Global Buy Now Pay Later Services Market

Market Size in USD Billion

CAGR :

%

USD

7.72 Billion

USD

49.41 Billion

2024

2032

USD

7.72 Billion

USD

49.41 Billion

2024

2032

| 2025 –2032 | |

| USD 7.72 Billion | |

| USD 49.41 Billion | |

|

|

|

|

Buy Now Pay Later Services Market Size

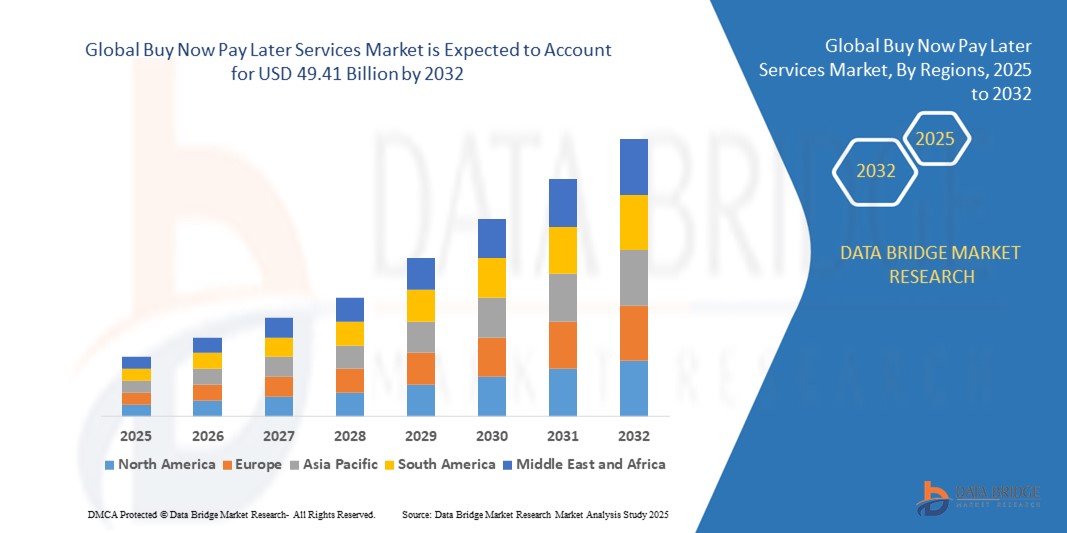

- The global buy now pay later services market size was valued at USD 7.72 billion in 2024 and is expected to reach USD 49.41 billion by 2032, at a CAGR of 26.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of digital payment solutions, growing e-commerce penetration, and rising consumer demand for flexible, interest-free financing options

- The expansion of online retail platforms and mobile wallet integrations is further driving the usage of buy now pay later services across multiple regions

Buy Now Pay Later Services Market Analysis

- The market is experiencing strong growth due to evolving consumer behavior favoring short-term credit solutions and instant financing options

- Technological advancements in payment processing, AI-driven credit risk assessment, and fraud detection are enhancing service efficiency and user experience

- North America dominated the buy now pay later services market with the largest revenue share of 38.5% in 2024, driven by the growing adoption of digital payment solutions, e-commerce expansion, and increasing consumer preference for flexible payment options

- Asia-Pacific region is expected to witness the highest growth rate in the global buy now pay later services market, driven by surge in mobile commerce, digital wallets, and tech-savvy consumers in countries such as China, Japan, and Australia. Expanding internet penetration and increasing partnerships between fintechs and merchants are accelerating BNPL adoption in the region

- The Online Platforms segment held the largest market revenue share in 2024, driven by the widespread adoption of e-commerce and digital wallets, which enable seamless integration of BNPL at checkout across multiple online retail platforms. Online platforms also offer features such as installment management, personalized offers, and cross-border payments, making them a preferred choice for tech-savvy consumers.

