Global Candy Market

Market Size in USD Billion

CAGR :

%

USD

252.51 Billion

USD

343.99 Billion

2024

2032

USD

252.51 Billion

USD

343.99 Billion

2024

2032

| 2025 –2032 | |

| USD 252.51 Billion | |

| USD 343.99 Billion | |

|

|

|

|

Candy Market Size

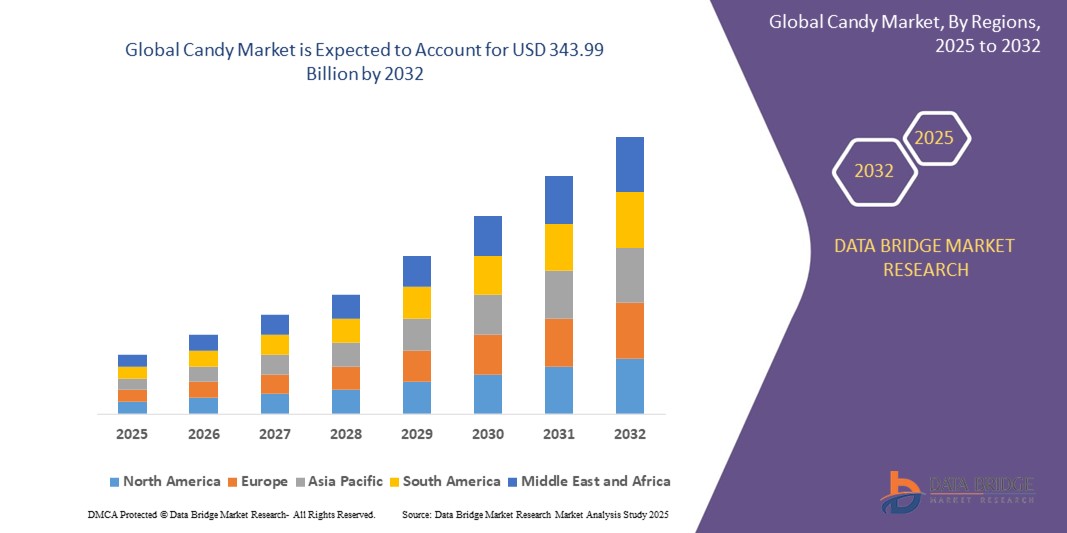

- The global candy market size was valued at USD 252.51 billion in 2024 and is expected to reach USD 343.99 billion by 2032, at a CAGR of 3.94% during the forecast period

- The market growth is primarily driven by increasing consumer demand for innovative flavors, premium and artisanal products, and growing indulgence trends across emerging economies.

- Moreover, rising disposable incomes, urbanization, and expanding distribution channels such as e-commerce and convenience stores are significantly enhancing market accessibility and sales volume

- These converging factors are accelerating the demand for diverse and high-quality candy products, thereby significantly boosting the industry's growth globally

Candy Market Analysis

- The global candy market is experiencing rising consumer preference for premium and artisanal products, driven by growing demand for indulgence and unique flavor experiences in both developed and emerging markets

- Increasing health awareness among consumers is pushing manufacturers to innovate with reduced sugar, natural ingredients, and functional candies fortified with vitamins and minerals, fueling product diversification and market expansion

- North America holds the largest revenue share of approximately 38.5% in 2025, supported by high disposable incomes, strong brand presence, extensive retail networks, and increasing consumer inclination towards premium and organic confectionery products in the U.S. and Canada

- The Asia-Pacific region is expected to witness the fastest growth during the forecast period, owing to rapid urbanization, rising middle-class incomes, and a growing youth population with increasing access to global candy brands in countries such as China, India, and Japan

- The Hard-Boiled Sweets segment is projected to dominate the market with a share of 41.7% in 2025, driven by their long shelf life, wide flavor variety, and growing popularity as on-the-go confectionery products among consumers globally

