Global Cloud Testing Market

Market Size in USD Billion

CAGR :

%

USD

13.07 Billion

USD

34.76 Billion

2024

2032

USD

13.07 Billion

USD

34.76 Billion

2024

2032

| 2025 –2032 | |

| USD 13.07 Billion | |

| USD 34.76 Billion | |

|

|

|

|

Cloud Testing Market Size

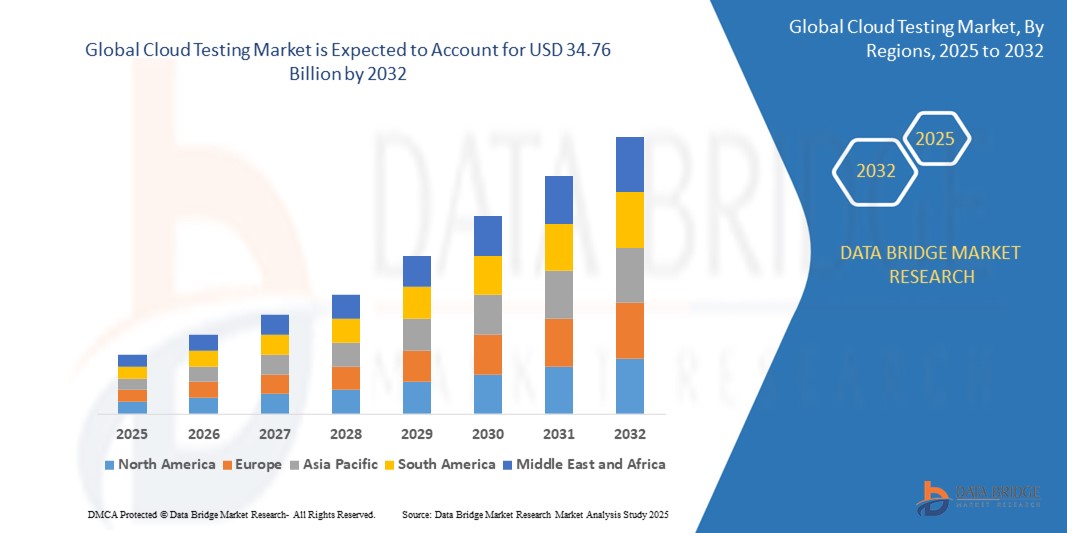

- The global cloud testing market was valued at USD 13.07 billion in 2024 and is expected to reach USD 34.76 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 13.00%, primarily driven by the increasing adoption of cloud-based solutions

- This growth is driven by factors such as the rising demand for scalable testing environments, cost-effectiveness of cloud testing, and advancements in AI-driven automation tools

Cloud Testing Market Analysis

- Cloud testing solutions are essential for evaluating the performance, scalability, and security of cloud-based applications. They enable organizations to conduct comprehensive testing in virtual environments, ensuring seamless functionality across various platforms

- The demand for cloud testing is significantly driven by the increasing adoption of cloud computing, DevOps methodologies, and the need for continuous integration/continuous deployment (CI/CD) pipelines. The rapid growth of digital transformation initiatives has also fueled the need for scalable and cost-effective testing solutions

- The North America region stands out as one of the dominant regions for cloud testing, driven by its strong presence of cloud service providers, technology enterprises, and early adoption of AI-driven automation tools

- For instance, the increasing number of enterprises migrating to cloud platforms in the U.S. has led to a surge in demand for cloud testing solutions. From large enterprises to startups, the region plays a key role in driving innovations in cloud testing technologies

- Globally, cloud testing ranks as one of the most critical components of modern software development cycles, following security testing solutions, and plays a pivotal role in ensuring the reliability and performance of cloud-based applications

Report Scope and Cloud Testing Market Segmentation

|

Attributes |

Cloud Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Cloud Testing Market Trends

“Increased Adoption of AI-Powered Automation and DevOps Integration”

- One prominent trend in the global cloud testing market is the growing adoption of AI-powered automation and seamless DevOps integration

- These advanced technologies enhance the efficiency and accuracy of cloud testing by enabling real-time monitoring, predictive analytics, and automated test execution across cloud environments

- For instance, AI-driven testing tools can identify potential defects early in the development cycle, optimize test coverage, and significantly reduce manual intervention, which is crucial for organizations implementing Agile and DevOps methodologies

- DevOps integration allows for continuous testing, ensuring that applications are validated at every stage of the software development lifecycle, leading to faster deployment and improved software quality

