Global Catalog Management System Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

2.46 Billion

2024

2032

USD

1.44 Billion

USD

2.46 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 2.46 Billion | |

|

|

|

|

Catalog Management System Market Size

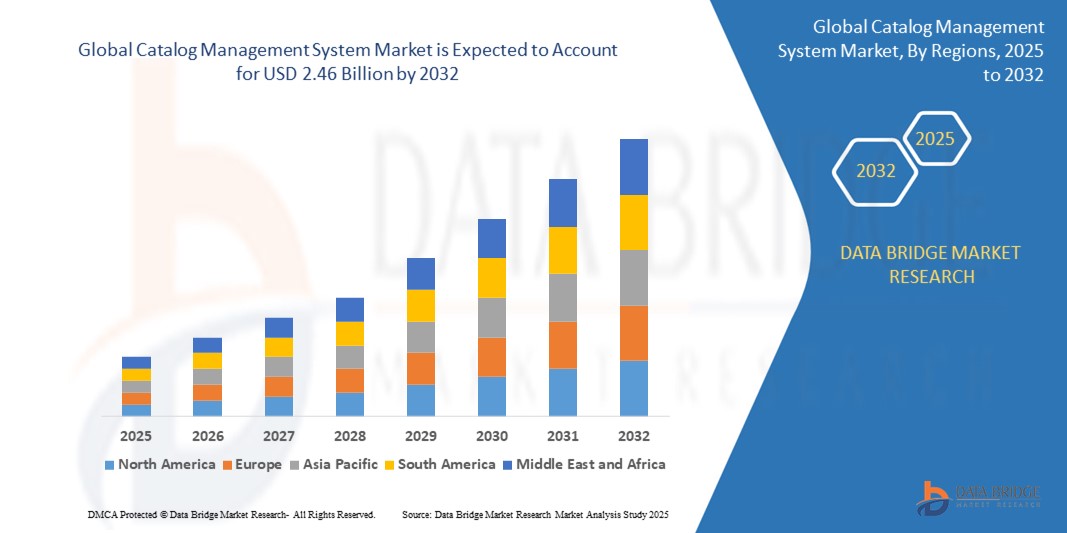

- The global catalog management system market size was valued at USD 1.44 billion in 2024 and is expected to reach USD 2.46 billion by 2032, at a CAGR of 6.90% during the forecast period

- The market growth is largely fuelled by the increasing demand for centralized product data management across e-commerce platforms, retail chains, and telecom providers

- Businesses are adopting catalog management systems to enhance customer experience, ensure data consistency across multiple channels, and streamline operations through automation

Catalog Management System Market Analysis

- The catalog management system market is experiencing robust growth driven by the increasing need for centralized and accurate product data management across multiple sales and distribution channels. As organizations expand their digital footprints, they require seamless and synchronized catalog systems to manage vast volumes of product information

- The rise of e-commerce and omnichannel retailing is encouraging businesses to adopt catalog management platforms that can ensure consistency in product details across websites, apps, and physical stores, enhancing the customer experience and reducing return rates

- North America dominated the catalog management system market with the largest revenue share of 48.3% in 2024, driven by high digital maturity, strong presence of retail and telecom giants, and widespread adoption of cloud-based business solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global catalog management system market, driven by expanding retail ecosystems, increasing mobile commerce, and government initiatives supporting digitalization and cloud technology adoption across emerging economies

- The product catalogs segment held the largest market revenue share in 2024, driven by rising demand for efficient management of dynamic product information across retail, e-commerce, and manufacturing sectors. Businesses increasingly rely on product catalogs to ensure accuracy, improve customer experience, and streamline sales processes. Their ability to centralize vast product data, including pricing, inventory, and specifications, makes them essential in digital commerce ecosystems

Report Scope and Catalog Management System Market Segmentation

|

Attributes |

Catalog Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration of Artificial Intelligence and Machine Learning in Catalog Systems • Rising Demand for Omnichannel Retail and Digital Product Information Management |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Catalog Management System Market Trends

“Shift Toward Cloud-Based Catalog Management Solutions”

- The market is witnessing a strong shift toward cloud-based catalog platforms as businesses seek flexible, scalable solutions that allow centralized control of product data across all sales channels. These cloud systems eliminate the need for heavy on-premise infrastructure while enabling faster time-to-market. Companies benefit from streamlined updates, enhanced collaboration, and real-time access from any location

