Global Copper Sulfate Pentahydrate Market

Market Size in USD Billion

CAGR :

%

USD

1.13 Billion

USD

1.29 Billion

2024

2032

USD

1.13 Billion

USD

1.29 Billion

2024

2032

| 2025 –2032 | |

| USD 1.13 Billion | |

| USD 1.29 Billion | |

|

|

|

|

Copper Sulfate Pentahydrate Market Size

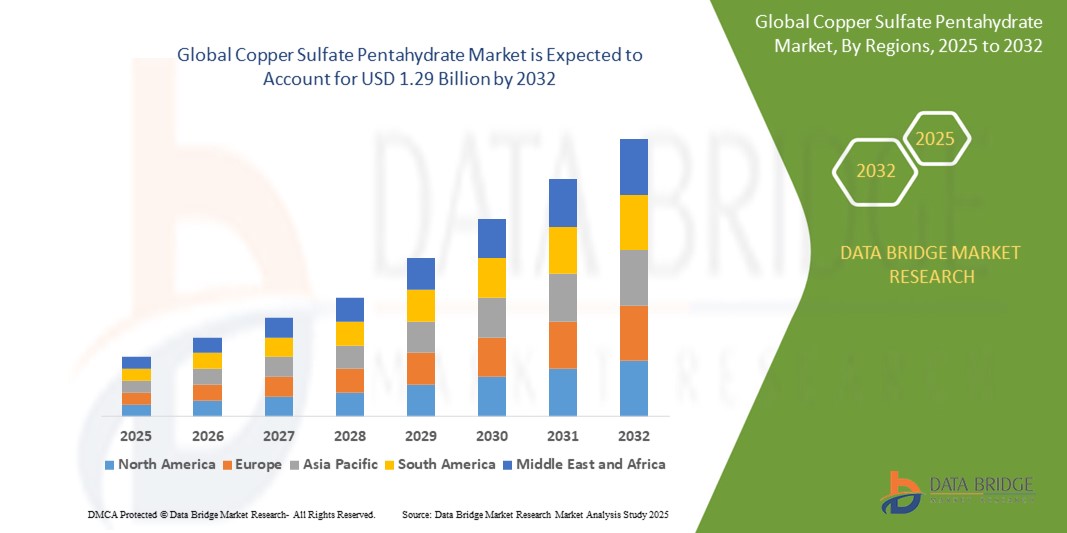

- The global copper sulfate pentahydrate market size was valued at USD 1.13 billion in 2024 and is expected to reach USD 1.29 billion by 2032, at a CAGR of 1.60% during the forecast period

- The market growth is largely fueled by the rising demand for copper-based compounds in agriculture, aquaculture, and industrial applications, supported by the expansion of precision farming and sustainable crop protection practices across developing and developed economies

- Furthermore, increasing utilization of copper sulfate pentahydrate in fungicides, feed additives, and electroplating processes is establishing it as a critical input in both agronomic and industrial sectors. These converging factors are accelerating product demand, thereby significantly boosting the industry's growth

Copper Sulfate Pentahydrate Market Analysis

- Copper sulfate pentahydrate is an inorganic compound widely used as a fungicide in agriculture, an algaecide in aquaculture, and as an electrolyte in industrial processes such as electroplating and mining. Its effectiveness, low cost, and multi-functionality make it a valuable additive across a range of end-use industries

- The escalating demand for this compound is primarily driven by increasing awareness of micronutrient deficiencies in crops, rising food security concerns, and the expansion of industrial sectors requiring copper-based chemical solutions for surface treatment and metal finishing

- Asia-Pacific dominated the copper sulfate pentahydrate market with a share of 46.46% in 2024, due to robust demand across agriculture, aquaculture, and industrial applications

- North America is expected to be the fastest growing region in the copper sulfate pentahydrate market during the forecast period due to its mature aquaculture industry, strong industrial base, and growing shift toward micronutrient-enriched crop inputs

