Global Smart Lock Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

21.31 Billion

2024

2032

USD

4.92 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 21.31 Billion | |

|

|

|

|

Smart Lock Market Size

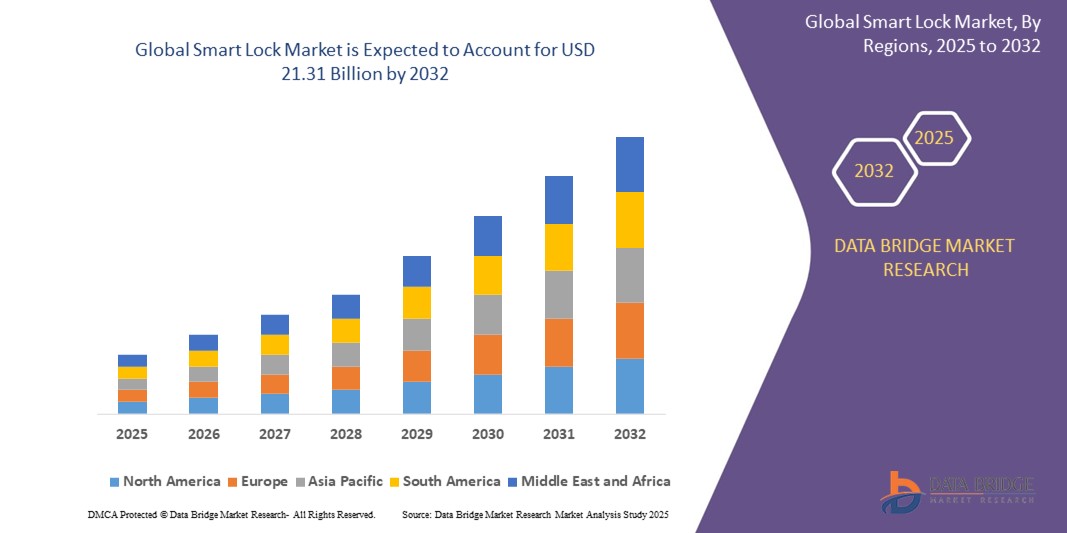

- The global smart lock market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 20.10% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing smart locks as the modern access control system of choice. These converging factors are accelerating the uptake of smart lock solutions, thereby significantly boosting the industry's growth

Smart Lock Market Analysis

- Smart locks, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for smart locks is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- Residential applications, especially in urban areas, constitute a significant portion of the global smart lock market

- North America dominates the smart lock market with the largest revenue share of 40.01% in 2025, characterized by early smart home adoption, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in smart lock installations, particularly in new smart homes and multi-dwelling units, driven by innovations from both established tech companies and startups focusing on AI and voice-activated features.

- Globally recognized as a top innovation within the smart home ecosystem, following smart speakers and surveillance cameras, smart locks are instrumental in creating secure and interconnected living spaces

Report Scope and Smart Lock Market Segmentation

|

Attributes |

Smart Lock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Lock Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A significant and accelerating trend in the global smart lock market is the deepening integration with artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This fusion of technologies is significantly enhancing user convenience and control over their security systems.

- For instance, the August Wi-Fi Smart Lock seamlessly integrates with all three major voice assistants, allowing users to lock or unlock their doors with simple voice commands. Similarly, Level Lock+ can be controlled via Siri and Apple HomeKit, offering a discreet smart lock solution

- AI integration in smart locks enables features such as learning user access patterns to potentially suggest security optimizations and providing more intelligent alerts based on activity. For instance, some Ultraloq models utilize AI to improve fingerprint recognition accuracy over time and can send intelligent alerts if unusual door activity is detected. Furthermore, voice control capabilities offer users the ease of hands-free operation, allowing them to lock or unlock doors remotely using simple verbal commands.

- The seamless integration of smart locks with digital assistants and broader smart home platforms facilitates centralized control over various aspects of the connected home environment. Through a single interface, users can manage their door locks alongside lighting, climate control, and other security devices, creating a unified and automated living experience.

- This trend towards more intelligent, intuitive, and interconnected locking systems is fundamentally reshaping user expectations for home security. Consequently, companies such as WELOCK are developing AI-enabled smart locks with features such as automatic locking/unlocking based on authorized access and voice control compatibility with Google Assistant and Amazon Alexa.

- The demand for smart locks that offer seamless AI and voice control integration is growing rapidly across both residential and commercial sectors, as consumers increasingly prioritize convenience and comprehensive smart home functionality.

Smart Lock Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The increasing prevalence of security concerns among homeowners and businesses, coupled with the accelerating adoption of smart home ecosystems, is a significant driver for the heightened demand for smart locks.

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced an advancement in IoT-based self-storage security, looking forward to integrating state-of-the-art sensors into the Passport locking solution. Such strategies by key companies are expected to drive the smart lock industry growth in the forecast period

- As consumers become more aware of potential security threats and seek enhanced protection for their properties, smart locks offer advanced features such as remote monitoring, activity logs, and tamper alerts, providing a compelling upgrade over traditional mechanical locks.

- Furthermore, the growing popularity of smart home devices and the desire for interconnected living spaces are making smart locks an integral component of these systems, offering seamless integration with other smart devices and platforms.