Report Scope and Candy Market Segmentation

|

Attributes |

Candy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Candy Market Trends

“Rising Demand for Health-Conscious and Functional Candy Products”

- A prominent and accelerating trend in the global candy market is the growing consumer preference for health-conscious and functional confectionery products. Increasing awareness of sugar-related health issues and demand for clean-label, natural, and fortified candies is shaping product innovation worldwide

- For instance, brands are launching sugar-free, low-calorie, and naturally sweetened candies using ingredients such as Estevia, monk fruit, and erythritol to cater to diabetic and weight-conscious consumers. Functional candies fortified with vitamins, minerals, probiotics, and plant-based proteins are gaining traction for their added health benefits

- The integration of natural ingredients such as turmeric, collagen, and adaptogens into candy formulations reflects the growing trend toward wellness-oriented snacking, appealing to consumers seeking indulgence without guilt. In addition, products highlighting allergen-free, gluten-free, and vegan certifications are increasingly popular

- The rise of e-commerce platforms and direct-to-consumer sales channels facilitates access to niche and premium health-focused candy brands, expanding consumer choice and driving market growth. Influencer marketing and social media campaigns focused on wellness further accelerate adoption of these products

- This trend is reshaping consumer expectations and compelling major candy manufacturers to invest heavily in research and development for innovative, better-for-you confectionery options. Companies such as Mars, Nestlé, and Hershey’s have launched entire product lines emphasizing reduced sugar, organic ingredients, and functional benefits

- The demand for healthier and functional candy products is especially strong in developed markets such as North America and Europe, while emerging markets in Asia-Pacific show growing interest as urbanization and disposable incomes rise

Candy Market Dynamics

Driver

“Rising Consumer Preference for Healthier and Functional Candy Options”

- Increasing health awareness and changing consumer lifestyles are key drivers for the growing demand for healthier and functional candy products globally. Consumers are actively seeking confectionery that aligns with clean-label, reduced sugar, and added-nutrient trends

- For instance, in March 2024, Mars, Inc. launched a new line of sugar-free and protein-fortified candies targeting fitness-conscious consumers, reflecting the industry’s pivot towards wellness-oriented snacking options

- The demand for natural sweeteners, organic ingredients, and fortified candies with vitamins, minerals, and probiotics is expanding product innovation across leading confectionery companies

- In addition, growing trends such as veganism, keto, and allergen-free diets are influencing candy formulations, prompting manufacturers to offer a diverse range of products tailored to specific dietary needs

- The surge in e-commerce and health-focused retail channels further facilitates consumer access to these innovative products, supporting market growth in both developed and emerging regions

- Convenience-driven formats such as bite-sized functional candies and on-the-go packaging also cater to busy consumers seeking indulgence without compromising health, fueling market expansion

Restraint/Challenge

“Health Concerns over Sugar Content and Regulatory Restrictions”

- Despite innovations, the candy market faces significant challenges due to increasing health concerns related to excessive sugar consumption and obesity, which are prompting stricter regulations and taxation in many countries

- For instance, in January 2024, the UK government expanded its sugar tax to cover a broader range of confectionery products, pressuring manufacturers to reformulate recipes or face reduced sales

- Public campaigns highlighting the negative health impacts of sugary snacks are influencing consumer behavior, leading to decreased consumption of traditional candies with high sugar content

- Regulatory complexities, including labeling requirements and restrictions on marketing to children, add to operational challenges for candy producers, especially those reliant on mass-market appeal

- Moreover, the perception of candy as an unhealthy indulgence can deter health-conscious consumers, limiting market growth potential in segments focused on wellness

- To overcome these hurdles, manufacturers must invest in product innovation with reduced sugar, alternative sweeteners, and transparent labeling while educating consumers on moderation and the benefits of new formulations

Candy Market Scope

The market is segmented on the basis of type, age group, price point, and distribution channel.