- This trend is revolutionizing the way cloud-based applications are tested, improving operational efficiency, reducing time-to-market, and increasing the demand for intelligent cloud testing solutions in the market

Cloud Testing Market Dynamics

Driver

“Growing Need Due to Increasing Cloud Adoption and Digital Transformation”

- The rapid adoption of cloud computing across industries is significantly contributing to the increased demand for cloud testing solutions

- As organizations migrate their applications and infrastructure to the cloud, the need for robust testing frameworks to ensure scalability, security, and performance has grown substantially

- Cloud-based applications require continuous testing due to their dynamic nature, with frequent updates, multi-cloud environments, and diverse user demands. This trend is particularly prominent in industries such as banking, healthcare, e-commerce, and IT services, where software reliability is critical

- The ongoing advancements in AI-driven automation, performance testing, and security compliance further highlight the necessity for cutting-edge cloud testing tools that can streamline processes and reduce testing time

- As businesses continue to prioritize digital transformation, DevOps, and CI/CD pipelines, the demand for scalable and automated cloud testing solutions is expected to rise, ensuring improved application reliability and seamless user experiences

For instance,

- In December 2022, a study by IDC revealed that global cloud spending is projected to exceed USD 1.3 trillion by 2026, with testing and quality assurance being one of the fastest-growing segments due to the increasing complexity of cloud-based applications

- As a result of the growing cloud adoption, digital transformation initiatives, and the rise of AI-driven testing, there is a significant increase in demand for cloud testing solutions to ensure robust, scalable, and secure applications

Opportunity

“Shift Toward Multi-Cloud and Hybrid Cloud Environments”

- Organizations are increasingly adopting multi-cloud and hybrid cloud strategies to avoid vendor lock-in, improve resilience, and enhance workload flexibility, leading to a rising demand for cloud-agnostic testing tools

- This shift is driving the need for testing platforms that can operate seamlessly across AWS, Microsoft Azure, Google Cloud, and private cloud environments, ensuring performance, compatibility, and security across diverse infrastructures

- Cloud testing providers are now focusing on developing platform-independent frameworks and containerized test environments (e.g., Docker, Kubernetes) to support this evolution

For instance,

- In October 2024, Microsoft introduced Azure Test Hub, an integrated testing service designed to manage hybrid testing scenarios and support interoperability with third-party cloud tools

- In May 2024, BrowserStack launched Percy Enterprise, an AI-powered visual testing solution that enables companies to track UI changes across browsers and devices in real time

- The integration of AI in cloud testing can lead to improved software quality, faster deployment cycles, and enhanced user experience. By leveraging AI-powered automation, organizations can reduce testing costs, enhance security compliance, and ensure seamless software performance in complex cloud ecosystems

Restraint/Challenge

“High Implementation Costs Hindering Market Penetration”

- The high cost of cloud testing implementation poses a significant challenge for the market, particularly affecting the adoption rates among small and medium-sized enterprises (SMEs)

- Cloud testing solutions, which are essential for ensuring the performance, security, and scalability of cloud-based applications, often require substantial investments in infrastructure, automation tools, and skilled workforce

- This financial barrier can deter smaller businesses with limited budgets from adopting advanced cloud testing frameworks, leading to a reliance on manual testing methods or basic tools that may not provide comprehensive test coverage

For instance,

- In November 2024, Oracle stated that one of the major hurdles for expanding the reach of their AI-driven cloud testing solutions was the high upfront investment required. The company acknowledged that expenses related to infrastructure setup, cloud migration, and ongoing support services often discourage smaller clients from fully embracing automated cloud testing platforms. This limitation directly impacts software quality, scalability, and overall customer experience

- Consequently, such limitations can result in disparities in software reliability, security vulnerabilities, and increased downtime, ultimately hindering the overall growth of the cloud testing market

Cloud Testing Market Scope

The market is segmented on the basis of component, service, and vertical.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Service |

|

|

By Vertical |

|

Cloud Testing Market Regional Analysis

“North America is the Dominant Region in the Cloud Testing Market”

- North America is expected to dominate the cloud testing market, driven by its strong technological infrastructure, rapid adoption of cloud computing, and the presence of major cloud service providers and testing solution vendors

- The U.S. holds a significant share due to the widespread implementation of DevOps, increasing demand for AI-driven testing automation, and the continuous evolution of cloud-based enterprise applications

- The availability of well-established regulatory frameworks for data security and compliance, along with substantial investments in cloud-based R&D by leading tech companies, further strengthens the market

