Global Calcium Ammonium Nitrate Market, By Grade (Technical Grade, Reagent Grade, Fertilizer Grade and Others), Application (Water Treatment, Inorganic Fertilizer, Concrete, Explosives, Ice Packs, Clear-Water Drilling, Additive and Others), Type (Nitrogen Content 27%, Nitrogen Content 15.5%, and Others), Form (Liquid and Solid), End User (Agriculture, Building and Construction, Pharmaceutical, Oil and Gas Industry, Mining, and Others) – Industry Trends and Forecast to 2031.

Calcium Ammonium Nitrate Market Analysis and Size

The calcium ammonium nitrate market is experiencing robust growth driven by advancements in precision agriculture, eco-friendly fertilizers, and enhanced production technologies. Innovations such as controlled-release formulations and improved nutrient delivery systems are boosting efficiency and sustainability. These advancements, coupled with rising global agricultural demands, are propelling market expansion, offering promising opportunities for stakeholders in the agricultural sector.

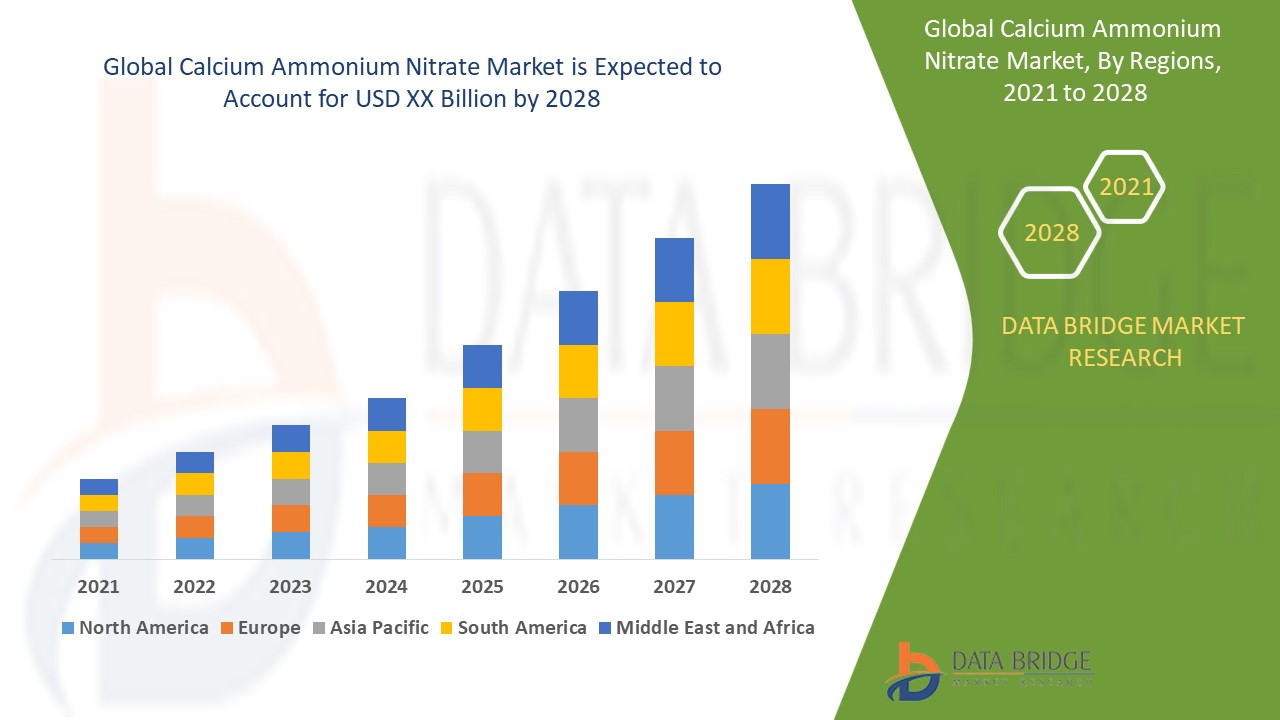

The global calcium ammonium nitrate market size was valued at USD 2.15 billion in 2023, is projected to reach USD 3.47 billion by 2031, with a CAGR of 6.20% during the forecast period 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Grade (Technical Grade, Reagent Grade, Fertilizer Grade and Others), Application (Water Treatment, Inorganic Fertilizer, Concrete, Explosives, Ice Packs, Clear-Water Drilling, Additive and Others), Type (Nitrogen Content 27%, Nitrogen Content 15.5%, and Others), Form (Liquid and Solid), End User (Agriculture, Building and Construction, Pharmaceutical, Oil and Gas Industry, Mining, and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Yara (Norway), EuroChem Group (Switzerland), HELM AG (Germany), FATIMA GROUP (Pakistan), Origin UK Operations Limited (U.K.), Barium & Chemicals, Inc. (U.S.), Agrico (U.S.), Fertinagro India Private Limited (India), AB "Achema" (Lithuania), GFS Chemicals, Inc. (U.S.), Blue Line Corporation (U.S.), Allan Chemical Corporation (U.S.), Del Amo Chemical Company Inc. (U.S.), Uralchem (Russia), and Airedale Group (U.K.)

|

|

Market Opportunities

|

|

Market Definition

Calcium ammonium nitrate is a widely used inorganic fertilizer combining calcium carbonate and ammonium nitrate. It provides essential nitrogen and calcium, enhancing soil fertility and plant growth. calcium ammonium nitrate is known for its stability and low explosiveness compared to pure ammonium nitrate, making it a safer option for agricultural use.