By Type

On the basis of type, the Candy market is segmented into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. The chocolate segment dominates the largest market revenue share of 38.7% in 2025, driven by its wide consumer appeal, premium positioning, and continuous product innovations such as single-origin and artisanal chocolates. Consumers often prioritize chocolate for gifting and indulgence purposes, fueling steady demand across regions

The gums and jellies segment is anticipated to witness the fastest growth rate of 18.5% from 2025 to 2032, propelled by rising consumer interest in sugar-free and functional chewing gums enriched with vitamins and natural extracts

By Age Group

On the basis of age group, the Candy market is segmented into children, adult, and geriatric. The children segment accounted for the largest market revenue share in 2024, driven by high consumption patterns fueled by colorful, fun packaging and product formats targeting young consumers

The adult segment is expected to witness the fastest CAGR from 2025 to 2032, boosted by increasing demand for premium, low-sugar, and functional candies that cater to health-conscious adults seeking indulgence without guilt

By Price Point

On the basis of price point, the Candy market is segmented into economy, mid-range, and luxury. The mid-range segment held the largest market revenue share in 2025, owing to its balance of affordability and quality that appeals to the mass market

The luxury segment is projected to witness the fastest growth rate from 2025 to 2032, driven by a growing consumer base for premium artisanal, organic, and ethically sourced confectionery products that emphasize exclusivity and superior taste

By Distribution Channel

On the basis of distribution channel, the Candy market is segmented into supermarket/hypermarket, convenience stores, pharmaceutical and drug stores, food services, duty-free outlets, e-commerce, and others. The supermarket/hypermarket segment held the largest market revenue share in 2025, benefiting from high consumer footfall and wide product assortments catering to diverse preferences

The e-commerce segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing penetration of online retail platforms, convenience of doorstep delivery, and the availability of niche and international candy brands catering to global consumers

Candy Market Regional Analysis

- North America dominates the global candy market with the largest revenue share of approximately 38.5% in 2025, driven by high consumer spending on premium and organic confectionery, increasing demand for sugar-free and natural ingredient products, and strong retail and e-commerce networks. The region benefits from health-conscious consumers seeking indulgent yet healthier options

- Consumers in North America are increasingly embracing functional candies fortified with vitamins, minerals, and plant-based ingredients, further propelling market growth. The availability of diverse product formats and flavors supports widespread adoption across urban and suburban markets

U.S. Candy Market Insight

The U.S. candy market captured the largest revenue share of about 80% within North America in 2025, fueled by evolving consumer tastes favoring artisanal, organic, and reduced-sugar options. Rising demand for convenience snacks and growing presence of specialty candy brands across supermarkets and online channels bolster the market. Leading manufacturers are investing in innovation to cater to premium and health-conscious consumers

Europe Candy Market Insight

The European candy market is projected to grow steadily, driven by demand for clean-label, vegan, and ethically sourced products. Countries such as France, the UK, Italy, and the Netherlands are key markets, with consumers favoring traditional confectionery alongside novel healthy formulations. High environmental and quality standards encourage manufacturers to prioritize sustainable sourcing and organic certifications.

U.K. Candy Market Insight

The UK candy market is anticipated to experience robust growth, supported by increasing demand for sugar-reduced and functional candies, as well as rising health and wellness trends. The proliferation of online retail platforms and specialty health stores increases product accessibility. Consumers seek transparency and ethical sourcing, boosting organic and fair-trade candy sales.

Germany Candy Market Insight

Germany’s candy market is characterized by strong consumer preference for premium quality and traditional confectionery, alongside emerging demand for sugar-free and vegan options. The market benefits from high disposable incomes and health-focused product innovations. Manufacturers emphasize sustainable packaging and natural ingredients to meet eco-conscious consumer demands.

Asia-Pacific Candy Market Insight

The Asia-Pacific candy market is expected to register the fastest CAGR over the forecast period, driven by rapid urbanization, rising middle-class incomes, and increasing youth population in countries such as China, India, Japan, and Australia. Growing exposure to global candy brands and expanding modern retail infrastructure fuel market penetration. Innovation in flavors and formats tailored to regional preferences supports rapid growth.