- Industrial grade segment dominated the market with a market share of 47.3% in 2024, due to its wide application in chemical processing, electroplating, mining, and laboratory usage. Its high purity and chemical stability make it a preferred choice for processes requiring precise chemical reactions and formulations. The rising demand from metal treatment and electrochemical industries is further driving the adoption of industrial-grade copper sulfate pentahydrate across global manufacturing hubs

Report Scope and Copper Sulfate Pentahydrate Market Segmentation

|

Attributes |

Copper Sulfate Pentahydrate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Copper Sulfate Pentahydrate Market Trends

“Growing Demand in Agriculture”

- The agricultural sector is a major driver of copper sulfate pentahydrate demand, as it is widely used as a fungicide, herbicide, and micronutrient to enhance crop health, protect against fungal diseases, and improve soil quality. This aligns with the global push toward sustainable and precision farming techniques improving crop yield and resilience

- For instance, companies such as Zhejiang Fenglong New Material Co., Ltd. are expanding their copper sulfate pentahydrate production to supply the demand from farmers in Asia-Pacific, which is the largest regional market driven by intensive agriculture in countries such as China and India

- Demand from expanding organic and integrated pest management (IPM) farming practices also contributes to growth, as copper sulfate is often positioned as a safer, approved treatment option

- Rising awareness of micronutrient deficiencies in soils worldwide is prompting greater adoption of copper sulfate-based fertilizers in regions with poor soil conditions

- Growing exports of high-value fruits and vegetables and the need to meet stringent import regulations for pesticide residue are pushing the use of copper sulfate formulations to ensure compliance

- Technological innovation in granular and slow-release formulations is improving application efficiency and reducing environmental impact, fueling further interest in the agricultural segmen

Copper Sulfate Pentahydrate Market Dynamics

Driver

“Increasing Usage in Animal Feed Additive”

- Copper sulfate pentahydrate is increasingly used as a feed additive in animal nutrition to promote growth, improve feed efficiency, and enhance immunity in livestock and poultry. This application is becoming a sizeable and consistent contributor to overall market growth, especially in emerging economies with expanding meat and dairy industries

- For instance, major agrochemical players such as Hebei Welcome Pharmaceutical Co., Ltd. and Shandong Gongda Chemical Co., Ltd. are ramping up production capacity of feed-grade copper sulfate in China to meet rising demand from the livestock sector, including pig and poultry farming

- Regulatory encouragement to improve animal health while reducing antibiotic use supports the feed additive segment’s growth, reinforcing copper sulfate’s role as an essential micronutrient

- Increasing meat consumption in Asia Pacific, Latin America, and parts of Africa is driving feed production, with copper sulfate as a critical supplement to maintain animal productivity and disease resistance

- Growing interest in functional feed additives that boost sustainable livestock farming is also expanding the application base for copper sulfate-based products. The feed additive demand exhibits resilience even in fluctuating agricultural markets, providing a steady revenue stream for copper sulfate manufacturers

Restraint/Challenge

“Fluctuating Raw Material Prices”

- The copper sulfate pentahydrate market is susceptible to raw material price volatility, particularly fluctuations in copper metal and sulfuric acid—key inputs that affect manufacturing costs and pricing stability. This creates challenges for producers and end-users alike, impacting margins and budgeting

- For instance, geopolitical tensions and supply chain disruptions have resulted in copper price spikes in recent years, as observed in global markets including Chile and the Democratic Republic of Congo, which produce major shares of copper ore

- Cost increases for sulfuric acid due to environmental regulations and production limitations further add to input cost pressures for copper sulfate manufacturers worldwide

- Price volatility complicates long-term contracts for industries dependent on copper sulfate pentahydrate, such as agriculture and animal feed, sometimes causing end users to seek alternatives or delay purchases

