Global Bread Mixes Market, By Ingredients (Wheat, Rice, Oats, Corn, and Others), Product Type (Organic and Conventional), Distribution Channel (Online Retailing, Supermarkets, and Departmental Stores) – Industry Trends and Forecast to 2029.

Bread Mixes Market Analysis and Size

Bread mixes provides manufacturers with numerous advantages, including increased product consistency, reduced chances of incorrect weighing of raw materials used in the production of bakery products, and lower labour and inventory costs. Baking premixes also include leavenings and customised combinations of flours and flour types in a variety of products.

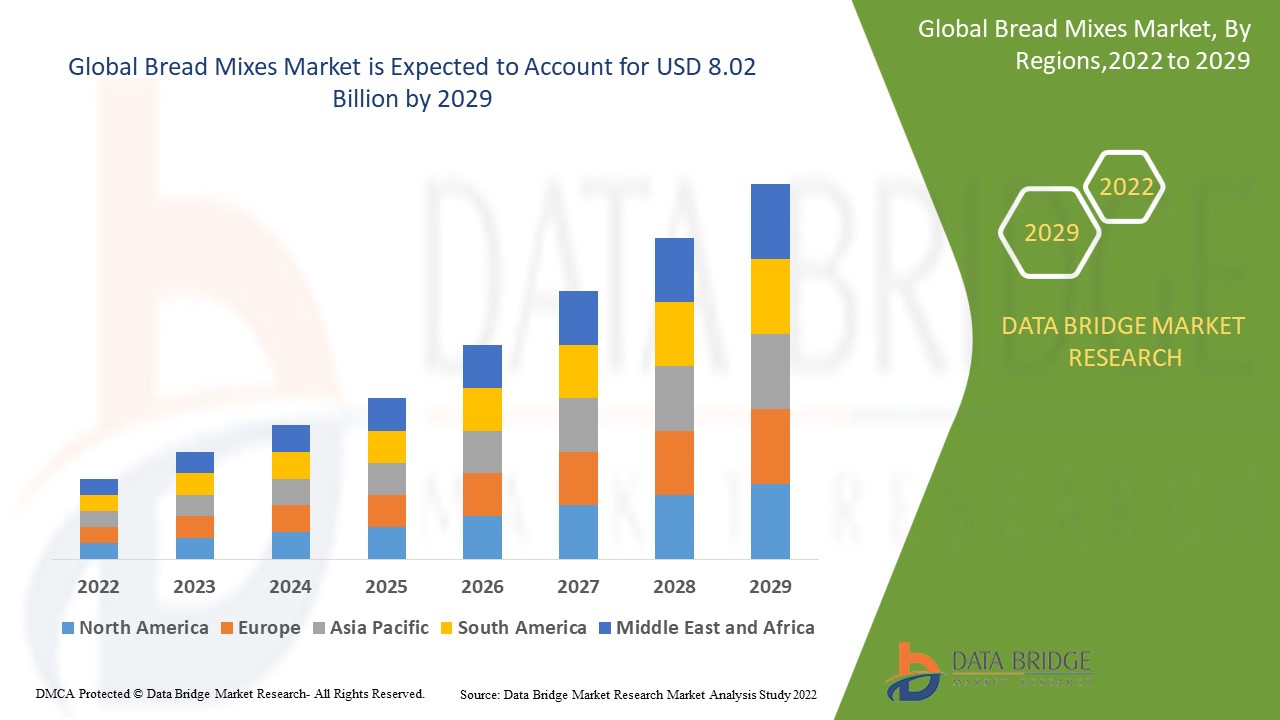

Data Bridge Market Research analyses that the bread mixes market which was growing at a value of USD 5.08 billion in 2021 is expected to reach the value of USD 8.02 billion by 2029, at a CAGR of 5.87% during the forecast period OF 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Bread Mixes Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Ingredients (Wheat, Rice, Oats, Corn, and Others), Product Type (Organic and Conventional), Distribution Channel (Online Retailing, Supermarkets, and Departmental Stores)

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

|

|

Market Players Covered

|

Kellogg Co. (U.S.), Dun & Bradstreet, Inc (U.S.), Conagra Brands, Inc. (U.S.), London Dairy Co. Ltd (U.K.), Danone S.A. (France), ADM (U.S.), Daiya Foods Inc. (Canada), Grupo Bimbo S.A.B.de C.V. (Mexico), Associated British Foods PLC (U.K.), General Mills Inc. (U.S.), Lantmännen Unibake (Denmark), Aryzta AG (Switzerland), Vandemoortele NV (Belgium), Europastry S.A. (Spain), Cole’s Quality Food Inc. (U.S.)

|

|

Opportunities

|

|

Market Definition

Bread mix is a mixture of flour, yeast, baking soda, salt, and additional ingredients. It is used to bake bread in less time and with fewer efforts. Wheat, rice, oat, and corn bread are all available on the market. It is available and manufactured in two forms: commercially manufactured and homemade. Food companies concentrated on meeting customers' needs more quickly and conveniently, including diversity and nutritional benefits.