Calcium Ammonium Nitrate Market Dynamics

Drivers

- Rising Demand for High Crop Yields

The calcium ammonium nitrate market is driven by the rising demand for high crop yields which is essential for meeting global food needs and ensuring efficient, sustainable agricultural practices. Calcium ammonium nitrate balanced nitrogen content is favored by farmers for its ability to enhance plant growth and soil fertility. For instance, in regions such as South Asia, where agriculture sustains a large population, calcium ammonium nitrate is increasingly preferred for its efficacy in promoting healthy crop development amidst escalating food requirements.

- Growing Government Subsidies and Support

Government subsidies and incentives, coupled with policies enhancing agricultural productivity, especially in developing nations, fuel the calcium ammonium nitrate market. These initiatives encourage farmers to utilize calcium ammonium nitrate fertilizer driving demand for products such as calcium ammonium nitrate, essential for boosting crop yields sustainably. For instance, in India, the government implements subsidy programs on fertilizers to make them affordable for farmers, thereby encouraging the widespread adoption of calcium ammonium nitrate. Similarly, in Brazil, policies aimed at boosting agricultural productivity incentivize the use of fertilizers such as calcium ammonium nitrate, contributing to the market's growth, especially in developing nations.

Opportunities

- Better Soil Health and Fertility

The demand for calcium ammonium nitrate is propelled by its pivotal role in enhancing soil fertility, particularly in acidic soils. With a heightened emphasis on long-term soil health, calcium ammonium nitrate stands out for its ability to balance nutrients effectively. For instance, in regions such as the Pacific Northwest of the U.S., where acidic soils are prevalent, calcium ammonium nitrate capacity to address pH imbalances and enrich soil fertility underscores its significance, driving market growth.

- Increasing Industrial and Commercial Use

The versatile application of calcium ammonium nitrate extends beyond agriculture. In mining and construction, calcium ammonium nitrate serves as a crucial ingredient in explosive formulations due to its stable properties. Additionally, the horticulture sector relies on calcium ammonium nitrate for nurturing ornamental plants and turf, ensuring healthy growth and vibrant aesthetics. These diverse industrial and commercial uses contribute significantly to driving the demand for calcium ammonium nitrate in the market.

Restraints/Challenges

- Trade Restrictions and Tariffs

Trade barriers, tariffs, and geopolitical tensions can severely hinder the global trade of fertilizers such as calcium ammonium nitrate. Such disruptions, fueled by trade disputes and protectionist measures, limit market access and escalate costs for calcium ammonium nitrate producers in affected regions. These challenges exacerbate uncertainties in the market, impeding growth and stability for industry players.

- Price Volatility of Raw Materials

The price volatility of raw materials, notably calcium carbonate and ammonia, directly impacts calcium ammonium nitrate production costs. Fluctuations driven by supply disruptions, energy price shifts, and currency fluctuations create uncertainty, hampering profitability for calcium ammonium nitrate manufacturers. This instability in input costs adds pressure on the market, restricting growth prospects and overall stability.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In 2022, the United States Department of Agriculture unveiled a USD 250 million investment initiative to bolster sustainable and organic fertilizer production nationwide, reflecting a commitment to environmentally friendly agriculture practices and resource management

- In 2021, the European Union launched its Organic Action Plan, spanning 2021-2030, as a pivotal component of the Farm to Fork Strategy. This comprehensive plan aims to elevate organic farming practices and promote the widespread adoption of organic fertilizers across Europe, fostering environmental stewardship and food system resilience

- In 2021, according to the United States Department of Agriculture, global wheat production reached 779 million metric tons, reflecting a modest 0.43% increase compared to 2020. This uptick suggests ongoing efforts and advancements in agricultural practices worldwide, contributing to sustained or improved yields despite potential challenges such as climate variability or market fluctuations

Calcium Ammonium Nitrate Market Scope

The market is segmented on the basis of grade, type, form, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Grade

- Technical Grade

- Reagent Grade

- Fertilizer Grade

- Others

Application

- Water Treatment

- Inorganic Fertilizer

- Concrete

- Explosives

- Ice Packs

- Clear-Water Drilling

- Additive

- Others

Form

- Liquid

- Solid

Type

- Nitrogen Content 27%

- Nitrogen Content 15.5%

- Others

End User

- Agriculture

- Building and Construction

- Residential

- Commercial

- Industrial

- Infrastructural

- Pharmaceutical

- Oil and Gas Industry

- On-Shore

- Off-Shore

- Mining

- Others

Calcium Ammonium Nitrate Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, grade, type, form, application and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to dominate the calcium ammonium nitrate market due to rising usage and expanding end-use sectors such as agriculture, pharmaceuticals, agrochemicals, industry, and water treatment. The region's growing demand drives market growth, fueled by diverse applications across various industries.

Europe is expected to show significant growth in the calcium ammonium nitrate market due to its status as a leading nitrate fertilizer producer. The presence of prominent manufacturers and increased application in chemical industries will drive demand, positively impacting market growth over the forecast period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Calcium Ammonium Nitrate Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- Yara (Norway)

- EuroChem Group (Switzerland)

- HELM AG (Germany)

- FATIMA GROUP (Pakistan)

- Origin UK Operations Limited (U.K.)

- Barium & Chemicals, Inc. (U.S.)

- Agrico (U.S.)

- Fertinagro India Private Limited (India)

- AB "Achema" (Lithuania)

- GFS Chemicals, Inc. (U.S.)

- Blue Line Corporation (U.S.)

- Allan Chemical Corporation (U.S.)

- Del Amo Chemical Company Inc. (U.S.)

- Uralchem (Russia),

- Airedale Group (U.K.)

SKU-