Japan Candy Market Insight

Japan’s candy market is growing steadily due to consumer interest in functional and low-calorie sweets, as well as unique traditional and fusion flavors. High standards for quality and innovation in packaging and product formats attract both domestic and international consumers. Health-conscious trends emphasize natural ingredients and limited sugar content.

China Candy Market Insight

China accounts for the largest market share in the Asia-Pacific region for candy in 2025, driven by increasing disposable incomes, urban lifestyle changes, and rising demand for premium and imported confectionery. Domestic production scales up with investments in quality and innovation. E-commerce platforms play a vital role in expanding market reach, particularly among younger consumers

Candy Market Share

The candy industry is primarily led by well-established companies, including:

- Ferrero (Italy)

- Meiji Holdings Co., Ltd (japan)

- THE HERSHEY COMPANY (U.S.)

- Quality Candy Company (U.S.)

- Nestlé (Switzerland)

- Cloetta (Sweden)

- General Mills Inc. (U.S.)

- Mondelez International (U.S.)

- Mars, Incorporated (U.S.)

- pladis global (U.K.)

- LOTTE CONFECTIONERY CO.LTD (South Korea)

- Storck (German)

- Perfetti Van Melle (Netherland)

- Candy Rush Muskoka (Canada)

- HARIBO GmbH & Co. KG (Germany)

- Arcor, (Argentina)

- Sweet Candy Company (U.S.)

- THE BANG CANDY COMPANY, (U.S.)

- Palmer-candy (U.S.)

- SUGARFINA USA LLC (U.S.)

- Jelly Belly Candy Company (U.S.)

Latest Developments in Global Candy Market

- In April 2024, Konjac Chews debuted as a distinctive confectionery, blending the chewy texture of gummy bears with the soft consistency of jello. These treats offer a refreshing, low-calorie snack, appealing to consumers seeking unique flavor experiences. Crafted with natural konjac, they provide a satisfying bite while supporting healthy digestion. Their vegan and gluten-free formulation makes them a versatile choice in the evolving confectionery market

- In April 2024, Lindt Lindor introduced Non-Dairy OatMilk Truffles, offering a plant-based alternative to its iconic chocolate treats. Available in OatMilk and Dark Chocolate OatMilk, these truffles feature a smooth-melting center encased in rich oat milk chocolate, ensuring a luxurious, dairy-free indulgence. This launch follows Lindt’s successful 2022 debut of Non-Dairy OatMilk Bars, reinforcing its commitment to inclusive chocolate experiences

- In May 2022, Bazooka Candy Brands unveiled Push Pop Gummy Pop-its at the Sweet & Snacks Expo in Chicago. This innovative gummy treat features an interactive, refillable container, enhancing the snacking experience. Available in Strawberry, Blue Raspberry, Berry Blast, and Watermelon, these gummies offer a fun, hands-on way to enjoy candy. The launch reinforces Bazooka’s commitment to edible entertainment and unique confectionery experience

- In May 2022, Bazooka Candy Brands introduced Push Pop Gummy Pop-its at the Sweet & Snacks Expo in Chicago. This innovative gummy treat features an interactive, refillable container, enhancing the snacking experience. Available in Strawberry, Blue Raspberry, Berry Blast, and Watermelon, these gummies offer a fun, hands-on way to enjoy candy. The launch reinforces Bazooka’s commitment to edible entertainment and unique confectionery experiences

- In March 2022, HARIBO introduced a festive lineup of Easter treats, bringing back fan-favorite gummies alongside two new additions: Jelly Bunnies and Chick 'n' Mix. Jelly Bunnies feature soft, bunny-shaped gummies, while Chick 'n' Mix offers a variety of Easter-themed sweets, including TangfastChicks and Fried Eggs. These seasonal delights cater to gummy candy enthusiasts, making Easter celebrations even sweeter

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.