Global Cardiac Marker Testing Market, By Type (Troponin I and T, Creatine kinase-MB (CK-MB), Brain Natriuretic peptide (Bnp or Nt-Probnp), Myoglobin, HIGH-sensitivity C-reactive protein (hs-CRP), and Other Biomarkers), Product (Instruments, Chemiluminescence, Immunofluorescence, ELISA, Immunochromatography, Reagents and Kits), Disease (Myocardial Infarction, Congestive Heart Failure, Acute Coronary Syndrome, Atherosclerosis, and Ischemia), Type of Testing (Laboratory Testing, Academic Institutions, and Point-Of-Care Testing) – Industry Trends and Forecast to 2031.

Cardiac Marker Testing Market Analysis and Size

Risk stratification in the context of cardiac marker testing refers to the use of biomarkers such as troponin, CK-MB, and B-type natriuretic peptide (BNP) to assess the likelihood of future cardiovascular events in patients. Elevated levels of these markers indicate myocardial damage, heart stress, or dysfunction, helping healthcare providers categorize patients into different risk groups. This stratification guides treatment decisions, determines the intensity of monitoring, and predicts prognosis, enabling personalized management plans tailored to the patient's cardiovascular risk profile. Thus, cardiac marker testing plays a critical role in optimizing patient outcomes by identifying those at higher risk who may benefit from more aggressive interventions or closer monitoring.