- Smaller manufacturers and regional suppliers may struggle to absorb raw material cost spikes, risking supply shortages or production cutbacks. Efforts to develop cost-efficient recycling and alternative production technologies remain nascent, so price instability continues to pose a significant challenge

Copper Sulfate Pentahydrate Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the copper sulfate pentahydrate market is segmented into industrial grade, agricultural grade, and feed grade. The industrial grade segment dominated the largest market revenue share of 47.3% in 2024, attributed to its wide application in chemical processing, electroplating, mining, and laboratory usage. Its high purity and chemical stability make it a preferred choice for processes requiring precise chemical reactions and formulations. The rising demand from metal treatment and electrochemical industries is further driving the adoption of industrial-grade copper sulfate pentahydrate across global manufacturing hubs.

The agricultural grade segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing usage as a fungicide, herbicide, and soil additive. The rising focus on crop yield improvement, disease management, and sustainable farming practices is pushing demand for this grade in developing economies. Enhanced awareness about micronutrient deficiencies in soil and the need for effective solutions in modern agriculture are also propelling the growth of agricultural-grade copper sulfate pentahydrate.

- By Application

On the basis of application, the copper sulfate pentahydrate market is segmented into agriculture and forestry, aquaculture, chemical industry, electroplating and galvanic, metal and mine, and others. The agriculture and forestry segment held the largest market revenue share in 2024, fueled by its role in controlling fungal diseases, improving plant health, and correcting copper deficiencies in crops. Its compatibility with integrated pest management programs and approval in organic farming practices have further enhanced its utility among farmers worldwide.

The aquaculture segment is projected to register the fastest CAGR from 2025 to 2032, primarily due to its increasing use in controlling algae blooms and parasitic infestations in fish farms. As global fish consumption rises and commercial aquaculture expands, copper sulfate pentahydrate is gaining traction as a reliable and cost-effective treatment solution. Regulatory support for responsible aquaculture practices and the growing need to maintain water quality and fish health are also contributing to the segment’s rapid growth.

Copper Sulfate Pentahydrate Market Regional Analysis

- Asia-Pacific dominated the copper sulfate pentahydrate market with the largest revenue share of 46.46% in 2024, driven by robust demand across agriculture, aquaculture, and industrial applications

- Rapid urbanization, expanding aquaculture activities, and increasing adoption of high-efficiency agrochemicals are accelerating market growth across the region

- Government support for sustainable farming practices and industrial expansion, along with rising awareness of micronutrient-based fertilizers, is further propelling demand

India Copper Sulfate Pentahydrate Market Insight

India leads the regional market due to its extensive use of copper sulfate pentahydrate in agriculture, particularly for fungal control and micronutrient correction in crops. High dependence on agriculture for livelihood, coupled with rising demand for productivity-enhancing inputs, drives consistent uptake. Supportive government schemes and awareness programs promoting balanced fertilization and crop protection are reinforcing market penetration across rural and semi-urban regions.

China Copper Sulfate Pentahydrate Market Insight

China’s market continues to expand rapidly, fueled by its dominant position in global aquaculture and industrial production. The chemical and electroplating sectors create sustained demand for high-purity copper sulfate, while rising food safety concerns are encouraging controlled aquaculture practices using copper-based treatments. Industrial modernization and advancements in precision agriculture are further driving demand across diverse end-use industries.

Europe Copper Sulfate Pentahydrate Market Insight

Europe is projected to witness moderate growth, supported by rising demand for environmentally sustainable agricultural inputs and industrial chemicals. Regulatory support for organic farming and micronutrient management is increasing adoption of copper sulfate in crop protection. Furthermore, the region’s strong base in chemical manufacturing and electroplating processes maintains a steady demand for high-quality copper compounds.

U.K. Copper Sulfate Pentahydrate Market Insight

The U.K. market is gaining traction as farmers and growers shift toward more regulated, residue-controlled plant protection solutions. Copper sulfate is used in limited yet critical roles in fungicide formulations, especially in organic farming systems. Industrial usage in galvanic applications and public sector investments in water treatment and sustainable agriculture are enhancing demand stability.