- In addition, the growing adoption of cloud-native applications, increasing reliance on SaaS (Software as a Service) platforms, and a high demand for performance and security testing are fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the cloud testing market, driven by rapid digital transformation, increasing cloud adoption, and rising investments in IT infrastructure

- Countries such as China, India, and Japan are emerging as key markets due to the growing number of enterprises shifting to cloud-based applications, the expansion of software development industries, and increasing demand for automated testing solutions

- Japan, with its advanced technology sector and strong presence of AI-driven automation tools, remains a crucial market for cloud testing solutions. The country continues to lead in the adoption of intelligent testing frameworks and DevOps practices to enhance software reliability and performance

- China and India, with their large IT sectors and increasing cloud deployments, are witnessing increased government and private sector investments in cloud security, AI-driven testing, and digital transformation initiatives. The expanding presence of global cloud service providers and growing demand for SaaS applications further contribute to market growth

Cloud Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Micro Focus (U.K.)

- SmartBear Software (U.S.)

- Tricentis (Austria)

- Akamai Technologies (U.S.)

- Microsoft (U.S.)

- CYGNET INFOTECH (India)

- Cavisson Systems Inc. (U.S.)

- Cigniti Technologies (India)

- Cognizant (U.S.)

- Capgemini (France)

- Neotys (France)

- Invensis Technologies Pvt Ltd (India)

- Codoid (India)

- Qualitest Group (U.S.)

- CresTech Software Systems (India)

- CG-VAK Software & Exports Ltd. (India)

- VOLANSYS Technologies (U.S.)

- Etelligens Technologies (India)

- IBM Corporation (U.S.)

- Oracle (U.S.)

Latest Developments in Global Cloud Testing Market

- In April 2024, Google introduced Axion, a custom-designed Arm-based server chip aimed at making cloud computing more cost-effective. This strategic move aligns Google with competitors like Amazon and Microsoft, who have already adopted similar approaches. Set to launch later in 2024, Axion will be used to power YouTube ad workloads. The announcement has sparked excitement, with Snap showing early interest in the cutting-edge technology

- In January 2024, American Tower and IBM joined forces to empower businesses with cutting-edge cloud solutions. This collaboration aims to revolutionize innovation and enhance customer experiences. American Tower will integrate IBM's hybrid cloud technology and Red Hat OpenShift into its existing Access Edge Data Center network. This combined offering will provide enterprises with powerful tools to leverage IoT, 5G, AI, and network automation. By working together, American Tower and IBM will enable businesses to meet the ever-evolving demands of their customers in the era of digital transformation

- In January 2024, Eviden and Microsoft signed a five-year strategic partnership. This collaboration builds on their existing relationship by delivering innovative Microsoft Cloud and AI solutions to diverse industries. The initiative aligns with Eviden's broader alliance strategy of strengthening existing partnerships and establishing new ones to enhance its global network

- In March 2021, Tricentis acquired Neotys, a leading provider of performance testing solutions for modern enterprise applications. This strategic acquisition aims to strengthen Tricentis' end-to-end continuous testing platform by integrating Neotys’ expertise in performance and load testing. By combining forces, the two companies intend to accelerate digital transformation for enterprises, enabling faster, more reliable software delivery through comprehensive and automated testing capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CLOUD TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CLOUD TESTING MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CLOUD TESTING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 CLOUD BASED SOFTWARE TESTING VS. TRADITIONAL SOFTWARE TESTING