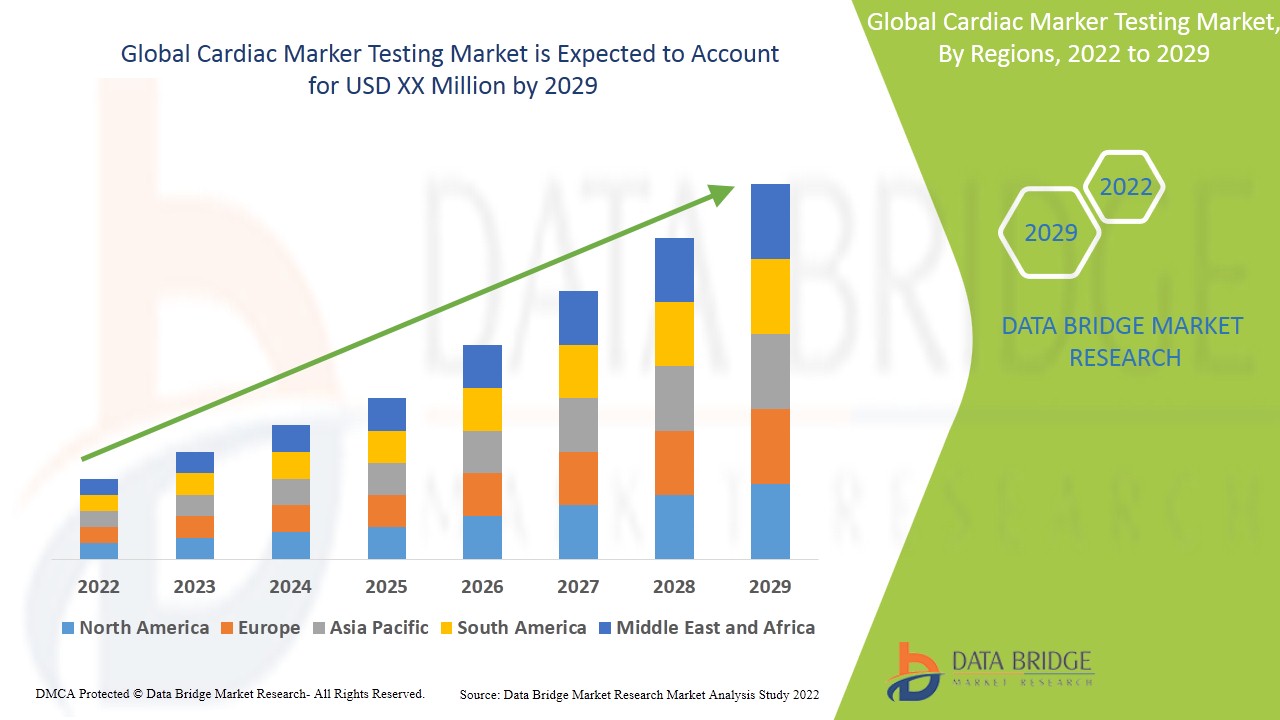

The global cardiac marker testing market size was valued at USD 12.68 Billion in 2023 and is projected to reach USD 25.46 Billion by 2031, with a CAGR of 9.10% during the forecast period of 2024 to 2031.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Troponin I and T, Creatine kinase-MB (CK-MB), Brain Natriuretic peptide (Bnp or Nt-Probnp), Myoglobin, HIGH-sensitivity C-reactive protein (hs-CRP), and Other Biomarkers), Product (Instruments, Chemiluminescence, Immunofluorescence, ELISA, Immunochromatography, Reagents and Kits), Disease (Myocardial Infarction, Congestive Heart Failure, Acute Coronary Syndrome, Atherosclerosis, and Ischemia), Type of Testing (Laboratory Testing, Academic Institutions, and Point-Of-Care Testing)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Rest of the Middle East and Africa

|

|

Market Players Covered

|

F. Hoffmann-La Roche Ltd (Switzerland), Abbott (U.S.), Siemens (Germany), Danaher (U.S.), bioMérieux, Inc. (France), Ortho Clinical Diagnostics (U.S.), Randox Laboratories Ltd (U.K.), BG Medicine (U.S.), HUMAN Co (Germany), Bhat Bio-tech India Private Limited (India),Merck KGaA (Germany), PerkinElmer Inc. (U.S.), QIAGEN (Netherlands), Agilent Technologies, Inc. (U.S.), Bruker (U.S.), Epigenomics AG (Germany), MESO SCALE, DIAGNOSTICS, LLC (U.S.), EKF Diagnostics Holdings plc. (U.K.), Nexus-Dx (U.S.), LifeSign LLC. (U.S.), DIALAB GmbH (Austria), Beckman Coulter, Inc. (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Cardiac marker testing involves measuring specific substances released into the bloodstream when the heart is damaged or under stress. These markers include enzymes such as creatine kinase (CK-MB) and troponins (troponin T and troponin I), as well as proteins such as myoglobin. Elevated levels of these markers help diagnose conditions such as myocardial infarction (heart attack) or other cardiac injuries. Cardiac marker testing is crucial for early detection, monitoring treatment effectiveness, and assessing the extent of cardiac damage in clinical settings.

Cardiac Marker Testing Market Dynamics

Drivers

- Rise in Geriatric Population

The rising age of the global population leads to a higher prevalence of age-related cardiovascular diseases, such as heart failure, myocardial infarction, and other cardiac conditions. Older adults are more prone to these conditions, necessitating regular monitoring and early detection through cardiac marker tests. This demographic shift increases the demand for diagnostic tools to manage and treat cardiovascular diseases effectively, thereby driving the growth of the cardiac marker testing market. Enhanced healthcare infrastructure and the emphasis on improving the quality of life for the elderly further boost the need for advanced cardiac diagnostic solutions.

- Rising Advancements in Diagnostic Technologies

Innovations such as high-sensitivity assays, automated analyzers, and point-of-care testing devices have greatly enhanced the accuracy, speed, and convenience of cardiac marker tests. These technological improvements allow for earlier and more precise detection of cardiac events, facilitating timely medical intervention and improving patient outcomes. Additionally, the integration of digital health solutions, such as smartphone-based diagnostics, is expanding access to cardiac marker testing, further propelling market growth. As technology continues to evolve, it is expected to drive continued advancements and adoption in cardiac marker testing worldwide.

Opportunities

- Increasing Strategic Collaborations

Collaborations between healthcare providers, diagnostic companies, and research institutions foster innovation and development of advanced cardiac marker tests. These collaborations enable the sharing of expertise, resources, and technology, leading to the creation of more sensitive and specific diagnostic tools. Joint ventures and alliances also facilitate faster regulatory approvals and market entry, expanding the availability of cutting-edge diagnostic solutions. Additionally, strategic collaborations often result in enhanced distribution networks and better access to emerging markets, ultimately driving the growth and adoption of cardiac marker testing worldwide.

- Expansion of Point-of-Care Testing (POCT)

POCT enables rapid, on-site diagnostic testing for cardiac markers, providing immediate results in various healthcare settings, including emergency departments, clinics, and even at patients' bedsides. This reduces the time to diagnosis and treatment for acute cardiac events, improving patient outcomes. The convenience and accessibility of POCT devices facilitate early detection and continuous monitoring of cardiovascular conditions. Advancements in POCT technology, combined with increasing adoption by healthcare providers, are propelling the growth of the cardiac marker testing market, ensuring timely and efficient cardiac care.