- Cloud-based catalog systems allow seamless integration with CRM, ERP, and digital commerce platforms, which supports synchronized workflows and improves operational efficiency. As catalog data becomes increasingly dynamic, real-time visibility across applications is critical. Cloud-native integration also reduces the friction associated with cross-departmental data management

- Small and medium-sized businesses are particularly embracing cloud deployment due to its cost-effectiveness and minimal IT overhead. These businesses can scale quickly without incurring large upfront infrastructure costs, enabling them to stay competitive with larger enterprises. The flexibility of SaaS-based models also offers predictable pricing structures

- Security enhancements and regular automated updates offered by leading cloud service providers have addressed earlier concerns about data protection, making cloud adoption more favorable. The ability to comply with evolving data standards without manual intervention is another major benefit. Built-in compliance modules also simplify governance

- For instance, Pimcore Cloud and Salesforce Commerce Cloud provide scalable, cloud-hosted catalog solutions that empower retailers to manage complex product data structures, automate updates, and ensure data consistency across all digital platforms with ease and reliability. These platforms are being widely adopted by modern retail and telecom brands

- The rise of cloud-based catalog management systems reflects a broader transformation in digital infrastructure preferences across industries. Businesses are prioritizing speed, flexibility, and data accuracy in an increasingly omnichannel environment. This trend is expected to accelerate further as cloud technology matures and integration capabilities continue to expand.

Catalog Management System Market Dynamics

Driver

“Rising Adoption of Omnichannel Commerce And Digital Cataloging Needs”

- As businesses expand across digital and physical touchpoints, the demand for centralized catalog management tools that ensure consistent product information across platforms is growing rapidly. Inaccurate or inconsistent data across channels can damage customer trust and reduce sales conversions. Catalog systems solve this by serving as a unified product data source

- Omnichannel retailing requires real-time updates across websites, mobile apps, physical stores, and third-party marketplaces, which only advanced catalog systems can support effectively. This seamless coordination helps improve the customer journey and brand perception. Catalog systems help eliminate duplication of effort and data silos

- Digital cataloging has become critical in e-commerce, where customers expect detailed descriptions, accurate specifications, and rich media. Catalog platforms help manage product variations, inventory levels, and language localization in a structured, automated manner. These platforms enable faster onboarding of products and reduce manual errors

- Retailers, telecom operators, and distributors are leveraging catalog tools to manage bundled offerings, promotional pricing, and region-specific product versions. The ability to instantly push changes across all channels gives businesses the agility needed in competitive markets. Configurable workflows and automation features also enhance efficiency

- For instance, global e-commerce leaders such as Amazon and Walmart depend on intelligent catalog management systems to synchronize millions of listings across countries, devices, and third-party platforms—ensuring consistency, accuracy, and trust in the buyer experience

- The growing complexity of product information across sales environments has made catalog management systems indispensable for operational excellence. These systems not only enable faster product rollouts and error reduction but also enhance customer satisfaction. The trend underscores a major digital transformation in how businesses handle product content

Restraint/Challenge

“Integration Challenges With Legacy Systems”

- Many enterprises, especially those with long-established IT frameworks, struggle to integrate modern catalog systems with legacy infrastructure due to incompatible architecture and outdated data formats. These systems often lack the APIs and flexibility needed to connect with cloud-native platforms, causing implementation delays

- Legacy systems require custom integration layers and middleware, which adds complexity and cost to the deployment of catalog management platforms. These integrations are often resource-intensive, requiring specialized technical expertise and long development cycles. For smaller companies, the cost burden becomes a significant deterrent

- Data inconsistencies and migration risks during integration can lead to downtime, product listing errors, and loss of critical information. Businesses must often cleanse and standardize their data before integration, which is time-consuming and prone to human error. This makes the transition challenging for large-scale organizations

- The lack of skilled personnel to manage hybrid environments—combining legacy and modern systems—further slows the adoption of catalog solutions. Without a dedicated IT strategy, businesses face ongoing maintenance issues, reduced performance, and poor return on investment. Long-term digital transformation efforts are frequently hindered

- For instance, traditional telecom firms using legacy OSS/BSS systems often face months-long delays integrating with new digital product catalogs, limiting their ability to launch customizable plans or bundled service packages efficiently, and causing missed revenue opportunities in fast-moving markets

- The complexity of integrating catalog systems with legacy IT environments remains a key restraint on market growth. Overcoming this challenge requires strategic investment in middleware, skilled personnel, and phased modernization. Companies that delay transformation risk losing agility and competitive edge

Catalog Management System Market Scope

The market is segmented on the basis of type, component, organization size, deployment type, and industry vertical.