Germany Copper Sulfate Pentahydrate Market Insight

Germany’s market is driven by its advanced chemical industry and strong emphasis on high-efficiency agriculture. Copper sulfate sees continued use in precision electroplating, scientific research, and as a feed additive. Regulatory emphasis on traceability and sustainability is encouraging use of well-characterized micronutrients in crop systems. Demand from organic farming and specialty industrial applications is expected to remain resilient.

North America Copper Sulfate Pentahydrate Market Insight

North America is expected to register the fastest CAGR from 2025 to 2032, driven by its mature aquaculture industry, strong industrial base, and growing shift toward micronutrient-enriched crop inputs. Rising concerns over water quality, disease control in aquaculture, and the need for effective fungicides are expanding the market scope. Technological advancements and regulatory clarity are further supporting market expansion.

U.S. Copper Sulfate Pentahydrate Market Insight

The U.S. holds the largest share in the North American market, supported by its extensive use across agriculture, chemical, and mining sectors. Copper sulfate is widely used in algae control, feed supplements, and electroplating operations. Government initiatives promoting micronutrient balance and sustainable aquaculture practices are strengthening market growth. Innovation in formulation and packaging is also enhancing accessibility for end-users across sectors.

Copper Sulfate Pentahydrate Market Share

The copper sulfate pentahydrate industry is primarily led by well-established companies, including:

- Wego Chemical & Mineral Corporation (U.S.)

- Allan Chemical Corporation (U.S.)

- Noah Chemicals (U.S.)

- Atotech (Germany)

- Laiwu Iron and Steel Group (China)

- Jiangxi Copper (China)

- Jinchuan Group (China)

- UNIVERTICAL (U.S.)

- Highnic Group (South Korea)

- G.G. MANUFACTURERS (India)

- Beneut (South Korea)

- Old Bridge Chemicals (U.S.)

- GREEN MOUNTAIN (U.S.)

- Mitsubishi (Japan)

- Sumitomo (Japan)

- Bakirsulfat (Turkey)

- Blue Line Corporation (U.S.)

- MCM Industrial (U.S.)

- Mani Agro Chem (India)

Latest Developments in Global Copper Sulfate Pentahydrate Market

- In 2024, Kocide 3000 was widely adopted in India’s integrated pest management (IPM) programs across key crops. The product’s lower metallic copper content aligned well with sustainable and organic farming practices, while consistent field performance strengthened its acceptance among progressive growers. Its compliance with FAO quality standards and broad-spectrum disease control made it a preferred choice for long-term crop protection strategies

- In 2023, Bharat Certis AgriScience Ltd. conducted region-specific trials of Kocide 3000 in citrus-growing areas of Maharashtra and Andhra Pradesh. The trials confirmed high efficacy against citrus canker and anthracnose, resulting in healthier plant canopies and improved fruit yield. These outcomes reinforced the product’s value proposition and accelerated its uptake in high-value horticulture segments

- In 2022, Bharat Certis AgriScience Ltd. launched Kocide 3000 in India, an advanced copper hydroxide fungicide imported from the U.S. Containing 46.1% WG (30% metallic copper), the formulation offered optimized particle size, enhanced rain-fastness, and increased Cu²⁺ bioavailability. The product addressed both fungal and bacterial infections, making it highly effective across a wide range of crops

- In 2020, Atul Ltd. introduced Kocide 1000 as a next-generation agricultural fungicide, replacing its earlier version, Kocide 2000. With improved particle uniformity and suspension stability, the upgraded formulation delivered better protection against fungal diseases. It was designed to improve overall field performance and reliability in integrated pest management systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Copper Sulfate Pentahydrate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Copper Sulfate Pentahydrate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Copper Sulfate Pentahydrate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.