- The convenience of keyless entry, remote access control for family members or service providers, and the ability to manage access through smartphone applications are key factors propelling the adoption of smart locks in both residential and commercial sectors. The trend towards DIY smart home installations and the increasing availability of user-friendly smart lock options further contribute to market growth.

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Concerns surrounding the cybersecurity vulnerabilities of connected devices, including smart locks, pose a significant challenge to broader market penetration. As smart locks rely on network connectivity and software, they are susceptible to hacking attempts and data breaches, raising anxieties among potential consumers about the security of their homes and data

- For instance, high-profile reports of vulnerabilities in IoT devices have made some consumers hesitant to adopt smart home security solutions, including smart locks

- Addressing these cybersecurity concerns through robust encryption, secure authentication protocols, and regular software updates is crucial for building consumer trust. Companies such as August and Level Home emphasize their advanced encryption methods and security features in their marketing to reassure potential buyers. Additionally, the relatively high initial cost of some advanced smart lock systems compared to traditional locks can be a barrier to adoption for price-sensitive consumers, particularly in developing regions or for budget-conscious homeowners. While basic smart locks from brands such as Wyze have become more affordable, premium features such as integrated cameras or advanced biometric scanning often come with a higher price tag.

- While prices are gradually decreasing, the perceived premium for smart technology can still hinder widespread adoption, especially for those who do not see an immediate need for the advanced features offered

- Overcoming these challenges through enhanced cybersecurity measures, consumer education on security best practices, and the development of more affordable smart lock options will be vital for sustained market growth

Smart Lock Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

- By Type

On the basis of type, the smart lock market is segmented into deadbolt, lever handles, padlock, server locks and latches, knob locks, and others. The deadbolt segment dominates the largest market revenue share of 43.2% in 2025, driven by its established reputation for security and ease of retrofit into existing door setups. Homeowners often prioritize deadbolt smart locks for their perceived robustness and the straightforward replacement of traditional deadbolts. The market also sees strong demand for deadbolt types due to their compatibility with various smart home ecosystems and the availability of diverse features enhancing security and convenience.

The lever handles segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by increasing adoption in commercial and hospitality sectors. Lever handles offer ease of access, making them suitable for individuals with mobility challenges, and their integration with smart technology provides businesses with convenient, controlled access solutions for employees and guests. The aesthetic appeal and design flexibility of smart lever handles also contribute to their growing popularity in modern commercial spaces.

- By Communication Protocol

On the basis of communication protocol, the smart lock market is segmented into Bluetooth, Wi-Fi, Z-Wave, Zigbee, and Others. The Wi-Fi held the largest market revenue share in 2025 of, driven by the widespread availability of home Wi-Fi networks and the ease of direct internet connectivity for smart locks. Wi-Fi-enabled smart locks often offer seamless remote access and integration with cloud-based services and voice assistants, making them a popular choice for residential users.

The Bluetooth segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its low power consumption and direct peer-to-peer connectivity, making it ideal for smartphone-based unlocking and localized access control. Bluetooth-enabled smart locks are particularly popular for their ease of setup and reliable performance within a limited range, often serving as a primary unlocking mechanism.

- By Unlocking Mechanism

On the basis of unlocking mechanism, the smart lock market is segmented into keypad, card key, touch based, key fob, and smartphone based. The smartphone-based unlocking held the largest market revenue share in 2025, driven by the ubiquitous use of smartphones and the convenience of managing access through dedicated mobile applications. Smartphone-based unlocking offers features such as remote access, digital key sharing, and activity logs, making it a highly versatile and user-friendly option.

The keypad segment held a significant market share in 2025, favored for its reliability and the ability to grant access using PIN codes, providing a convenient alternative to physical keys or smartphones. Keypads are particularly popular in rental properties and for providing access to service personnel.

- By Application

On the basis of application, the smart lock market is segmented into commercial, residential, industrial, government institution, and others. The residential segment accounted for the largest market revenue share in 2024, driven by the increasing adoption of smart home ecosystems, rising awareness about home security, and the convenience of remote locking/unlocking. Real estate developments and the boom in short-term rentals also encourage adoption.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for centralized security, employee access control, and audit trails. Businesses benefit from keyless solutions that can be managed remotely, offering flexibility for multiple users and locations.

Smart Lock Market Regional Analysis

- North America dominates the smart lock market with the largest revenue share of 40.01% in 2024, driven by a growing demand for home automation and security, as well as increased awareness of smart home technology

- Consumers in the region highly value the convenience, advanced security features, and seamless integration offered by smart locks with other smart devices such as thermostats and lighting systems.

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the growing preference for remote monitoring and control, establishing smart locks as a favored solution for both residential and commercial properties.

U.S. Smart Lock Market Insight

The U.S. smart lock market captured the largest revenue share of 81% within North America in 2025, fueled by the swift uptake of connected devices and the expanding trend of home automation. Consumers are increasingly prioritizing the enhancement of home security through intelligent, keyless entry systems. The growing preference for DIY smart home setups, combined with robust demand for voice-controlled systems and mobile application integration, further propels the smart lock industry. Moreover, the increasing integration of smart home technologies, such as Alexa, Google Assistant, and Apple HomeKit, is significantly contributing to the market's expansion.