- By Type

On the basis of type, the catalog management system market is segmented into service catalogs and product catalogs. The product catalogs segment held the largest market revenue share in 2024, driven by rising demand for efficient management of dynamic product information across retail, e-commerce, and manufacturing sectors. Businesses increasingly rely on product catalogs to ensure accuracy, improve customer experience, and streamline sales processes. Their ability to centralize vast product data, including pricing, inventory, and specifications, makes them essential in digital commerce ecosystems.

The service catalogs segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing adoption in the telecom and IT industries. These catalogs help standardize service offerings, automate provisioning, and improve service delivery workflows. With growing demand for bundled services, digital subscriptions, and personalized plans, service catalogs are gaining traction for enhancing operational agility and customer satisfaction.

- By Component

On the basis of component, the market is segmented into solution and services. The solution segment dominated the market in 2024 due to rising implementation of catalog platforms for managing and automating complex product data workflows. Businesses are adopting robust catalog software to centralize data and enable multi-channel publishing, which significantly improves operational efficiency.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing need for consulting, customization, and system integration support. Organizations increasingly rely on managed and professional services to optimize catalog deployments, ensure smooth integration with legacy systems, and enhance long-term performance.

- By Organization Size

On the basis of organization size, the catalog management system market is segmented into large enterprises and small & medium enterprises (SMEs). The large enterprises segment held the largest revenue share in 2024, owing to their complex operations, diverse product portfolios, and the need for real-time synchronization across global markets. These organizations prioritize catalog platforms that support automation, scalability, and integration with enterprise resource planning (ERP) and customer relationship management (CRM) tools.

The SMEs segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the shift toward digital transformation and cloud adoption. As smaller businesses strive to compete with larger players, they are adopting cost-effective catalog solutions to streamline product management, improve accuracy, and enhance customer engagement across e-commerce and retail platforms.

- By Deployment Type

On the basis of deployment type, the market is segmented into cloud and on-premises. The cloud segment accounted for the largest market share in 2024, attributed to its flexibility, lower upfront costs, and ease of remote access. Cloud-based catalog systems support real-time updates and scalable infrastructure, making them ideal for businesses with distributed teams and dynamic product offerings.

The on-premises segment is expected to witness the fastest growth rate from 2025 to 2032, remains relevant among enterprises with strict data control requirements and legacy infrastructure. Certain sectors, such as banking and government, continue to prefer on-premises deployment for its customizable architecture and enhanced security compliance.

- By Industry Vertical

On the basis of industry vertical, the catalog management system market is segmented into IT and telecom, retail and e-commerce, banking, financial services and insurance (BFSI), media and entertainment, travel and hospitality, and other industry verticals. The retail and e-commerce segment dominated the market in 2024, supported by rising demand for accurate, real-time product data across multiple sales channels. Catalog systems in this vertical help reduce product return rates, enhance user experience, and enable rapid scaling of listings.

The IT and telecom segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of service catalogs for managing bundled offerings and digital services. As telecom companies shift toward automated provisioning and personalized service delivery, catalog platforms are becoming essential for agility, compliance, and efficient service orchestration.

Catalog Management System Market Regional Analysis

• North America dominated the catalog management system market with the largest revenue share of 48.3% in 2024, driven by high digital maturity, strong presence of retail and telecom giants, and widespread adoption of cloud-based business solutions

• Enterprises in the region prioritize real-time product data management and customer personalization across e-commerce platforms, leading to increased investment in centralized catalog management systems

• The region’s leadership is further supported by the presence of key technology providers, high internet penetration, and the shift toward omnichannel commerce, enabling companies to deliver consistent product experiences across all customer touchpoints

U.S. Catalog Management System Market Insight

The U.S. catalog management system market captured the highest revenue share within North America in 2024, fueled by the rising need for product data synchronization across large, diversified sales networks. Enterprises are leveraging advanced catalog platforms to improve agility, reduce listing errors, and streamline operations in both retail and telecom domains. In addition, the U.S. market benefits from strong cloud adoption and rapid deployment of AI-powered catalog systems that support dynamic product content and rule-based automation for real-time updates and personalization.