Report Scope and Buy Now Pay Later Services Market Segmentation

|

Attributes |

Buy Now Pay Later Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption Of Digital Payments And E-Commerce Platforms |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Buy Now Pay Later Services Market Trends

Increasing Adoption of Flexible Financing Solutions in E-Commerce

• The growing shift toward buy now pay later (BNPL) solutions is transforming the consumer payment landscape by enabling instant, interest-free credit for online and offline purchases. The convenience and speed of these services allow customers to make purchases without immediate payment, boosting sales conversion rates for merchants. In addition, merchants benefit from improved cash flow and higher repeat purchase rates due to enhanced customer satisfaction. The trend is further supported by growing smartphone penetration and digital payment adoption worldwide

• Rising demand for digital payment alternatives among younger, tech-savvy consumers is accelerating the adoption of BNPL platforms. These services are particularly effective in regions with high e-commerce penetration and mobile wallet usage, helping reduce cart abandonment and increase transaction volumes. BNPL also enhances financial inclusion for consumers with limited access to traditional credit, broadening the customer base for retailers

• The ease of use, transparency, and low barrier to entry of modern BNPL solutions are making them attractive for both small and large purchases, supporting frequent usage and higher average order values. Merchants benefit from increased customer engagement and loyalty, while consumers enjoy better budgeting flexibility. This convenience is driving global adoption across multiple sectors, including fashion, electronics, travel, and healthcare

• For instance, in 2023, several online fashion retailers in North America reported a 20% increase in average order value after integrating BNPL options at checkout, improving sales performance and customer satisfaction. Retailers also observed reduced cart abandonment rates and stronger repeat purchase behavior, contributing to long-term revenue growth. The integration of BNPL with mobile apps and loyalty programs further enhanced customer engagement

• While BNPL services are accelerating consumer spending and supporting merchant growth, their impact depends on continued platform innovation, regulatory compliance, and responsible lending practices. Providers must focus on secure, user-friendly offerings and localized strategies to fully capitalize on this growing demand. Continuous technological upgrades, such as AI-based credit assessment, are also enhancing adoption and reducing risk

Buy Now Pay Later Services Market Dynamics

Driver

Rising E-Commerce Penetration and Changing Consumer Payment Preferences

• The rapid growth of e-commerce is pushing retailers and payment providers to adopt BNPL solutions as a preferred financing option. Consumers increasingly favor interest-free, short-term credit to manage cash flow while purchasing goods online. BNPL adoption also supports higher conversion rates for online merchants, particularly during seasonal sales and promotions

• Shifts in consumer behavior, including preference for digital wallets, contactless payments, and flexible installment plans, are driving BNPL adoption globally. Younger generations are particularly inclined toward these innovative payment options, contributing to sustained market growth. The convenience and speed of transactions further strengthen customer trust in BNPL services

• Partnerships between BNPL providers, merchants, and fintech platforms are strengthening infrastructure, improving service accessibility, and fostering seamless payment experiences. Collaborative initiatives are enabling global expansion, facilitating localized offerings, and integrating BNPL into point-of-sale systems. These partnerships also promote cross-sector adoption, including retail, travel, healthcare, and education

• For instance, in 2022, major BNPL platforms in Europe partnered with leading online retailers to offer integrated checkout financing, significantly increasing adoption rates and transaction volumes. The collaboration helped standardize BNPL offerings and enhanced consumer confidence in digital installment payments. It also supported small and medium-sized retailers in providing competitive financing options

• While awareness and merchant integration are propelling market growth, providers must address concerns regarding responsible lending, consumer credit risk, and platform security to ensure sustained adoption. Risk mitigation strategies, including AI-based fraud detection and credit scoring, are becoming critical to maintaining long-term credibility and market stability

Restraint/Challenge

Regulatory Scrutiny, Credit Risk, and Market Saturation

• Increasing regulatory oversight in key markets, including requirements for transparency, consumer protection, and reporting, may slow expansion and increase compliance costs for BNPL providers. This includes new licensing mandates, interest rate disclosures, and data privacy regulations that require platform upgrades and operational adjustments