Restraints/Challenges

- High Initial Costs

Advanced diagnostic technologies and the reagents used for cardiac marker tests are often expensive, making these tests less affordable for many healthcare facilities, particularly in low- and middle-income countries. The initial investment in equipment and ongoing operational costs can be prohibitive, limiting widespread adoption. This cost barrier can prevent healthcare providers from implementing routine cardiac marker testing, reducing access to timely and accurate diagnostics for patients with cardiovascular conditions.

- Lack of Skilled Professionals

Interpreting cardiac marker test results accurately requires specialized training and expertise, which many healthcare facilities, particularly in low-resource settings, may lack. This shortage of trained personnel can lead to misdiagnosis or delayed diagnosis, undermining the effectiveness of cardiac marker testing. Moreover, the complexity of some testing technologies necessitates proper handling and analysis to ensure reliable results.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In May 2022, Quidel Corporation launched the "Triage Cardiac Panel," FDA-approved for use in emergency departments to aid in diagnosing myocardial infarction. This panel specifically measures levels of creatine kinase MB, myoglobin, and troponin I, critical markers indicative of heart damage. The introduction of this diagnostic tool enhances rapid decision-making in emergency settings, facilitating quicker intervention and treatment for patients suspected of acute cardiac events

- In January 2022, PocDoc launched a revolutionary smartphone-based cardiovascular test aimed at pharmacies, private healthcare providers, and NHS facilities. This innovation covers a comprehensive five-market lipid panel, promising significant cost savings for the NHS through reduced staffing needs. This advancement aligns with the trend towards personalized diagnostics and decentralized healthcare solutions, potentially transforming how cardiovascular health is managed and monitored

Cardiac Marker Testing Market Scope

The market is segmented on the basis of type, product, disease and type of testing. The growth amongst these segments will help you analyze meagre growth segments in the industries, and provide the users with valuable market overview and market insights to help them in making strategic decisions for identification of core market applications.

Type

- Troponin I and T

- Creatine kinase-MB (CK-MB)

- Brain Natriuretic peptide (Bnp or Nt-Probnp)

- Myoglobin

- HIGH-sensitivity C-reactive protein (hs-CRP)

- Other Biomarkers

Product

- Instruments

- Chemiluminescence

- Immunofluorescence

- ELISA

- Immunochromatography

- Reagents

- Kits

Disease

- Myocardial Infarction

- Congestive Heart Failure

- Acute Coronary Syndrome

- Atherosclerosis

- Ischemia

Type of Testing

- Laboratory Testing

- Hospital Labs

- Refrence Labs

- Contract Labs

- Academic Institutions

- Point-Of-Care Testing

Cardiac Marker Testing Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, type, product, type of testing and disease as referenced above.

The countries covered in the market report are the U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa (MEA), Brazil, Argentina and Rest of South America.

North America dominates the market due to the region invests heavily in research and development, fostering innovation and technological advancement in diagnostic technologies. Major global players such asAbbott, Danaher, and others are headquartered in North America, ensuring a strong presence and extensive product availability. The region benefits from a well-established healthcare infrastructure, supporting widespread adoption of advanced diagnostic solutions.

Asia-Pacific is expected for rapid and lucrative growth in the market due to rising incidences of cardiovascular diseases. Public-private initiatives aimed at enhancing awareness among both patients and physicians about the importance of early diagnosis are driving this growth. Increasing healthcare expenditure and advancements in diagnostic technologies are further contributing to the region's expanding market for diagnostic solutions, making it a key area of focus for companies seeking growth opportunities in healthcare and diagnostics.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the market. The data is available for historic period 2016-2021.

Competitive Landscape and Cardiac Marker Testing Market Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to epigenetics diagnostic market.

Some of the major players operating in the market are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Siemens (Germany)

- Danaher (U.S.)

- bioMérieux, Inc. (France)

- Ortho Clinical Diagnostics (U.S.)

- Randox Laboratories Ltd (U.K.)

- BG Medicine (U.S.)

- HUMAN Co (Germany)

- Bhat Bio-tech India Private Limited (India)

- Merck KGaA (Germany)

- PerkinElmer Inc. (U.S.)

- QIAGEN (Netherlands)

- Agilent Technologies, Inc. (U.S.)

- Bruker (U.S.)

- Epigenomics AG (Germany)

- MESO SCALE DIAGNOSTICS, LLC (U.S.)

- EKF Diagnostics Holdings plc. (U.K.)

- Nexus-Dx (U.S.)

- LifeSign LLC. (U.S.)

- DIALAB GmbH (Austria)

- Beckman Coulter, Inc. (U.S.)

SKU-