6. GLOBAL CLOUD TESTING MARKET, BY OFFERING

6.1 OVERVIEW

6.2 TESTING TOOLS/PLATFORMS

6.2.1 PERFORMANCE/LOAD TESTING TOOLS

6.2.2 FUNCTIONAL TESTING TOOLS

6.2.2.1. ACCEPTANCE TESTING

6.2.2.2. INTEROPERABILITY TESTING

6.2.2.3. SYSTEM VERIFICATION TESTING

6.2.3 SERVICE VIRTUALIZATION TOOLS

6.2.4 API TESTING TOOLS

6.2.5 CROSS BROWSER TESTING TOOLS

6.2.6 GRAPHICAL USER INTERFACE (GUI) TESTING TOOLS

6.2.7 SECURITY TESTING

6.2.8 OTHERS

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

7. GLOBAL CLOUD TESTING MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 PUBLIC

7.3 PRIVATE

7.4 HYBRID

7.5 COMMUNITY

8. GLOBAL CLOUD TESTING MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISE

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

9. GLOBAL CLOUD TESTING MARKET, BY PRICING MODEL

9.1 OVERVIEW

9.2 FREE

9.3 SUBSCRIPTION BASED

9.3.1 MONTHLY

9.3.2 ANNUAL

10. GLOBAL CLOUD TESTING MARKET, BY CLOUD SERVICE MODEL

10.1 OVERVIEW

10.2 INFRASTRUCTURE AS A SERVICE (LAAS)

10.3 PLATFORM AS A SERVICE (PAAS)

10.4 SOFTWARE AS A SERVICE (SAAS)

11. GLOBAL CLOUD TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 BY OFFERING

11.2.1.1. SOLUTION

11.2.1.2. SERVICES

11.3 GOVERNMENT

11.3.1 BY OFFERING

11.3.1.1. SOLUTION

11.3.1.2. SERVICES

11.4 IT AND TELECOMMUNICATION

11.4.1 BY OFFERING

11.4.1.1. SOLUTION

11.4.1.2. SERVICES

11.5 HEALTHCARE

11.5.1 BY OFFERING

11.5.1.1. SOLUTION

11.5.1.2. SERVICES

11.6 MANUFACTURING

11.6.1 BY OFFERING

11.6.1.1. SOLUTION

11.6.1.2. SERVICES

11.7 TRANSPORTATION

11.7.1 BY OFFERING

11.7.1.1. SOLUTION

11.7.1.2. SERVICES

11.8 RETAIL AND E-COMMERCE

11.8.1 BY OFFERING

11.8.1.1. SOLUTION

11.8.1.2. SERVICES

11.8.1.3. SUPPORT SERVICES

11.9 MEDIA AND ENTERTAINMENT

11.9.1 BY OFFERING

11.9.1.1. SOLUTION

11.9.1.2. SERVICES

11.10 OTHERS

12. GLOBAL CLOUD TESTING MARKET, BY REGION

12.1 GLOBAL CLOUD TESTING MARKET SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 NORTH AMERICA

12.1.1.1. U.S.

12.1.1.2. CANADA

12.1.1.3. MEXICO

12.1.2 EUROPE

12.1.2.1. GERMANY

12.1.2.2. U.K.

12.1.2.3. FRANCE

12.1.2.4. ITALY

12.1.2.5. SPAIN

12.1.2.6. THE NETHERLANDS

12.1.2.7. SWITZERLAND

12.1.2.8. TURKEY

12.1.2.9. BELGIUM

12.1.2.10. RUSSIA

12.1.2.11. REST OF EUROPE

12.1.3 ASIA-PACIFIC

12.1.3.1. CHINA

12.1.3.2. JAPAN

12.1.3.3. SOUTH KOREA

12.1.3.4. INDIA

12.1.3.5. SINGAPORE

12.1.3.6. AUSTRALIA

12.1.3.7. MALAYSIA

12.1.3.8. PHILIPPINES

12.1.3.9. THAILAND

12.1.3.10. INDONESIA

12.1.3.11. REST OF ASIA-PACIFIC

12.1.4 SOUTH AMERICA

12.1.4.1. BRAZIL

12.1.4.2. ARGENTINA

12.1.4.3. REST OF SOUTH AMERICA

12.1.5 MIDDLE EAST AND AFRICA

12.1.5.1. SOUTH AFRICA

12.1.5.2. EGYPT

12.1.5.3. SAUDI ARABIA

12.1.5.4. U.A.E

12.1.5.5. ISRAEL

12.1.5.6. REST OF MIDDLE EAST AND AFRICA

12.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13. GLOBAL CLOUD TESTING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14. GLOBAL CLOUD TESTING MARKET, SWOT AND DBMR ANALYSIS

15. GLOBAL CLOUD TESTING MARKET, COMPANY PROFILE

15.1 ORACLE CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 CA TECHNOLOGIES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 IBM

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 MICROFOCUS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 CAPGEMINI

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 TRICENTIS

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 COGNIZANT

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 NEOTYS

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 SMARTBEAR SOFTWARE

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.10 CYGNET INFOTECH

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 CUSTOMERCENTRIX

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 CIGNITI

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 SOASTA

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 CAVISSON SYSTEMS

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 XAMARIN

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 AKAMAI TECHNOLOGIES INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 MICROSOFT

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 WIPRO LIMITED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 BLAZEMETER LLC

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.20 INVENSIS TECHNOLOGIES PVT LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16. CONCLUSION

17. QUESTIONNAIRE

18. RELATED REPORTS

19. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.