• Rising consumer defaults and inadequate credit assessment practices pose risks to both providers and merchants, potentially impacting profitability and market trust. Providers must implement AI-based credit scoring and risk monitoring systems to mitigate losses and maintain healthy portfolio performance while keeping BNPL accessible

• Market saturation and intense competition among BNPL platforms are pressuring providers to differentiate through technology, partnerships, and value-added services. With numerous startups and established financial institutions entering the market, continuous innovation in customer experience and merchant integrations becomes crucial for retention and growth

• For instance, in 2023, several Asian and European BNPL startups scaled back operations or merged due to heightened regulatory scrutiny and rising credit risk, impacting regional market dynamics. Consolidation is leading to fewer, stronger players dominating the landscape while smaller providers adapt strategies to niche segments or regional markets

• Addressing regulatory compliance, credit evaluation, and sustainable growth strategies is critical to ensuring long-term expansion and maintaining consumer and merchant confidence in BNPL services. Moreover, transparency in fees, timely dispute resolution, and ethical lending practices are becoming vital differentiators in maintaining trust and long-term market stability

Buy Now Pay Later Services Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the buy now pay later (BNPL) services market is segmented into Online Platforms and Point of Sale (POS) Financing. The Online Platforms segment held the largest market revenue share in 2024, driven by the widespread adoption of e-commerce and digital wallets, which enable seamless integration of BNPL at checkout across multiple online retail platforms. Online platforms also offer features such as installment management, personalized offers, and cross-border payments, making them a preferred choice for tech-savvy consumers.

The Point of Sale Financing segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in physical retail stores and growing consumer preference for flexible, interest-free installment payments. POS-based BNPL solutions provide instant approval and convenience at checkout, enhancing the in-store shopping experience while boosting sales conversion and average transaction values for merchants.

- By Application

On the basis of application, the BNPL market is segmented into Retail, Healthcare, Travel and Hospitality, Automotive, and Others. The Retail segment held the largest revenue share in 2024, driven by rising e-commerce penetration and increasing consumer demand for flexible payment options. BNPL services in retail enhance purchasing power, reduce cart abandonment, and promote repeat purchases, making them highly attractive for merchants and customers alike.

The Healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing need for affordable healthcare payments, elective procedures, and wellness services. BNPL solutions in healthcare allow patients to access treatments without immediate financial burden, improving affordability and adherence while driving adoption across clinics, hospitals, and online health platforms.

Buy Now Pay Later Services Market Regional Analysis

• North America dominated the buy now pay later services market with the largest revenue share of 38.5% in 2024, driven by the growing adoption of digital payment solutions, e-commerce expansion, and increasing consumer preference for flexible payment options

• Consumers in the region are increasingly attracted to BNPL offerings for their convenience, interest-free installments, and simplified checkout processes, enhancing online and in-store shopping experiences

• This widespread adoption is further supported by high internet penetration, advanced fintech infrastructure, and a digitally savvy population, establishing BNPL as a favored payment method across retail, healthcare, travel, and other sectors

U.S. Buy Now Pay Later Services Market Insight

The U.S. BNPL market captured the largest revenue share in North America in 2024, fueled by the rapid growth of e-commerce, mobile payment adoption, and consumer preference for interest-free financing. Shoppers are increasingly leveraging BNPL options for large-ticket purchases and recurring expenses, driving market expansion. Moreover, partnerships between fintech providers and major retailers are further enhancing BNPL penetration, while robust regulatory support ensures secure and transparent transactions.

Europe Buy Now Pay Later Services Market Insight

The Europe BNPL market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the rise in online retail, evolving consumer payment preferences, and increased demand for flexible financing solutions. Consumers are drawn to the convenience and transparency of BNPL services, which reduce the need for credit checks and immediate full payments. The region is witnessing growing adoption across retail, travel, and healthcare sectors, with fintech startups and banks offering innovative BNPL solutions to meet market needs.