Bread Mixes Market Dynamics

Drivers

- Manufacturers constant effort to increase supply and distribution chains

Advances in online retail are one of the key trends driving the evolution of the bread mix market. Large product distribution channels include convenience stores, specialty stores, supermarkets, drug stores, and hypermarkets. Continuous efforts by retailers and manufacturers to expand their supply and distribution chain have played a significant role in increasing access to bread mix products.

- Growing preferences for natural ingredients and rising trend for RTE food

Natural functional bakery ingredients are becoming increasingly popular as the younger generation prefers them over synthetic ingredients due to health concerns. Natural bakery ingredients like bread mixes extend the shelf life of finished products like whole wheat bread, multigrain bread, and others. Food ingredients in convenience foods provide quality, freshness, taste, and texture, all of which are appealing to consumers. Increased demand for bread mixes for bread machines directly correlates to increased demand for baked goods, which drives market growth.

Opportunity

The bread mix industry is undergoing structural changes, which are allowing for the emergence of new opportunities and strategies. Continuous R&D will aid in the development of innovative bread mix solutions for a wide range of applications. Companies are attempting to launch new fillings through iterative and incremental procedures in order to meet the demands of gluten-free, non-GMO verified, and vegan consumers.

Restraints

However, the easy availability of product substitutes, stringent government regulations governing quality standardisation, and supply chain disruptions caused by the pandemic will limit the bread mixes market's potential for growth. The high cost of R&D activities, as well as the volatility of raw material prices, will slow the growth rate of the bread mixes market. Other market growth restraints include rising obesity prevalence, high blood sugar levels in patients, and an increase in the global incidence rate of diabetes.

This bread mixes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the bread mixes market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Bread Mixes Market

The newly discovered COVID-19 pandemic has significantly impacted the entire food and beverage industry, including the Indian bread flour and premixes industry. This pandemic has resulted in mass production shutdowns and supply chain disruptions, negatively impacting the economy. Due to the lockdown, non-edible product sales were high at the start of 2020, while edible product sales, such as breads, cakes, bakery products, and many others, were insufficient due to a labour shortage. The prevalence of in-home cooking will drive demand for premixes products. Concerned about job losses and declining income, consumers may reduce discretionary spending by down-trading in the same product category.

Recent Development

- Bakels India's Baking Center will be officially inaugurated in 2021 by Bakels Group CEO Patrick Gloggner and Group Technical Director Paul Morrow. Craft, Artisanal, and Industrial Bakers will be able to take advantage of a creative environment to develop and test new product concepts using a diverse range of world-class ingredients from Bakels.

- In 2021, the Corbion Solution Delivers Consumer-Friendly Dough Conditioning That Allows Bakers to Scratch DATEM, which overcomes quality hurdles such as Wheat protein and high speed processing, will be available.

- Slurrp Farm raised USD 2 million in a Series A funding round led by Fireside Ventures in 2020, with plans for product innovation, marketing, and increasing inventory to meet rising demand.

Global Bread Mixes Market Scope

The bread mixes market is segmented on the basis of ingredients, product type and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Ingredients

- Wheat

- Rice

- Oats

- Corn

- Others

Product type

- Organic

- Conventional

Distribution channel

- Online Retailing

- Supermarkets

- Departmental Stores

Bread Mixes Market Regional Analysis/Insights

The bread mixes market is analysed and market size insights and trends are provided by country, ingredients, product type and distribution channel as referenced above.

The countries covered in the bread mixes market are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

The bread mixes market is dominated by North America. Bread, cakes, and pizza are in high demand in North America, and consumption is expected to increase steadily. The Western European regional market is expected to grow at a moderate rate over the forecast period. Due to the globalisation in developing countries such as India and China, the bread mix market is expected to grow rapidly.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Bread Mixes Market Share Analysis

The bread mixes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to bread mixes market.

Some of the major players operating in the bread mixes market are:

- Kellogg Co. (U.S.)

- Dun & Bradstreet, Inc (U.S.)

- Conagra Brands, Inc. (U.S.)

- London Dairy Co. Ltd (U.K.)

- Danone S.A. (France)

- ADM (U.S.)

- Daiya Foods Inc. (Canada)

- Grupo Bimbo S.A.B.de C.V.(Mexico)

- Associated British Foods PLC (U.K.)

- General Mills Inc. (U.S.)

- Lantmännen Unibake (Denmark)

- Aryzta AG (Switzerland)

- Vandemoortele NV (Belgium)

- Europastry S.A. (Spain)

- Cole’s Quality Food Inc.(U.S.)

SKU-