION INHIBITORS

14.2.1.2. INORGANIC CORROSION INHIBITORS

14.3 POWER GENERATION

14.3.1 POWER GENERATION, BY INHIBITOR TYPE

14.3.1.1. ORGANIC CORROSION INHIBITORS

14.3.1.2. INORGANIC CORROSION INHIBITORS

14.4 CHEMICALS

14.4.1 CHEMICALS, BY INHIBITOR TYPE

14.4.1.1. ORGANIC CORROSION INHIBITORS

14.4.1.2. INORGANIC CORROSION INHIBITORS

14.5 METALS PROCESSING

14.5.1 METAL PROCESSING, BY INHIBITOR TYPE

14.5.1.1. ORGANIC CORROSION INHIBITORS

14.5.1.2. INORGANIC CORROSION INHIBITORS

14.6 PULP & PAPER

14.6.1 PULP & PAPER, BY INHIBITOR TYPE

14.6.1.1. ORGANIC CORROSION INHIBITORS

14.6.1.2. INORGANIC CORROSION INHIBITORS

14.7 WATER TREATMENT

14.7.1 WATER TREATMENT, BY INHIBITOR TYPE

14.7.1.1. ORGANIC CORROSION INHIBITORS

14.7.1.2. INORGANIC CORROSION INHIBITORS

14.8 OTHERS

15 GLOBAL CORROSION INHIBITORS MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION) (KILO TONS)

15.1 OVERVIEW

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 SWITZERLAND

15.3.7 NETHERLANDS

15.3.8 RUSSIA

15.3.9 TURKEY

15.3.10 BELGIUM

15.3.11 NETHERLANDS

15.3.12 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 SINGAPORE

15.4.6 THAILAND

15.4.7 INDONESIA

15.4.8 MALAYSIA

15.4.9 AUSTRALIA

15.4.10 PHILIPPINES

15.4.11 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 SAUDI ARABIA

15.6.4 UNITED ARAB EMIRATES

15.6.5 ISRAEL

15.6.6 REST OF MIDDLE EAST AND AMERICA

16 GLOBAL CORROSION INHIBITORS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL CORROSION INHIBITORS MARKET – COMPANY PROFILES

17.1 CORTEC CORPORATION

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 SWOT ANALYSIS

17.1.4 REVENUE ANALYSIS

17.1.5 RECENT UPDATES

17.2 BASF SE

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 SWOT ANALYSIS

17.2.4 REVENUE ANALYSIS

17.2.5 RECENT UPDATES

17.3 AKZO NOBEL N.V.

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 SWOT ANALYSIS

17.3.4 REVENUE ANALYSIS

17.3.5 RECENT UPDATES

17.4 HENKEL

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 SWOT ANALYSIS

17.4.4 REVENUE ANALYSIS

17.4.5 RECENT UPDATES

17.5 THE LUBRIZOL CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 SWOT ANALYSIS

17.5.4 REVENUE ANALYSIS

17.5.5 RECENT UPDATES

17.6 SUEZ

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 SWOT ANALYSIS

17.6.4 REVENUE ANALYSIS

17.6.5 RECENT UPDATES

17.7 SOLVAY (SYENSQO)

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 SWOT ANALYSIS

17.7.4 REVENUE ANALYSIS

17.7.5 RECENT UPDATES

17.8 EASTMAN CHEMICAL COMPANY

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 SWOT ANALYSIS

17.8.4 REVENUE ANALYSIS

17.8.5 RECENT UPDATES

17.9 LANXESS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 SWOT ANALYSIS

17.9.4 REVENUE ANALYSIS

17.9.5 RECENT UPDATES

17.1 ECOLAB

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 SWOT ANALYSIS

17.10.4 REVENUE ANALYSIS

17.10.5 RECENT UPDATES

17.11 NOURYON

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 SWOT ANALYSIS

17.11.4 REVENUE ANALYSIS

17.11.5 RECENT UPDATES

17.12 EVONIK INDUSTRIES

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 SWOT ANALYSIS

17.12.4 REVENUE ANALYSIS

17.12.5 RECENT UPDATES

17.13 ARKEMA

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 SWOT ANALYSIS

17.13.4 REVENUE ANALYSIS

17.13.5 RECENT UPDATES

17.14 ICL

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 SWOT ANALYSIS

17.14.4 REVENUE ANALYSIS

17.14.5 RECENT UPDATES

17.15 VCI TECHNOLOGY (M) SDN BHD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 SWOT ANALYSIS

17.15.4 REVENUE ANALYSIS

17.15.5 RECENT UPDATES

17.16 SUMISAUJANA TCM CHEMICALS

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 SWOT ANALYSIS

17.16.4 REVENUE ANALYSIS

17.16.5 RECENT UPDATES

17.17 CLARIANT

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 SWOT ANALYSIS

17.17.4 REVENUE ANALYSIS

17.17.5 RECENT UPDATES

17.18 SOLENIS (ACQUIRED BY PLATINUM EQUITY)

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 SWOT ANALYSIS

17.18.4 REVENUE ANALYSIS

17.18.5 RECENT UPDATES

17.19 BAKER HUGHES, (A GE COMPANY, LLC)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 SWOT ANALYSIS

17.19.4 REVENUE ANALYSIS

17.19.5 RECENT UPDATES

17.2 GCP APPLIED TECHNOLOGIES (ACQUIRED BY SAINT-GOBAIN)

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 SWOT ANALYSIS

17.20.4 REVENUE ANALYSIS

17.20.5 RECENT UPDATES

18 QUESTIONAIRESS

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Corrosion Inhibitor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Corrosion Inhibitor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Corrosion Inhibitor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.