U.K. Buy Now Pay Later Services Market Insight

The U.K. BNPL market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing penetration of e-commerce, mobile shopping apps, and a strong consumer appetite for installment-based payments. Retailers and service providers are integrating BNPL solutions to enhance sales and customer loyalty, while fintech collaborations continue to expand market reach. The regulatory environment is also evolving to ensure consumer protection and responsible lending practices.

Germany Buy Now Pay Later Services Market Insight

The Germany BNPL market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption of digital payment methods, expanding online retail, and demand for alternative financing solutions. German consumers value the flexibility, transparency, and convenience offered by BNPL platforms. The market is further supported by the presence of established fintech companies and partnerships with major retailers, enabling seamless integration of BNPL options across multiple channels.

Asia-Pacific Buy Now Pay Later Services Market Insight

The Asia-Pacific BNPL market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing smartphone penetration, rising e-commerce activity, and a growing preference for cashless transactions in countries such as China, India, and Australia. The region’s expanding middle class and government initiatives promoting digital payments are further driving adoption. In addition, partnerships between local fintech providers and international platforms are increasing BNPL accessibility, making it a preferred payment option across retail, travel, and healthcare sectors.

Japan Buy Now Pay Later Services Market Insight

The Japan BNPL market is expected to witness the fastest growth rate from 2025 to 2032 due to high smartphone usage, growing e-commerce penetration, and a consumer preference for flexible payment methods. Japanese consumers are increasingly using BNPL for online shopping, subscription services, and travel bookings. The integration of BNPL solutions with popular payment apps and e-commerce platforms is driving market expansion, while regulatory support ensures safe and transparent transactions.

China Buy Now Pay Later Services Market Insight

The China BNPL market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid digital payment adoption, the growing middle class, and increased consumer preference for installment-based purchasing. BNPL services are gaining traction across retail, healthcare, and travel sectors. The country’s fintech ecosystem, supported by strong local players and partnerships with e-commerce giants, is expanding market reach and making BNPL a widely accepted payment method.

Buy Now Pay Later Services Market Share

The Buy Now Pay Later Services industry is primarily led by well-established companies, including:

- PayPal Holdings, Inc. (U.S.)

- Affirm Holdings, Inc. (U.S.)

- Klarna Bank AB (Sweden)

- Afterpay Limited (Australia)

- Zip Co Limited (Australia)

- Splitit Payments Ltd. (Israel)

- Sezzle Inc. (U.S.)

- Openpay Group Ltd (Australia)

- Scalapay S.r.l. (Italy)

- Payright Limited (Australia)

- Laybuy Holdings Limited (New Zealand)

- Zilch (U.K.)

- FuturePay Inc. (U.S.)

- ViaBill A/S (Denmark)

- Atome Financial (Singapore)

- PayClip (Mexico)

- LatitudePay (Australia)

- Payflex (South Africa)

- Clearpay (U.K.)

- hummgroup (Australia)

- Quadpay, Inc. (U.S.)

- TendoPay (Philippines)

- OctiFi (Singapore)

- Akulaku (Singapore)

- Hoolah (Singapore)

- PayLater (Indonesia)

Latest Developments in Global Buy Now Pay Later Services Market

- In December 2023, PayPal Holdings, Inc. completed the acquisition of Paidy Inc., a Japanese buy now, pay later (BNPL) service provider, aiming to strengthen its presence in Japan and expand its global BNPL offerings. This strategic move enhances PayPal’s portfolio, enabling seamless payment solutions for consumers and merchants, while accelerating growth in the rapidly expanding Asian BNPL market. The acquisition is expected to improve customer reach, increase transaction volumes, and solidify PayPal’s competitive position in the global digital payments ecosystem

- In November 2023, Klarna Bank AB launched its new “Pay Now” feature, allowing customers to make instant payments directly from their bank accounts. The addition complements Klarna’s existing BNPL services, providing consumers with greater flexibility and faster checkout options. This development is anticipated to boost customer adoption, increase merchant engagement, and strengthen Klarna’s market share in the competitive BNPL and digital payments industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.