Europe Smart Lock Market Insight

The European smart lock market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent security regulations and the escalating need for enhanced security in homes and offices. The increase in urbanization, coupled with the demand for connected devices, is fostering the adoption of smart locks. European consumers are also drawn to the convenience and energy efficiency these devices offer. The region is experiencing significant growth across residential, commercial, and multi-family housing applications, with smart locks being incorporated into both new constructions and renovation projects.

U.K. Smart Lock Market Insight

The U.K. smart lock market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of home automation and a desire for heightened security and convenience. Additionally, concerns regarding burglary and safety are encouraging both homeowners and businesses to choose keyless entry solutions. The UK’s embrace of connected devices, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth.

Germany Smart Lock Market Insight

The German smart lock market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of digital security and the demand for technologically advanced, eco-conscious solutions. Germany’s well-developed infrastructure, combined with its emphasis on innovation and sustainability, promotes the adoption of smart locks, particularly in residential and commercial buildings. The integration of smart locks with home automation systems is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local consumer expectations.

Asia-Pacific Smart Lock Market Insight

The Asia-Pacific smart lock market is poised to grow at the fastest CAGR of over 24.5% in 2025, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards smart homes, supported by government initiatives promoting digitalization, is driving the adoption of smart locks. Furthermore, as APAC emerges as a manufacturing hub for smart lock components and systems, the affordability and accessibility of smart locks are expanding to a wider consumer base.

Japan Smart Lock Market Insight

The Japan smart lock market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a significant emphasis on security, and the adoption of smart locks is driven by the increasing number of smart homes and connected buildings. The integration of smart locks with other IoT devices, such as home security cameras and lighting systems, is fueling growth. Moreover, Japan's aging population is such asly to spur demand for easier-to-use, secure access solutions in both residential and commercial sectors.

China Smart Lock Market Insight

The China smart lock market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for smart home devices, and smart locks are becoming increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable smart lock options, alongside strong domestic manufacturers, are key factors propelling the market in China.

Smart Lock Market Share

The smart lock industry is primarily led by well-established companies, including:

- Assa Abloy (Sweden)

- Allegion (Ireland)

- Kwikset (U.S.)

- Yale (Sweden)

- August Home (U.S.)

- Schlage (U.S.)

- Level Lock (U.S.)

- Lockly (U.S.)

- U-tec (U.S.)

- TP-Link (China)

- Eufy Security (China)

- Aqara (China)

- Nuki (Austria)

- Danalock (Denmark)

- Samsung SmartThings (South Korea)

- Honeywell (U.S.)

- Brinks Home (U.S.)

- Vivint (U.S.)

- ZKTeco (China)

- Tesa (Spain)

Latest Developments in Global Smart Lock Market

- In April 2023, ASSA ABLOY Group, a global leader in access solutions, launched a strategic initiative in South Africa aimed at strengthening the security of residential and commercial properties through its advanced smart lock technologies. This initiative underscores the company's dedication to delivering innovative, reliable access control solutions tailored to the unique security needs of the local market. By leveraging its global expertise and cutting-edge product offerings, ASSA ABLOY is not only addressing regional challenges but also reinforcing its position in the rapidly growing global smart lock market

- In March 2023, HavenLock Inc., a veteran-led company based in Tennessee, introduced the Power G version of its smart locking system, specifically engineered for schools and commercial environments. The innovative Haven Lockdown System is designed to enhance security protocols, offering a reliable and effective solution for emergency situations. This advancement highlights HavenLock's commitment to developing cutting-edge safety technologies that safeguard vulnerable spaces, ensuring greater protection and peace of mind for institutions and their communities

- In March 2023, Honeywell International Inc. successfully deployed the Bengaluru Safe City Project, aimed at enhancing urban safety through its advanced smart lock and security technologies. This initiative harnesses state-of-the-art solutions to create a more secure and resilient city environment, underscoring Honeywell's dedication to utilizing its expertise in innovative security systems. The project highlights the increasing significance of smart technology in urban safety, contributing to the development of safer, smarter communities

- In February 2023, Sentrilock, LLC, a leading provider of electronic lockbox solutions for the real estate industry, announced a strategic partnership with the Chesapeake Bay and Rivers Association of REALTORS (CBRAR) to create a smart electronic lockbox marketplace for REALTOR members. This collaboration is designed to enhance security and streamline accessibility for real estate professionals, facilitating more efficient and secure property transactions. The initiative underscores Sentrilock's commitment to driving innovation and improving operational effectiveness within the real estate sector

- In January 2023, Schlage, a leading provider of access and home security solutions under Allegion Plc, unveiled the Schlage Encode Smart Wi-Fi Lever at the NAHB International Builders’ Show (IBS) 2023. This innovative residential smart lock, equipped with Wi-Fi connectivity, enables users to manage access remotely through a dedicated app. The Schlage Encode lever highlights the company’s commitment to integrating advanced technology into home security systems, offering homeowners enhanced convenience and control while ensuring robust security

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.