Europe Catalog Management System Market Insight

The Europe catalog management system market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing digitalization in retail, telecom, and financial sectors. With stringent data governance regulations and a push toward e-commerce expansion, companies in Europe are adopting catalog platforms to maintain accurate product information and regulatory compliance. The growing demand for localized content, multilingual support, and efficient supplier catalog integration is also contributing to market expansion across major economies such as Germany, France, and the United Kingdom.

U.K. Catalog Management System Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising investments in e-commerce platforms and digital product experiences. Retailers and service providers in the country are turning to catalog management tools to ensure accuracy, streamline product onboarding, and improve omnichannel performance. The shift in consumer behavior toward online shopping and personalized experiences is pushing businesses to adopt catalog systems that can adapt to fast-changing product demands.

Germany Catalog Management System Market Insight

The Germany market is expected to witness the fastest growth rate from 2025 to 2032, driven by a well-developed industrial base and rising adoption of integrated catalog tools in manufacturing and telecom. German enterprises place a strong emphasis on operational efficiency and product data accuracy, which catalog management systems help deliver. With increasing digital initiatives in enterprise IT and a focus on eco-efficient technologies, demand for scalable, automated, and secure catalog platforms is set to rise further.

Asia-Pacific Catalog Management System Market Insight

The Asia-Pacific catalog management system market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid digital transformation, growing e-commerce activity, and increasing investments in cloud infrastructure across China, India, and Southeast Asia. Businesses in the region are deploying catalog platforms to support omnichannel strategies, streamline supplier data, and manage high-volume product listings in real time. Government-led initiatives promoting digital commerce and data standardization are further accelerating market growth.

China Catalog Management System Market Insight

China accounted for the largest revenue share in the Asia-Pacific catalog management system market in 2024, driven by a booming e-commerce industry and rapid B2B digitalization. Enterprises are leveraging catalog systems to manage cross-border listings, streamline product data for marketplaces such as Alibaba and JD.com, and support mobile-first consumer experiences. Domestic demand is also strengthened by government-backed digital infrastructure projects and a vibrant ecosystem of software solution providers.

Japan Catalog Management System Market Insight

The Japan catalog management system market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s advanced IT infrastructure and increasing demand for efficient digital content management in retail and telecom sectors. Japanese enterprises are focusing on automation and data accuracy to enhance customer experience and reduce operational inefficiencies. The widespread use of e-commerce platforms and the country's emphasis on precision and compliance are encouraging businesses to adopt catalog systems that ensure consistency, localization, and real-time updates. In addition, the integration of catalog management with artificial intelligence and analytics is gaining momentum, helping companies in Japan optimize product offerings and streamline supply chain operations.

Catalog Management System Market Share

The Catalog Management System industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- Coupa Software Inc. (U.S.)

- ServiceNow Inc. (U.S.)

- Proactis Holdings Plc (U.K.)

- Fujitsu Limited (Japan)

- Broadcom Corporation (U.S.)

- Comarch SA (Poland)

- Zycus Inc. (U.S.)

- GEP Worldwide (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Salsify Inc. (U.S.)

- Insite Software Solutions, Inc. (U.S.)

- Amdocs (Israel)

- Vroozi, Inc. (U.S.)

- Sellercloud Inc. (U.S.)

Latest Developments in Global Catalog Management System Market

- In February 2024, IBM launched the open-source Mistral AI model on its Watsonx platform, marking a significant development in enterprise AI offerings. This launch includes an optimized version of Mixtral-8x7B, which reduces latency by up to 75%, improving performance and scalability. The model expands IBM’s portfolio of AI options, offering enterprises greater flexibility and control through open-source and third-party models. Available via the Watsonx AI and data platform, it supports enterprise-grade AI studio, data governance, and storage features. This move strengthens IBM’s position in the enterprise AI space, enhancing its catalog capabilities and appeal to data-driven businesses

- In December 2023, Salsify entered into a strategic partnership with Mamenta to enhance global marketplace capabilities for brands. This collaboration merges Salsify’s Product Experience Management (PXM) platform with Mamenta’s advanced catalog management tools, streamlining global product data synchronization. The integration enables brands to efficiently manage, optimize, and scale their product catalogs across international marketplaces. The partnership is expected to improve product visibility, speed-to-market, and operational efficiency, reinforcing both companies’ positions in the catalog management system landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.